DXY rebounded last night and EUR sank:

Australian dollar was bashed:

Base metals were slaughtered:

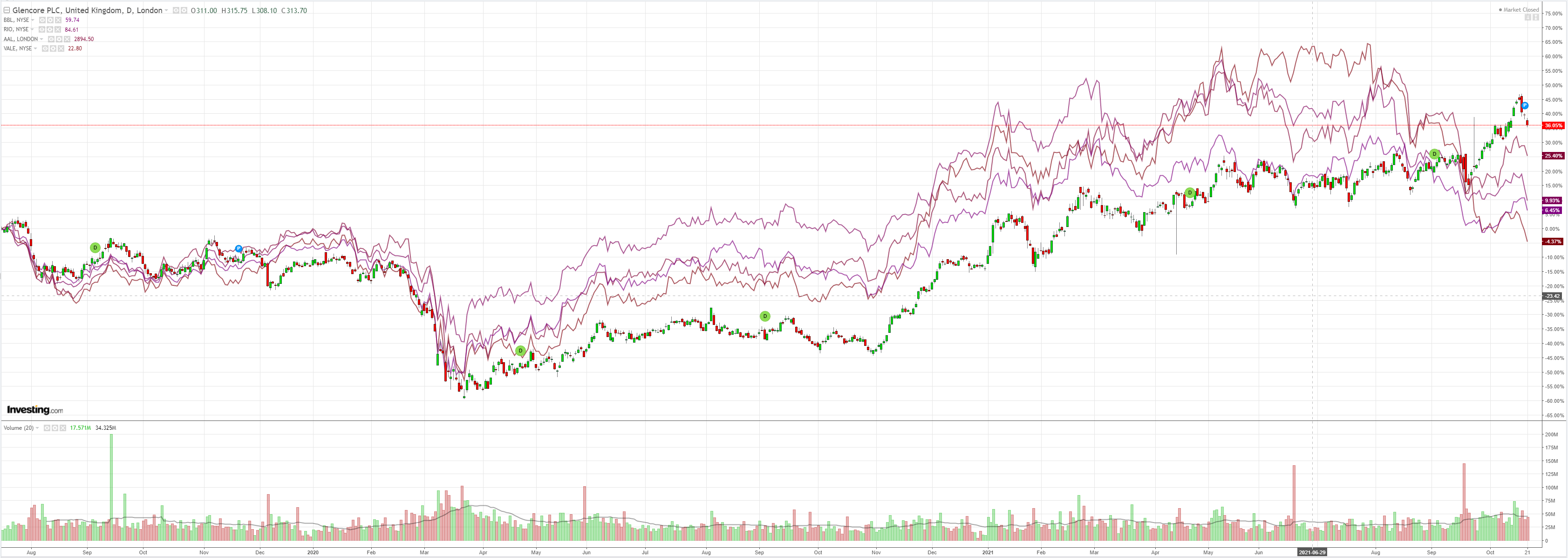

Big miners cremated:

EM stocks weak:

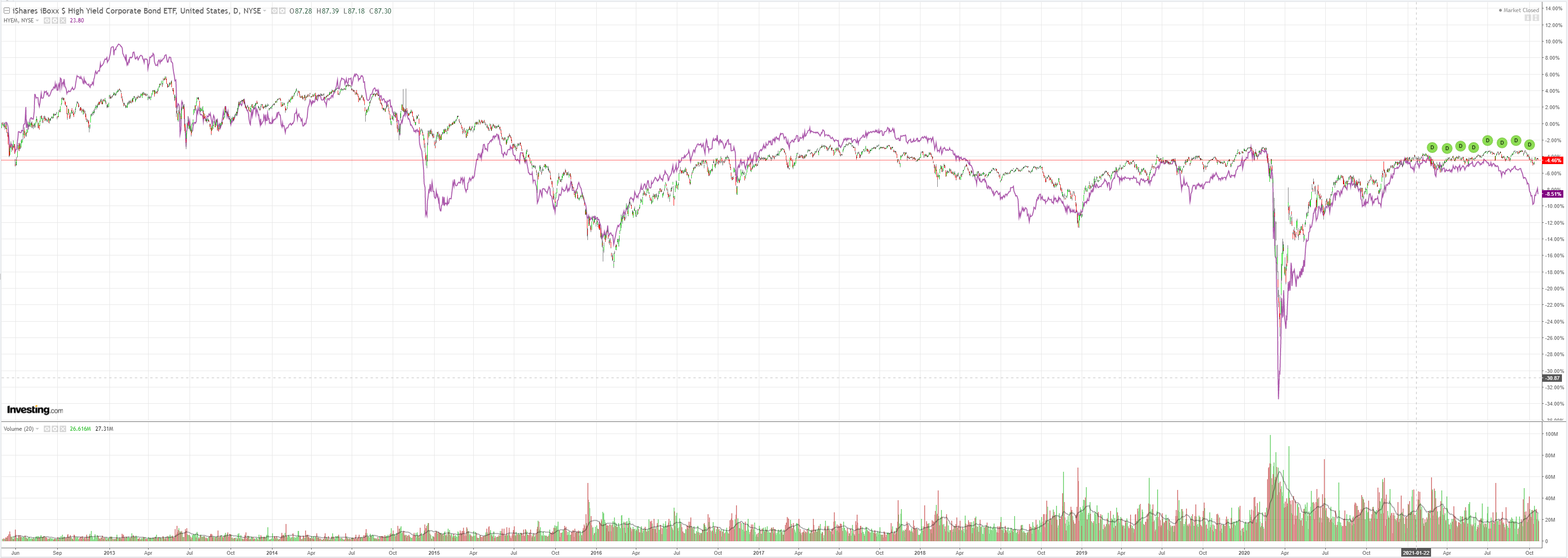

Junk weaker:

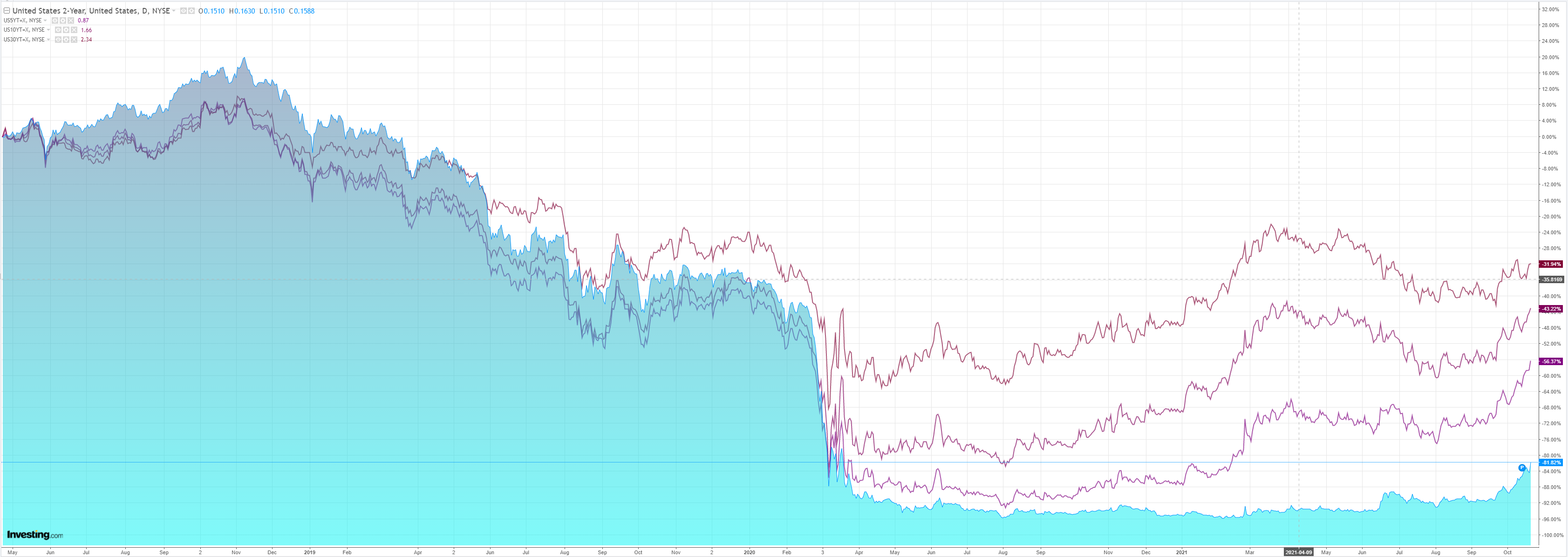

As yields lifted but the further out you go the flatter the curve:

Which drove Growth:

Westpac has the wrap:

Event Wrap

US initial weekly jobless claims fell to 290k (est. 297k, prior 296k), with continuing claims also lower at 2481k (est. 2548k, prior 2603k).

The Philadelphia Fed business survey disappointed at 23.8 (est. 25.0, prior 30.7). While sentiment should revert back towards more historically typical levels into 2022, it should remain elevated due to support from factory efforts to rebuild inventories.

The leading index for September rose 0.2% (est. 0.4%, prior 0.8%) to a record high. Components were mixed, with six making positive contributions, led by ISM new orders, while four gauges declined, led by building permits.

Existing home sales beat expectations, rising 7.0% in September (est. 3.7%, prior -2.0%). Sales have been choppy this year amid record high prices, record low inventories, low but rising mortgage rates, and the pandemic’s migration to the suburbs.

FOMC member Waller said that inflation risks are to the upside and the FOMC might have to respond faster if price pressures remain too high. The next few months will be critical for his inflation views, he added.

Eurozone consumer confidence slipped to -4.8 (est. -5.0, prior -4.0).

Event Outlook

Australia: RBA Governor Lowe participates in an online panel at Universidad de Chile’s Conference on Central Bank Independence, Mandates and Policies.

Japan: The October Nikkei manufacturing PMI is likely to reflect continuing global supply chain disruptions, whilst the October services PMI will highlight a lagged recovery versus other developed markets.

Euro Area/UK: The October Markit manufacturing PMIs for Europe, the UK and Germany are also likely to be affected by the global supply chain. The October services PMIs should remain robust with delta less of an issue for the region. UK consumer sentiment is expected to remain well above recent lows despite late September’s fuel crisis. September retail sales will again be burdened by the shift from goods to services as the UK reopens.

US: The October manufacturing and services PMIs are expected to print at healthy levels despite global uncertainties and delta being a higher risk to activity in the US. The FOMC’s Daly will speak on the Fed and climate change risk.

The key driver of the evening was the imploding energy bubble in China. It sucked in the entire commodity complex given if China has enough energy then it will begin to produce enough metals.

Thermal coal was slain:

Coking coal butchered:

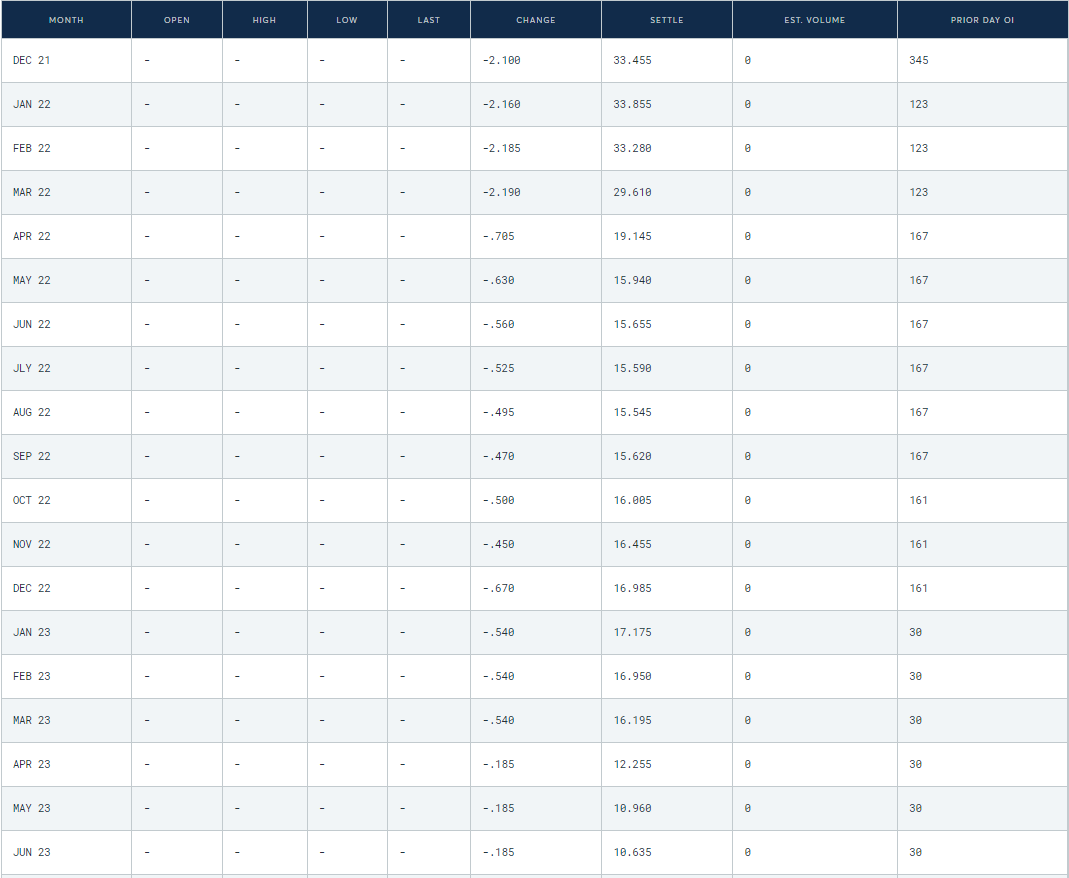

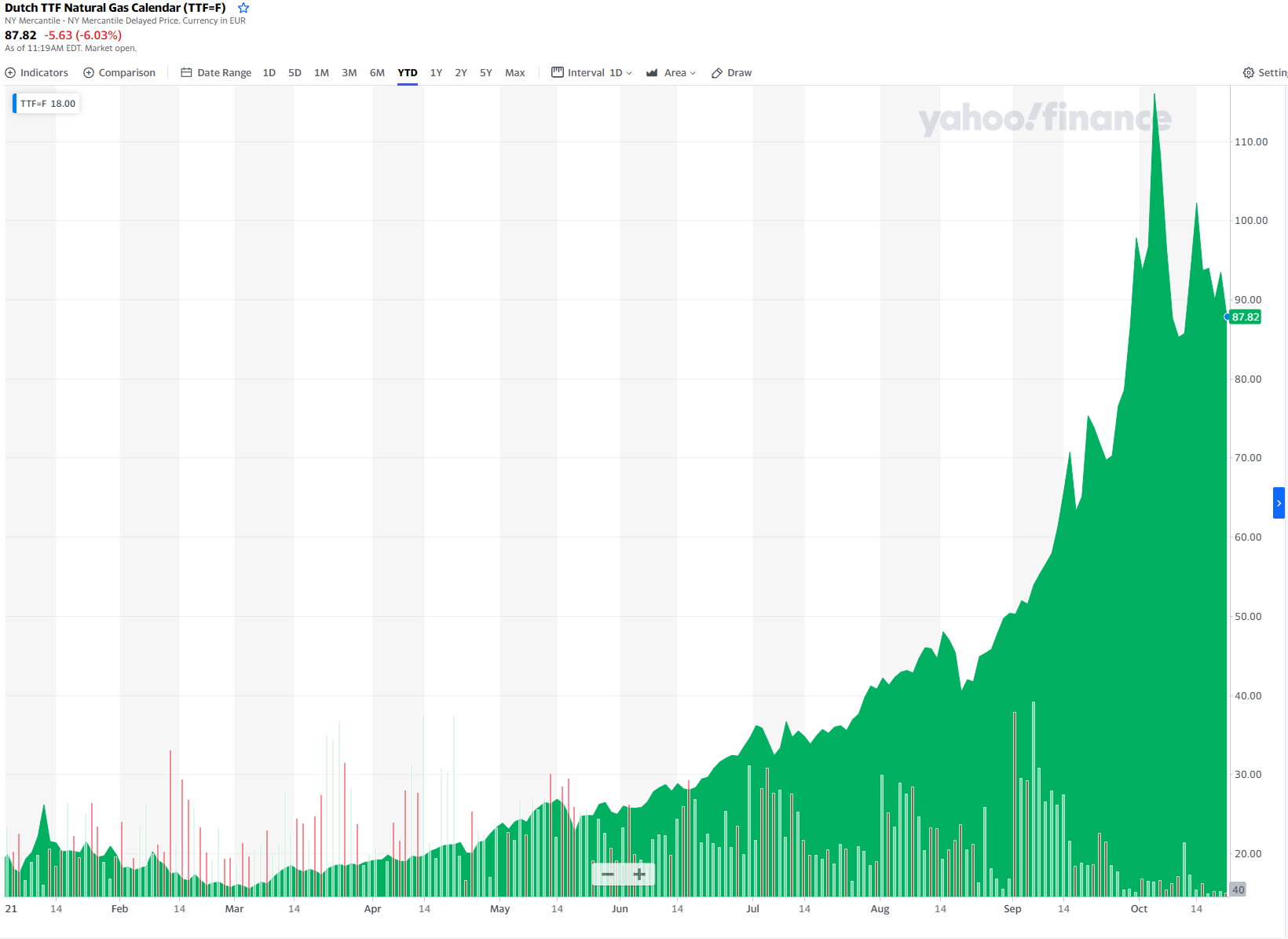

Even JKM and TTF caught the downdraft:

It looks to me like the coal bubble is over. It may take a few months to fully deflate and weather could still play a role but China has got it by the throat via booming domestic production and surging imports. Stand by for an enormous coal glut in 2022.

Gas is still more complex. Vlad Putin is keeping the pressure on:

Russia can increase gas supplies to Europe as soon as Germany approves the new Nord Stream 2 pipeline, President Vladimir Putin said, underlining Moscow’s conditions for help to resolve the continent’s energy crisis.

Putin said Gazprom (MCX:GAZP), the Kremlin’s gas monopoly, could increase flows by an extra 17.5bn cubic metres via the new pipeline “the day after tomorrow” if regulators approved it “tomorrow.”

The amount, equal to roughly 10 per cent of the gas Russia shipped to Europe and Turkey in 2020, would provide significant additional supplies at a time of record prices in Europe, even before the pipe’s second line is fully filled in December.

Not much mucking around there. This one is the lap of the gods.

As the energy bubble deflates, freeing Chinese metals processing just as its construction collapses and bulks crater, the global economy slows as spending shifts from goods to services, supply-side bottlenecks ease and the Fed tapers, the base case is that Goldman Sach’s careful nurtured commodities bubble is going to implode spectacularly across 2022.

Does that sound like a good bet on the AUD to you?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.