DXY is still poised for higher as markets capitulate to the coming global recession:

AUD was slain, breaking post-COVID support:

Oil gave in:

Metals have now erased Ukraine. Global recession next!

Miners (LON:GLEN) were flogged:

EM stocks (NYSE:EEM) are into free fall:

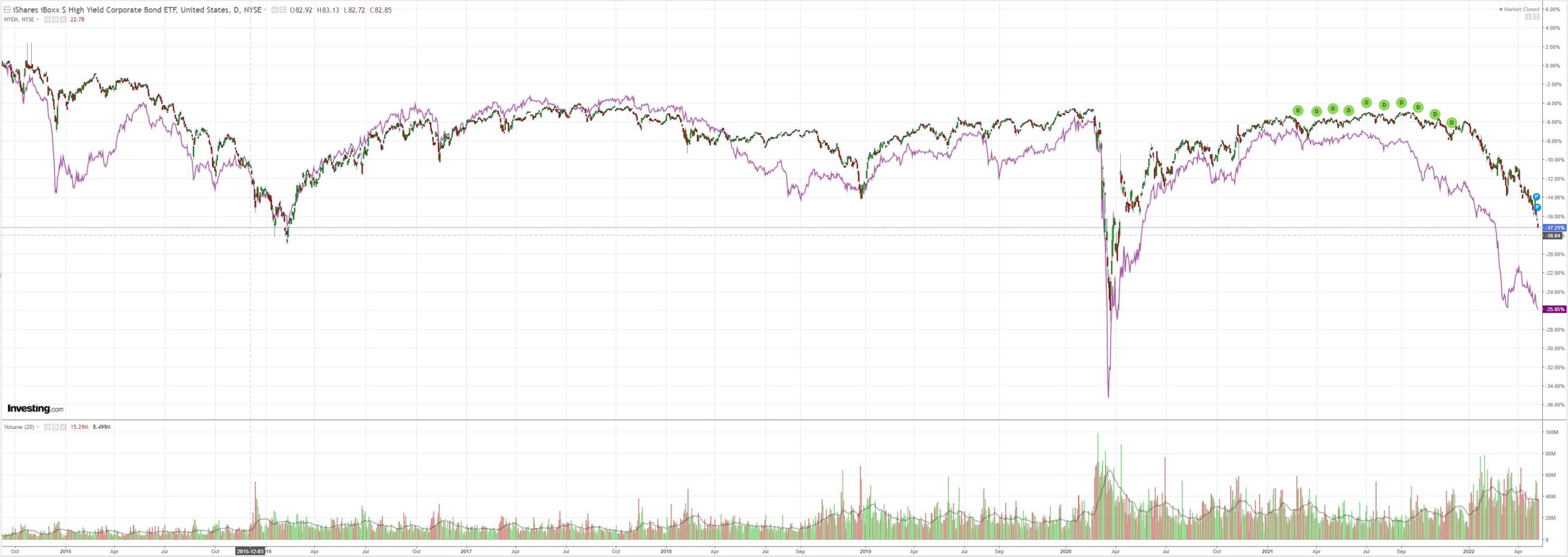

Tracking junk (NYSE:HYG):

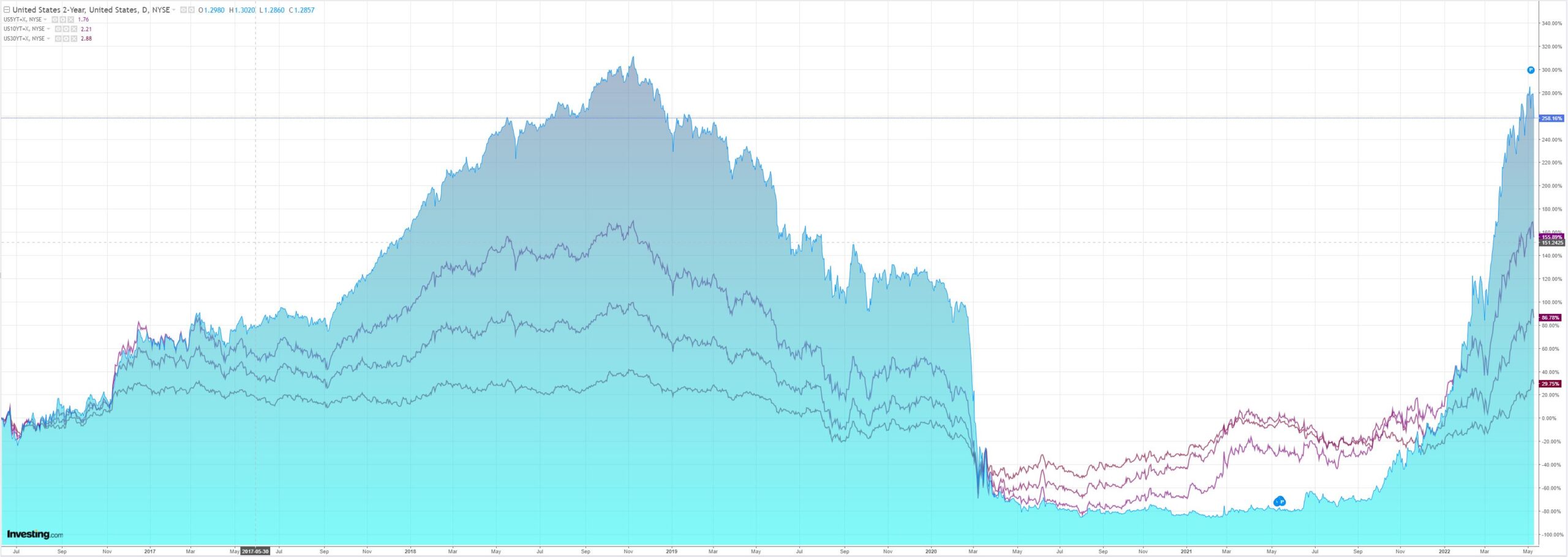

Yields fell but there was a bear steepening:

As stocks obliterated support:

Markets are beginning to price the coming global recession. Ironically, this will guarantee its arrival as it drives a hiccup in US consumption which will spill over to China and Europe via trade landing on already weak economies thanks to the war, energy, OMICRON and property shocks.

This is the macro backdrop. However, it is not the proximate driver of the AUD crash. For that we look to China and the CNY:

Why is the CNY falling so fast? It’s a classic case of “at first slowly then all at once” as markets realise China is a nasty risk in geopolitical, trade, policy and growth terms.

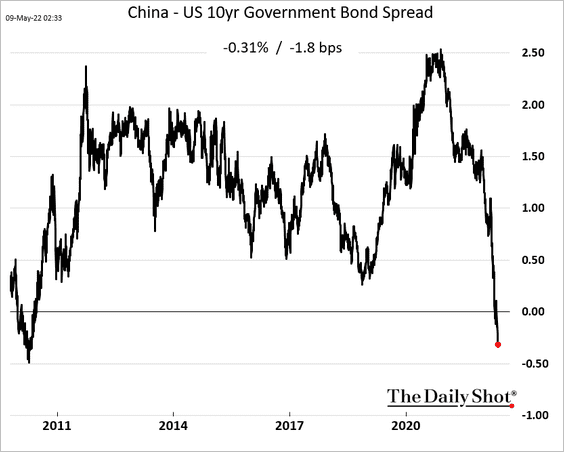

And, of course, the Fed is killing it:

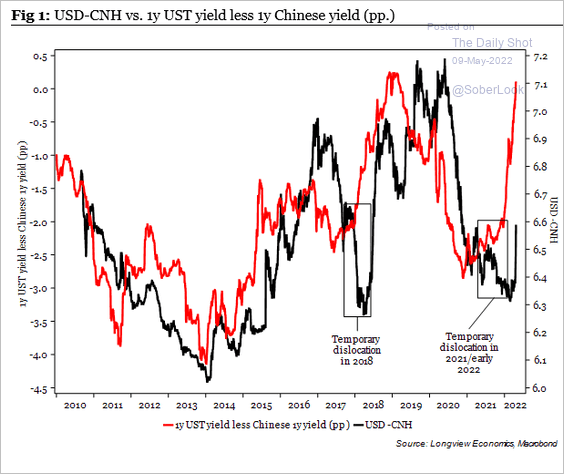

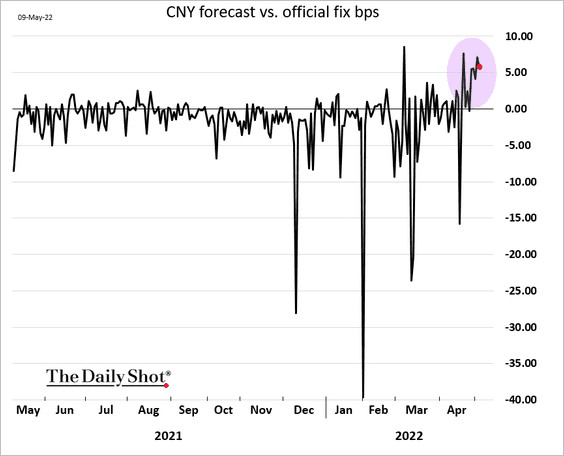

Or, rather, the Fed is exposing China’s impossible trinity of trying to control interest rates, currency and capital flows all at once. Its still trying to slow the currency fall down:

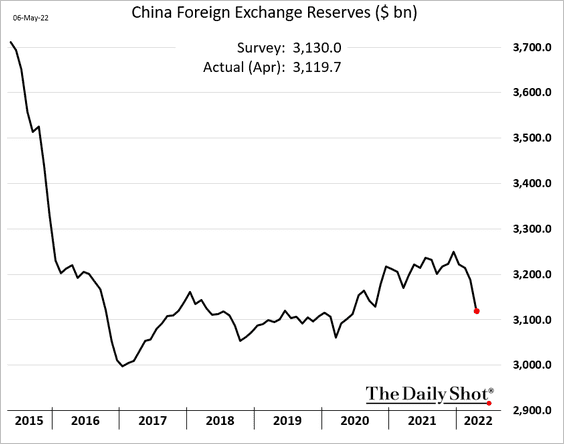

Lest it depletes more foreign currency reserves and lose control completely:

I don’t know if China will end up in a classic EM currency crisis before this move is done. What we can say for sure is that a falling CNY is spectacularly deflationary for the world as it:

- destroys DM and EM competitiveness;

- lifts domestic manufacturing and commodity competitiveness, and

- when accompanied by a hawkish Fed, delivers a bowel-shaking shock to EM external accounts.

For markets that are primed for inflation across the board, a massively deflationary CNY shock is entirely on the wrong side of the boat.

Where CNY goes, AUD follows.