DXY is up and away for the NY:

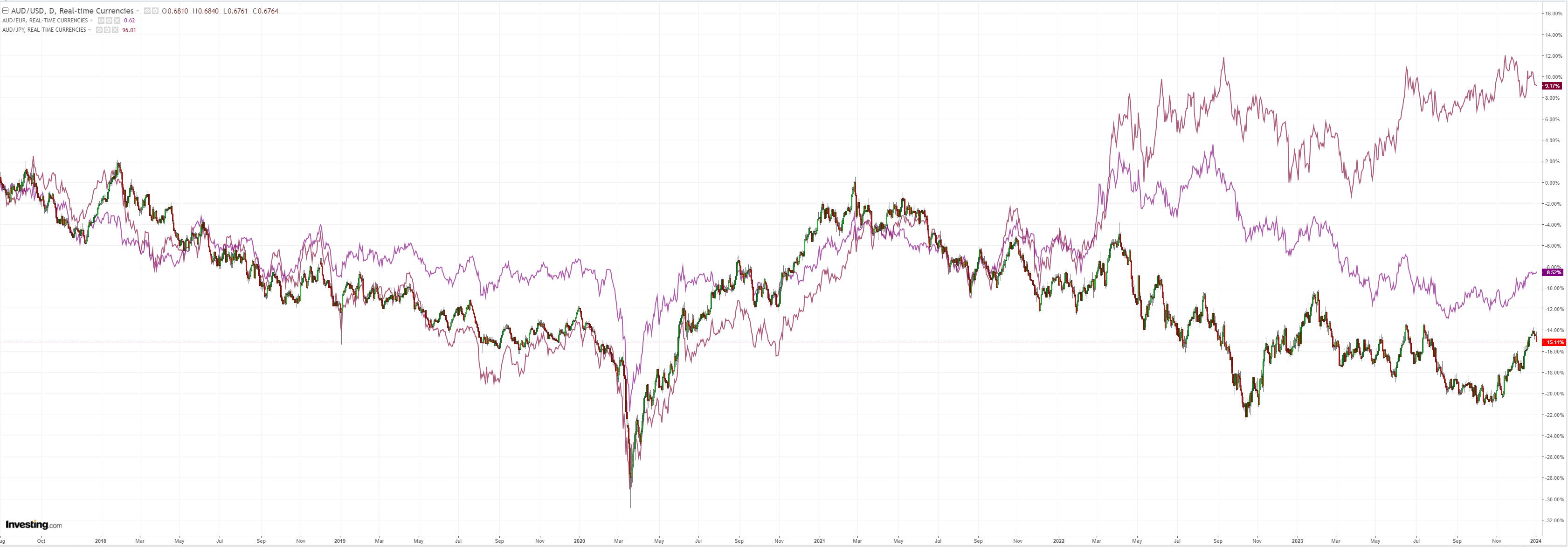

AUD was smashed:

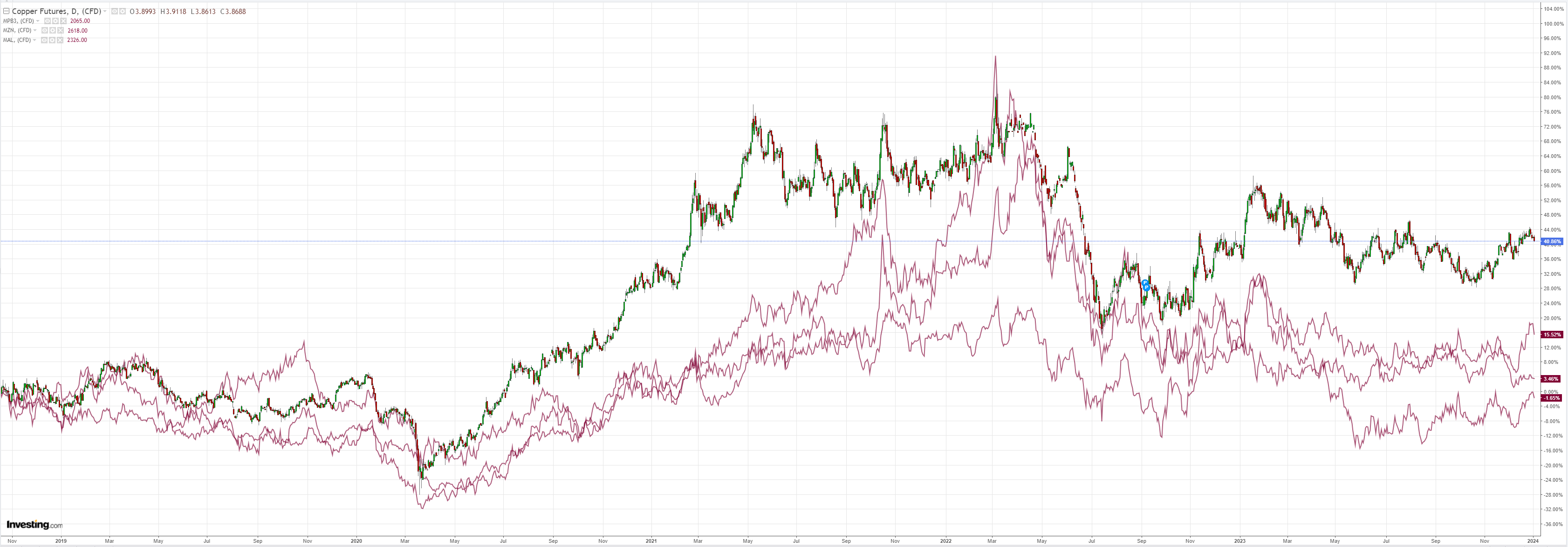

Good ‘ol concrete boots helped drag it down:

There is too much oil:

Dirt schmirt:

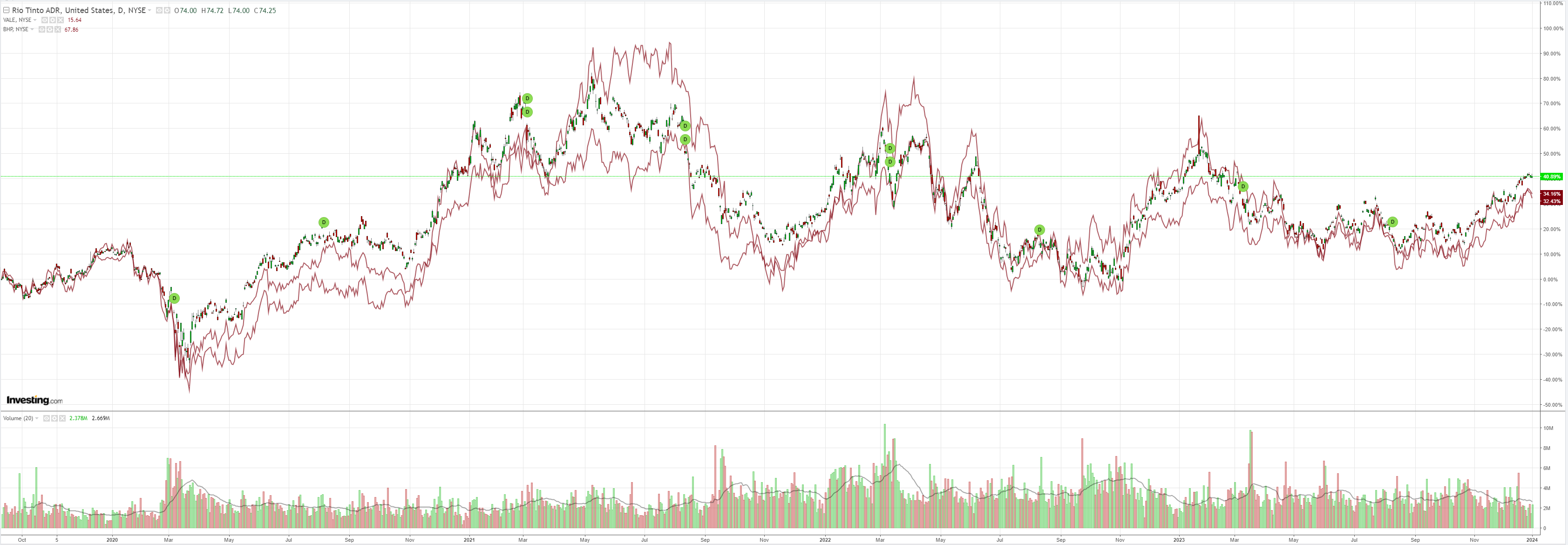

Miners rolled:

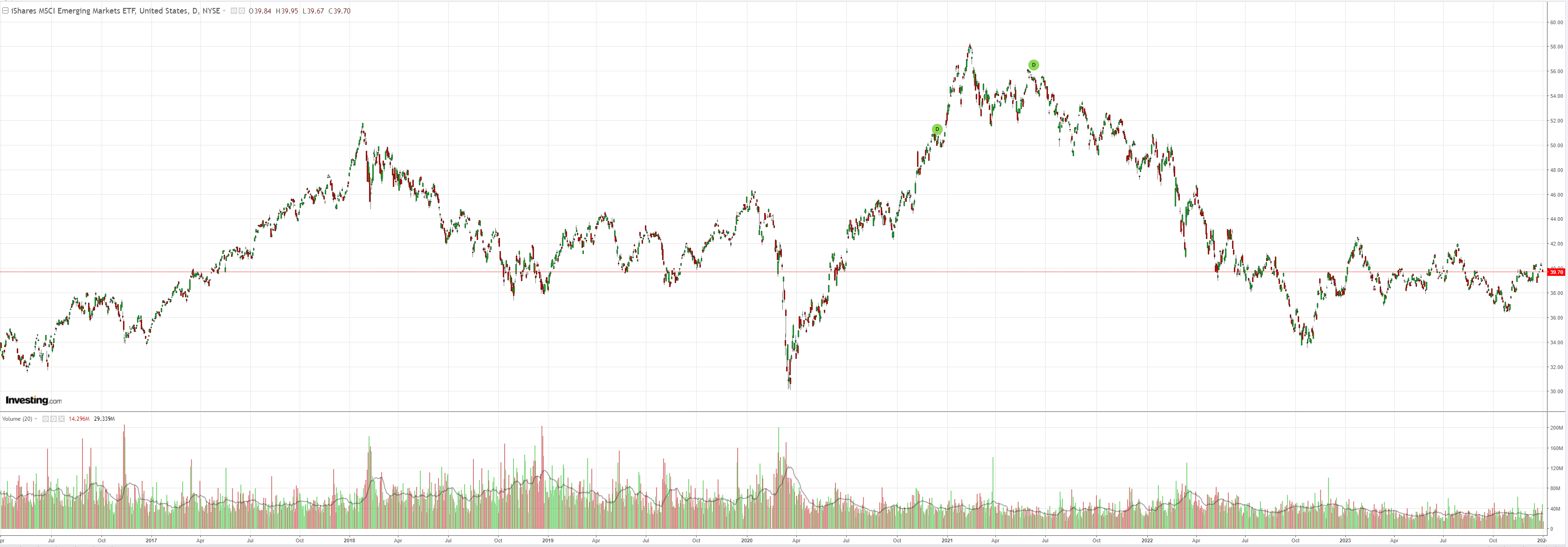

EM lol:

Junk spreads are stalled in bad sign for the rally:

Yields popped:

Stocks dropped:

Everything is way overheated, so this is a more natural pullback than reversal for the time being.

So long as oil keeps falling, I am on board with a global softish landing.

The failure of Houthi missiles to give oil a sustained lift is revealing. Systematics are short of crude, so there is plenty of firepower to buy. Yet, it keeps falling.

The broader market has priced the big drop in yields in a large multiple expansion. For it to continue, yields will need to keep falling. Hence the significance of oil.

That is my base case given an oil glut that needs to pressure highest cost shale producers in the mid-$60s.

So, I still see this as a pullback for an overbought AUD in a rising trend.