DXY held its gain last night:

AUD held its losses:

Oil is not well:

Metals did a bit better:

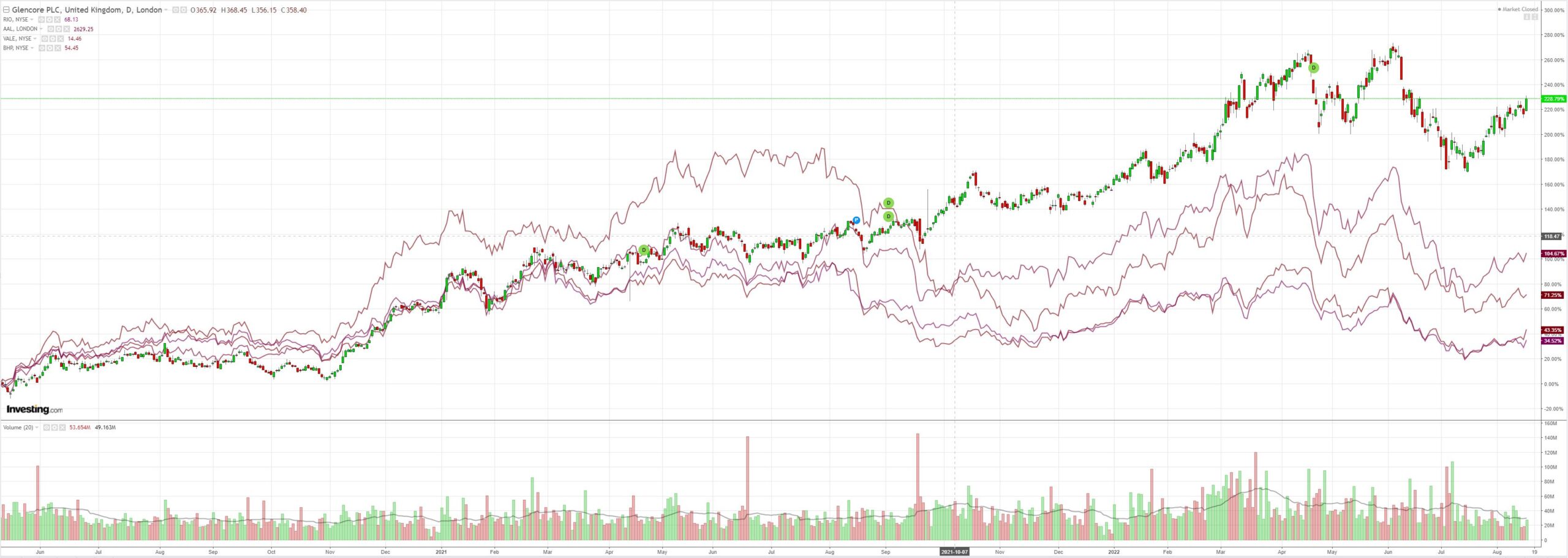

Mining (LON:GLEN) popped. Meh:

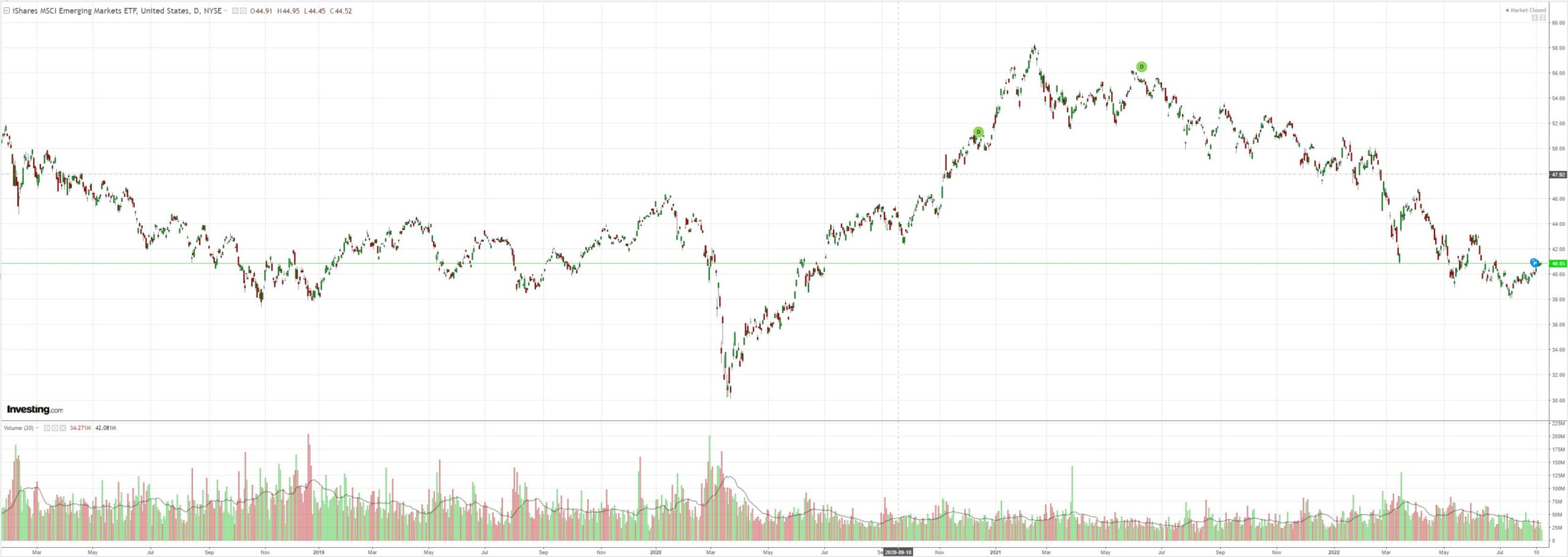

EM stocks (NYSE:EEM) are trying:

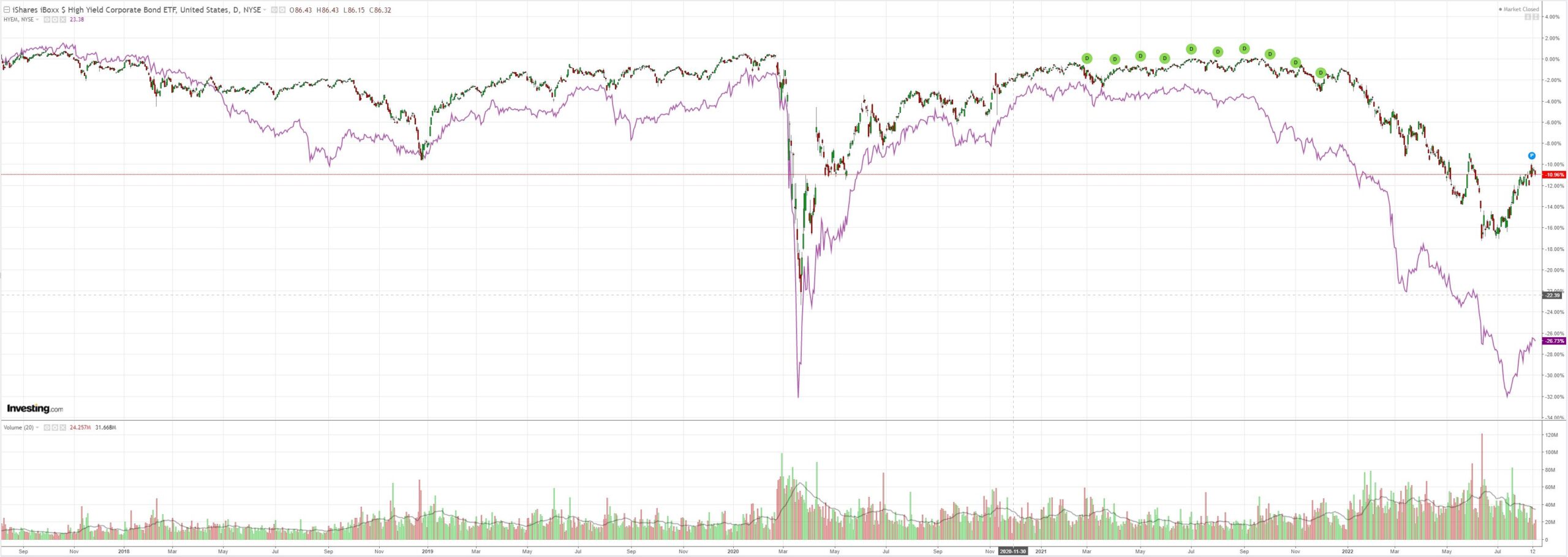

But junk (NYSE:HYG) has stalled:

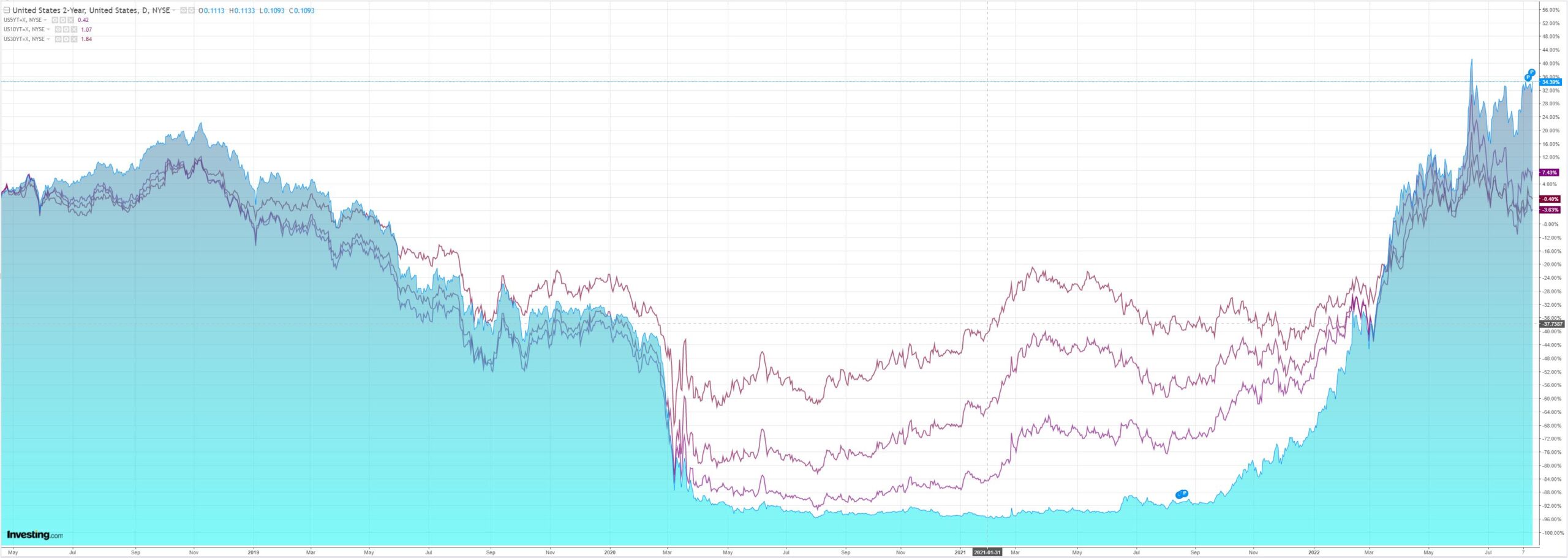

The US curve pancaked:

And stocks paused:

Westpac has the wrap:

Event Wrap

US industrial production in July was stronger than expected, up 0.6%m/m, with manufacturing rising 0.7%m/m (est. +0.3% for both). Capacity utilisation rose to 80.3% (est. 8.2%, prior revised to 79.9% from 80.0%). Housing starts in July stuttered at an annual pace of 1.446m (est. 1.528m, prior revised to 1.599m from 1.559m), Building permits remained elevated at 1.674m (est. 1.640m, prior 1.696m revised from 1.685m).

The Atlanta Fed’s GDP prediction model lowered Q3 to 1.81% from 2.45% last week (a Bloomberg survey of economists indicates 1.5%).

Canada’s CPI in July was as expected at +0.1%m/m and 7.6%y/y (prior 8.1%y/y), with oil prices receding but core measures rising.

Germany’s ZEW survey showed the Current Situation at -47.6 vs prior -45.9, Expectations -55.2 vs prior -53.8, Eurozone Current Situation -42.0 vs prior -44.4, and Eurozone Expectations -54.9vs prior -51.1.

UK labour data was solid and in line with expectations, with unemployment (3mths to June) at 3.8%. Although employment slipped slightly, jobless claims continued to decline and ex-bonus average earnings rose +4.7%y/y (est. +4.5%y/y).

Event Outlook

Aust: The Westpac-MI Leading Index will include a mixed batch of component updates but, on balance, looks likely to weaken again. Given the anecdotal evidence of firm wage pressures, the slow-moving WPI is expected to make a solid gain in Q2 with risks to the downside (Westpac f/c: 0.9%).

NZ: At today’s policy meeting, the RBNZ is widely expected to lift the Official Cash Rate by 50bp from 2.5% to 3.0% and to continue signalling further tightening ahead. The statement will be announced at 2pm and Governor Orr’s press conference will be at 3pm.

Japan: June’s core machinery orders should point towards a positive level of capital investment in Q2 (market f/c: 1.0%).

Eur/UK: The second estimate of Eurozone’s Q2 GDP will provide more colour around the upside surprise to output growth. Meanwhile, another lift in the UK’s CPI is anticipated in July as energy inflation pressures remain (market f/c: 0.4%mth; 0.8%yr).

US: Pressure on consumer spending from inflation and rising rates are expected to weigh heavily on retail sales in July (Westpac f/c: 0.0%; market f/c: 0.1%). Solid growth in business inventories is reflecting a robust pace of inventory recovery (market f/c: 1.4%). The FOMC’s July meeting minutes will provide more detail around the path for policy through 2022/23.

The major chart to watch right now is this one. CNY/USD is at the verge of breakdown with the PBoC so far offering little resistance:

If it breaks then expect AUD to sink with it, as well as broader risk assets.