In VERY unusual FX crisis price action DXY swooned last night:

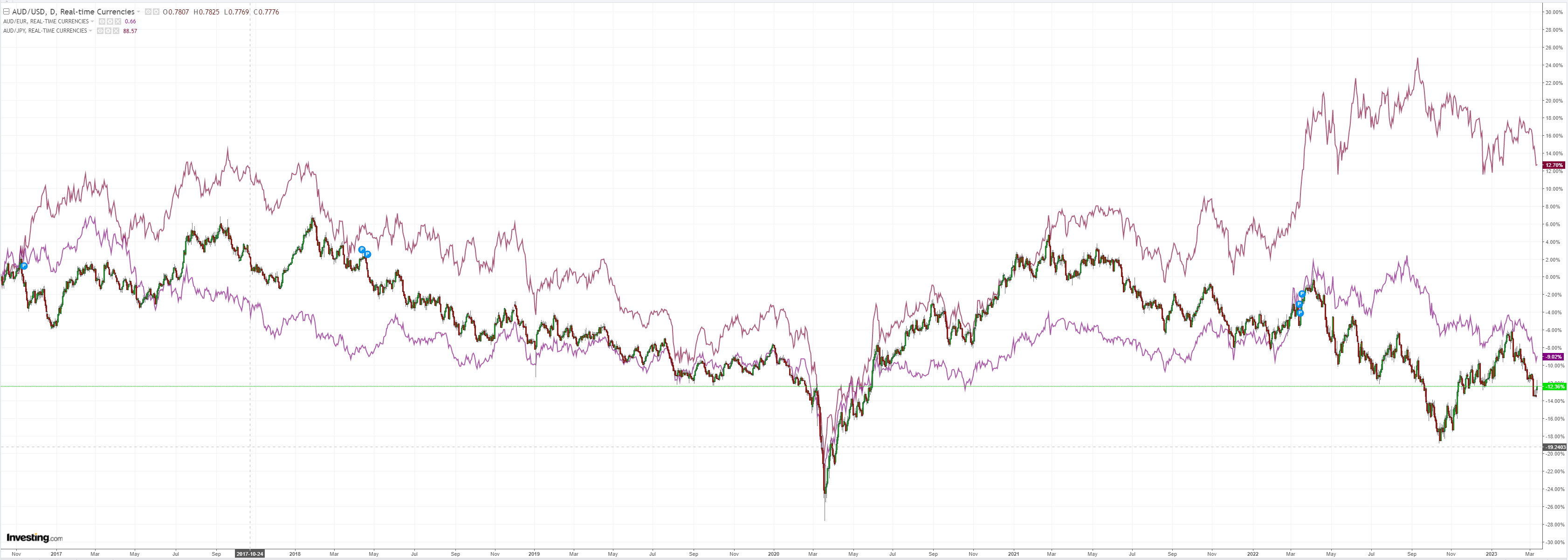

AUD took off:

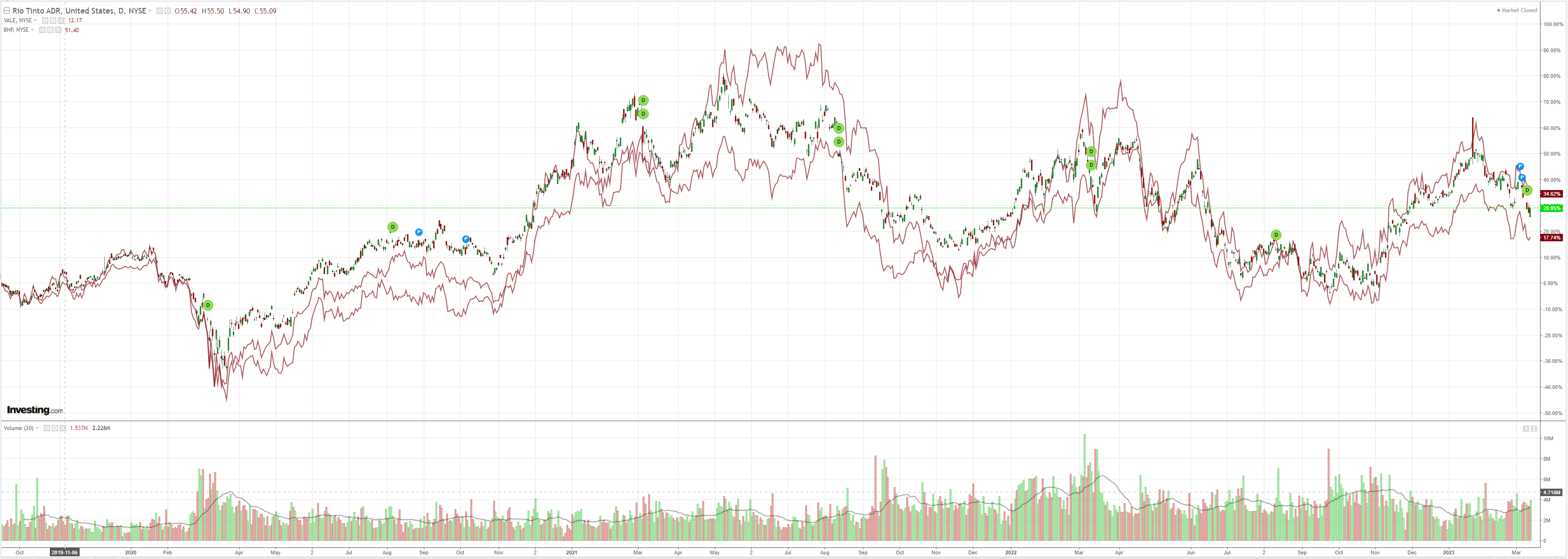

Dirt held up:

As did miners (NYSE:RIO):

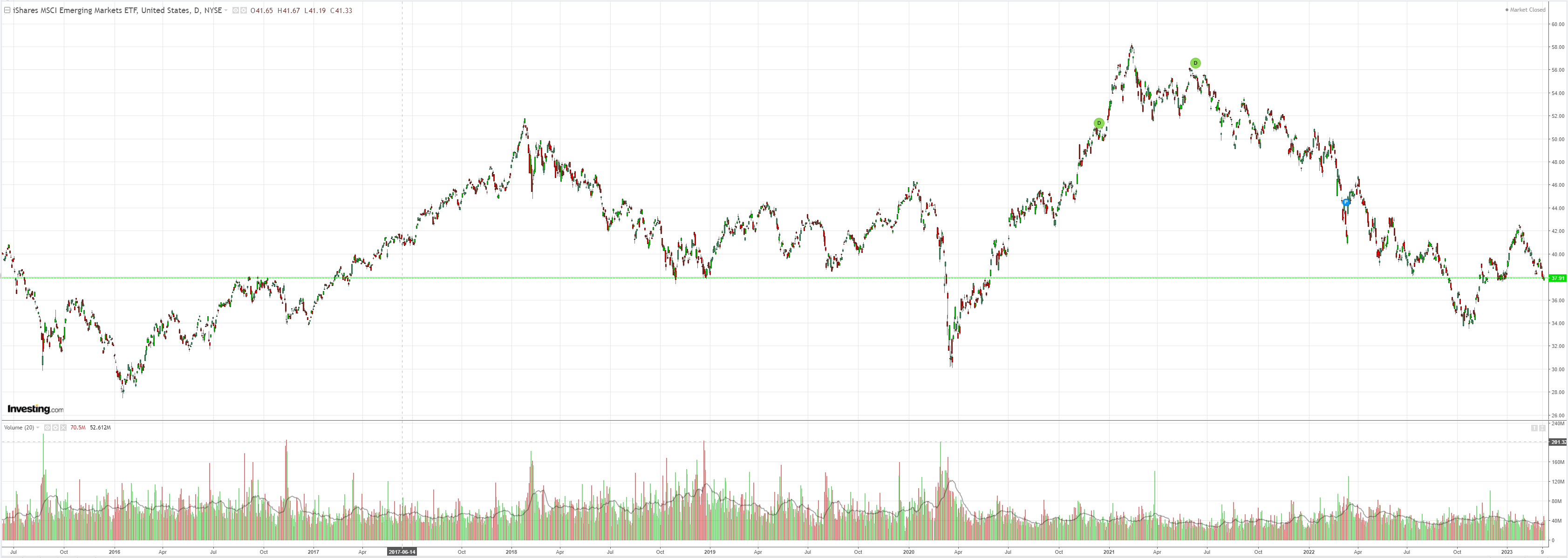

EM stocks (NYSE:EEM) were OK too:

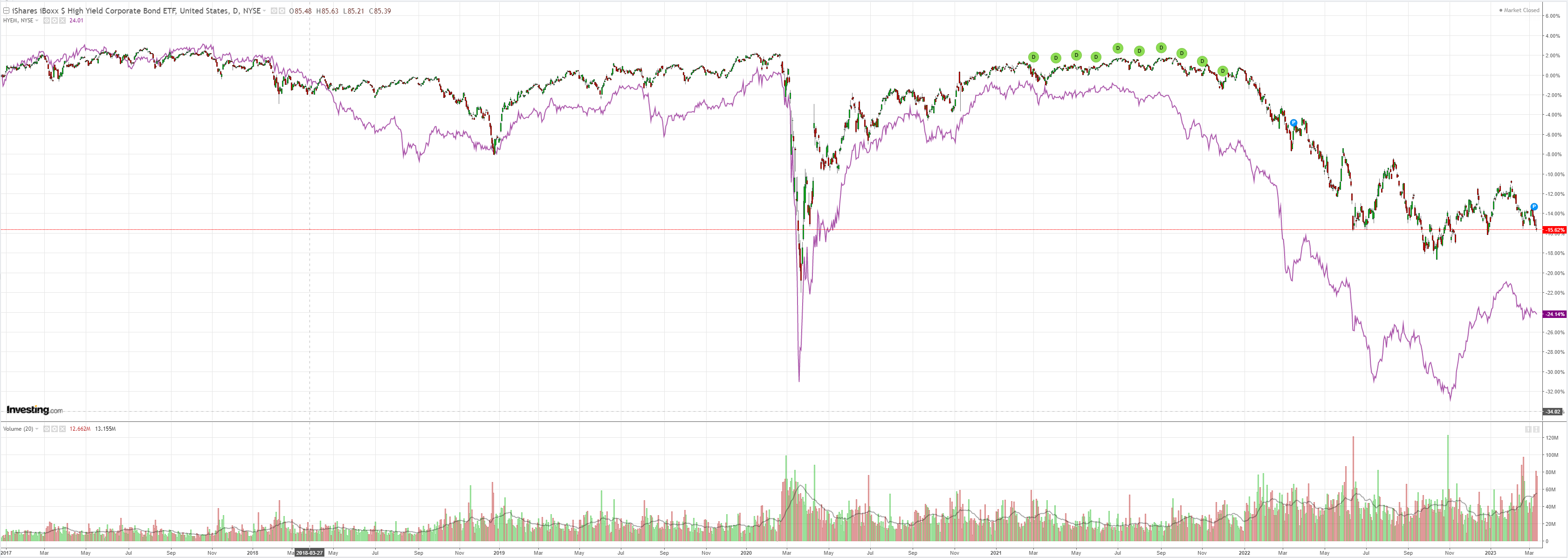

And junk (NYSE:HYG):

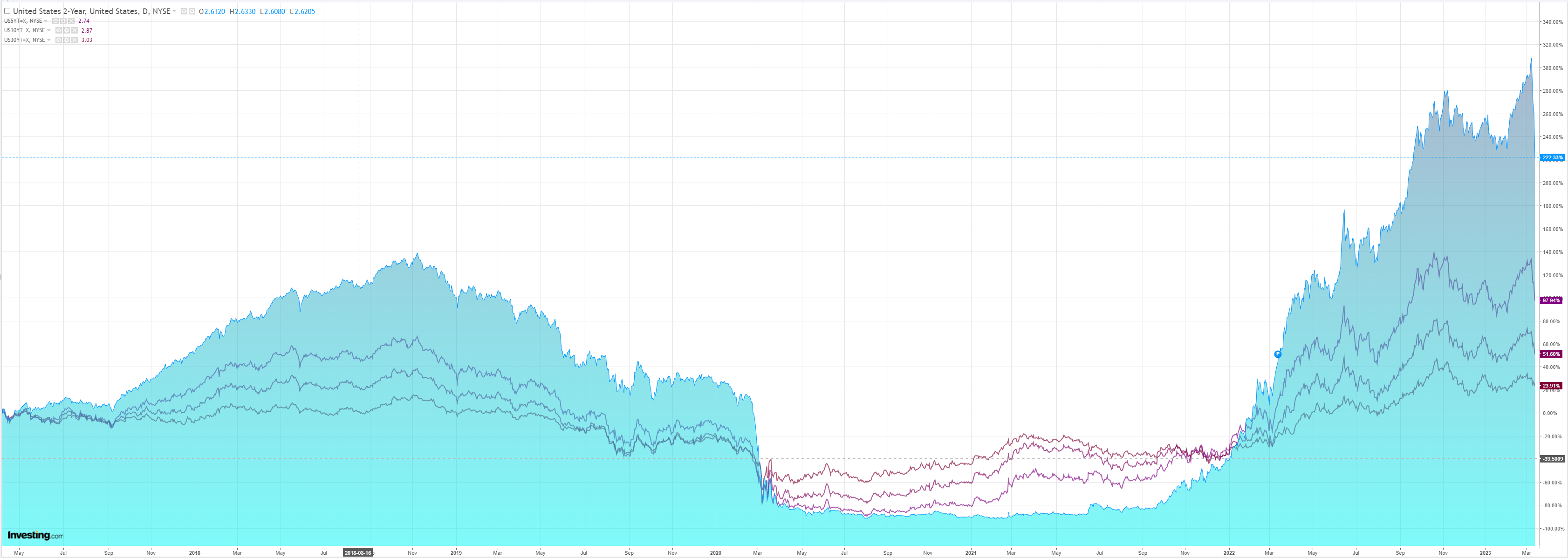

As US 2-year yields crashed the most since 1987:

Village idiot stocks are always the last to know:

The US bank run is ongoing in some measure. Interbank spreads are blowing out as well. The US looks to be headed directly into a credit crunch and recession. Deutsche:

The market is sending a consistent message today: it fears that a US recession is about to start. We are now pricing in Fed cuts rather than hikes, the yield curve is bull steepening sharply, commodities and equities are down with cyclicals underperforming. This is all consistent with an imminent US recession. Without taking a strong view on whether this will indeed happen, it is worth making three observations.

First, a systemic financial event is not a necessary condition for recessionary dynamics. Competition for deposits is likely to become irreversibly more intense in the US banking system going forward, leading to an upward drift in the bank-based cost of financing and an extra layer of tightening hitting the real economy. How large this is remains to be seen but as our economists have highlighted, the starting point of bank lending conditions has in any case already been extremely weak.

Second, the dollar is behaving extremely unusually, down against the vast majority of G10 and EM currencies despite a recession priced in. Can this be sustained? If dollar funding and money markets remain well behaved, we argued earlier today the answer is most likely yes. This is an exceptionally unusual cycle where the dollar has front-loaded recessionary pricing far more than any other period in history. What is more, given the relative starting point of monetary policy, there remains asymmetric potential for an interest rate differential narrowing against the USD even in a slower global growth environment. In other words, what matters most for the USD is if the Fed decides to paused then eventually cut.

Third, the correlation breakdown between risk appetite and the dollar will put pressure on portfolio construction if sustained. Most asset manager’s asset allocation has over the last decade been constructed on the basis of a negative correlation between the USD and risk appetite. When equities sell-off, the dollar rallies providing natural protection for foreign currency investors and creating an incentive to hold dollar positions unhedged. We highlighted earlier this year how this dynamic was slowly starting to shift. If the dollar entirely stops providing hedging value to underlying US risky asset positions it would likely add another leg of pressure to the USD.

Fair enough and possible. But I don’t trust it. If interbank spreads keep widening then the panic will grow and, I fear, DXY will become the only game in town.

EUR can’t be trusted given the panic will spread there and the ECB also be knocked off its monetary tightening.

China will also bit hit by a large external shock with CNY suffering.

Discretion is the better part of valour on a strong AUD mid-global recession trade.