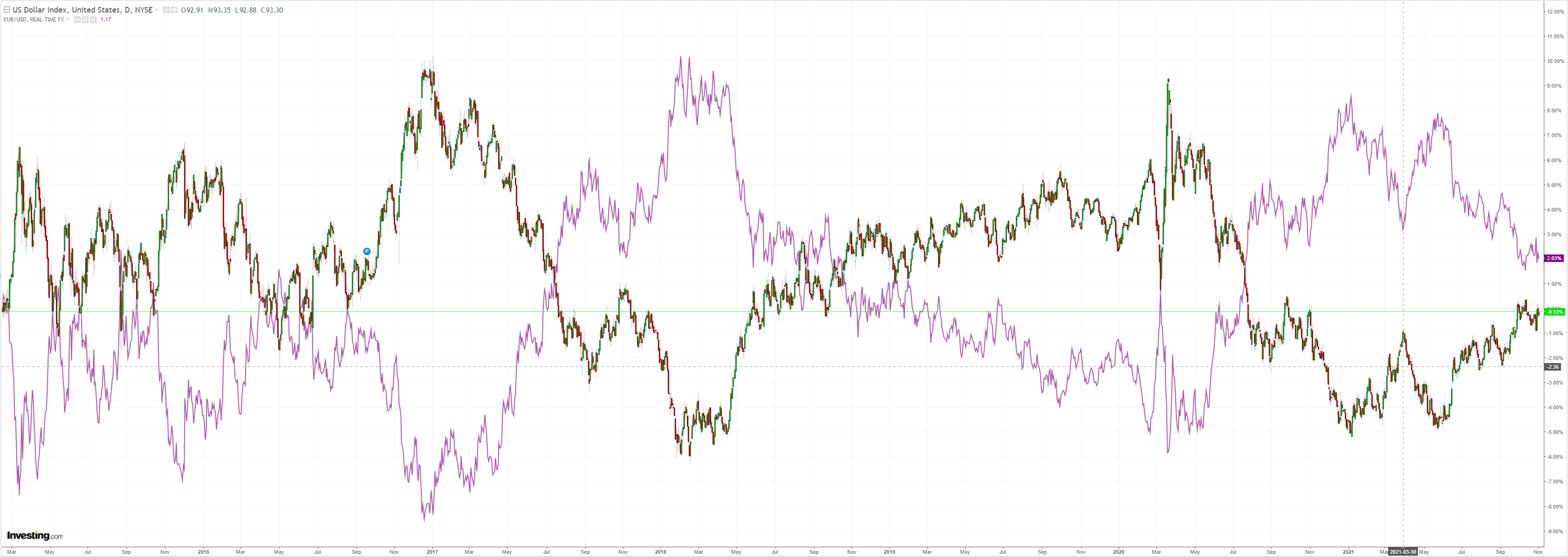

DXY was firm last night and EUR soft:

The Australian dollar puked lower:

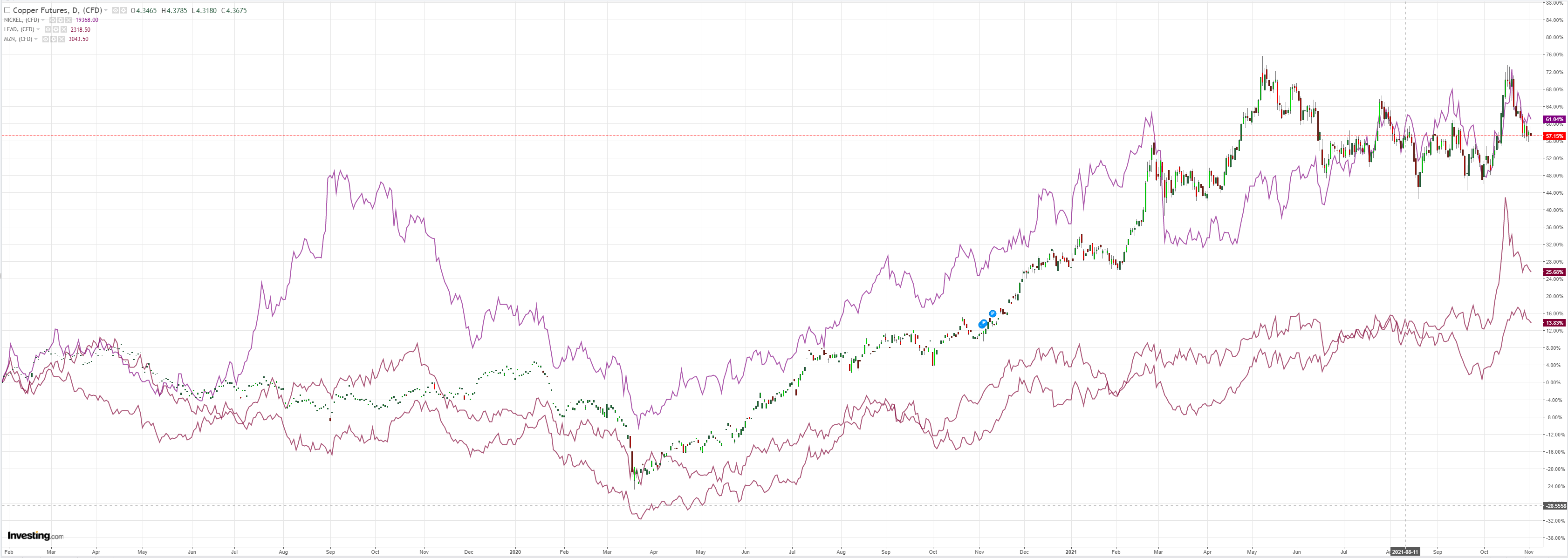

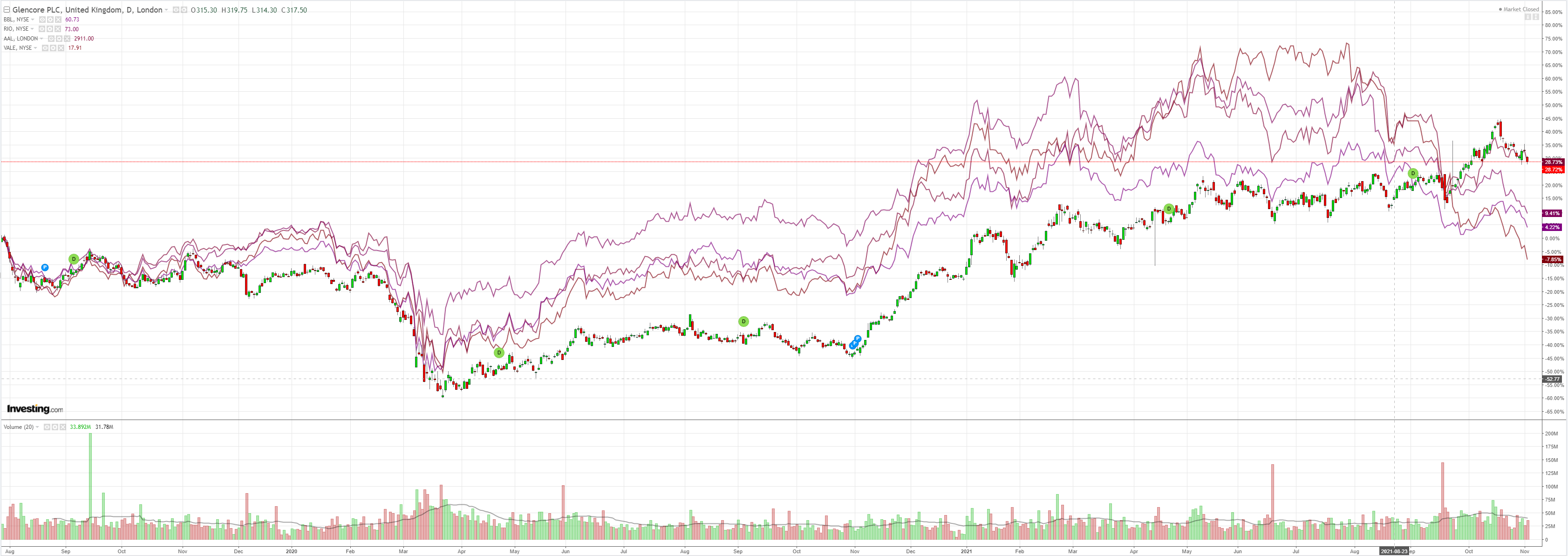

Base metals eased:

Big Iron is being flushed:

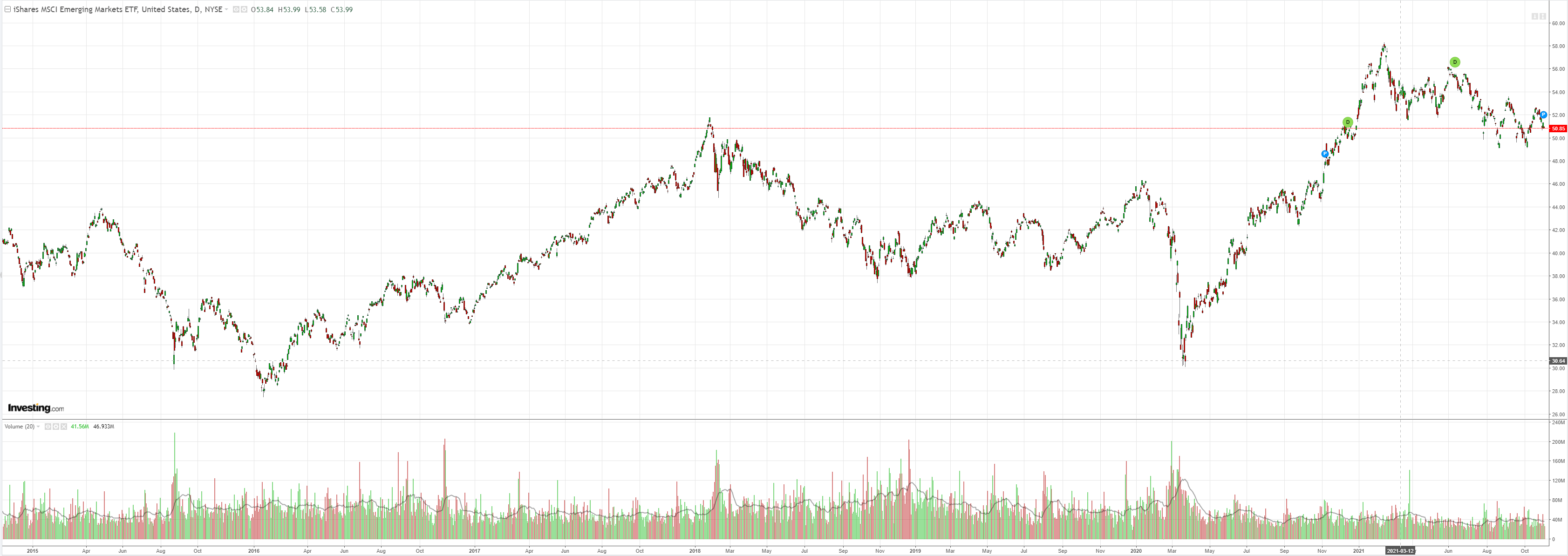

EM stocks still look sick:

And junk:

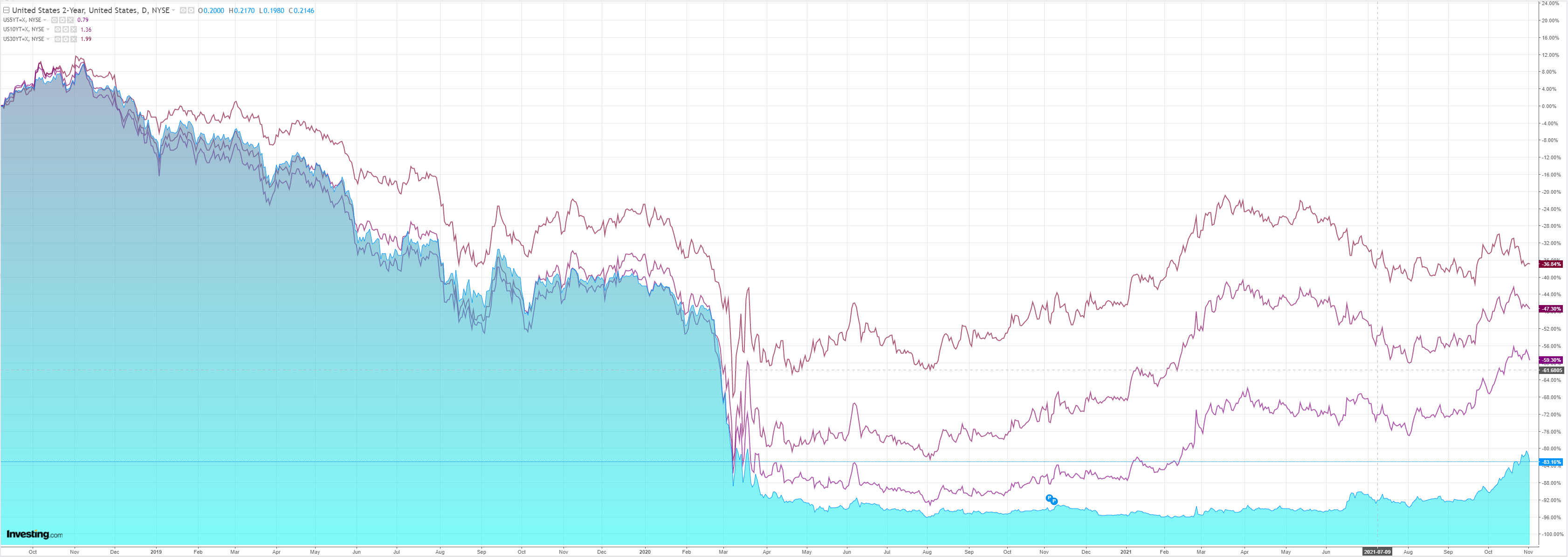

Treasury yields fell away:

Which boosted, you guessed it, GAMMA:

Westpac has the wrap:

Event Wrap

Markit’s final Oct. Eurozone PMI was marked down slightly, to 58.3 from 58.3, with further emphasis on production activity being hampered by extreme supply and cost constraints.

Event Outlook

Aust: In September, dwelling approvals are expected to fall 8% as August’s gain from high-rise approvals reverses and HomeBuilder activity continues to unwind.

NZ: Strong employment indicators over recent months imply a robust employment result for Q3 (Westpac f/c: 0.8%); the unemployment rate is likely to again be distorted by Covid lockdowns (Westpac f/c: 3.8%). The Q3 labour cost index is also expected to highlight labour market tightness (Westpac f/c: 1.0%). The RBNZ Financial Stability Report is due as well.

Japan: The final release of the October Nikkei Japan services PMI should signal soft domestic demand.

China: The Caixin China services PMI is expected to pull back in October as delta risks escalate again (market f/c: 53.1).

Europe/UK: The Markit services PMIs for Europe and the UK will be the final release for the month. September’s Euro Area unemployment rate reportwill reflect continued recovery, while UK Nationwide house prices should see annual growth remain above 9% in October (market f/c: 0.3%).

US: October’s ISM non-manufacturing PMI and Markit services PMI should retain strength as reopening buoys activity and expectations. Another robust print for ADP employment change is anticipated in October (Westpac f/c: 400k). September factory orders however are expected to weaken on volatility in transport orders. The FOMC is expected to reveal a formal taper decision at its November meeting. We expect a reduction in purchases of $15bn per month from December 2021 to mid-2022.

In the context of little data, I think it fair to say that the RBA’s dovish commentary yesterday popped inflation overexcitement globally. Obviously that’s what hammered the AUD.

I remain of the view that it is right to be skeptical. Locally, inflation pressures are narrow and wage growth still terrible. Globally, the supply-side constraints of this year will ease as volumes fall back on softening goods consumption and the Chinese accident.

I especially like the look of this kind of thing (the magazine cover indicator):

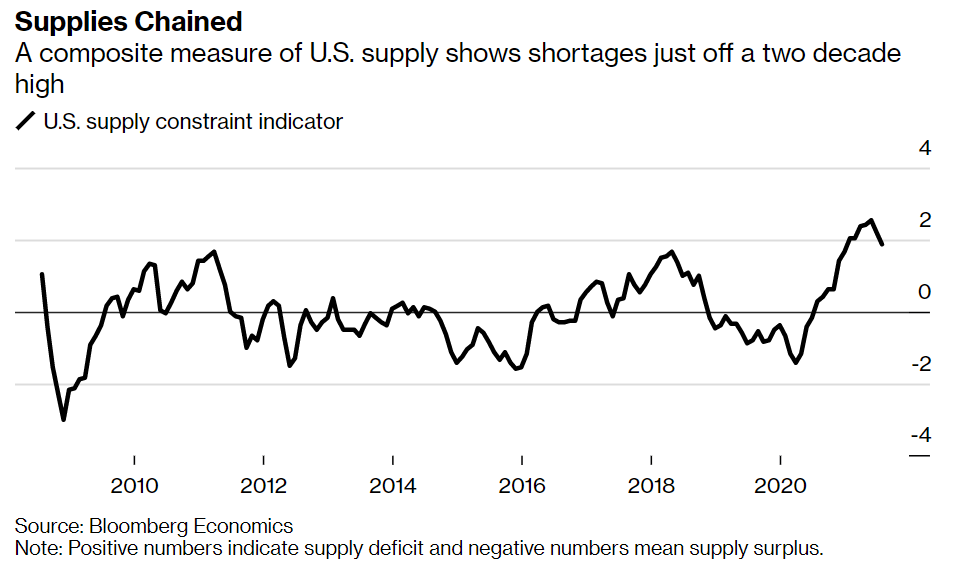

This comes with this chart:

Next up, congested logistics like ports, shipping, containers and other transport are all going to unclog after the Christmas rush subsides.

All of these supply-side inflation pulses are temporary and should revert to pre-Covid prices the moment that bottlenecks clear. Which appear to converge around the new year and should ease throughout 2022.

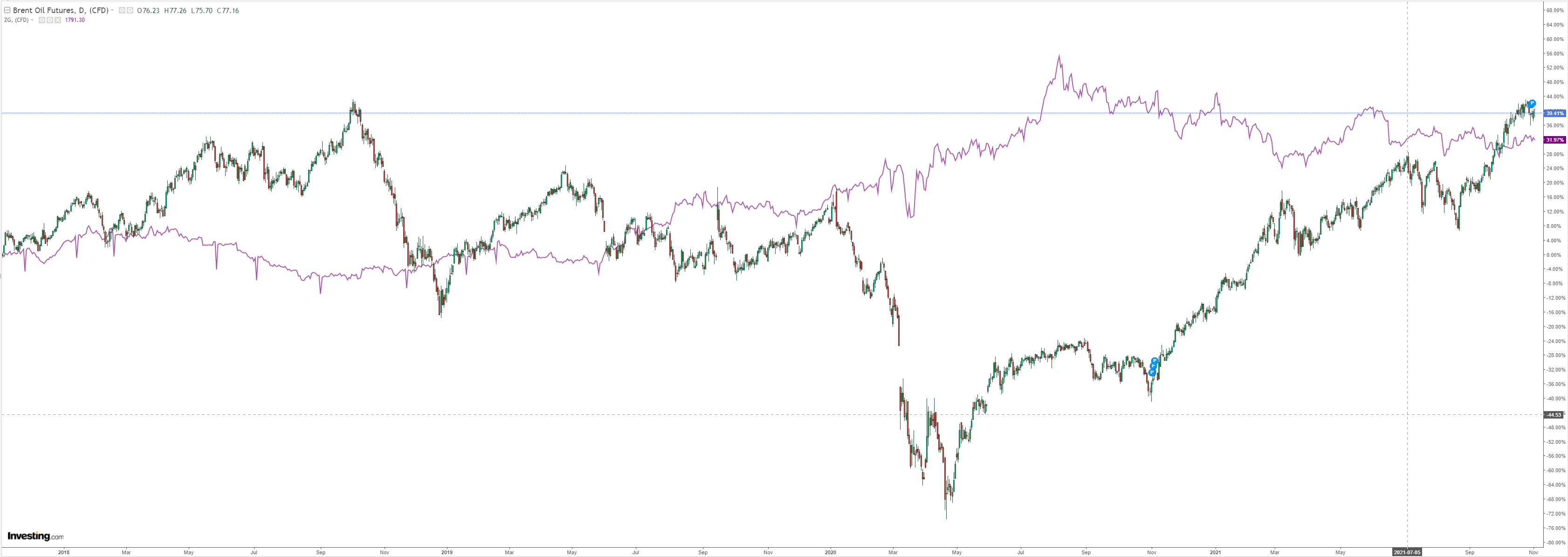

The second factor driving global inflation is that markets fearing inflation have bid up commodity prices as a hedge.

This has, in turn, created more inflation as input prices rocket higher. But as the supply-side prices collapse that rationale will also fall away and those hoarding raw materials against a more expensive rainy day will panic sell.

Barring a new Chinese property stimulus, I can’t see any macro reason for ongoing AUD strength except a market drunk on a stagflation narrative.

But who knows when that ends!