DXY is holding:

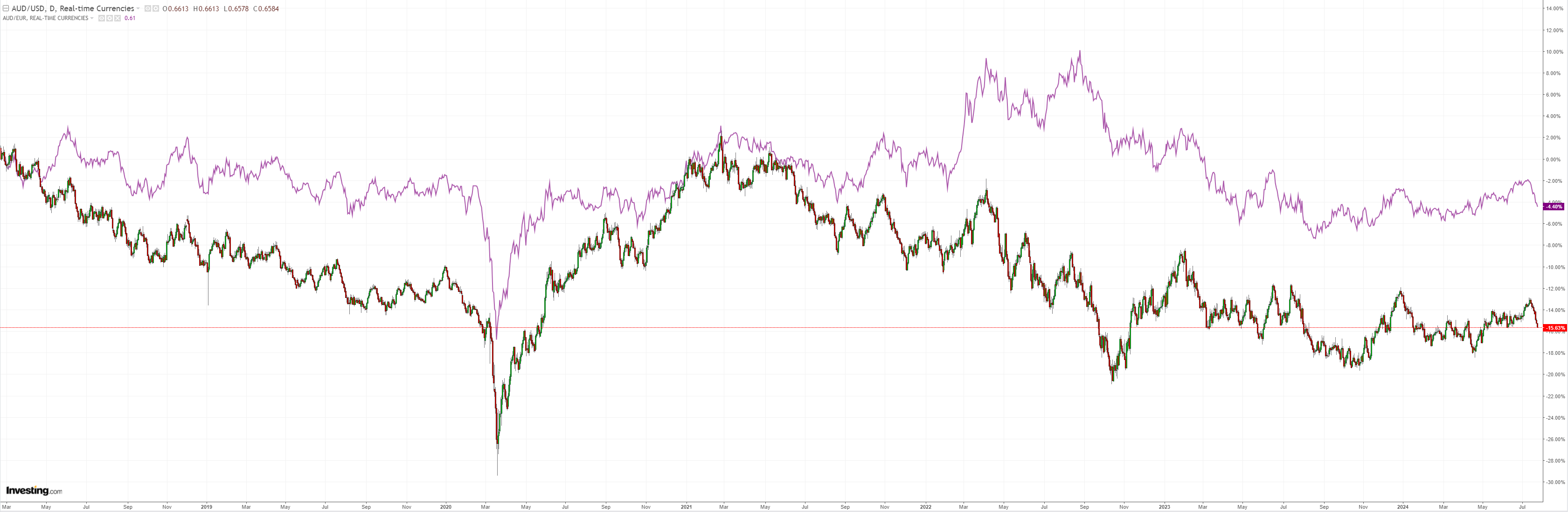

AUD was smoked again:

JPY is confirming risk off:

Oil and gold held:

Copper bull oh dear:

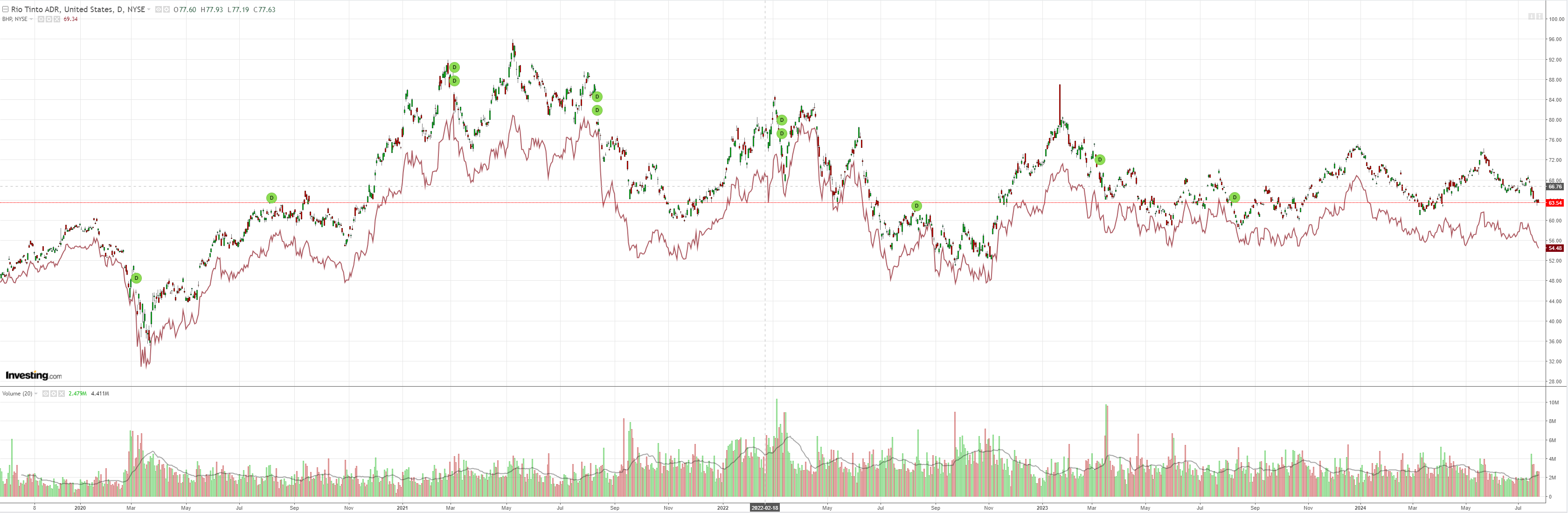

Big miners are in all sorts:

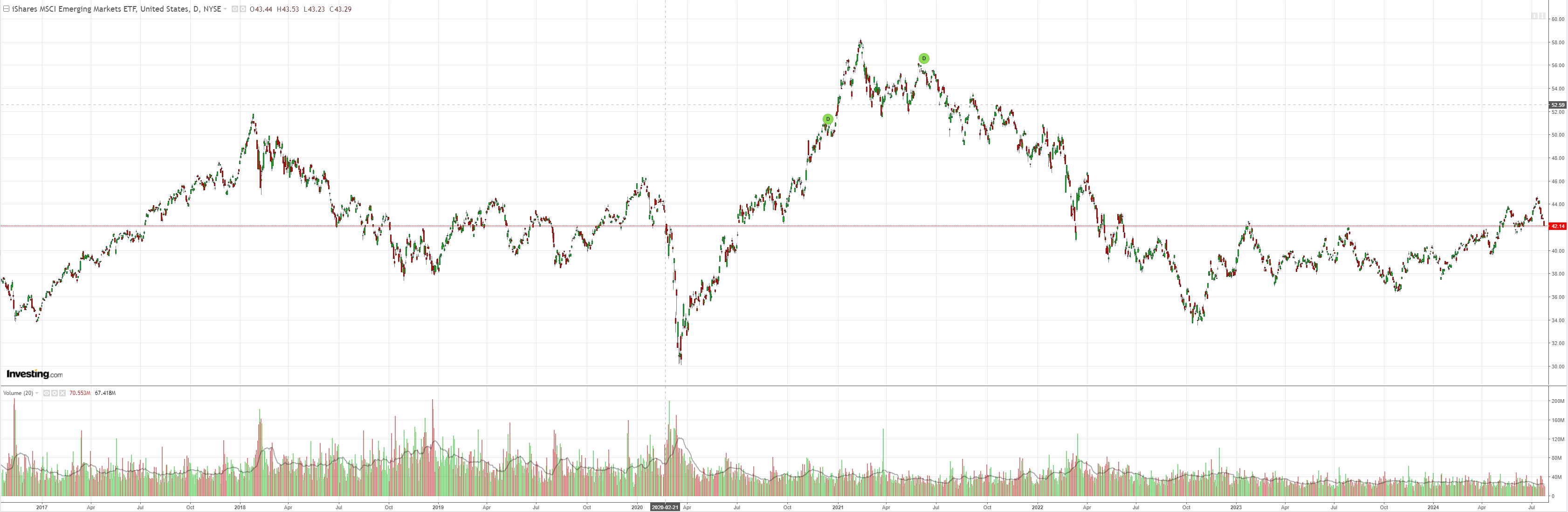

EM false break:

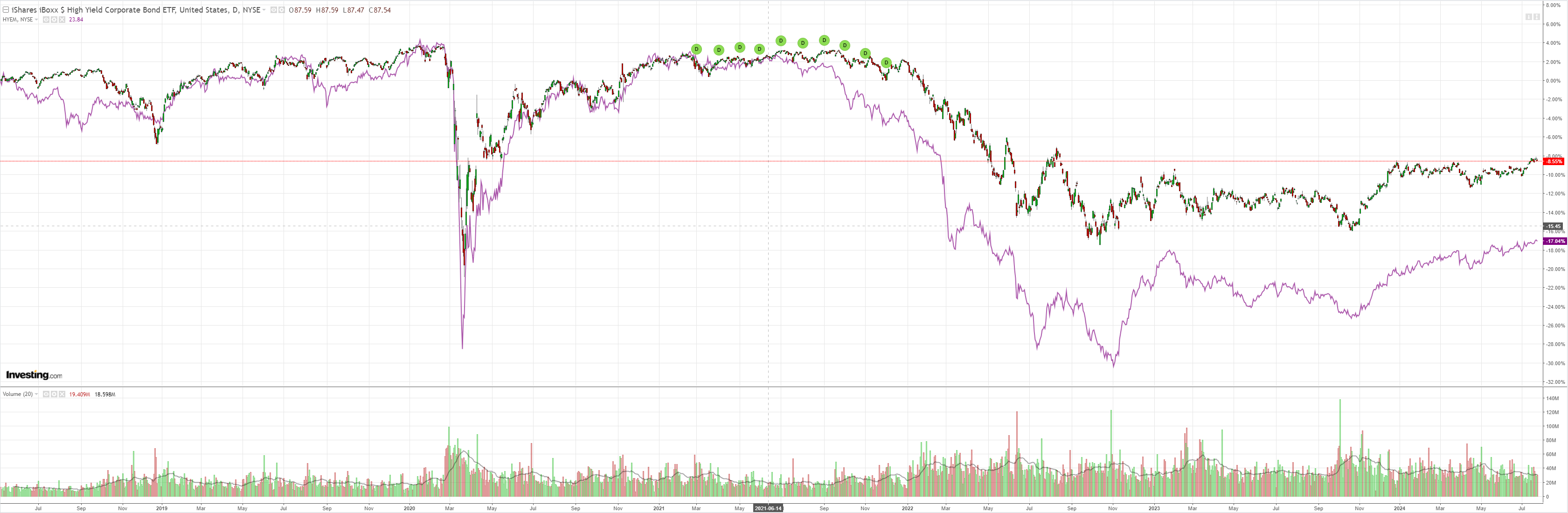

Junk still happy with fundamentals:

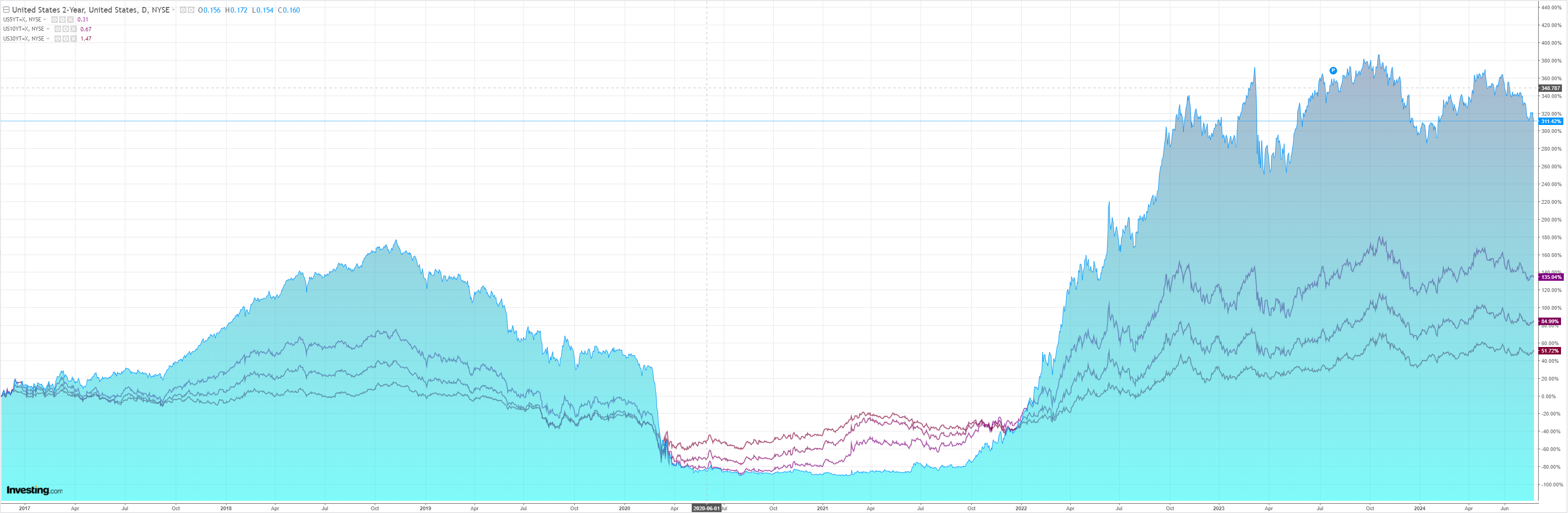

The curve steepened:

Stock were smashed:

Charlie McElligott has a good read through on the price action:

Risk sentiment remains fragile, where death by Macro paper cut reigns locally :

1)Poor Eurozone PMIs continue to show European activity softening (particularly in Germany which CONTRACTED for the first time since March), while

2) a recent spate of Corporate Earnings have shown a few high profile “meh” US releases too which disappointed vs expectations inTLSA, GOOGL, V and AMZN feed concerns about Mag7 crowding and Consumer (while DB and LVMH big misses and fueling more significant concerns about the magnitude of the aforementioned European growth slowdown)—and additionally,

3) further “hawkish” price-action in Yen on a BoJ hike “sources” story for next week’s meeting continues to take bodies and drive ongoing unwind in G10 FX Carry and Momentum Re. BoJ / Yen, Reuters source report earlier stating that the BoJ is “weighing” a rate hike next week, along with potential announcement of a detailed plan that would potentially cut bond buying in half, and stating that the boJ has a “long way to go” toward rate levels deemed neutral—as we see further $Yen smashdown to levels last seen start May.

These developments are further weighing on what’s been a messy period in consensus FX positioning, now experiencing ~-2.5 to -3 z-score moves lower in G10 FX Momentum and Carry –strats over the past two weeks, largely as a function of the Yen rallying through key levels vs USD, but also too, seeing significant movement in GBP / NOK /SEK / NZD / EUR against the Greenback as well.

And as an additional “curiosity” for risk sentiment, this morning we see ex Fed and current Bloomberg opinion writer BillDudley pulling a full-tilt U-turn, departing the “high for longer” camp, and instead, now calling for a Fed cut, preferably as soon as NEXT WEEK—as the lagged and variable impact of prior tightening is now hitting the economy, with tapped consumers, slowing momentum from Biden’s fiscal stim, softening labor (references Sahm rule, naturally), all while inflation pressures have abated.

From a USD Rates perspective, the exuberance off the back of the much anticipated Steepening-out we’ve seen in curves (both bull- and bear-) clearly speaks to “the pain trade” being a flattener—so what would that require?

1) An economy which continues to refuse to crater despite the market almost “willing it,” which means a shallower Fed cut cycle holds serve and doesn’t provide much more room for front-end to really move a bunch from here;

2) And locally, an upswing in Harris / Dem odds, as the long-end Trump sell-off scenario is predicated upon the perceived inflationary policy catalysts of tariffs and deportation of illegals (plenty of attention paid to the Reuters / IPSOS national poll yday where Harris is leading Trump 42% to 38% in a three way contest with Kennedy, and a 44% vs 42% lead among registered voters—although again, it’s State polls and electoral college which matters vs popular vote).

Plenty of risk in that little lot and it hasn’t even mentioned China, which is fading fast and has an exaggerated role to play in the outcome of the US election and subsequent global growth.

AUD can’t stabilise until broader markets do.