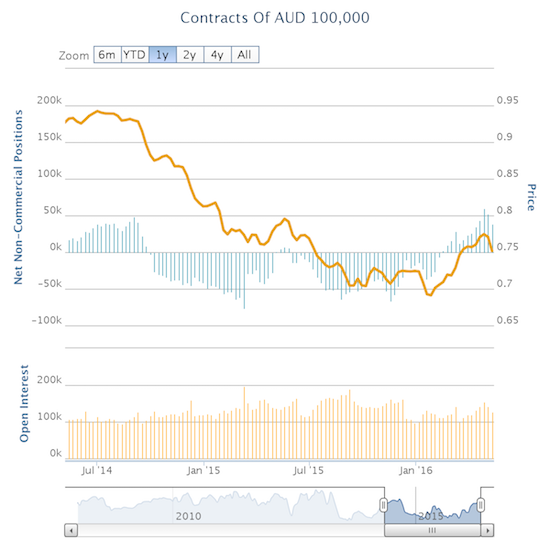

In the wake of poor inflation data, a rate cut from the Reserve Bank of Australia (RBA) and then a dovish Statement on Monetary policy, speculators decided that this was not the time to have such a large net long exposure to the Australian dollar (NYSE:FXA).

Source: Oanda’s CFTC’s Commitment of Traders

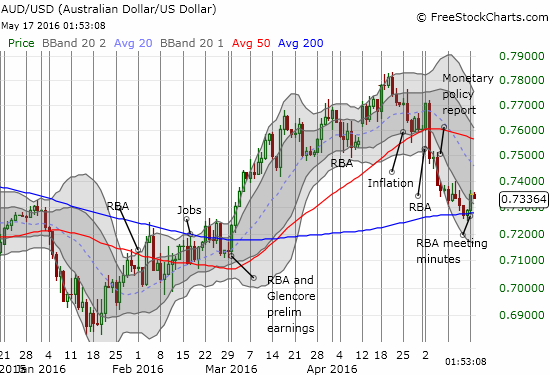

Roll forward to May 16 – the Australian dollar rallied afresh in the wake of the release of minutes from the RBA’s last policy meeting. The text was very consistent with the announcement from the meeting and was not nearly as informative as the Statement On Monetary Policy that followed a few days later. So to explain the rally I have to default to the standby of “market expectations.” I am guessing market participants feared the minutes could contain clues to more rate cuts around the corner. The minutes contained no such language.

The RBA minutes helped AUD/USD find support at the 200-DMA. Given the minutes were consistent with info that caused the Australian dollar to slide twice, I doubt this support will hold for long.

Source: FreeStockCharts.com

Here are some key points from the minutes…

Inflation is a real concern for the RBA. The Statement on Monetary Policy included the same commentary on inflation found in the minutes:

…the CPI data had indicated that weakness in domestic cost pressures had been broadly based. Non-tradables inflation had declined further in March to around its lowest year-ended rate since the late 1990s, reflecting low growth in labour costs and a range of other factors, including heightened retail competition, a moderation in conditions in housing rental and construction markets, and declines in the cost of business inputs such as fuel and utilities…

the lower-than-expected CPI outcome could not be explained entirely by temporary factors.

Despite the inflation concerns, the RBA is just as confident about the economy as before. Perhaps this confidence comes from its willingness to cut rates to counter low inflation and an expectation that the Australian dollar’s exchange rate will remain low enough to support the economy. The market clearly decided to take the positive spin on this news even though this quote repeats information provided in the Statement on Monetary Policy from almost two weeks ago.

Members noted that there had been no material change to the forecasts for growth in the Australian economy, although the unexpected strength recorded in the latter part of 2015 had led to an upward revision to year-ended GDP growth in the near term. The effects of low interest rates and the depreciation of the exchange rate since early 2013 were expected to lead to a gradual strengthening of growth to an above-trend rate and help a further rebalancing of activity towards the non-resources sectors of the economy.

For those expecting a potential bottom in commodities to lead to renewed growth in investments, the RBA has bad news….at least for Australia:

Members noted that the recent rally in commodity prices was not expected to boost mining investment over the next couple of years.

The earlier publication of the Statement on Monetary Policy led to a swoon in the Australian dollar. This statement contained plenty of sobering info, which the minutes did nothing to lessen.

Starting with inflation, the RBA basically justifies its rate cut by noting low inflation is a global problem. Australia is just part of the pack.

Meanwhile, there have been further improvements in labour market conditions across all three economies. Despite that, inflation in the major advanced economies remains below central banks’ targets and inflation expectations have declined. This has been an important concern for central banks and contributed to the European Central Bank’s decision to ease monetary policy further in March.

The RBA also cast a wary eye toward China, its most important trade partner. The RBA delivered rare criticism of China’s economic policies by noting that the government appears to be sacrificing long-term financial stability for short-term gains. I feel THIS observation is something to watch!

The Chinese authorities appear, at present, to be giving greater priority to short-term growth objectives than to the longer-term goals of deleveraging and achieving growth that is less reliant on investment and heavy industry. The outlook for the Chinese economy continues to be a key source of uncertainty for the forecasts. One risk is that the pursuit of the authorities’ near-term growth targets is likely to increase already elevated levels of debt and could potentially delay addressing the problem of excess capacity in the manufacturing and resources sectors.

Given the commentary on China, I am not surprised to read that the RBA is skeptical about the sustainability of the current run-up in commodity prices.

…it is assumed that the prices of bulk commodities are not sustained at current levels. Chinese steel demand is still expected to decline over the next couple of years and a substantial amount of new, low-cost iron ore supply is likely to enter the market over that period.

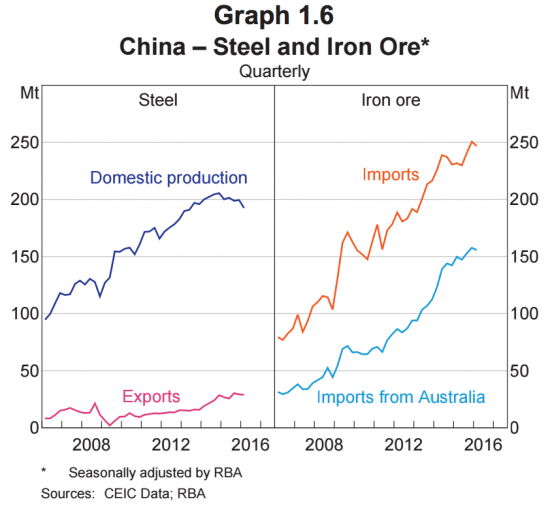

Note that the most sober analysts have understood this forecast for quite some time. I have also stuck by it in staying bearish on iron ore. The chart below shows how steel production has tapered even as iron ore imports continue to rip higher.

Iron ore continues to flood into China despite a notable tapering in steel production.

Source: Reserve Bank of Australia Statement on Monetary Policy

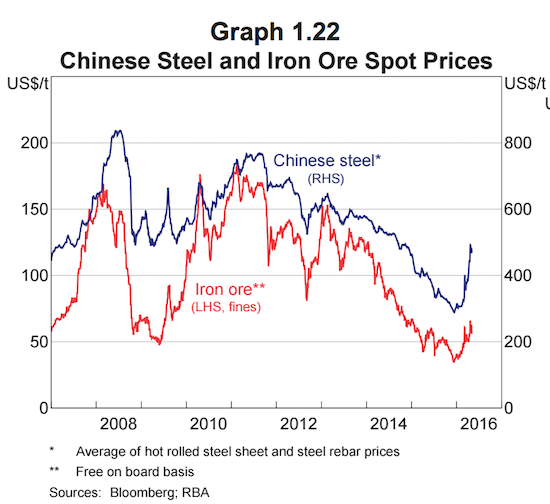

The price of iron ore has experienced a tremendous rebound so far this year even with the implosion of the latest price bubble. Like many others, the RBA did not allow this price bubble and speculative activity to motivate a change in forecast. The most likely path forward is on-going “downward pressure on prices.”

The spot price of iron ore has increased significantly over recent months to be around 60 per cent above the low reached in December 2015, although it remains 70 per cent below its 2011 peak…The prices of iron ore and steel rose sharply after the Chinese Government announced its growth targets for 2016 in early March, which led to improvements in the near-term outlook for steel demand. Re‑stocking of iron ore inventories and some production cuts from high-cost global iron ore producers, including in China, are also likely to have supported prices. Speculative activity in futures markets may also have played a role. At the same time, however, the expected increase in the global supply of iron ore, as capacity expansions come on line in Australia and Brazil, may exert downward pressure on prices, and Chinese steel production is expected to moderate over the year ahead.

Iron ore and steel prices are peas in a pod.

Source: Reserve Bank of Australia Statement on Monetary Policy

As usual, my main interest in this report was commentary on the Australian dollar. The RBA only noted that past depreciation should support inflation pressures. Uncertainty in the exchange rate makes the RBA’s job of forecasting more difficult…

The substantial exchange rate depreciation over recent years is expected to continue to place some upward pressure on inflation for a time. While the exchange rate is assumed to remain around current levels over the forecast period, it may respond to a number of influences, including any unanticipated changes to the outlook for growth in China, commodity prices or the monetary policy decisions of the major central banks. It therefore represents a significant source of uncertainty for the forecasts of inflation, as well as for the outlook for growth in activity.

Going forward, I expect the Australian dollar to meander with sparks from the occasional economic report. Until the inflation outlook improves, I expect a negative bias on the Australian dollar. I have shifted my trading strategy accordingly to more aggressively fade rallies.

Be careful out there!

Full disclosure: net short the Australian dollar