DXY appears stuck in a firm range. I’m not sure we’ll see a downside break even with Fed easing:

AUD is printing bearish candles daily. At a bottom we would expect the opposite:

North Asian FX is going nowhere:

Oil reversed risk:

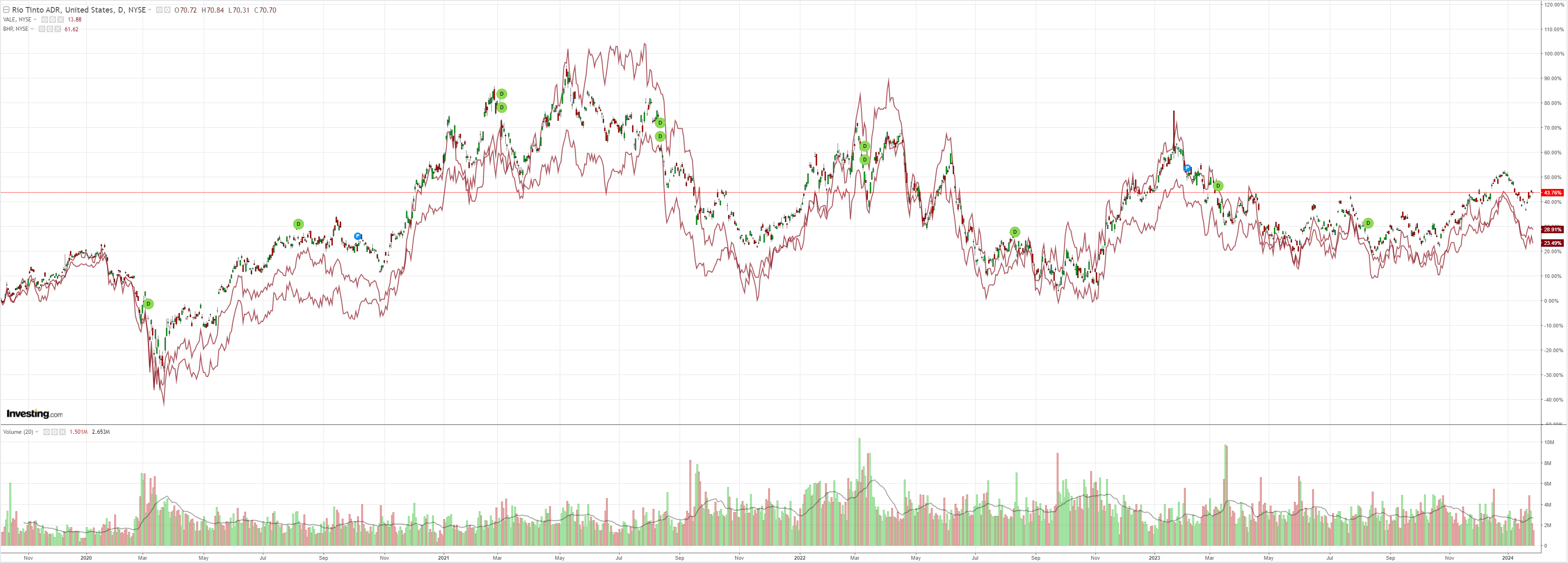

Dirt yawn:

Same for miners:

And EM despite the China stick save:

Junk is looking to rally some more:

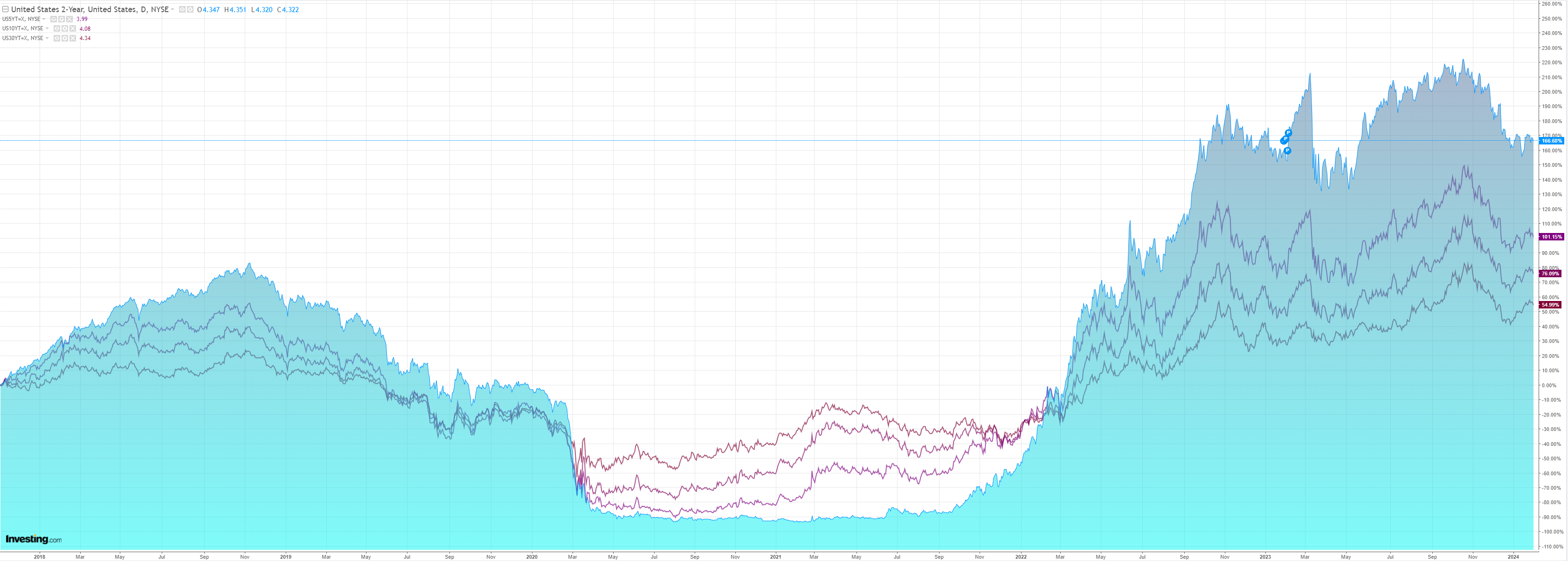

As yields tumble again:

Lighting up stocks:

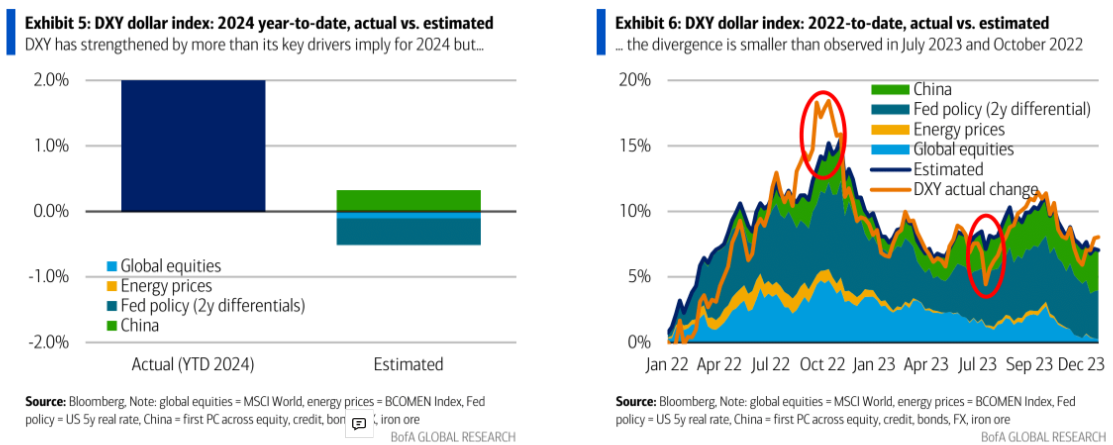

BofA explores the mighty greenback:

USD strength year-to-date has raised some eyebrows as it seems at odds with robust risk sentiment and lower US rates (vs. the rest of the world).

Our key driver framework reinforces this intuition: the DXY index has strengthened 2% YTD but its betas imply roughly flat performance, with rates & risk offset by deterioration in China sentiment (Exhibit 5).

However, the USD “overshoot” may be less dramatic than it first appears.

Exhibit 6 shows our DXY framework in cumulative changes since Jan 2022–virtually the entire long-term appreciation can be attributed to its four key drivers, especially rate differentials and China.

More importantly this longer-term perspective shows the gap between actual and estimated DXY levels pales in comparison to far bigger divergences observed in July 2023 and October 2022.

Fed clarity awaits data…Mixed Fed communication suggests a consensus has yet to be reached on the timing of the first rate cut and when to slow QT.

This raises the stakes of US data, starting with January numbers next week. We are especially focused on services, which has underpinned resilience in the consumer, jobs and inflation. For FX markets, service sector deceleration (vs. manufacturing) can be symptomatic of US recoupling with the rest of the world, a necessary condition for USD depreciation.

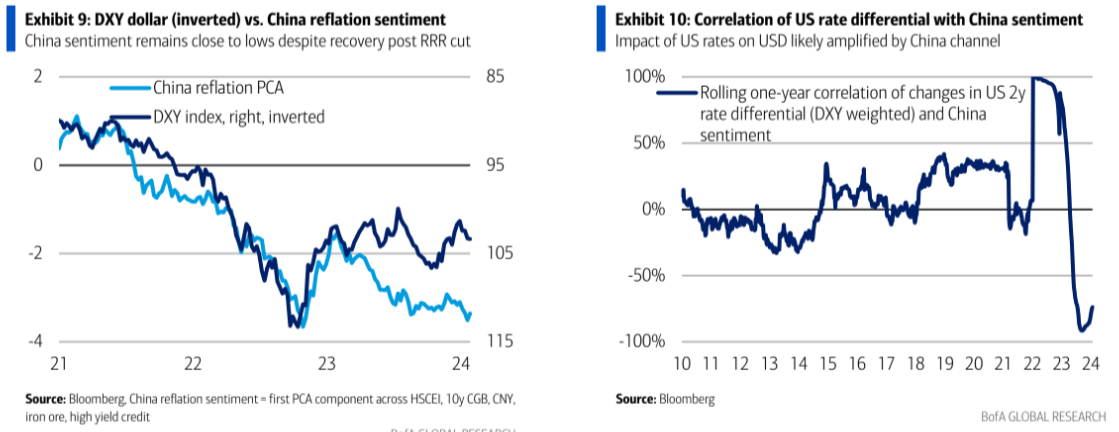

…China sentiment (especially equities and commodities) rebounded strongly after thesurprise 50bp RRR cut this week, but simply reversed the decline from mid-Jan: our China sentiment measure remains at a historically weak level (Exhibit 9).

Policy stimulus in China–even of the“big bang” variety–has lost some ofits market potency as investors err on the side of caution, awaiting evidence of recovery in the hard data, which will inevitably lag.

Or, more likely, not come at all.

My base is still a grind higher for AUD as the Fed leads global easing, but it is going nowhere fast.