DXY was strong last night:

AUD was squashed:

Oil up!

Metals struggled:

Miners (LON:GLEN) dead catted some more:

Not EM stocks (NYSE:EEM):

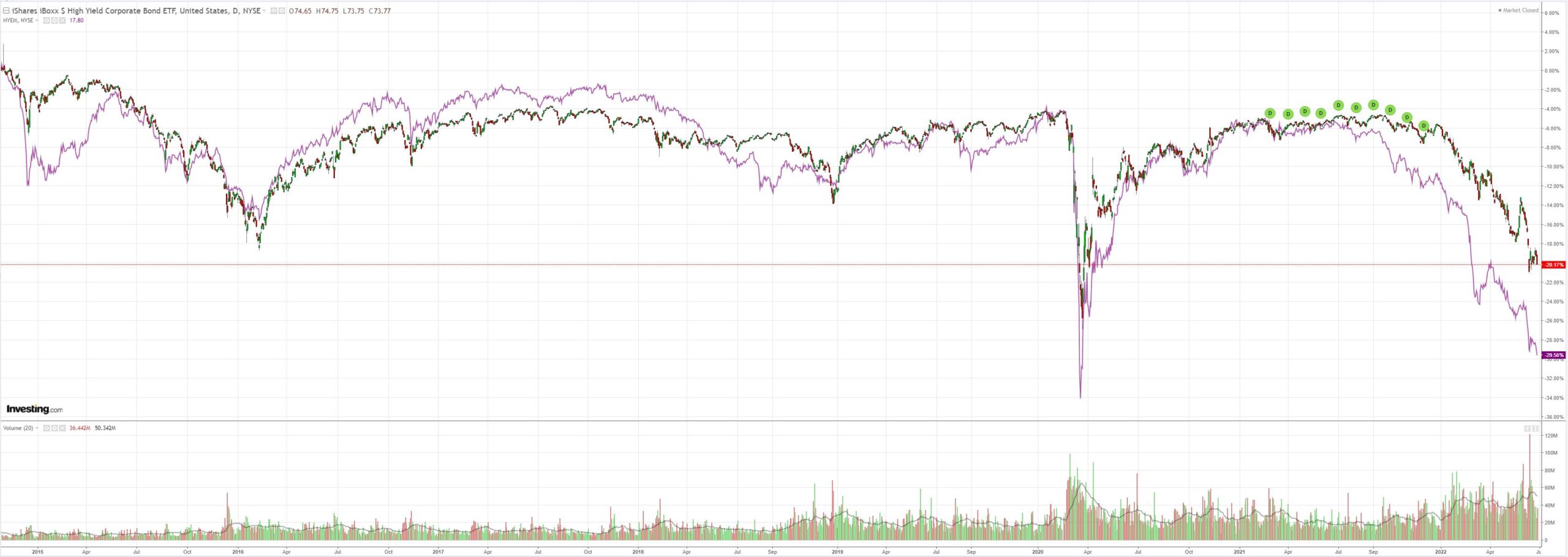

And junk (NYSE:HYG) is on the express elevator to hell with everything else soon to follow:

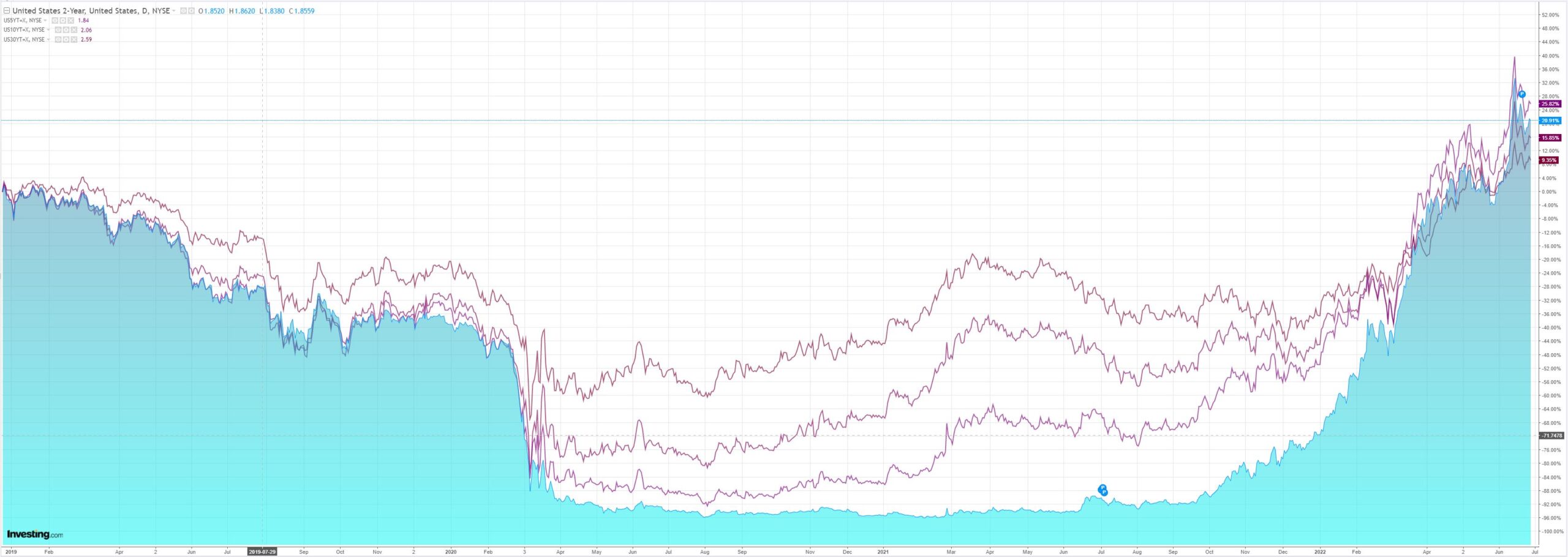

Treasuries were bid:

Stocks were smashed:

Westpac has the wrap:

Event Wrap

US Conference Board consumer confidence fell to 98.7 (est. 100.0, prior revised from 106.4 to 103.2), led by decidedly softer expectations (66.4, prior revised to 73.7 from 77.5).

The Richmond Fed manufacturing activity survey fell to -19 (est. -7, prior -9), similar to the weakness seen in yesterday’s Dallas Fed survey. New orders fell to -38 from -16, and shipments fell to -29 from -14. Wages remained elevated, while there were early signs of supply chain relief and receding prices. US housing data for April was mixed but close to estimates. FHFA prices rose +1.6%m/m (est. +1.4%m/m), and CoreLogic’s rose +1.8%m/m (est. +1.9%m/m).FOMC member Williams said the Fed needs to get to a 3% to 3.5% funds rate this year, and the debate at the July 26-27 FOMC will be about 50bp vs 75bp. He believes rates will get into restrictive territory in 2023, and expects the economy to slow enough to push the unemployment rate a little above 4%, but a recession this year is not his base case. Bullard published an essay on inflation, noting that getting ahead of inflation will keep it low and stable and promote a strong real economy. He noted the lessons learned from the 1974, 1983, and the 1994-5 experiences, concluding that the latter two approaches were the better examples to follow.

ECB President Lagarde said that they would take the first step of applying flexibility in reinvesting maturities and coupons from PEPP to counter “fragmentation” pressures from 1July.

Event Outlook

Aust: A softer gain is anticipated in May’s retail sales as spending rotates towards non-retail items (Westpac f/c: 0.3%).

Eur: Economic and consumer confidence should continue to be affected by the Russia-Ukraine conflict and historically elevated prices in June.

US: The final estimate for Q1 GDP is due (market f/c: -1.5%). Meanwhile, FOMC Chair Powell will participate in a panel at the ECB’s Central Banking forum. The FOMC’s Mester will also speak at the forum and Bullard is due to speak at a different event.

The Chinese victory over OMICRON, such as it is, fired up oil as it lifted some travel restrictions.

Needless to say, any Chinese oil demand recovery of substance is very bad news for the global economy. It will force the Fed to hollow out demand with higher rates to crash the oil price.

Indeed, China itself is running on the spot here as it lifts domestic demand only to see its external demand smashed. That’s the reality of today’s oil resource limitation.

As I have said before, it really is the Fed versus oil now and yesterday the Fed lost.

As for Australia, there was a time when higher commodity prices were seen to benefit the local economy and lifted the AUD.

That time is long past as energy inflation runs rampant everywhere and the only place to hide is King Dollar.