DXY was only firm Friday night amid tearaway US jobs numbers as markets get excited about the possibility of largely irrelevant ECB tightening:

But that couldn’t save the AUD which was poleaxed across DMs:

Oil is the one-way rocketship of doom. Gold is dead:

Base metals did better:

But miners (LON:GLEN) are flamed out:

EM stocks (NYSE:EEM) held their latest cascading ledge:

But the canary in the coal mine, global junk debt (NYSE:HYG), is stone dead silent:

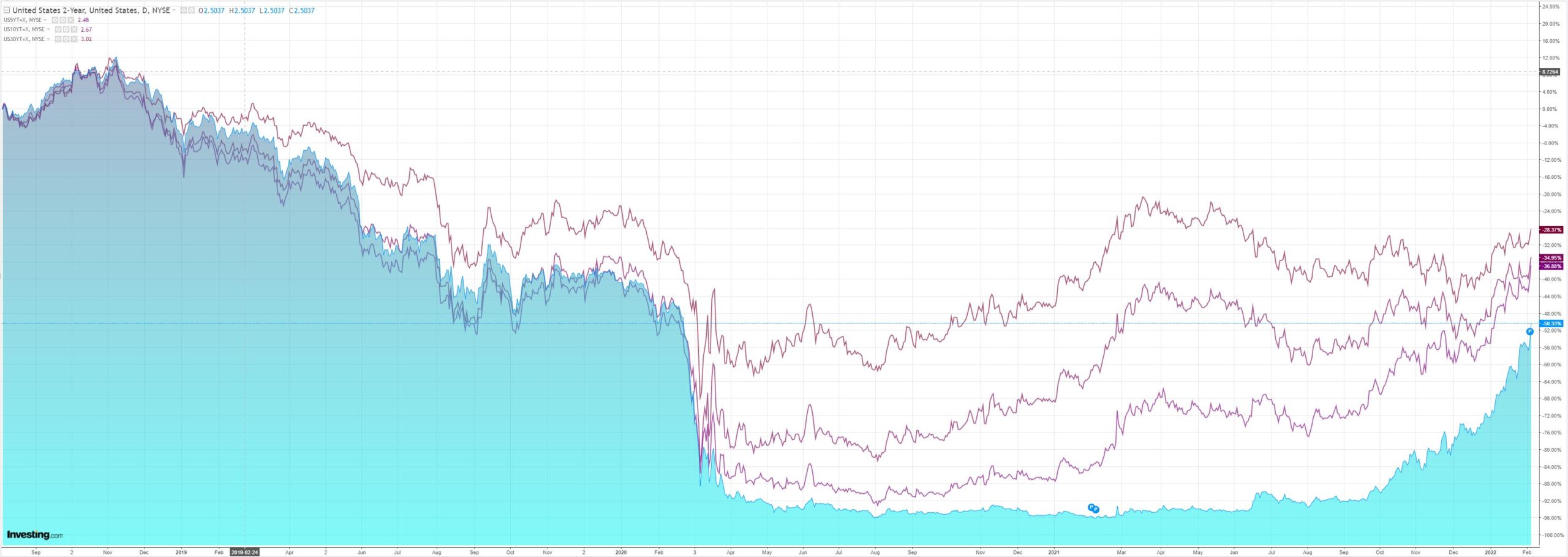

As yields blasted higher. She can’t take it, Captain! The 5-10 is going to invert!

S&P 500 Futures managed a bounce after the Meta crash the day before but there is no basis for anything but lower on the above macro spread of indicators:

Driving the action was tearaway US jobs. Goldman with the wrap:

BOTTOM LINE: Nonfarm payrolls rose 467k in January—well above consensus and even further above our forecast of -250k. The ex-Omicron pace was probably even higher, as the household survey showed a 763k increase in unpaid absences, some of whom were likely excluded from the nonfarm payroll counts. We expected the very low pace of year-end layoffs to support job growth this month, and with hindsight, this tailwind more than offset the temporary Omicron drag. The unemployment rate ticked up to 4.0% due to higher labor force participation. Average hourly earnings jumped to 5.7% year-on-year from 4.7% as previously reported, 0.5pp above consensus. We continue to expect the Fed to raise the funds rate five times this year, with the first hike in March.

This was so far above consensus, and the revisions so strong at +7ook, that it smells of numberwang which may be why DXY was held back.

That said, it did not prevent big moves in credit markets with a bear flattening, especially in the belly of the curve, driving widening spreads in global junk that is the number one warning of further equity market and AUD weakness ahead:

Junk debt and the Pacific peso travel together and are only going one way as the Fed tightens into a slowdown and the known unknown of a credit event.