DXY is off and running with EUR sinking:

But AUD does not care, soaring with the energy Icarus:

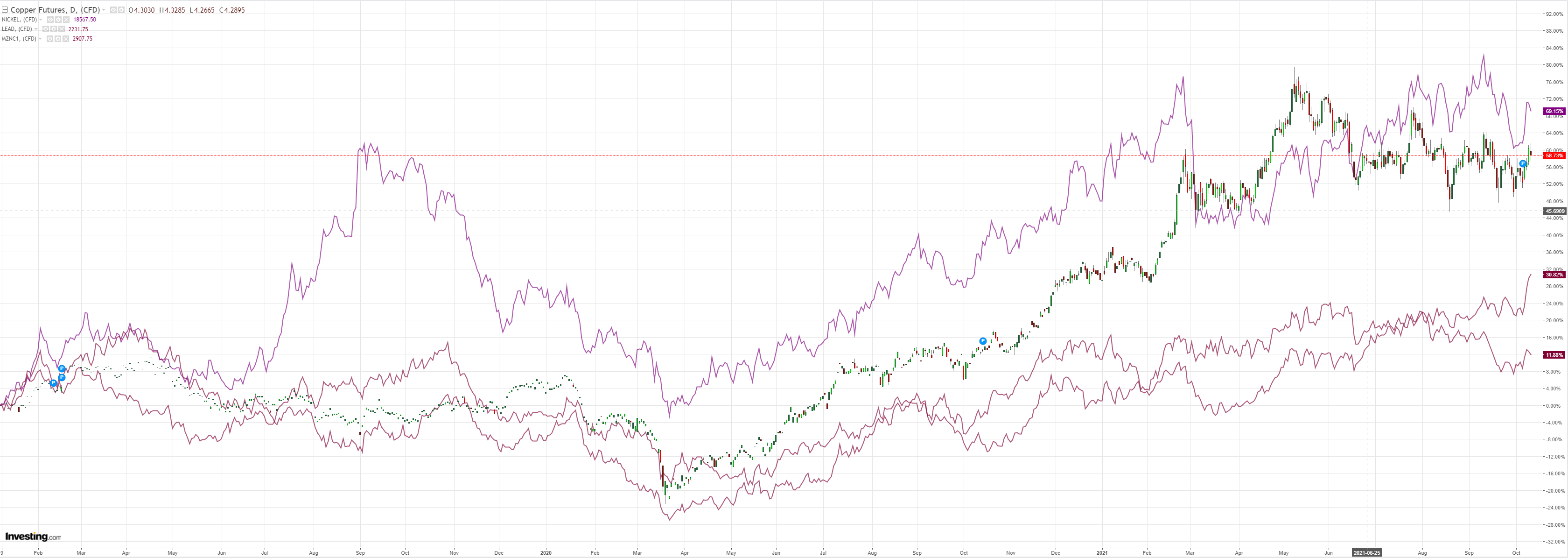

Base metals took pause:

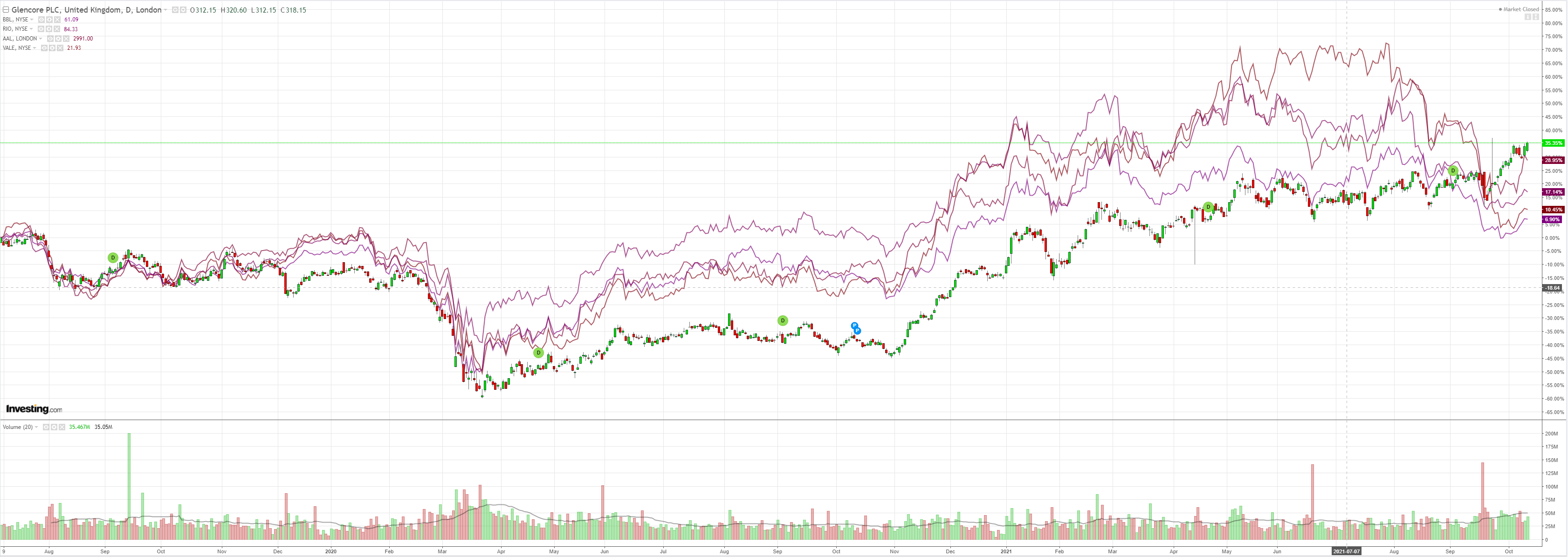

Big miners too:

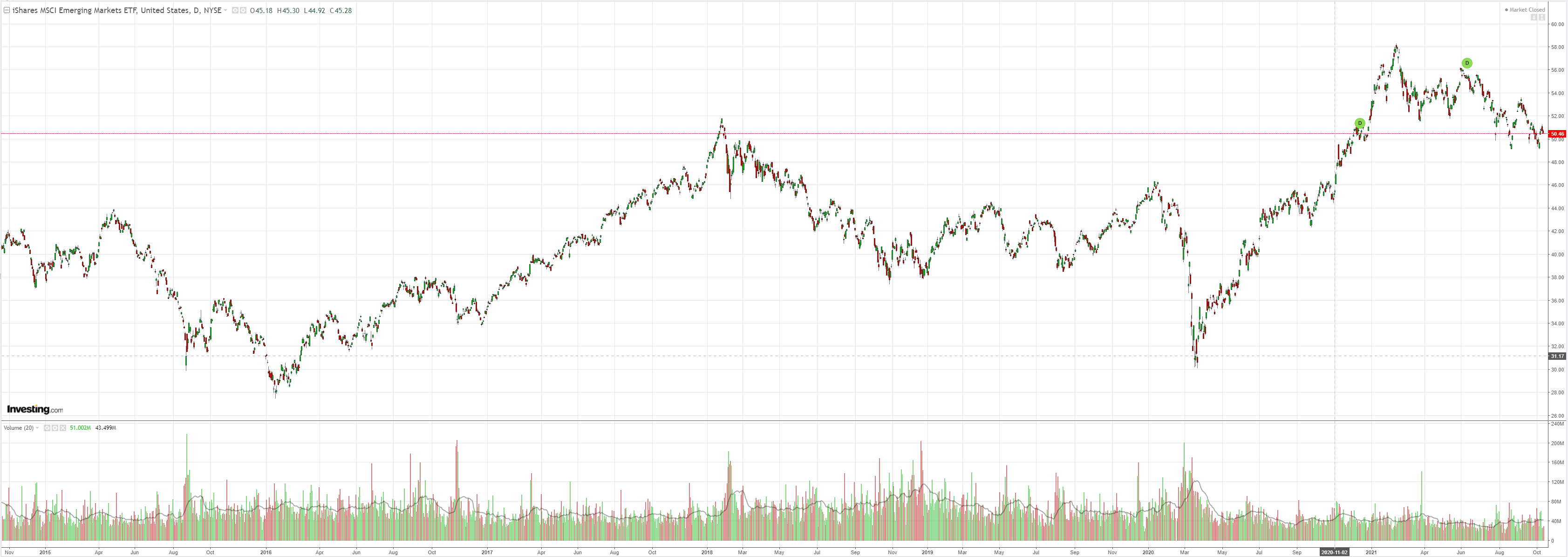

EM stocks look so very, very bad:

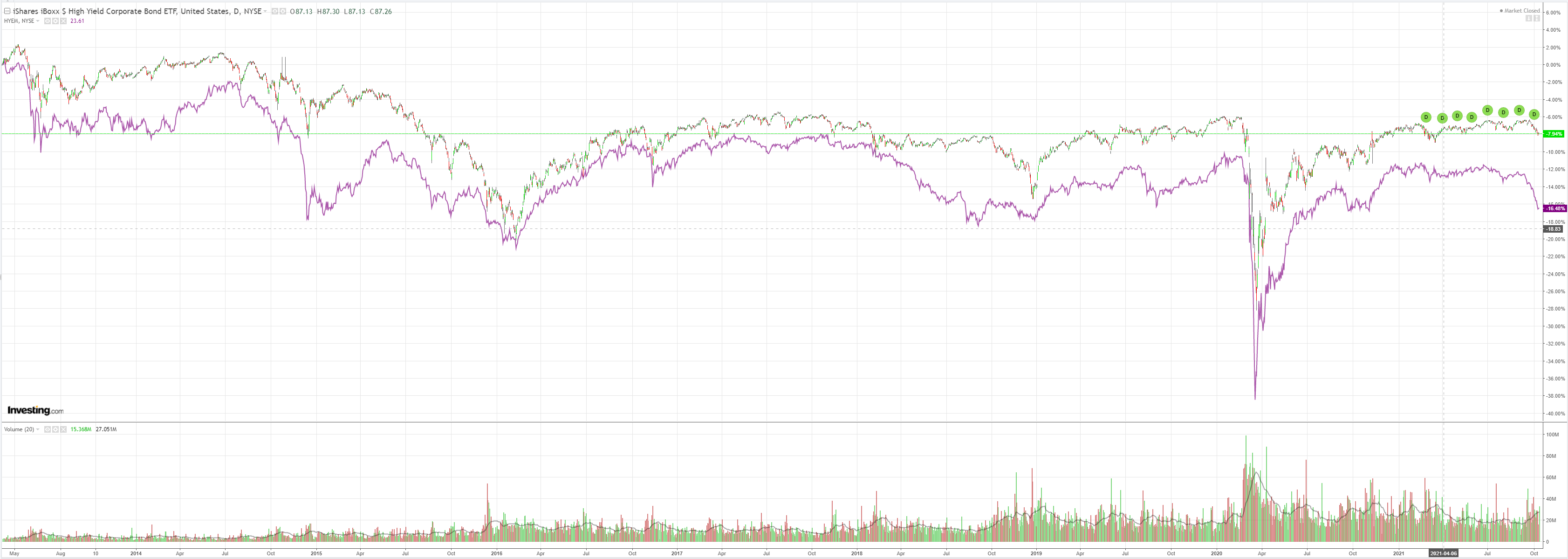

Junk took a breather in its free fall:

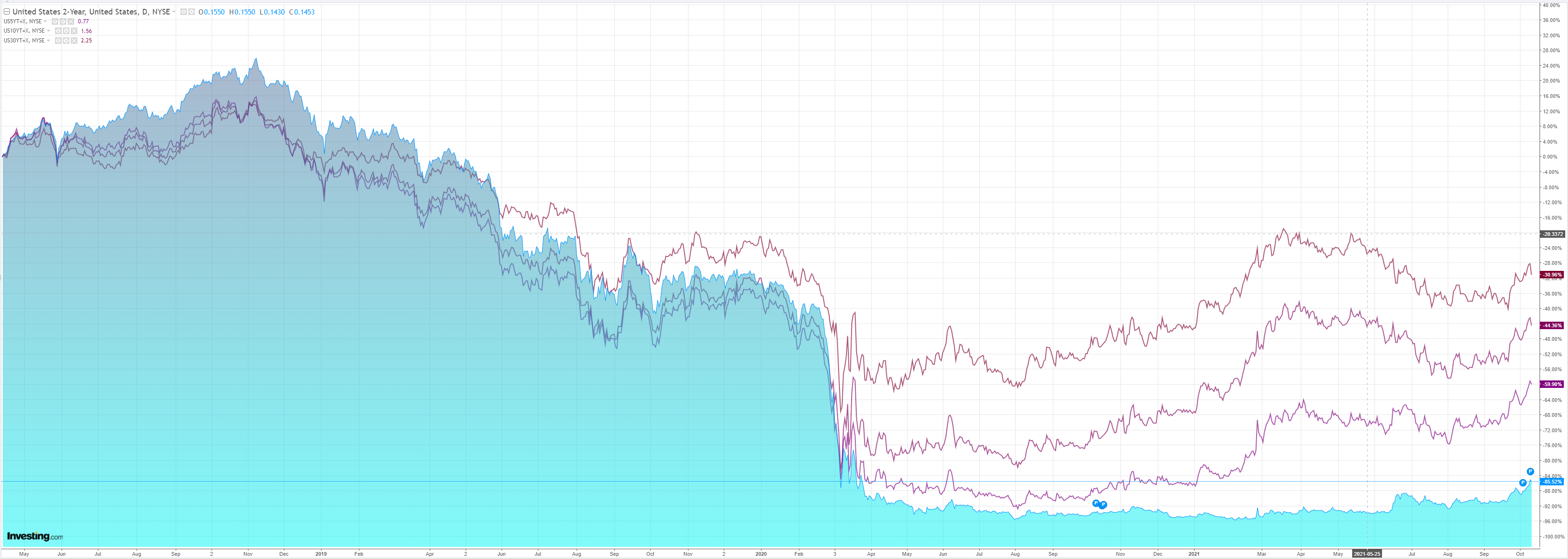

As yields eased:

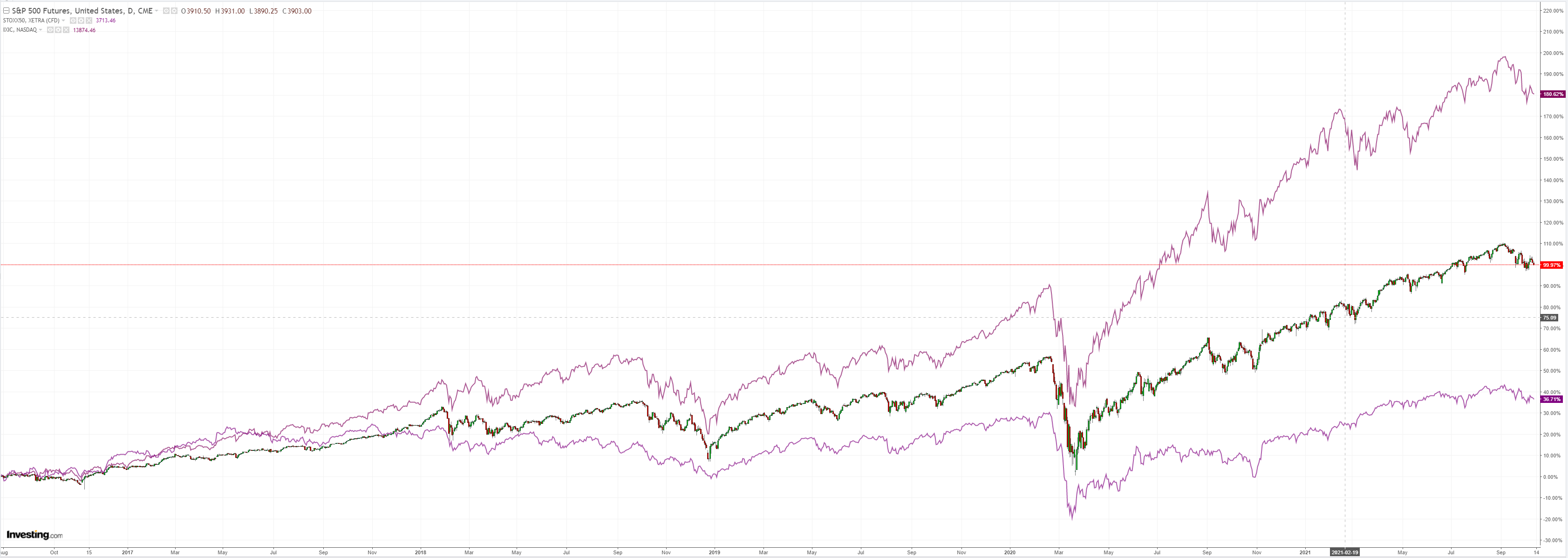

But stocks fell anyway:

Westpac has the wrap:

Event Wrap

US NFIB small business optimism in September slightly disappointed at 99.1 (est. 99.5, prior 100.1). Once again, optimism is restrained by record labour shortages which are leading to an unprecedented (42%) amount of firms raising wages.

The JOLTS job openings survey in August fell to a still very high 10.44m (est. 10.95m, prior revised to record high of 11.1m from 10.93m). Notably, the quit rate (effectively preparedness to resign) rose to a record 2.9% – a sign of confidence in finding alternative employment.

Fed Vice-chair Clarida reiterated that QE tapering could soon be warranted and he concurs with most of his colleagues that the bond buying program should come to an end around mid- 2022. Inflation risks are to the upside, but the surge should prove “transitory.” Underlying inflation continues to hover around the 2% goal. The economy continues to strengthen and the labour market’s improvement this year has been “notable.” He acknowledged that the supply challenges in the labour market have been a surprise. FOMC member Bostic said: “It is becoming increasingly clear that the feature of this episode that has animated price pressures — mainly the intense and widespread supply-chain disruptions — will not be brief. By this definition, then, the forces are not transitory.”

Germany’s ZEW financial investor survey in September disappointed in both the current situation at 21.6 (est. 28.0, prior 31.9), and expectations at 22.3 (est. 23.5, prior 26.5). Pullbacks occurred for the Eurozone as well (expectations to 21.0 from 31.1 in August, current situation 15.9 from 22.5).

UK unemployment in August was in line with expectations at 4.5% (prior 4.6%), while employment rose 235k (est. 250k, prior 183k). Jobless claimants in September. fell 51.1k (prior revised to -88k from 58.4k), and August average weekly earnings rose 7.2% (est. 7.0%).

The IMF slightly downgraded it world economic growth outlook in 2021, down 0.1% to 5.9%, while 2022 was unchanged at 4.9%. The Press conference had much discussion over the persistence of what are still seen as transitory inflation pressures, as well as the diverse range of inflation drivers, and associated policy measures across economies as well as the unprecedented level of uncertainty relating to the pandemic.

Event Outlook

Australia: Westpac-MI Consumer Sentiment has continued to show impressive resilience of late, the September read of 106.2 comfortably above those of the 5 years prior to the pandemic.

New Zealand: REINZ housing data continues to highlight the effect of restrictions on sales, but also strength in price growth. September food prices and October ANZ business confidence are also due.

China: September’s trade balance is expected to show continued strength in the world’s demand for Chinese goods.

Europe: Industrial production is expected to reverse July’s gain in August. The UK’s August trade balance is also due.

United States: The minutes of the September FOMC meeting will provide greater clarity on the Committee’s view of the risks. The September CPI is likely to print a robust 0.3% gain, as it did in August.

European data is sickening already, crushed by supply bottlenecks and the energy shock at home and abroad. Next up it is going to be hit by the China shock.

AUD normally tracks EUR but for now it has decoupled as it soars with the energy Icarus. Credit Suisse (SIX:CSGN):

AUD, NZD, CAD–This energy rally is the thorn in the side of popular AUD shorts and we arestarting to see covering from a range of leveraged and slower-moving accounts. 0.7170 feels likeadistant memory, as does the 0.7240/50 zone through which this covering accelerated. At currentlevels, things should become more balanced (0.7410 the next pivot), but we stick by our view thatAUD dips will be used to reduce (0.7300/15 now) and retain longAUDNZD exposure, targeting1.06/1.07 range. In NZD, the key levels are 0.6985 and 0.7010 – we do not see these beingbreached in the n/term. In CAD, I think AUDCAD exhaustion on this move into 0.91 is telling andwhilst we continue to see RM CAD demand, wewill wait for a squeeze to re-buy the crude proxy

I look on this as a great chance to reload on DXY. My base case is now that China is going into a major debt-deflation recession as its development sector collapses. The energy bubble is going to pop spectacularly in a few months. All commodities are going to crash.

Next year brings the new EM crisis and AUD gets trashed.