DXY is hanging in but does

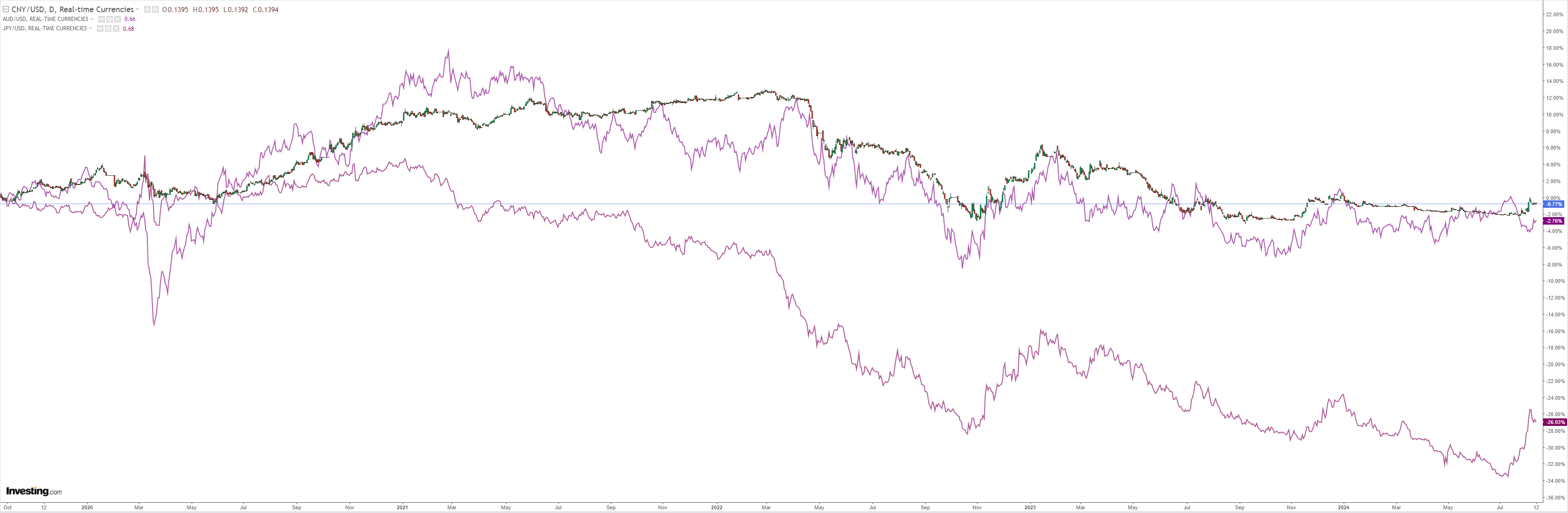

North Asia is fading:

Oil and gold roared on the imminent attack upon Israel:

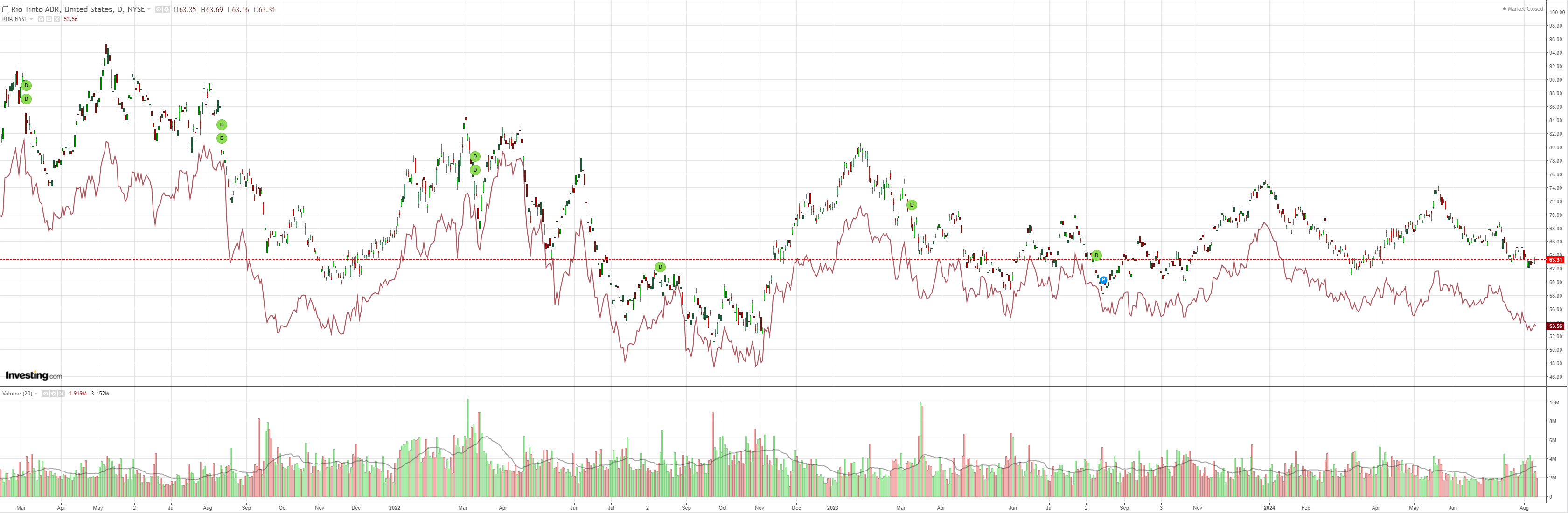

Apparently, Israel has lots of copper, not:

Miners are the highway to hell:

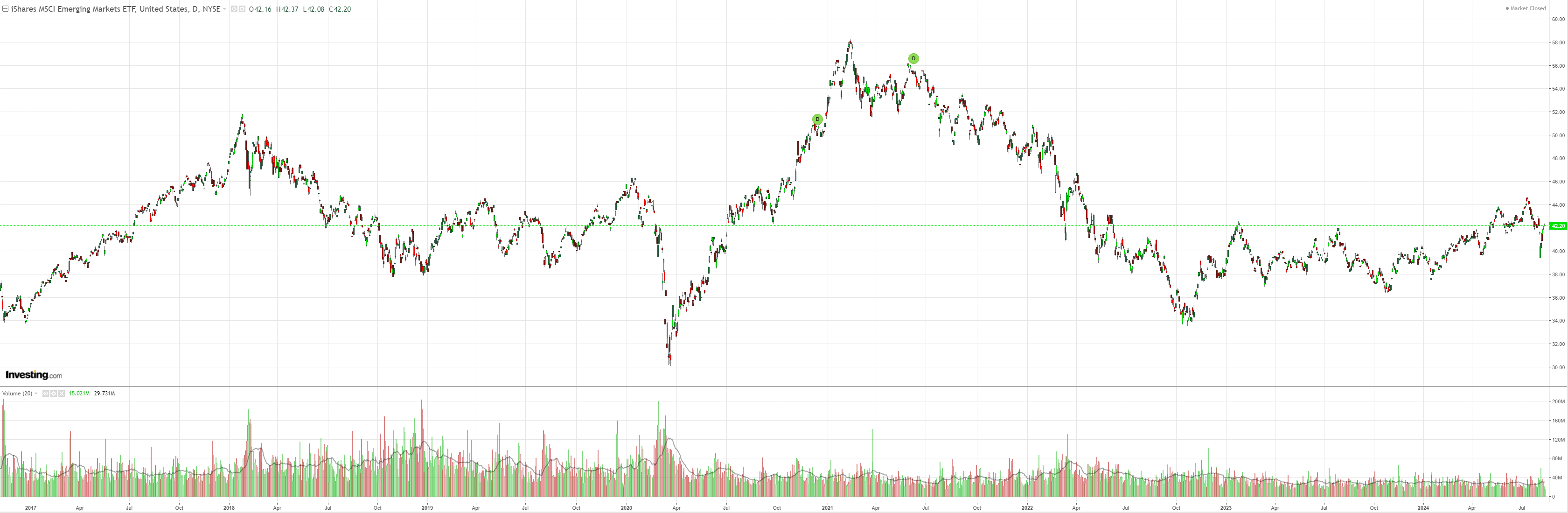

EM is stuck at the point of control:

Junk is trying:

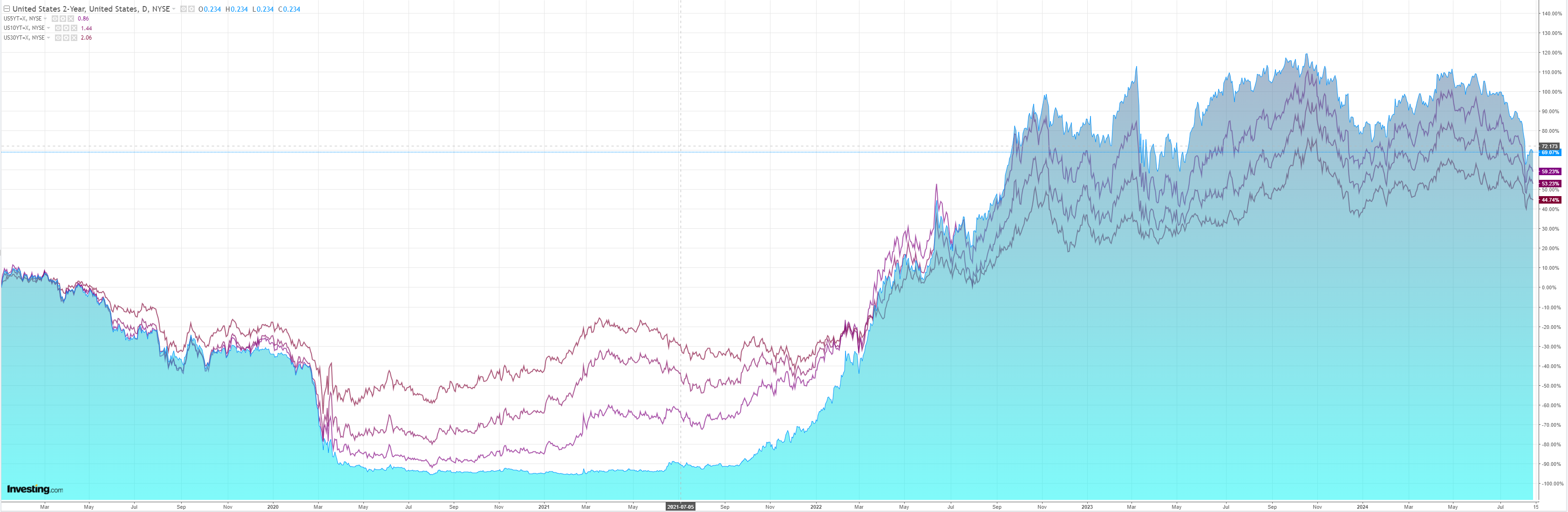

Yields are bid on tomorrow’s US inflation

Which helped stocks that haven’t been able to breach the island top:

Goldman is looking for another weak CPI:

We estimate a 0.16% increase in July core CPI (month-over-month SA).

Our forecast reflects further declines in used car prices (-1.5%) and airfares (-2.5%), as well as a modest decline in new car prices (-0.1%) after a rebound in incentives following last month’s disruptions to dealer software systems.

We expect another firm increase in the car insurance category (+0.7%) based on continued—albeit decelerating—increases in premiums in our online dataset.

We expect modest boosts from tobacco prices related to new taxes in Colorado and Maryland and from the partial-month impact of a postage price hike on July 14th.

After last month’s step lower, we assume another moderate increase in OER (+0.29%) and a partial rebound in primary rent (+0.33%), reflecting payback for the January spike in OER and drop in rent.

We estimate a 0.17% rise in headline CPI, reflecting higher food (+0.15%) and energy (+0.4%) prices.

That would certainly get the Fed cutting in September and DXY would likely gap lower and AUD higher.

Unless Israel blows up spectacularly.