DXY is sinking and I still don’t trust it:

AUD is falling even faster which makes more sense:

Commods were all up:

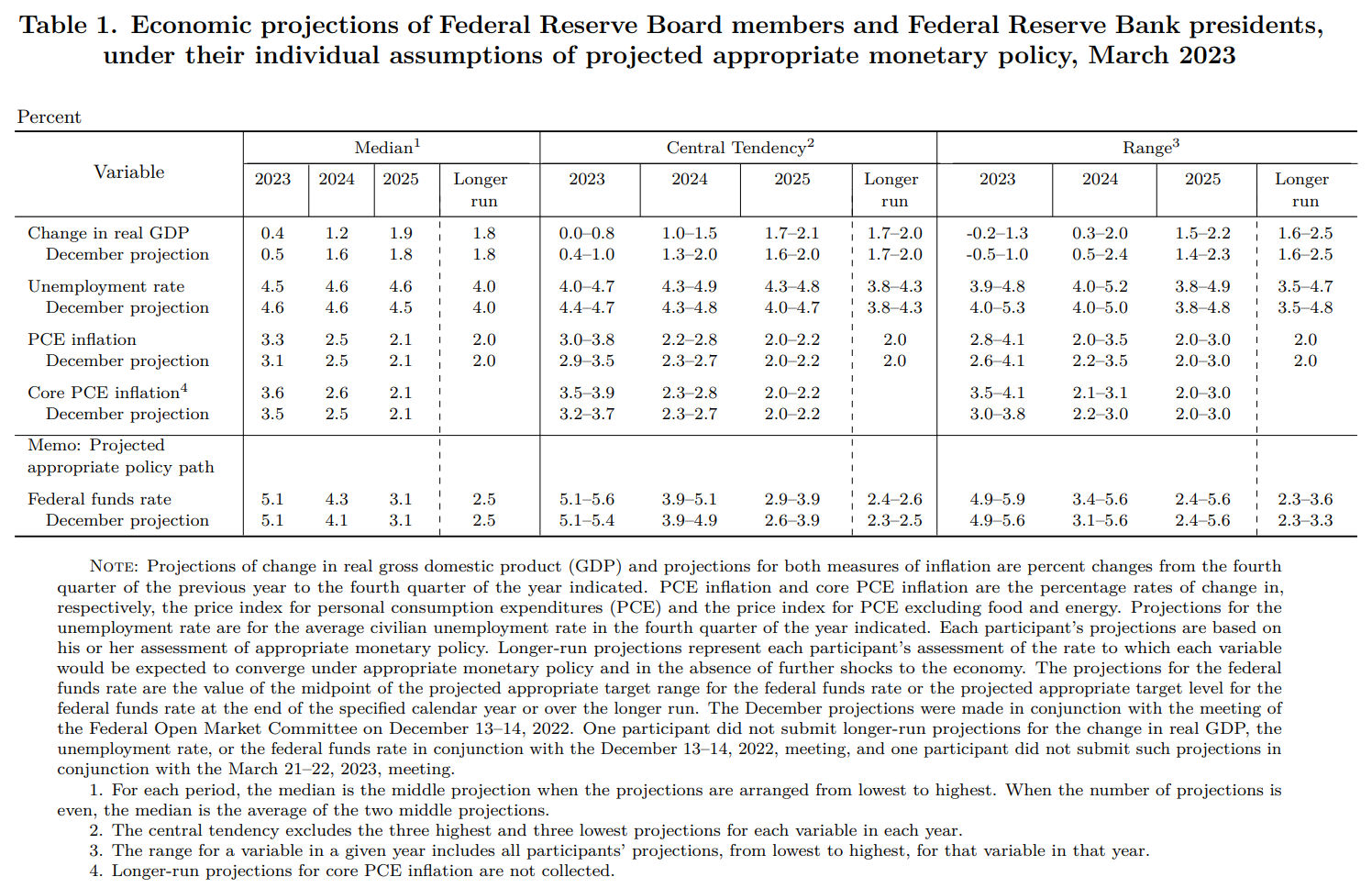

But not miners (NYSE:RIO):

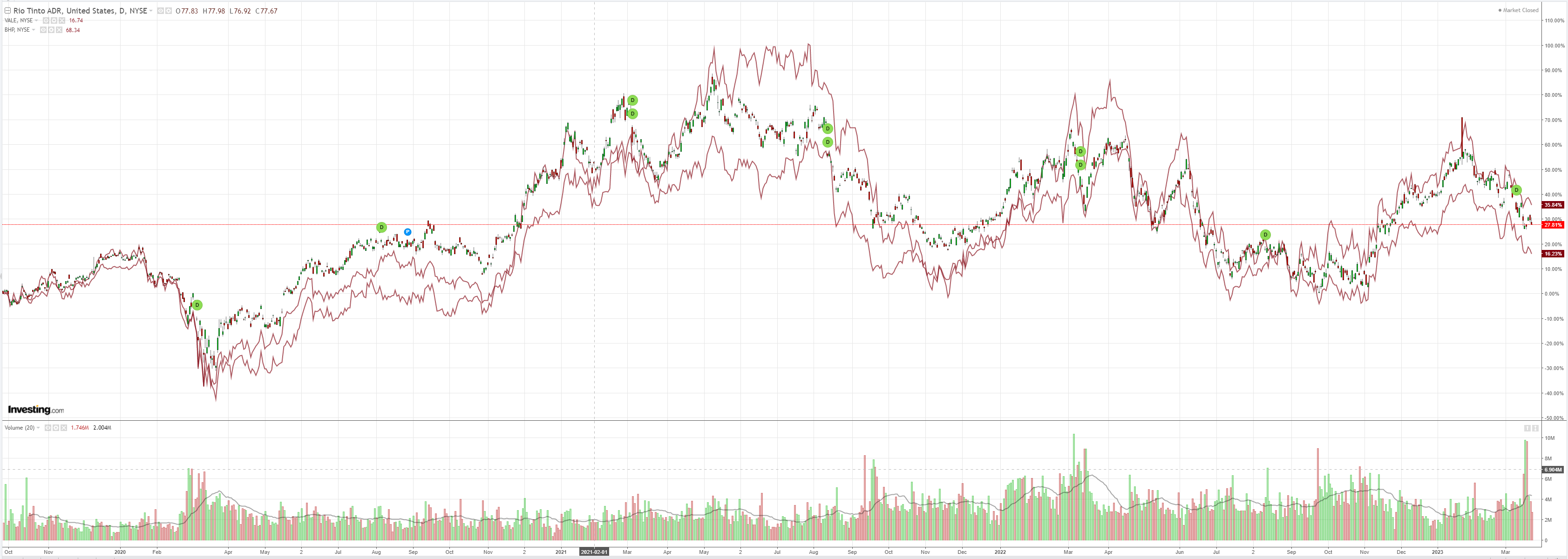

EM stocks (NYSE:EEM) popped and dropped:

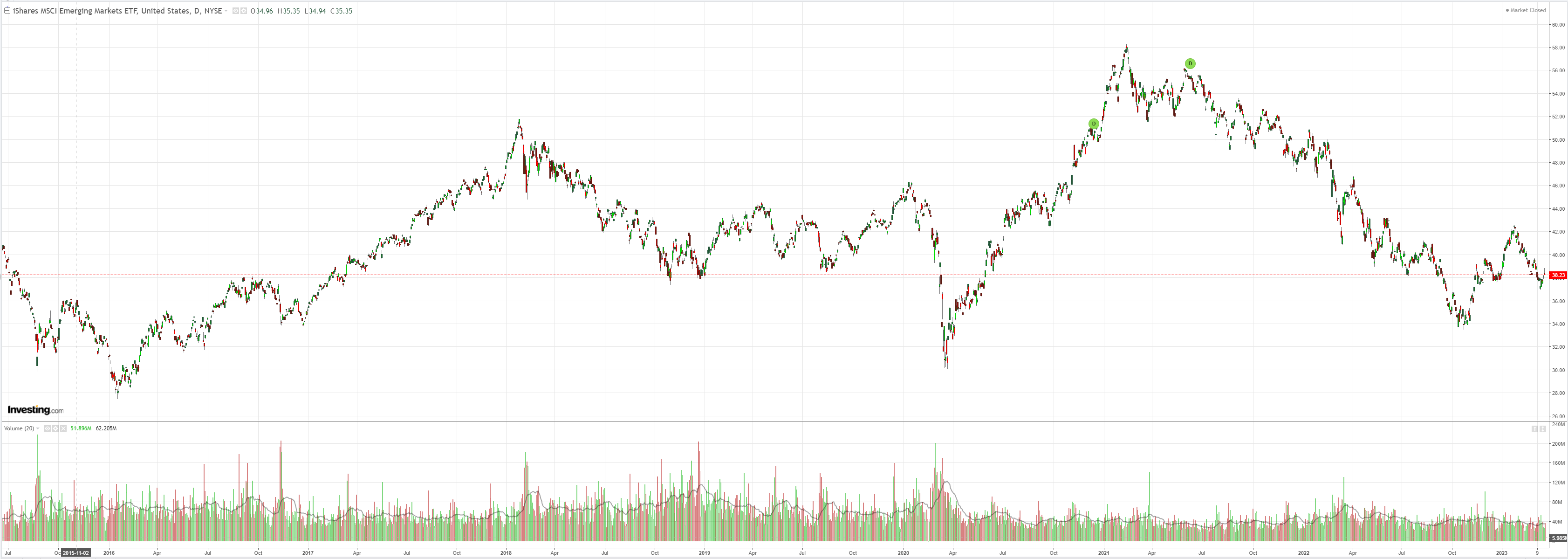

Junk (NYSE:HYG) too:

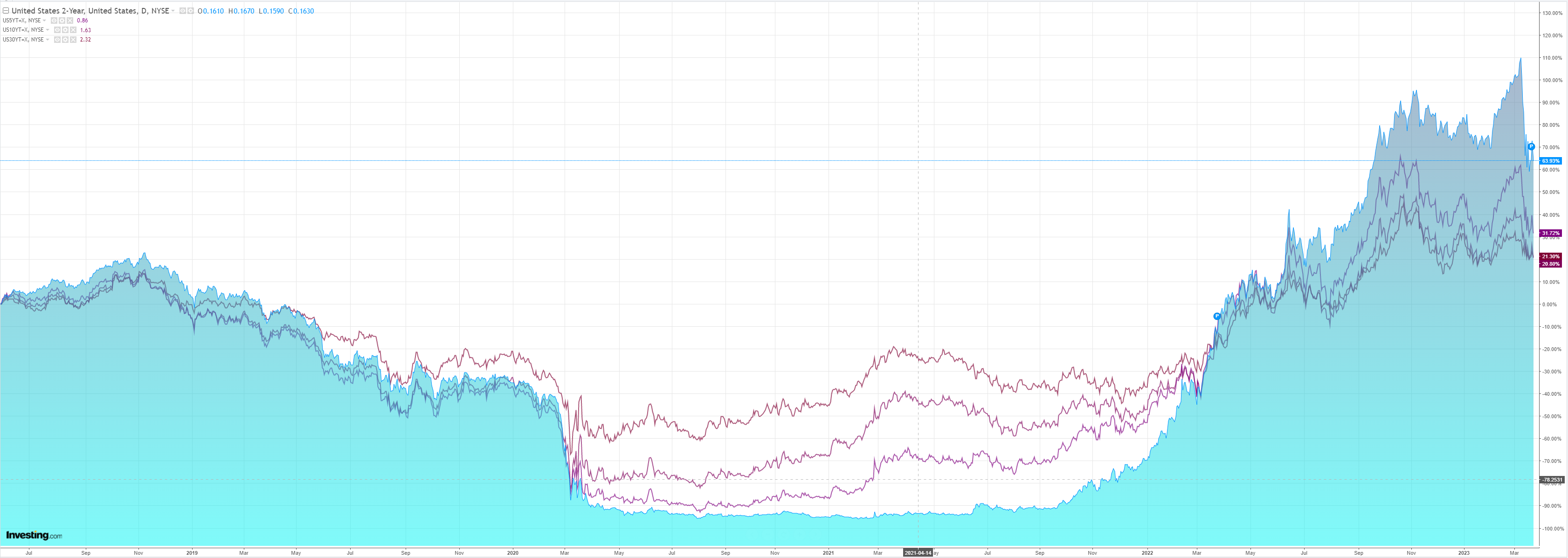

Yields were creamed:

And stocks:

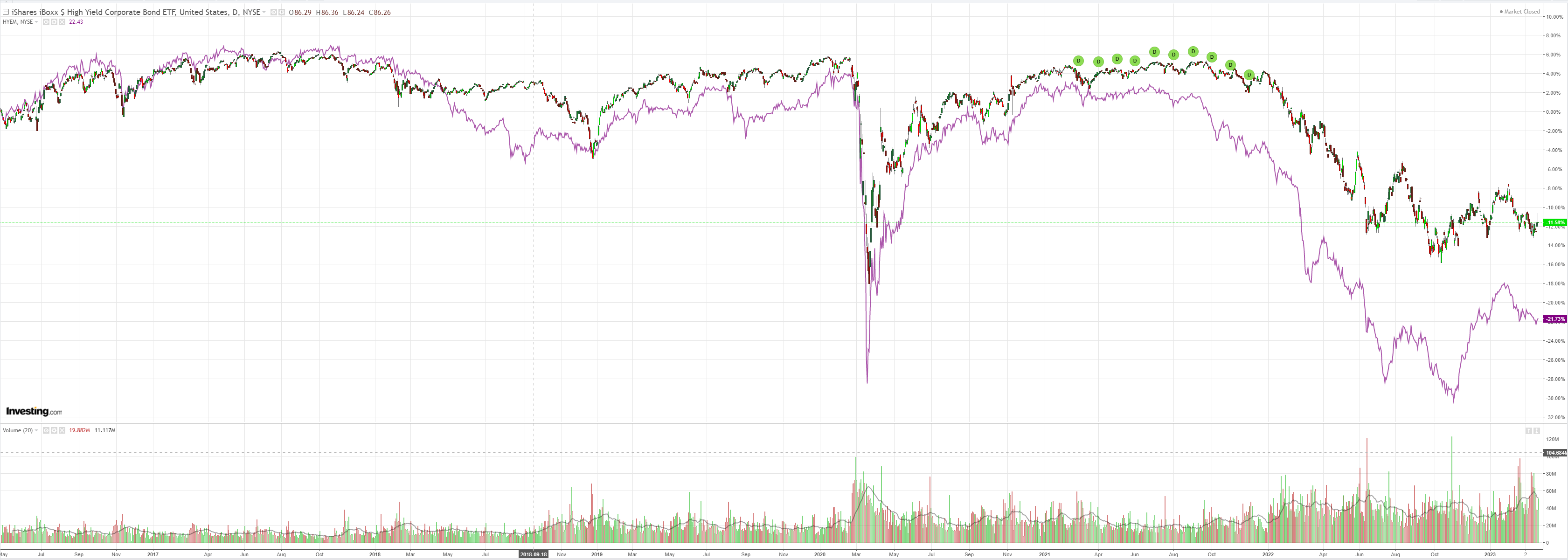

The Fed hikes 25bps and remained hawkish and most projections strengthened:

They must be looking at some other economy than the US. If it’s all so rosy then why only hike 25bps?

Because it’s not rosy. A credit crunch is underway in regional banks and it is getting worse, not better. JPM:

Since the Fed started its tightening cycle a year ago, the most vulnerable US banks likely lost around $1tr of deposits , half of which happened after the SVB crisis and the other half before. Of this $1tr, half went to Government Money Market Funds and the other half to larger/safer US banks.

In our opinion, this ongoing US bank deposit shift has three likely drivers: the Fed’s rate hikes and the failure of bank deposit rates to respond to this rise, the Fed’s QT and the fact that almost $7tr of US bank deposits are uninsured. An FDIC guarantee of all US bank deposits would certainly help, but it might not be enough to completely stop this deposit shift.

The uncertainty generated by deposit movements could cause banks to become more cautious on lending. This risk is heightened by the fact that mid- and small-size banks play a disproportionally large role in US bank lending.

The greatest vulnerabilities with respect to credit creation going forward lie with non-mortgage bank lending to households and mortgage bank lending for non-financial non-corporate businesses. Non-financial corporate businesses look less vulnerable as they could in principle instead make use of debt capital markets to offset potential reduced bank lending, though this is clearly dependent on market conditions.

Janet Yellen made it worse:

YELLEN: NOT TIME YET TO SAY IF FDIC INSURANCE CAP APPROPRIATE

So long as this continues, expect AUD to fall.