DXY is up and away and appears rapidly headed for a breakout test in a major chart range lasting fifteen years. The set-up is a bullish ascending triangle. If it can break through 100 and then 104 then a march higher highs not seen since the 1990s becomes very possible:

Why not? Oil shortages are blowing a gale behind shale activity, just as it also squashes household discretionary income and hammers imports for everywhere else, lifting the trade balance. Rampant inflation and a hawkish Fed are widening credit spreads by the day, especially in EM. A weak China is ravaged by plunging property developers. Europe is wracked by war and commodity shocks.

Why wouldn’t the world buy DXY? And in so doing create a feedback loop of doom as it drains markets of liquidity and makes all of the above worse, lifting DXY demand even further.

Yeh, I can see DXY roaring to twenty-year highs.

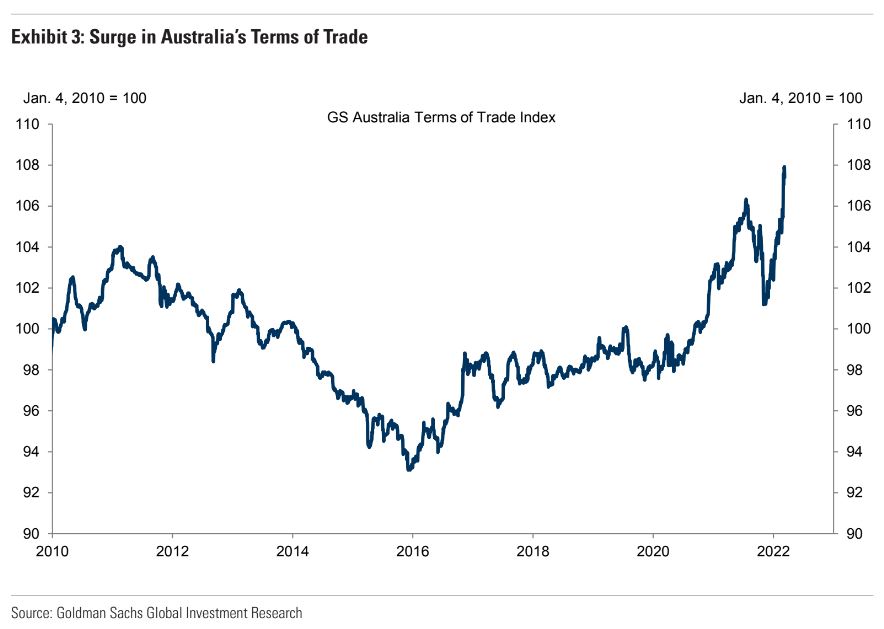

Yet, as Australia’s terms of trade rocket to unimaginable highs on the Ukraine conflict, the AUD has been one of the few currencies capable of fighting a DXY unleashed. Still, it couldn’t do so on Friday night:

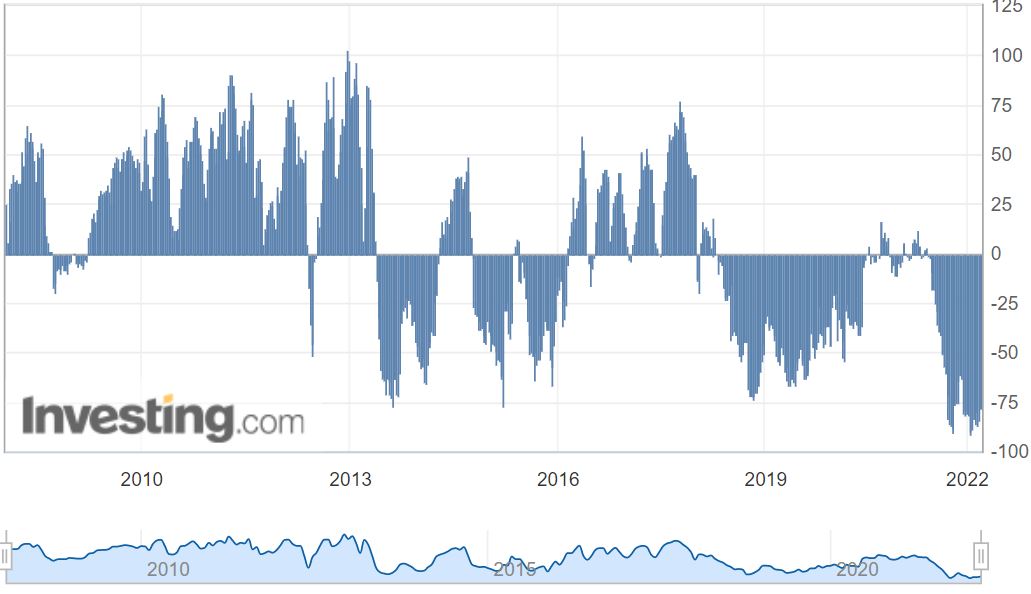

The recent price spike has not been enough to puke the AUD shorts:

Base metals retraced some more:

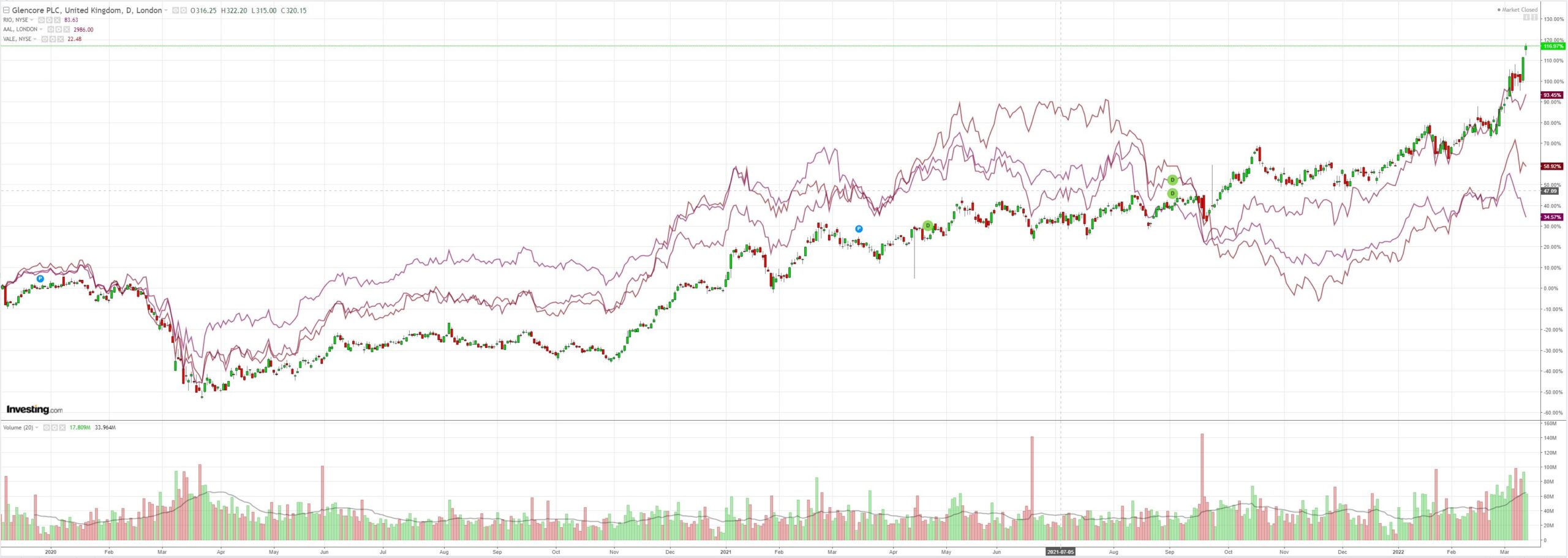

Big miners have bifurcated. The evil Glencore PLC (LON:GLEN) is now numero uno on coal:

But how long before all commodities crash? The global economy is reeling under blow after blow to the supply side and demand destruction is via scarcity pricing and the Fed is coming swiftly into view. EM equity (NYSE:EEM) is a bloodbath:

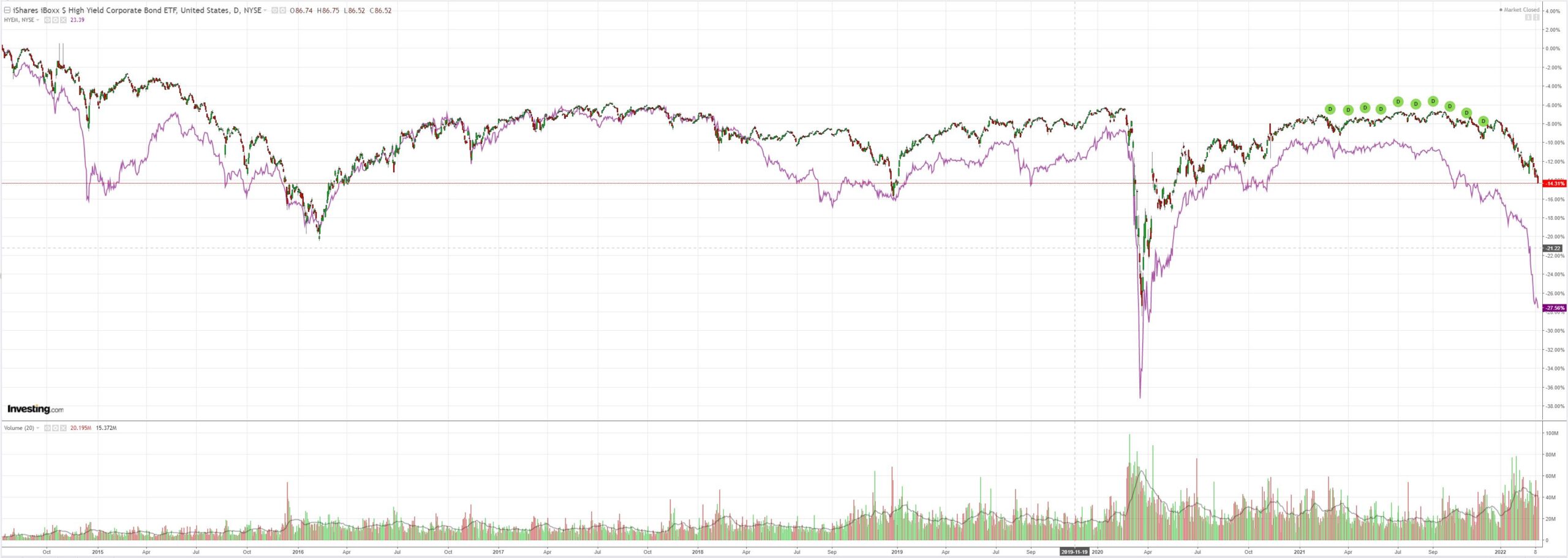

EM junk credit (NYSE:HYG) is the screaming comet of doom. US junk broke Friday night as well:

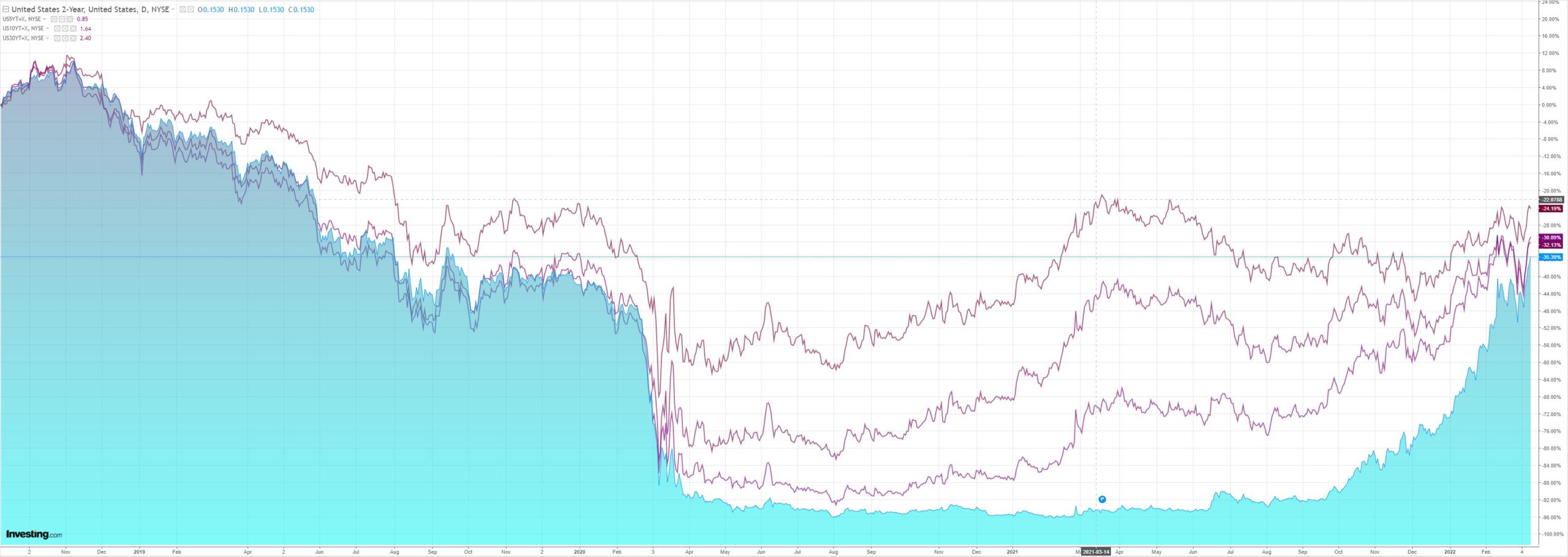

The Treasury curve is headed fast for inversion:

Stocks are set to retest lows:

Here’s Goldman’s take on the AUD:

AUD & NZD: Marking our forecasts to market. The rapidly shifting macro backdrop has required us to reassess our outlook for AUD & NZD. On the one hand, our economists have recently revised down our growth forecasts in the Euro area and the US, and risks to global growth still look skewed to the downside. On the other hand, our economists pulled forward their forecast for RBA lift-off on the back of higher-than-expected inflation, Asia underperformance has not played out as we anticipated, and rising commodity prices, particularly coal and iron ore prices, have notably benefitted Australia’s terms of trade (Exhibit 3). As a result, we are marking-to-market our AUD & NZD forecasts across our 3, 6, and 12m forecast horizon, raising AUD/USD to 0.73 (vs. 0.70, 0.70, 0.71 previously) and NZD/USD to 0.68 (vs. 0.66, 0.66, 0.67 previously). Thus, we are also turning more neutral on the AUD/NZD cross with a flat forecast of 1.07 over the next 12 months (vs. 1.06, 1.06,1.06 previously).

The trillion-dollar question for the AUD is when do markets make the leap to a global recession in H2, 2022 being the base case, and begin to reprice commodities on failing growth and demand? The recent blowoff top sure looks like it was driven by speculators and leverage and the same vol can be expected on the downside when the penny drops.

The permabullish Goldman shocked on the weekend by lifting its US recession probability to 35%. To my mind, it’s more like 60% and requires an immediate resolution in Ukraine to boot.

This week the Fed will join the building headwinds with its first hike and if you believe markets there are another seven coming this year. How many will be it get away before it all falls apart? One, two, three?

When the time comes, and the global recession becomes a certainty, the AUD will crash as King Greenback crushes commodities.