DXY eased overnight:

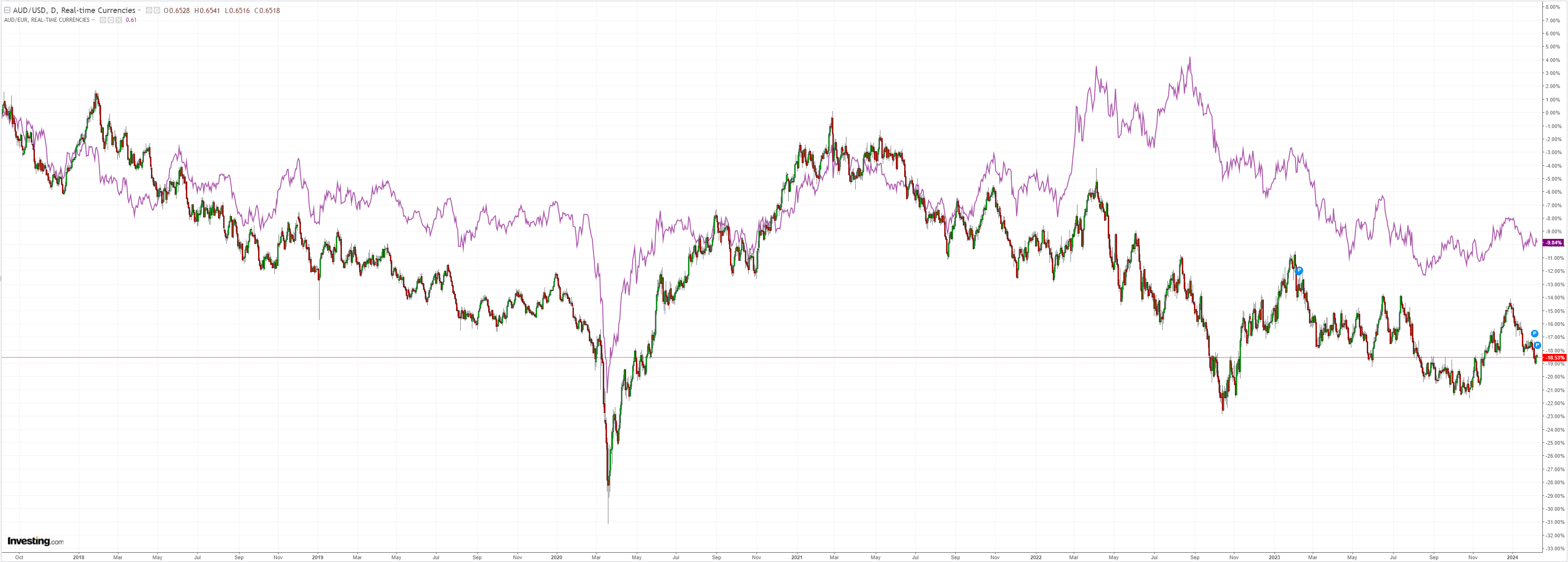

AUD stopped falling:

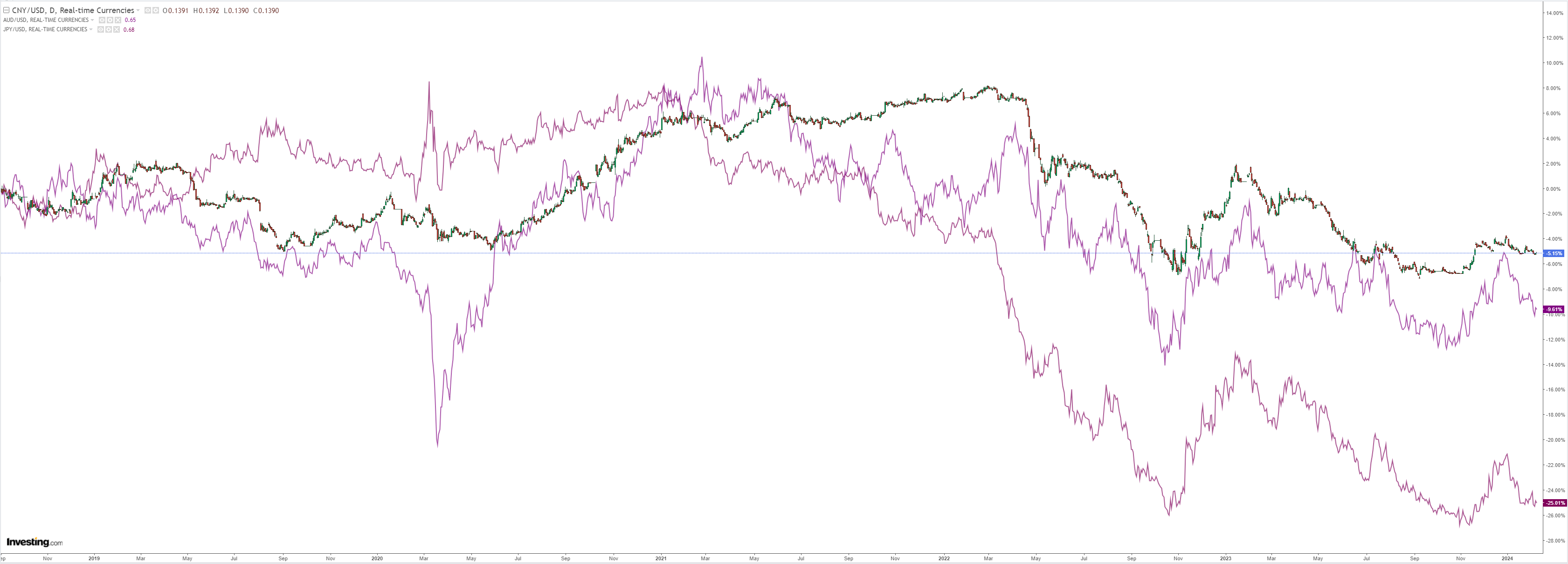

North Asia too:

Oil and gold firmed:

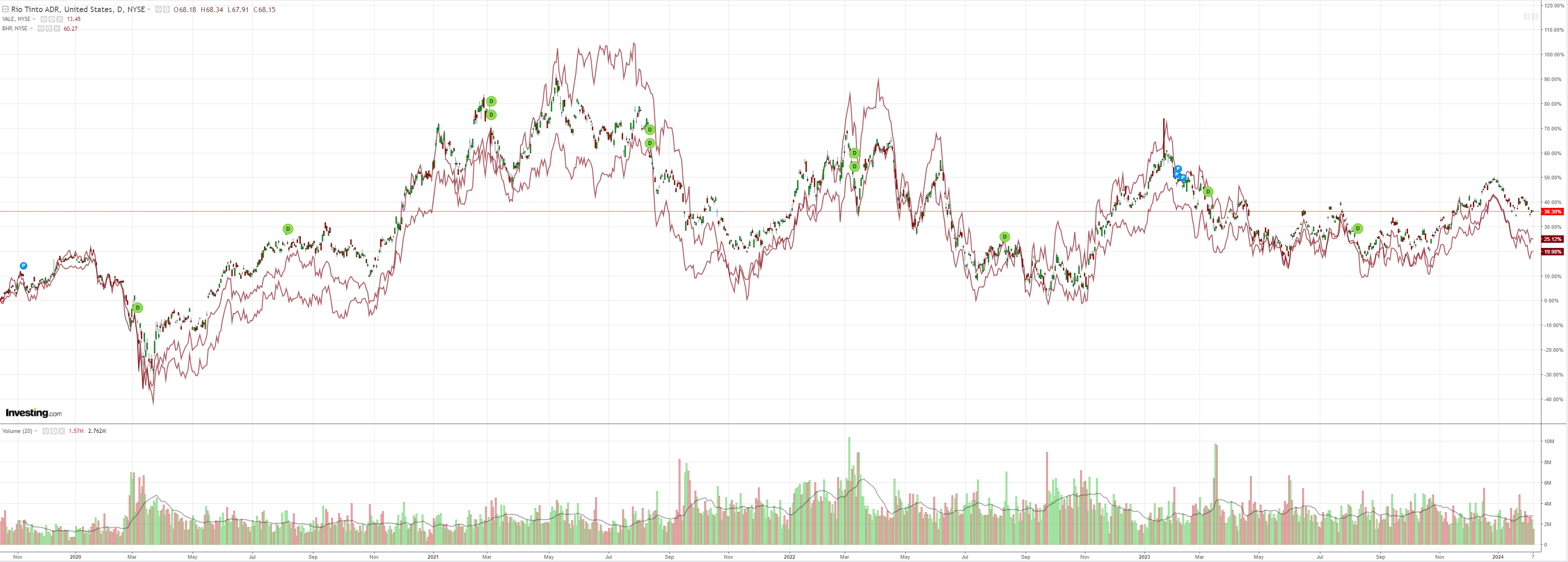

Dirt is conspicuously ignoring the China stock save:

Miner meh:

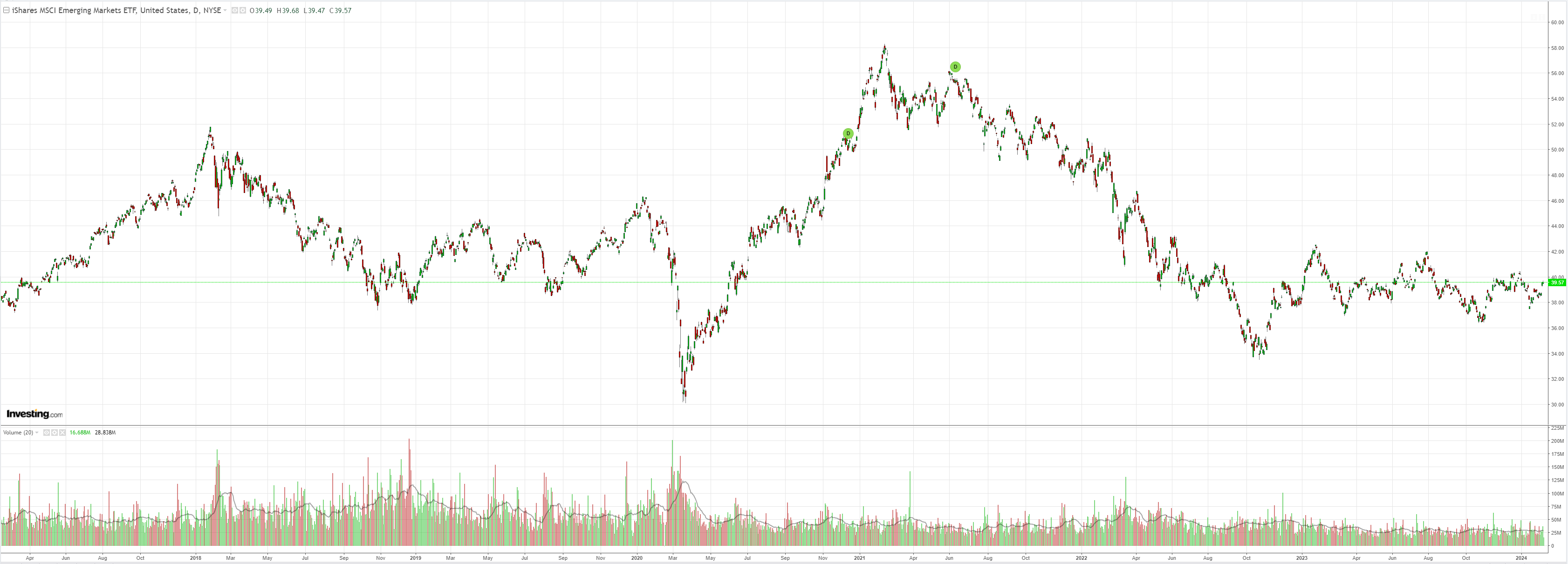

EM meh:

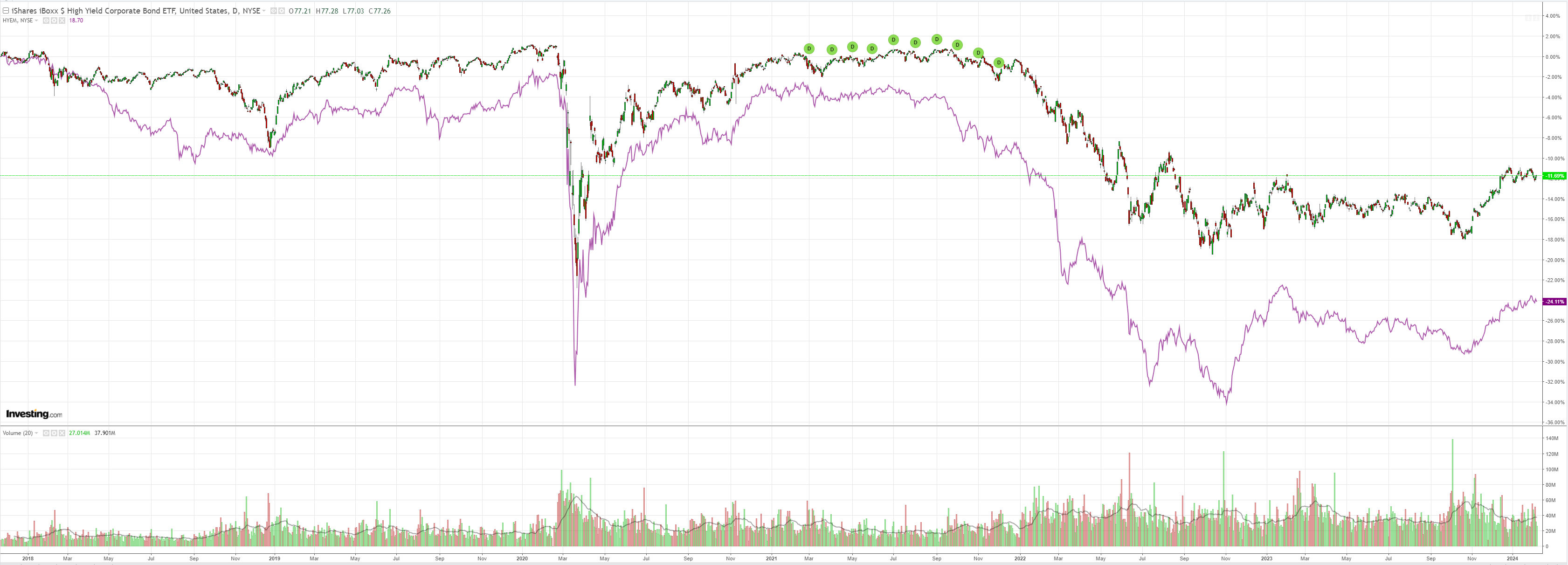

Junk meh:

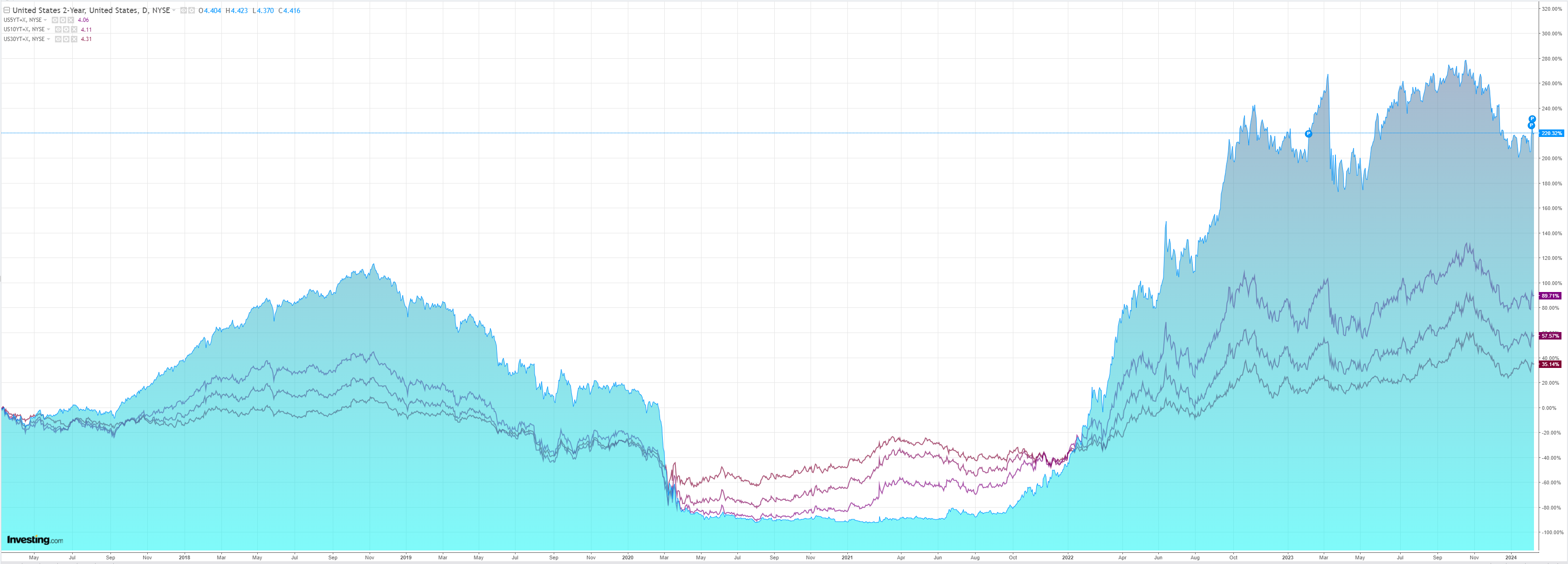

Yields meh:

Stocks only go up!

UBS with the discussion:

How might the dollar trade if US growth stays very strong?

Last week’s release of strong Jan US employment data forced the market to re-assess the pace of Fed rate cuts it expects.

The Dec’24 SOFR contract’s implied rate rose to 4.1%, the highest level since mid-December, while 10y Treasury yield recorded its largest single day move since early May.

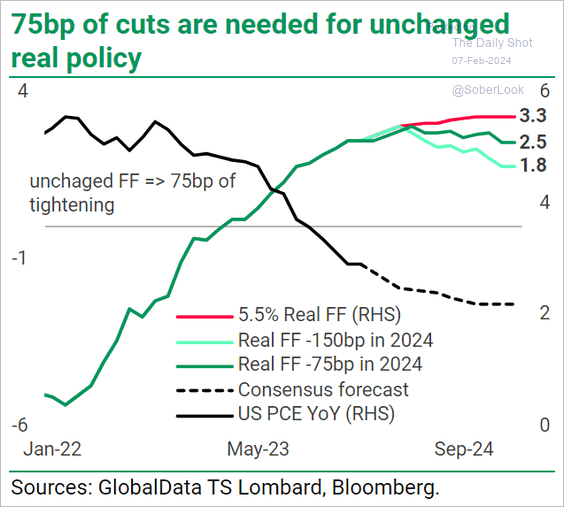

The market believes that US growth is late cycle and that sooner or later output data will slow down to match the sharp decline seen in actual and expected inflation (UBS expects a US recession in 2024); nonetheless, a residual threat remains that in fact hopes for Fed easing are both premature and overextended in scale.

As a reference, markets walked into ’24 with expectations of c.225bps of rate cuts in next two years. Just a 10% correction in these high stakes has lifted the greenback by 2.5% YTD.

In that context, the market debate around the tail risks has understandably opened up i.e. what if the US economy powers on in an election year where both major parties sound in favour of keeping the fiscal taps open, potentially including new tax cuts from 2025 onwards.

This raises the possibility that the USD could be much stronger than market consensus expects not just in the rest of Q1 but potentially for 2024 as a whole.

A potential Trump presidency could also support the USD, at least initially.

In addition, as long as likely GOP candidate Trump is leading in the polls (here), the approach of the November US elections will keep the market focused on the possibility of new across-the-board tariffs and a series of trade wars from 2025 onwards.

Standard economic theory assumes that the USD will be the main beneficiary of such moves, and this added layer of support beyond growth and rate differentials could further underpin the greenback.

Note Trump’s recent comments around tariffs, particularly on China.

I still think Biden is the base case, but Trump will impact pricing at the margin if his polling stays robust. He is emphatically DXY bullish.

I don’t see a US recession in 2024, either.

That said, Fed cuts are coming and quantum is not as important as trend:

On balance, DXY is more likely to surprise to the upside.