DXY is breaking down with inflation:

AUD fell anyway:

North Asia is mixed:

Oil and gold soft:

Metals too:

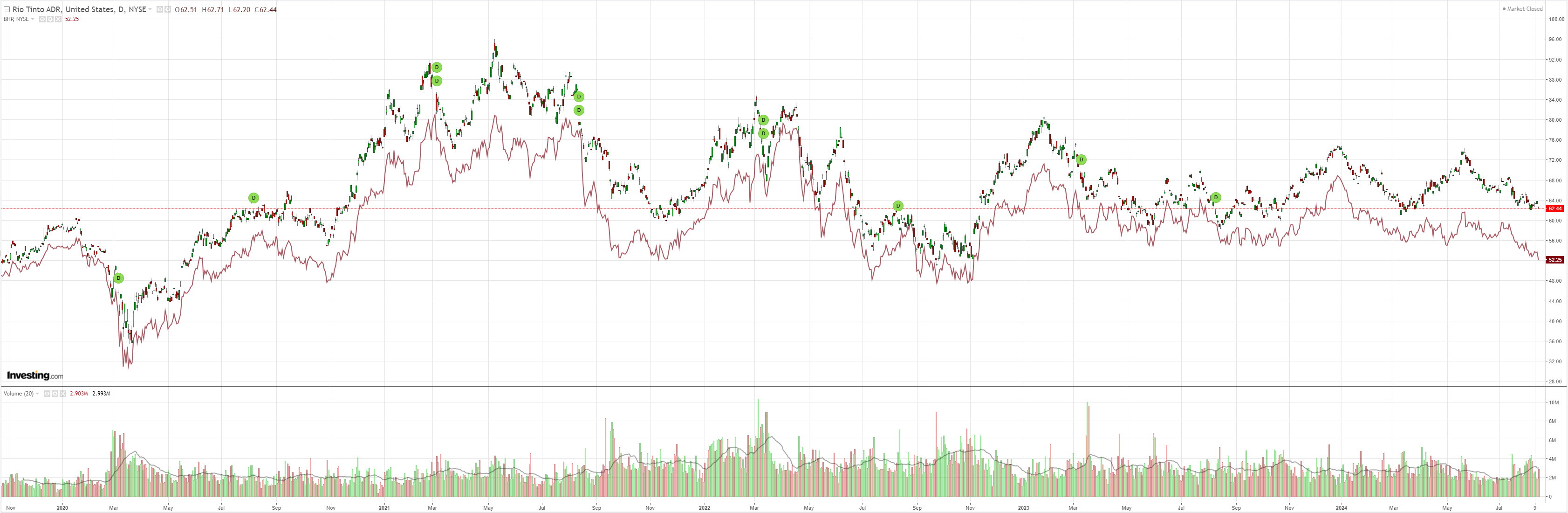

Miners have have fallen down the bottomless shaft:

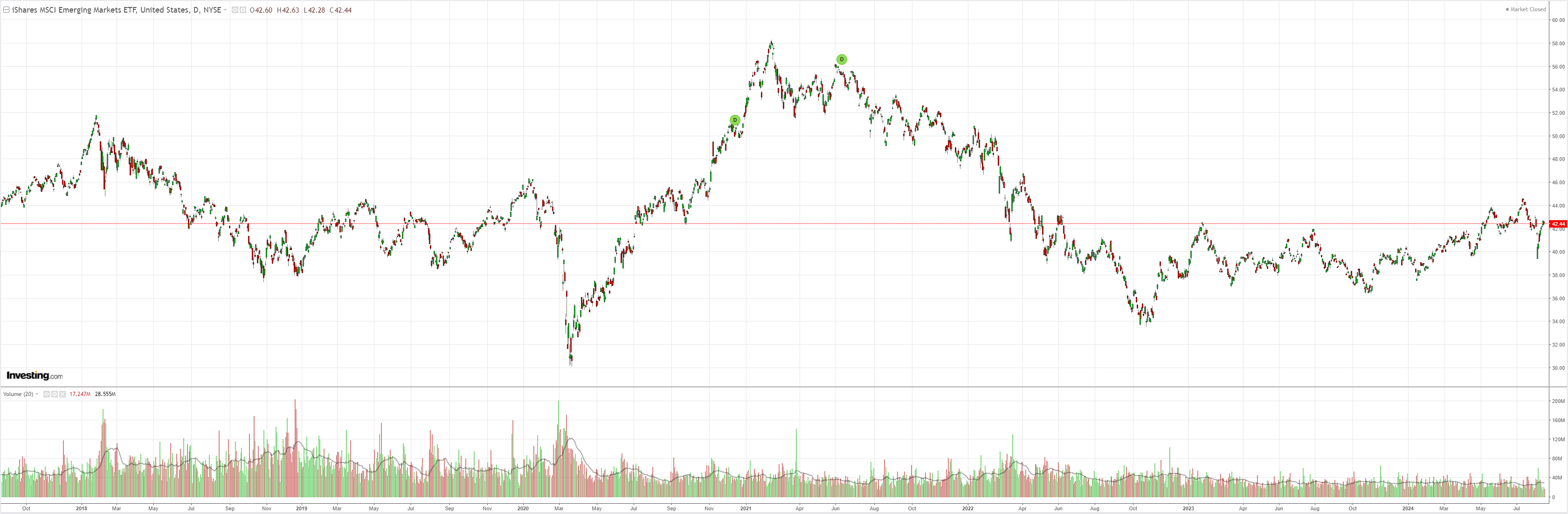

EM meh:

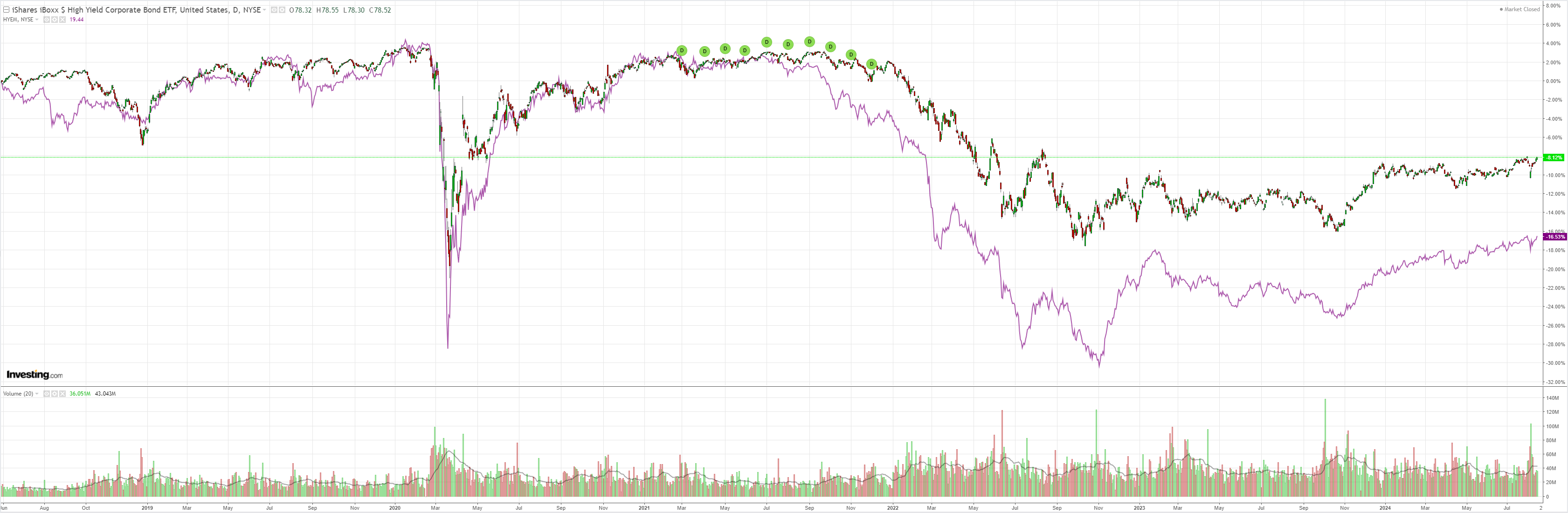

Junk is back:

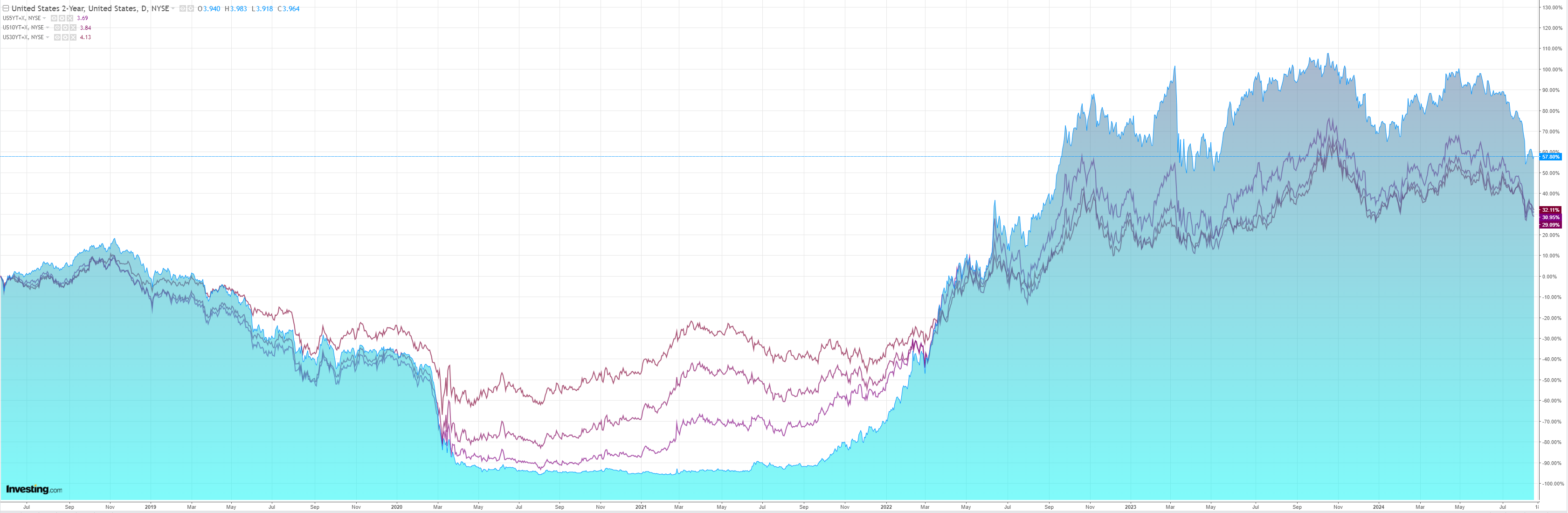

As yields confirm US inflation is beaten:

Stocks are jumpy:

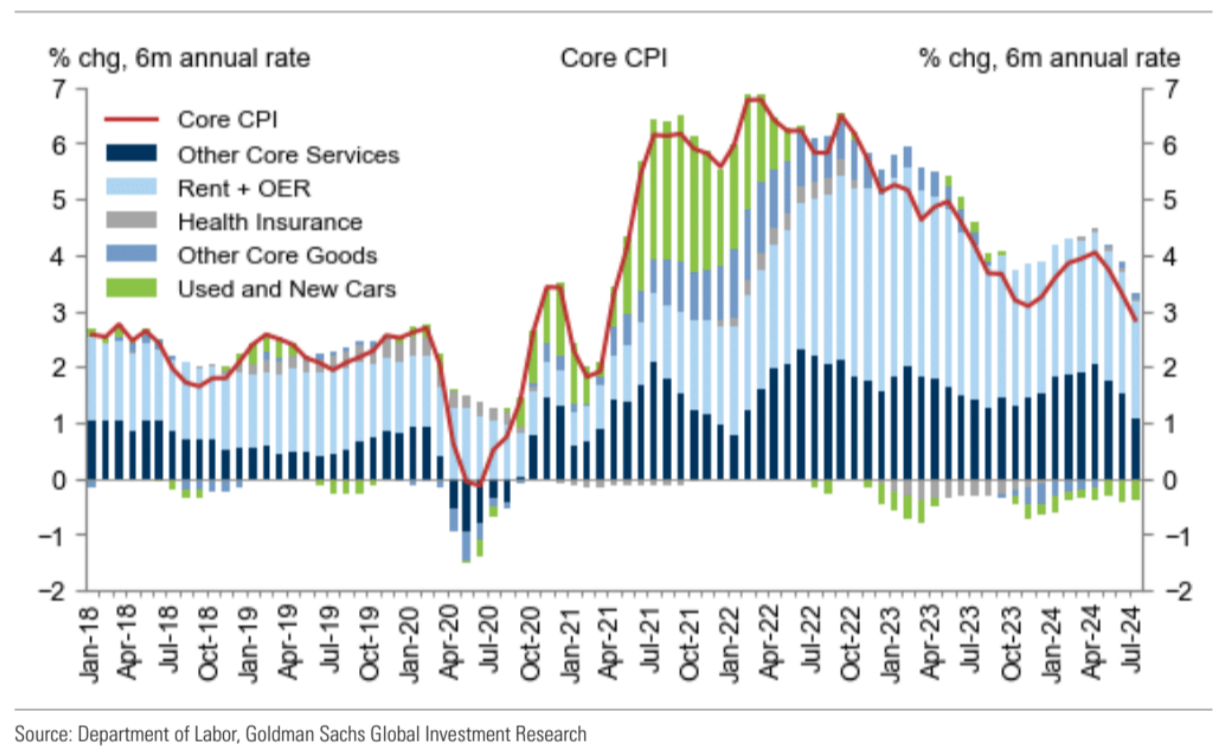

US inflation is beaten. Goldman:

July core CPI rose 0.17% month-over-month, roughly in line with expectations.

The composition was mixed, as large declines in the volatile used cars and airfares components were offset by above-trend increases in the car insurance and rent components.

Non-housing services prices increased 0.21%.

Based on details of the CPI and PPI reports, we estimate that the core PCE price index rose 0.14% in July.

With OER set to fall much further, the Fed has won, and rate cuts will begin in September. I expect 25bps in every meeting into next year.

This is short-term bearish DXY but AUD fell anyway. I can only put that down the terrible Chinese credit data and the big break lower in iron ore.

The Aussie terms of trade are a major input in the currency and the future is bleak:

I’m still selling AUD rallies.