DXY is refusing to break down. This is probably a soft landing signal, especially given the hard landing underway in Europe:

AUD is caught between soft and hard landings:

CNY is going nowhere still:

Oil and gold have puked:

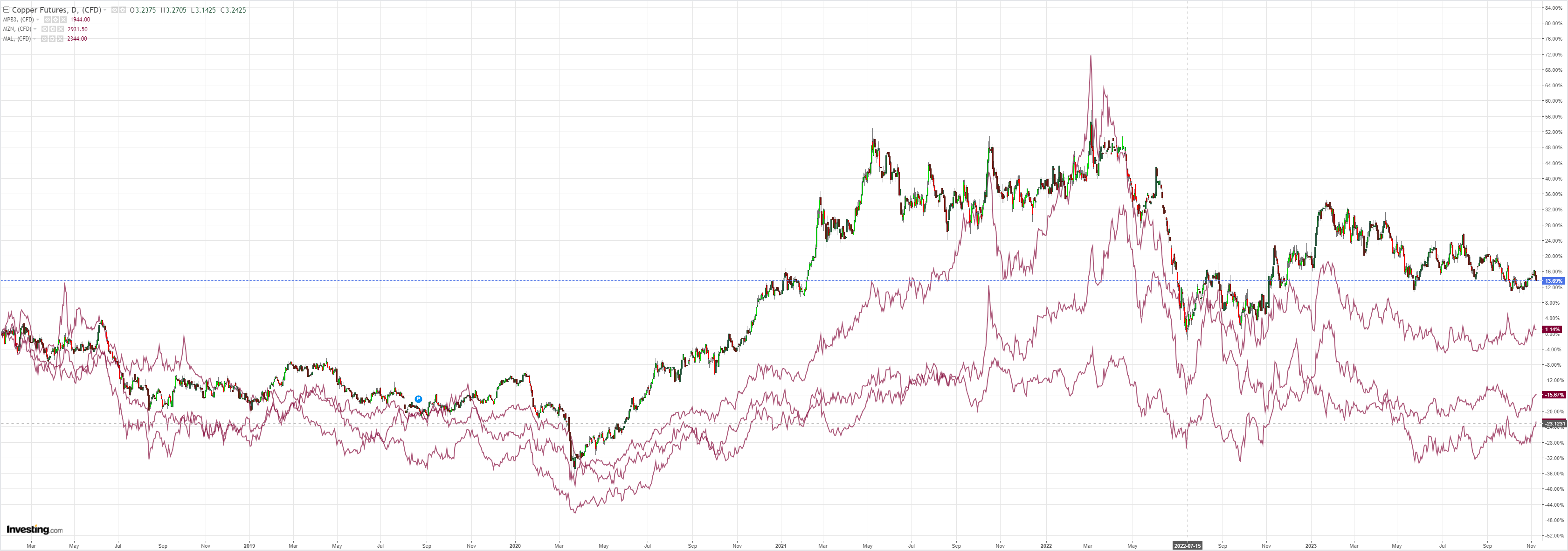

Dirt is struggling:

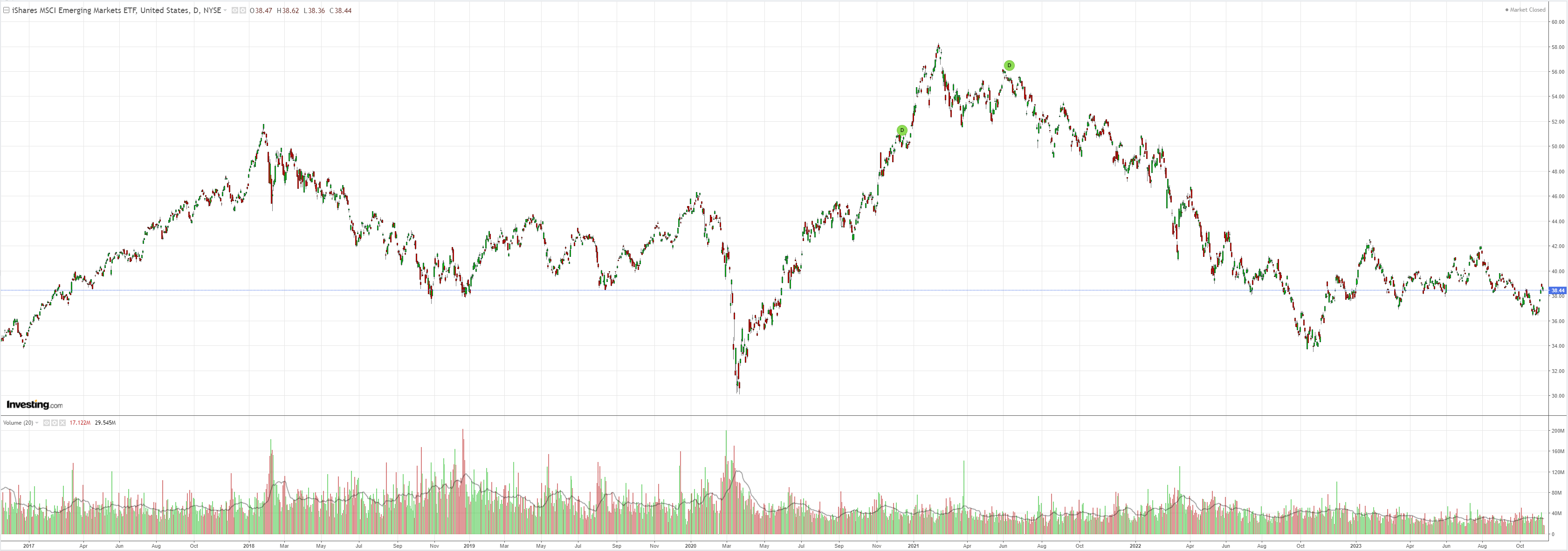

EM too:

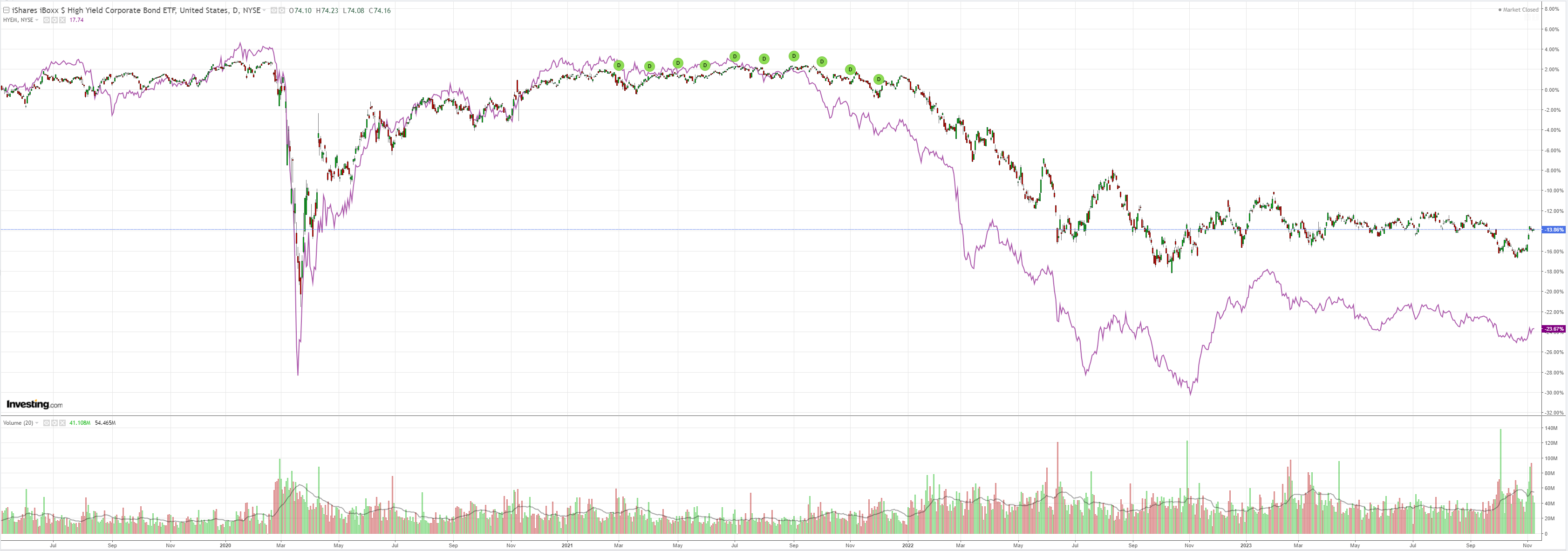

Junk is caught between soft and hard landings as well:

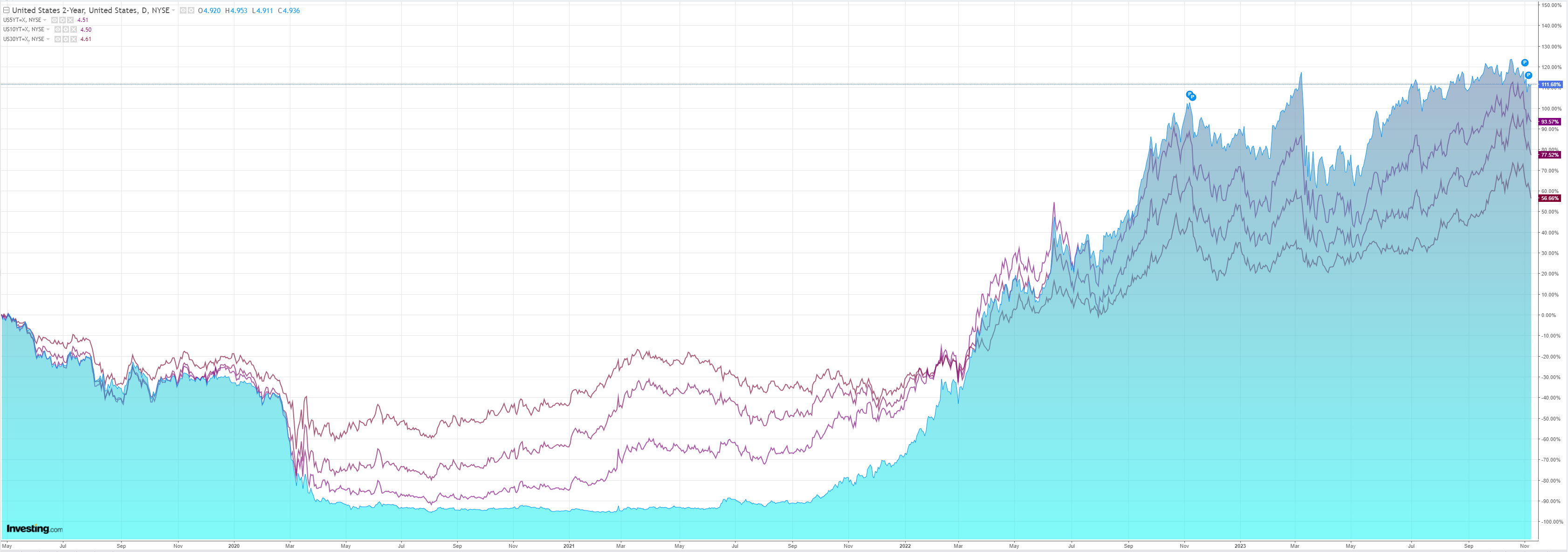

Yields are pulverised:

Which stocks love, so long as the landing is soft!

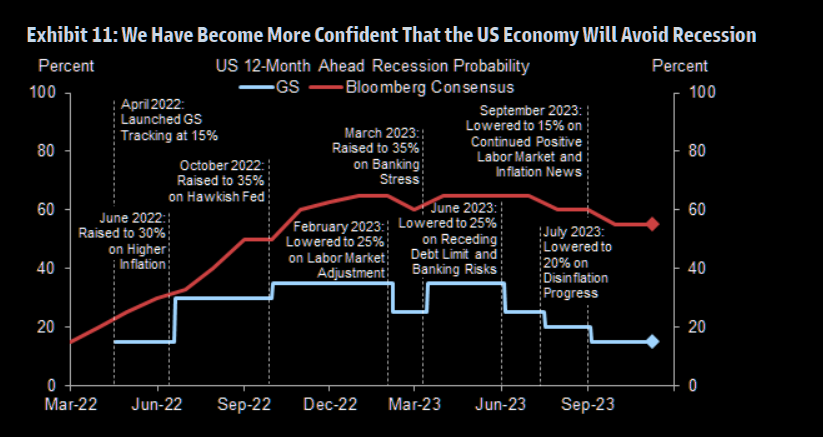

Goldman is crowing that a soft landing is coming:

“Despite the good news on growth and inflation in 2023, concerns about a recession among forecasters haven’t declined much. Even in the US, which has outperformed so clearly on growth in the past year, the chart shows that the median forecaster still estimates a probability of around 50% that a recession will start in the next 12 months.This is down only modestly from the 65% probability seen in late 2022 and far above our own probability of 15% (which in turn is down from 35% in late 2022).”

So far, it has been right. But I can’t recall the last time Goldman predicted a recession, so this is just as likely to be a stopped clock.

We can say that US headwinds were mounting strongly via FCI tightening, but the release valve is now off. Equities are free to run while yields fall to kick the cycle forward with another round of wealth effects.

On the other hand, Europe is heading into a hard landing, China is growing only thanks to bridges to nowhere and the GDP deflator, and Australia is in interminable per capita recession.

There is nothing much to recommend the AUD in that mix.