DXY was solid overnight and it was about the only thing that was:

AUD was bashed:

With commodities:

And miners (LON:GLEN):

EM stocks (NYSE:EEM) have died and gone to hell:

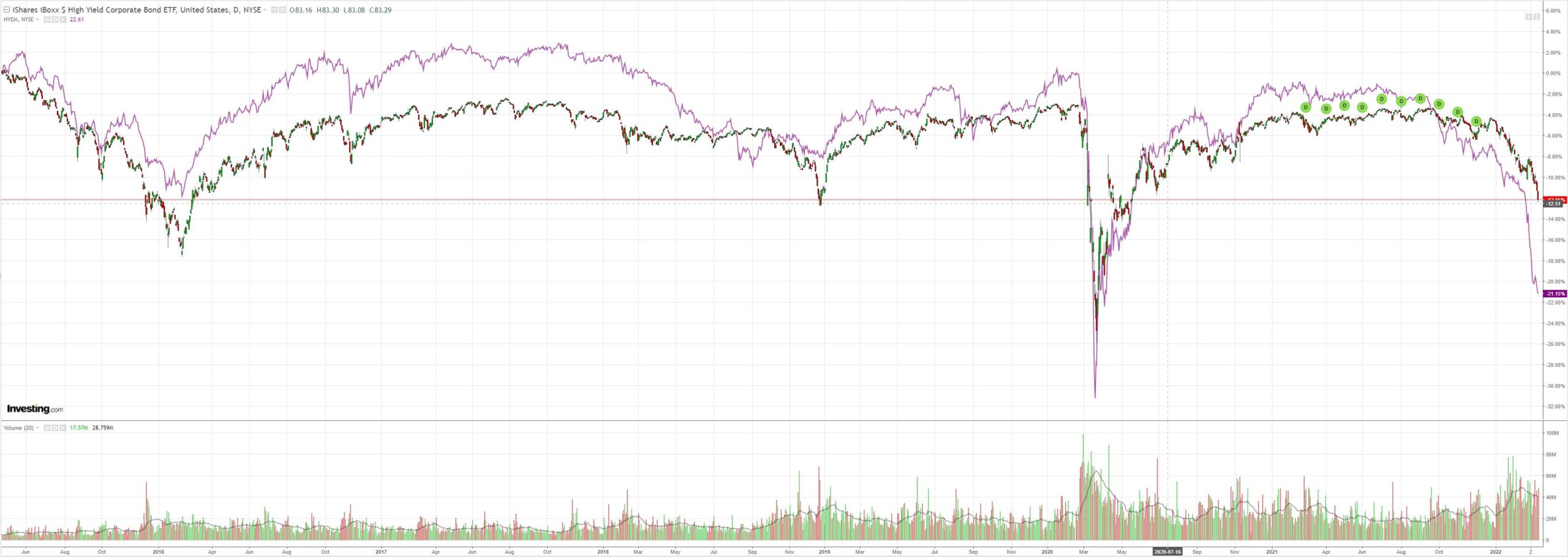

On the coattails of junk (NYSE:HYG):

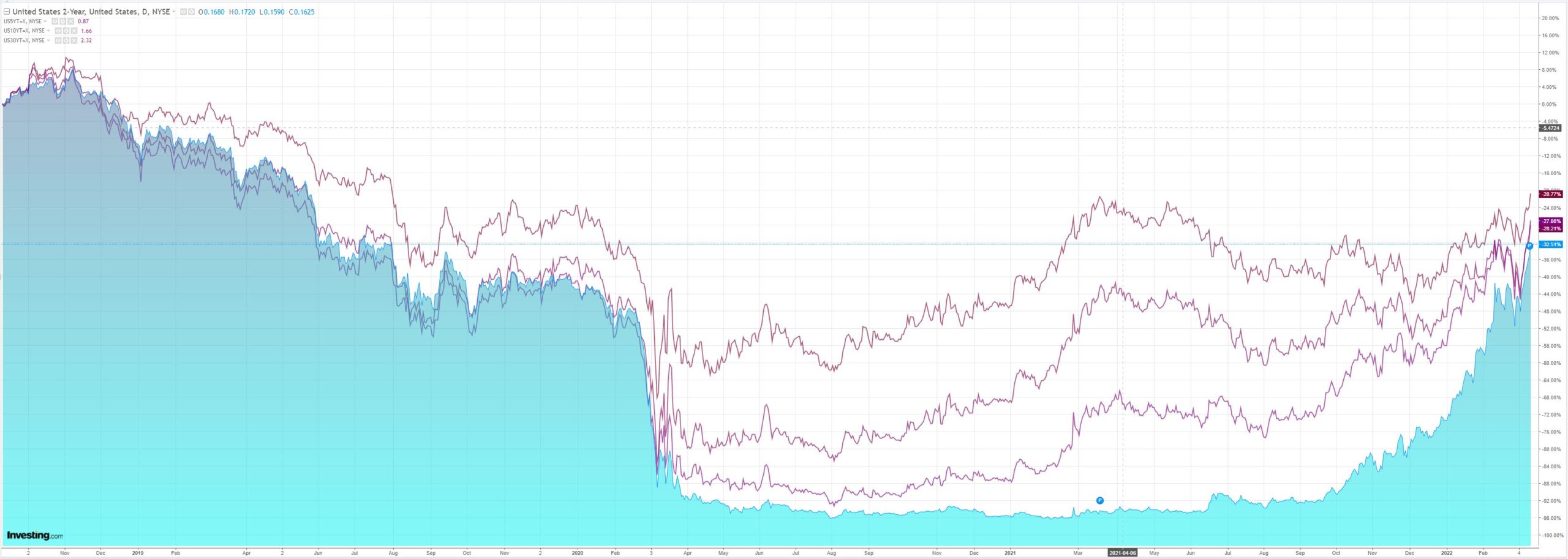

As Treasury yields blow-off:

Stocks fell again:

Westpac has the wrap:

Event Wrap

US and Chinese officials conducted a “substantial discussion” of the Russian war against Ukraine in their first high-level, in-person talks since the invasion, but the White House announced no specific outcomes or agreements.

The European Union approved a fourth round of sanctions on Russia, including banning the sale of luxury goods, as well as the purchase of Russian steel and iron products.

China placed Shenzhen province into a covid-related lockdown for at least a week, and forbade people from leaving Jilin province – the first time the government has sealed off an entire province since early 2020.

Event Outlook

Aust: The Q1 ACCI-Westpac business survey will offer insight into manufacturers’ experience with intense supply-side issues amidst the rebound in activity. The RBA March meeting minutes will provide more colour surrounding the Board’s views.

NZ: February’s BusinessNZ PSI is expected to remain soft as omicron concerns weigh on services consumption.

China: Despite the slow start to the year with omicron, retail sales should continue to strengthen over the course of 2022 (market f/c for Feb: 3.0%yr YTD). Supply issues remain as headwinds for industrial production (market f/c: 4.0%yr YTD), while infrastructure and business investment should offset the weakness in residential fixed asset investment (market f/c: 5.0%yr YTD).

Eur/UK: The March ZEW survey of expectations will likely reflect an uncertain outlook given the Russia-Ukraine conflict. Meanwhile, the UK’s recovery should continue to edge the ILO unemployment rate lower in January (market f/c: 4.0%).

US: Producer prices will continue to be supported by supply issues in February (market f/c: 0.9%). The March Fed Empire state index will provide a timely update on the NY manufacturing sector (market f/c: 7.0%).

Yields blew out on the fear of more inflation coming from Chinese lockdowns. But that’s reflexive. The real fear now is a global recession and it is only a matter of time before Treasuries turn hot on that basis.

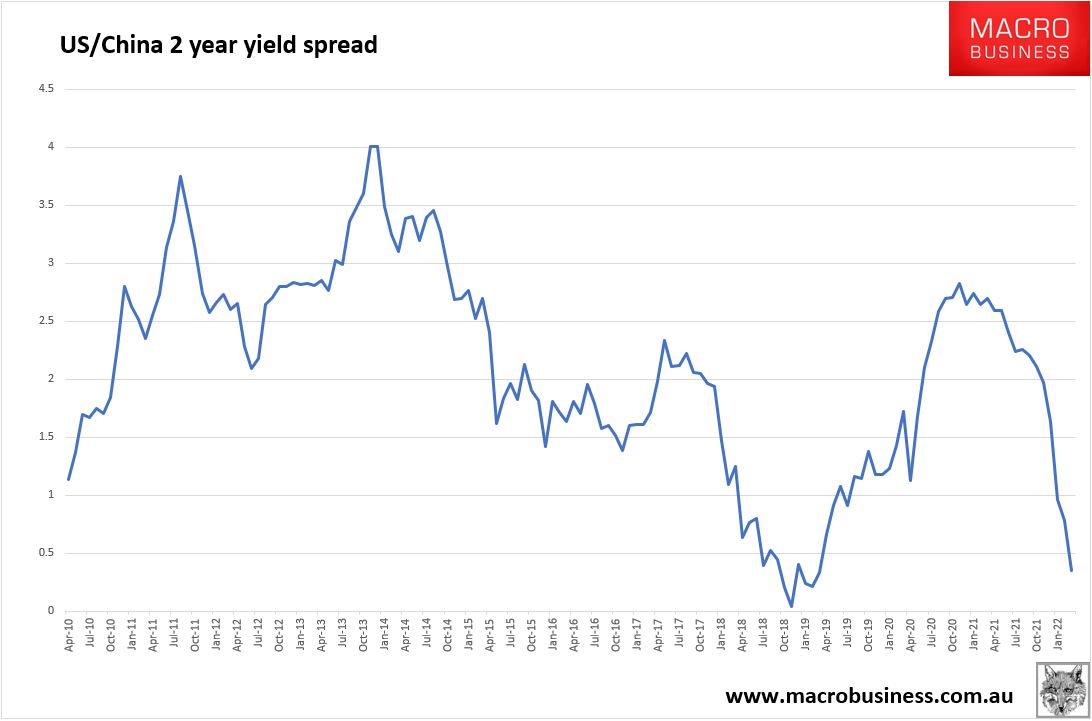

Particularly since the Chinese economy is now leading the world into recession as property, policy error, OMICRON, and an external shock combine resulting in this:

The Chinese yuan weakens against the US dollar for the fifth consecutive day on Monday, with the entire gains in February erased, driven by growing expectations that the People’s Bank of China (PBOC) will introduce more monetary easing measures and conerns over the fast spread of locally transmitted coronavirus cases.

The onshore yuan broke through the 6.35 per dollar mark to hit 6.3623 at one point, the weakest level since February 15. Before the market open, the central bank set the daily fixing at a one-month low of 6.3506 per dollar, 200 pips or 0.3% weaker than the previous fix 6.3306.

The offshore yuan has weakened by 0.4% since late February, from 6.31 per dollar to hit 6.3820 on Monday.

A double whammy of slowing economic growth and a resurgence of COVID-19 cases stoked concerns about further yuan depreciation.

China will further cut interest rates to stabilise the economy, as narrowing China-US yield spreads won’t change Beijing’s monetary policy loosening bias, said Yu Yongding, an influential economist and former PBOC advisor, reported the state-run China Securities Journal.

Even as the Federal Reserve raises its benchmark rate to 2%, the US real interest rates would remain negative due to high inflation, in contrast to positive rates in China, said Yu.

In addition, China has policy tools to prevent severe capital outflows, while the yuan’s flexibility can improve further to offset the impact on monetary policy independence from cross-border capital flows, Yu added.

Once CNY starts to fall then it is all over for EMs, commodities, the AUD and, before long, Fed tightening.

And fall CNY must: