DXY is an unstoppable AI monster. EUR is history:

AUD is in free fall with EUR and CNY:

{68|Gold}} is in all sorts of trouble. OPEC squashed oil:

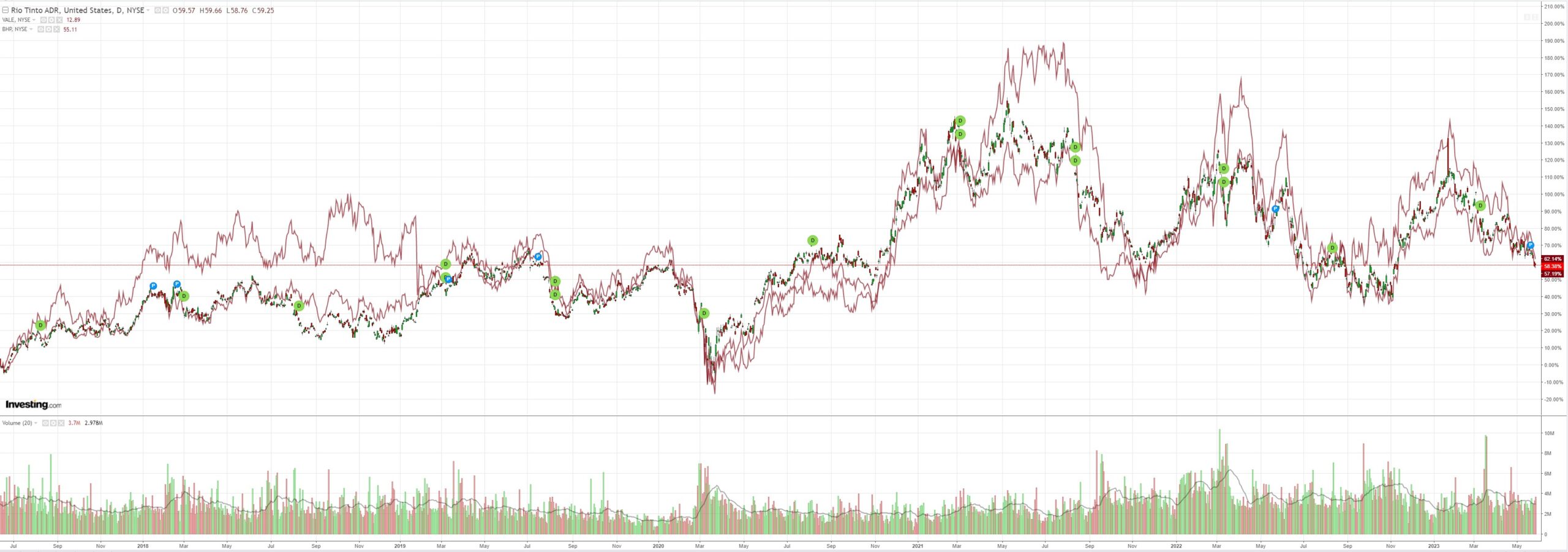

The commodities crash took a breather. This ain’t over:

Big miners (NYSE:RIO) are bleeding out:

With EM stocks (NYSE:EEM):

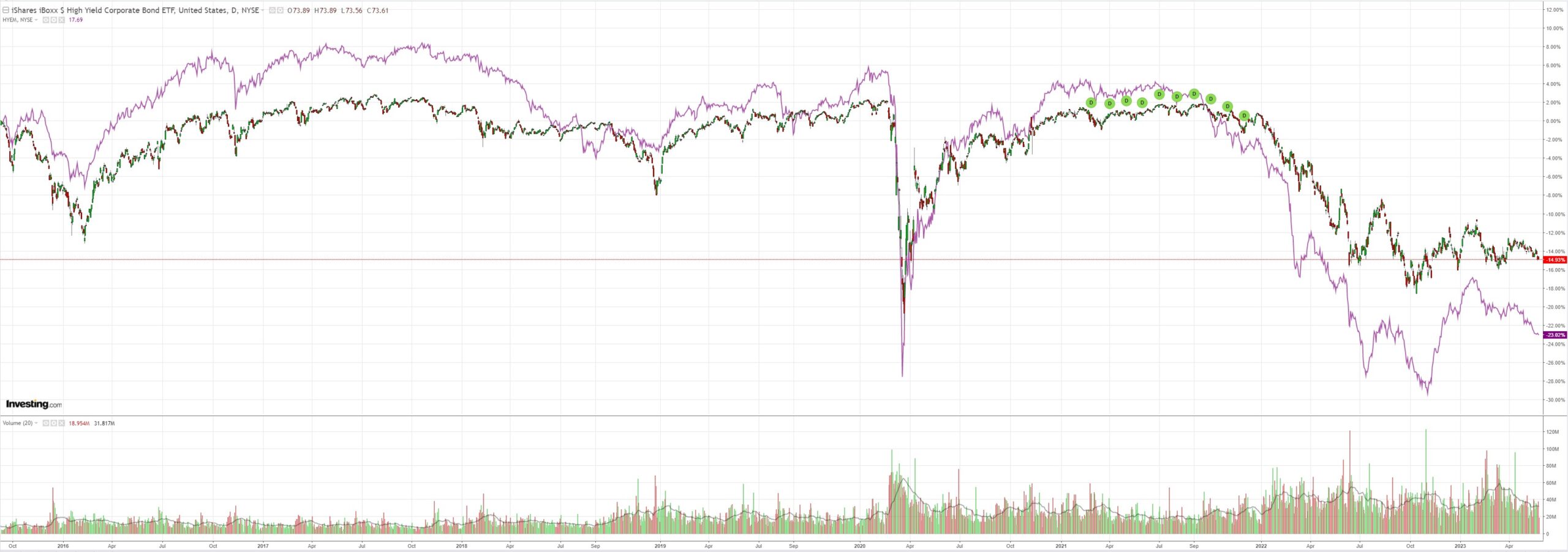

And junk (NYSE:HYG):

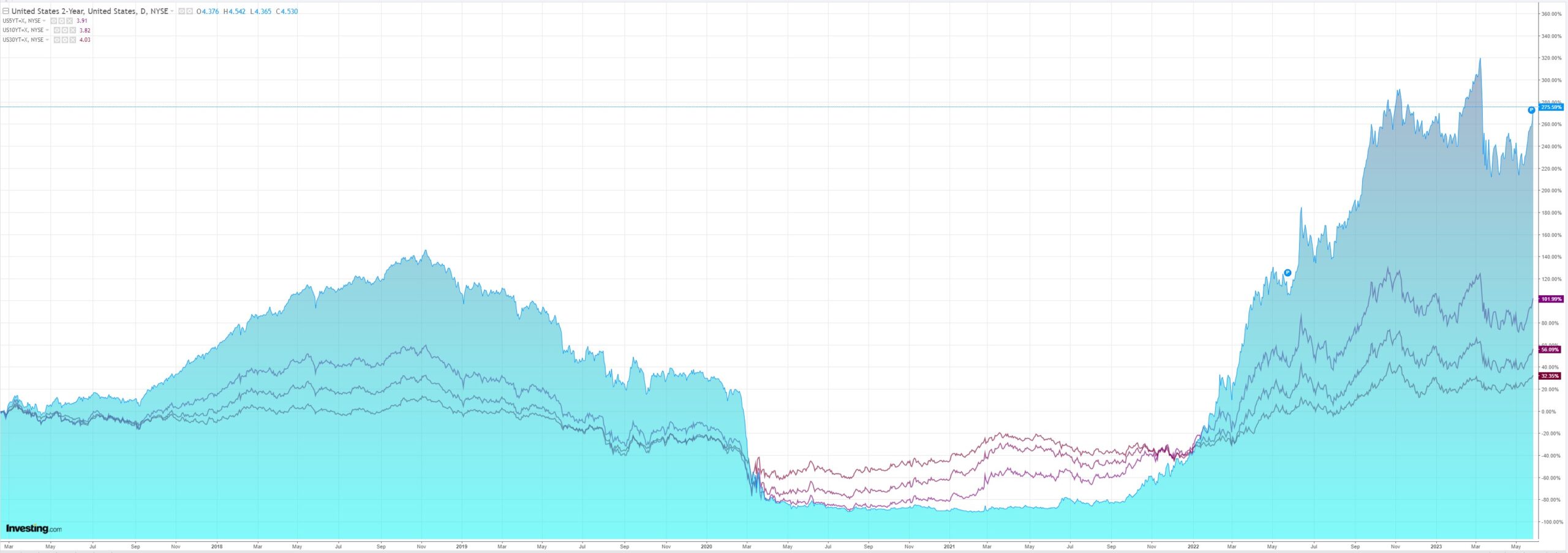

As Treasuries are terminated by AI:

Which keeps inflating stocks”

(NASDAQ:NVDA) earnings triggered another round of AI FOMO. This is real “red pill, blue pill” stuff now as AI shreds asset markets.

The US is the AI capital and is guzzling blue pills like it is going out of fashion. Illusion, denial, mass mania, and fantasy are all in control of stocks.

Conversely, every other market is taking the red pill and facing a harsh reality.

Treasuries are getting slaughtered as stocks rise, pricing out rate cuts and, soon enough, pricing in more hikes given inflation is not defeated.

Chinese and European assets are being burned as the former goes ex-growth and the latter no growth. Credit spreads are blowing out for both.

In FX, EUR and CNY are in free fall as reality bites.

In this environment of a late cycle bubble in AI lifting US activity via wealth effects, as everywhere else swoons on real economy headwinds, I can’t see any reason why DXY should not be back at its former highs, far above.

All that can stop it is a left-tail event:

- the AI bubble collapses upon itself as liquidity dries up;

- the AI bubble collapses as the rising DXY and stalling global economy hammer earnings;

- the AI bubble collapses on an X-date default;

- the AI bubble collapses on the bank run.

Or all four, or some unknown unknown event.

Until then, the red pill path ahead for AUD is to be sucked down a greasy tube into a bottomless, dark reality.