DXY eased but the trend higher is intact:

AUD is absolutely paralysed:

As North Asia goes down the gurgler:

Oil CTAs are a big problem:

Dragging up metals:

Miners are stuck:

EM too:

The junk warning siren is getting louder:

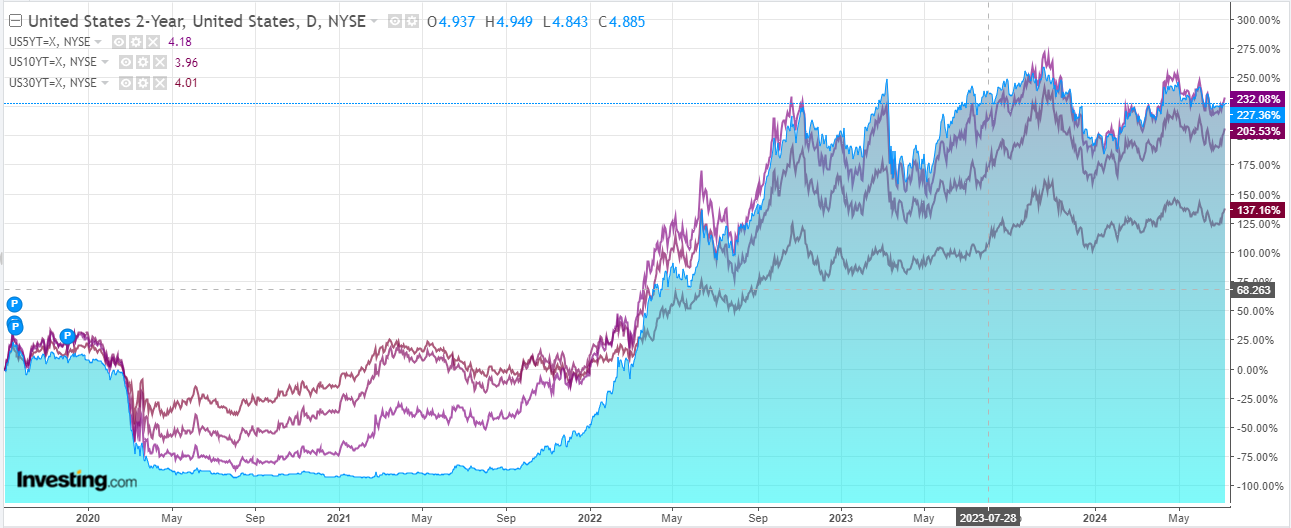

As yields jackknife with Trump odds:

And stocks don’t care about anything:

There is a lot going on but European elections are most pressing. BofA has more:

French Election: downside EUR risk premia building

With the Fed providing little actionable guidance, market attention has quickly shifted to French election risks.

We see three main scenarios with different FX implications:

1.A presidential majority–EUR positive on higher hopes for further euro area integration and with fiscal concerns likely in check

2.Hung parliament–modestly EUR positive from current levels, but upside limited by parliament’s ability to address future shocks

3.National Rally majority–notably EUR negative on fiscal concerns and onpotentially lower hopes for further euro area integration

These scenarios present notably asymmetric risks for the EUR–which, in a very bad scenario, could even test parity.

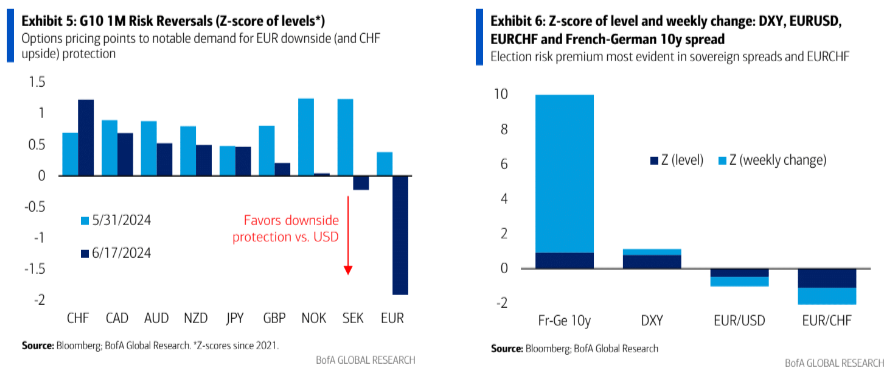

The market has taken notice. Moves in French-German sovereign spreads have been most notable, with the ~30bp widening in 10-year spreads representing a 9 standard deviation weekly move as the market reassesses credit risks going forward.

Spot FX has been relatively more contained, though the episode has naturally weighed on the EURCHF pair, as was so often typical during the euro are banking and sovereign crisis.

FX options markets have reacted more discernably, with 1-month EUR/USD risk reversals moving notably over the past week, as the EUR and (to a much lesser degree) SEK being the only G10 currencies trading with a premium for downside protection vs the USD.

It’s still not clear which scenario will win out, though gridlock is probably favourite.

While this might deliver a short-term relief rally, I can’t see how it is in any way a EUR positive. The chaos of a hung parliament will be used by the Right to charge for the presidency in 2027.

Add Donald Trump winning next and what Europe is going to do about Ukraine becomes a near existential question for the EU.

Australian dollar is entering a period of intensifying risks.