DXY was firm last night:

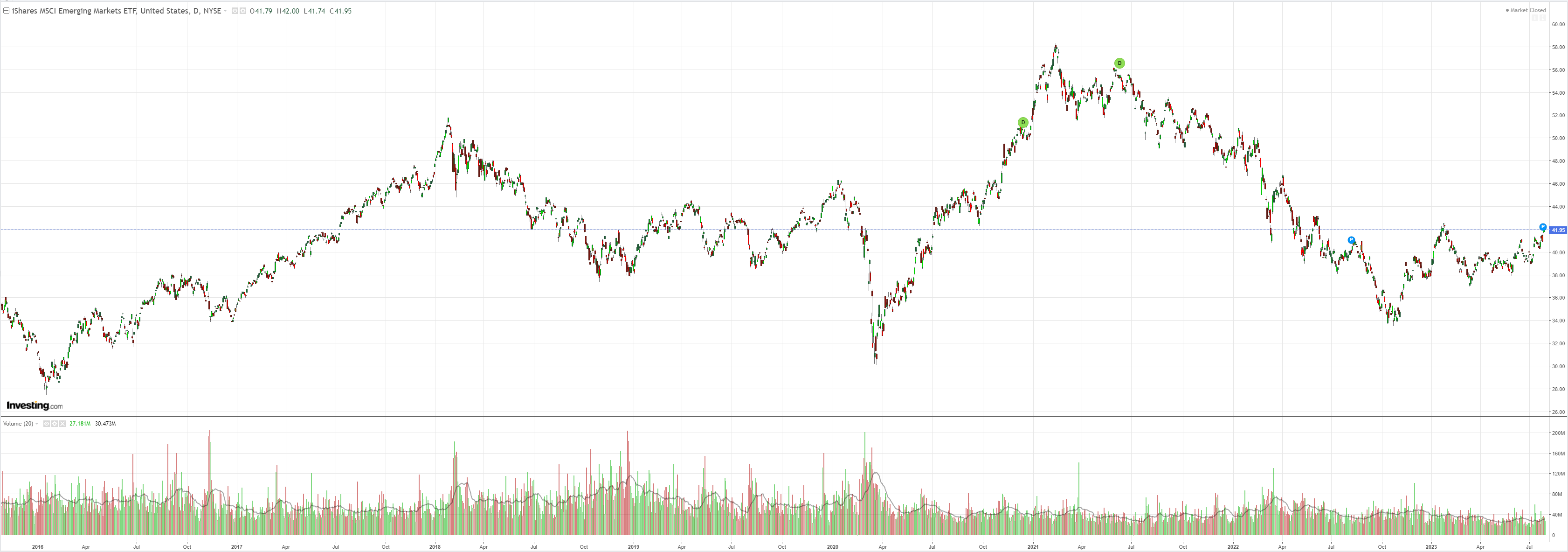

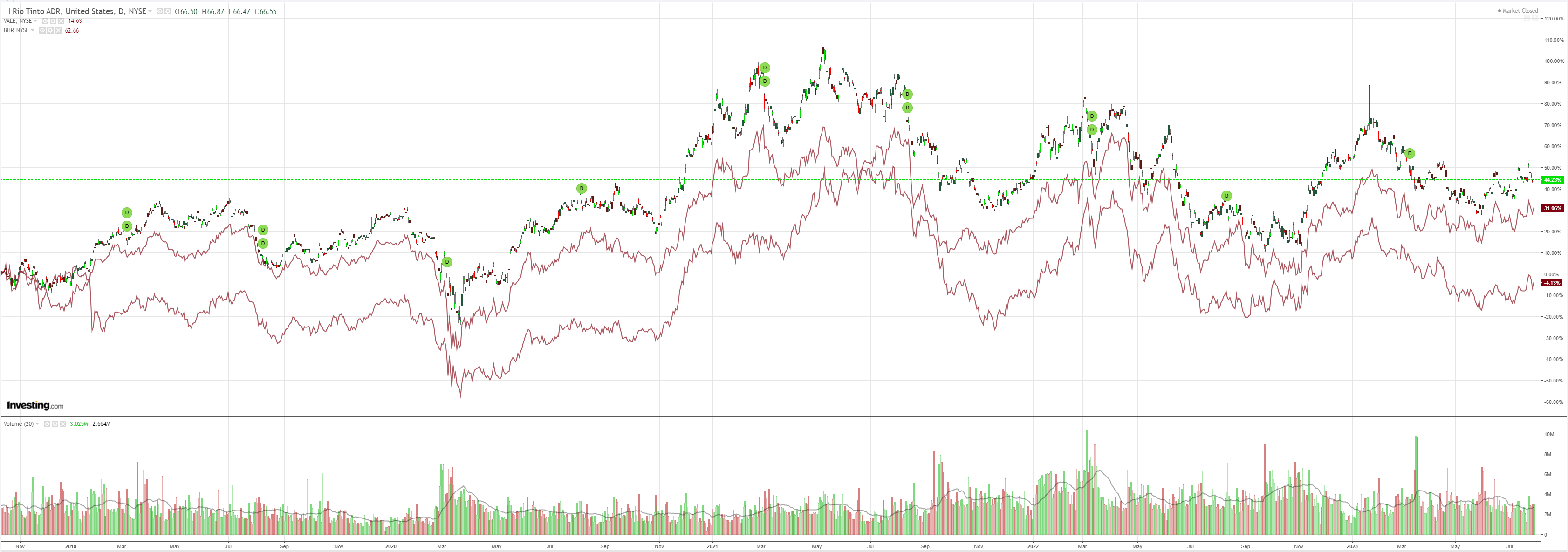

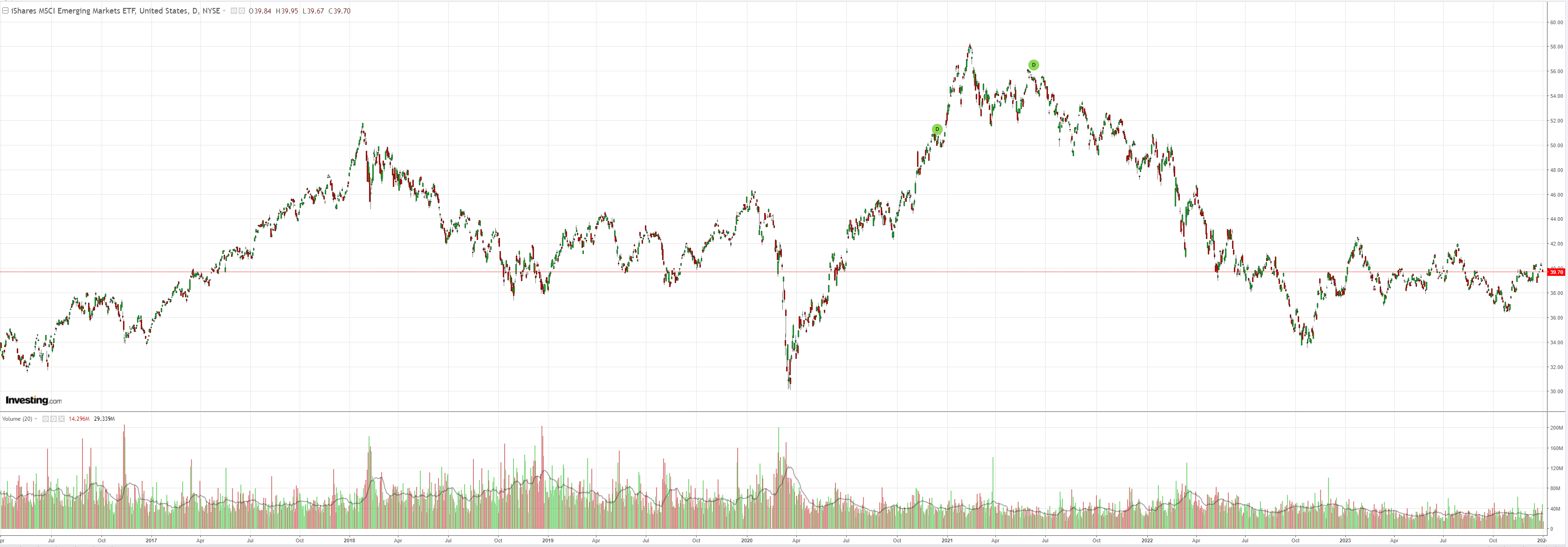

The whole Crap Complex roared on the China stimulus delusion. AUD, commods, miners, EM and junk:

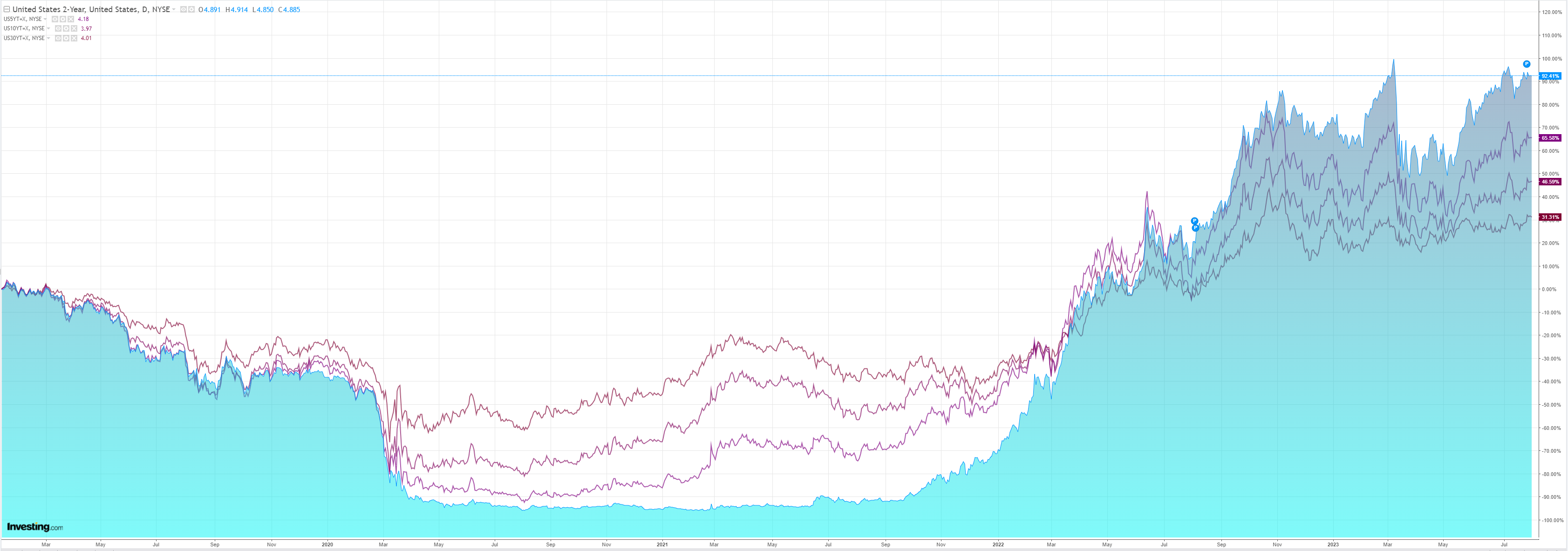

Yields were stable:

Stocks eked out gains

It’s not easy positioning for long-cycle events. But that is what is underway in China. A long-cycle credit adjustment, like that in the US in 2008.

Markets are hopeless at discounting such events. They follow the cyclical pulses on muscle memory instead. Everything I read from Wall Street is glowing about the Chinese stimulus. A kowtowing Morgan Stanley (NYSE:MS) is shopping it as a pivot on the scale of 2018 which is absurd.

It is a near complete bust for commodities (my comments in caps):

- Thirteen government departments outlined a plan on July 18 to boost household spending on everything from electric appliances to furniture. Local authorities are encouraged to help residents refurbish their homes, and people should get better access to credit to buy household products, according to the measures announced. YAWN

- On July 28, three government agencies outlined a plan to increase manufacturing of small consumer goods — or the so-called light industry sector, which makes up more than a quarter of China’s exports. Steps will be taken to increase sales of green and smart home goods in rural areas, and expand the use of battery products in electric cars, power stage and telecommunications. An exchange dedicated to helping small firms get access to funds will also be expanded. DEMAND VIA SUPPLY. RIIIIGHT…

- On July 27, China’s housing minister urged financial regulators and lenders to strengthen efforts to revive the sector. He called for homebuyers who had paid off previous mortgages to be considered as first-time purchasers. Up to now, many buyers in big cities who have a mortgage history but don’t currently own a property are subject to higher down-payment rules. NOBODY WANTS TO BUY, QUITE SENSIBLY.

- The NDRC released a 10-step plan on July 21 to increase car purchases, particularly for new-energy vehicles, including lower costs for electric-vehicle charging and extending tax breaks. In June, the Ministry of Commerce launched a six-month campaign to boost car purchases and drive electric vehicle adoption in rural areas. NORMAL STUFF.

- The Communist Party and government issued a rare joint pledge on July 19 to improve conditions for private businesses after wrapping up an almost two-year regulatory crackdown of the technology sector. TOO LATE. DERISKING TO CONTINUE.

- The National Development and Reform Commission released a plan on July 24 encouraging private firms to invest in key industries like transportation, water conservation, clean energy, new infrastructure, advanced manufacturing and modern agricultural facilities. Local governments have submitted more than 2,900 projects, worth a total of 3.2 trillion yuan ($445 billion), that businesses can invest in. The NDRC will also seek to finance the projects through bank loans and real estate investment trust products. PRIVATE MONEY WON’T INVEST IN LOSSMAKING INFRASTRUCTURE, WHICH IS ALL THAT IS LEFT.

- The PBOC on June 13 cut its main policy interest rates in a surprise move, providing monetary stimulus to the economy. The move came ahead of data showing a slump in real estate, a worrying decline in private sector investment and record joblessness among young people. MUCH MORE TO COME HERE. NO CHOICE.

There is nothing of magnitude to offset the structural real estate adjustment. Especially so for commodities and uniquely so for bulks.

It looks to me like this is some combination of:

- Beijing ideology does not and will not stimulate consumption;

- a bursting property development and infrastructure bubble of unimaginable proportions, and

- the natural constraints of a dictatorial system terrified of liberating its people.

Whatever it is, Beijing knows it can’t drive its previous growth model any further but is unwilling to embrace a new one.

The stimulus is a bust. China is ex-growth. Europe is buggered by it. EM as a viable asset class is in question.

DXY wins. AUD toast in due course.