DXY is still hovering at twenty-year highs:

AUD largely shrugged off the RBA as it looks forward to the Fed:

Oil was weak:

Metals too:

And miners Glencore (LON:GLEN):

EM stocks (NYSE:EEM) are clinging to the cliff top:

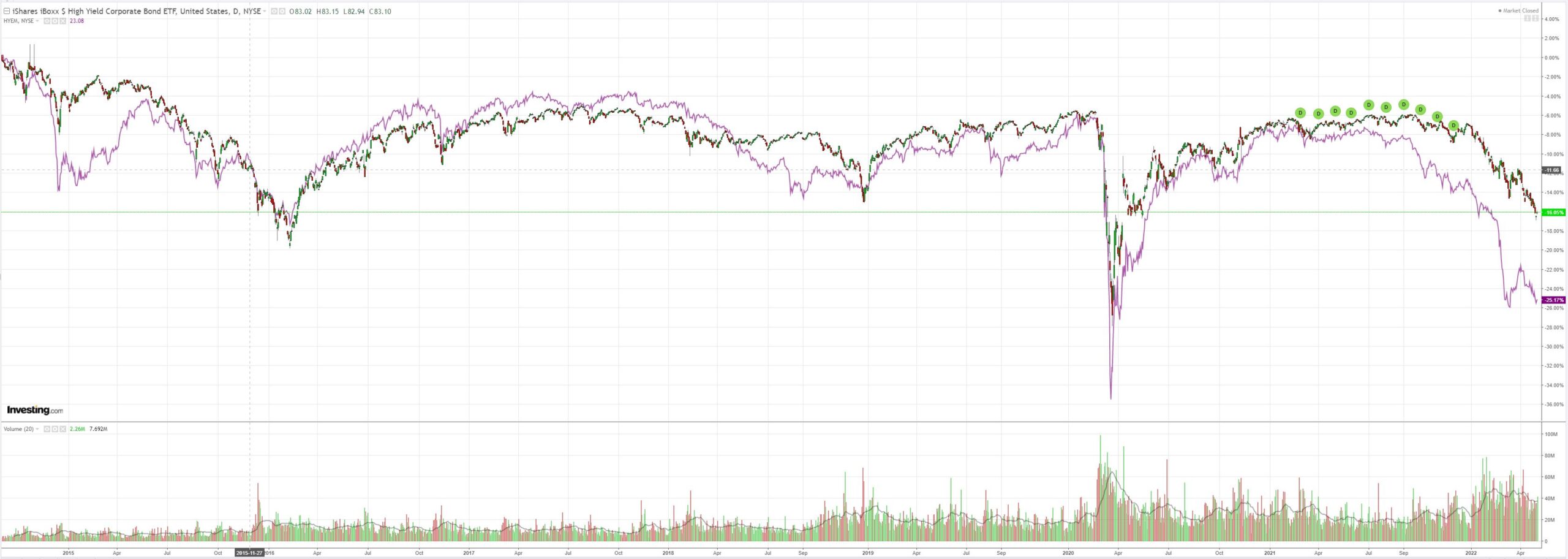

And junk (NYSE:HYG):

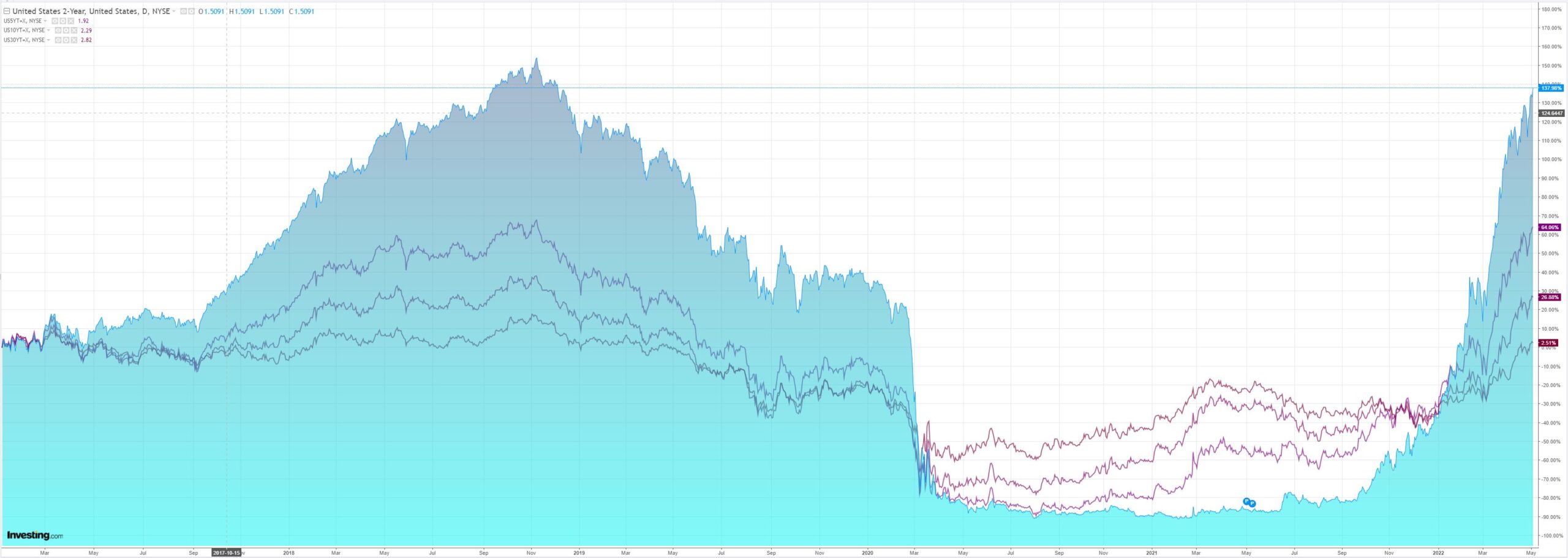

As yields rose again plus the curve flattened:

Stocks managed minor gains:

Westpac has the wrap:

Event Wrap

US factory orders in March rose 2.2% (est. 1.2%), with robust petroleum-led non-durable gains of 2.3% for shipments and orders, and 2.2% for inventories, after upwardly-revised February figures for all the major indicators. Durable goods orders for March were finalised higher at +1.1% (previously +0.8%). JOLTS job openings rose further to 11549k (est. 11200k, prior 11344k) – a record high. The quit rate increased from 2.9% to 3.0%, also setting a record high.

Eurozone PPI inflation in March beat elevated expectations at 5.3%m/m and 36.8%y/y (est. 5.0%m/m) – record highs. Energy prices remain the main culprit, although even excluding energy the annual rate hit 13.6% y/y,

ECB board member Schnabel said a July rate hike is possible and the central bank must act on inflation.

Event Outlook

Aust: Weather and fuel price effects are expected to weigh on retail sales in March (Westpac f/c: -1.0%). Housing finance approvals are set to fall in March given the housing cycle peak has started this year (Westpac f/c: -3.5%); owner-occupier loans are expected to outstrip investor loans in the decline for the month (Westpac f/c: -4.0% and -2.5% respectively).

NZ: Ongoing tightness in the labour market suggests employment growth will remain subdued and the unemployment rate will fall slightly in Q1 (Westpac f/c: 3.0% and 0.2% respectively); the labour cost index should continue to indicate wages growth with a lag behind inflation (Westpac f/c: 0.7%). The RBNZ Financial Stability Report will provide a review of the financial system’s health.

Eur/UK: European retail sales are expected to decline in March as inflation weighs on consumer spending (market f/c: -0.2%). The final estimate of April’s S&P Global services PMI is due for the Euro Area (market f/c: 57.7). Meanwhile, net mortgage lending in the UK is set to soften as rate rises start to take effect (market f/c: £4.7bn).

US: ADP employment change should continue to point towards robust jobs growth (market f/c: 385k). The trade deficit is set to remain wide on account of strong demand and inventory rebuild (market f/c: -$107.1bn). The April S&P Global and ISM services PMIs will reflect the robust health of the sector (market f/c: 54.7 and 58.5 respectively). The FOMC is expected to raise the Fed Funds rate by 50bp at their May meeting to 0.875% and provide a confirmation of the quantitative tightening process.

Tomorrow is Fed day. Every key market that I follow is at key resistance or support. We appear poised for either a major breakdown or reversal. Goldman wraps the Fed:

Policy actions at the May FOMC meeting seem set after Chair Powell and other FOMC members strongly suggested that they intend to raise the policy rate by50bp and announce the start of balance sheet reduction.

The key question is therefore what comes next. We forecast another 50bp hike in June followed by a deceleration to a 25bp/meeting pace of tightening for the rest of 2022, but see reasonably high chances that the FOMC will continue to hike in 50bp increments until reaching their median neutral rate estimate of2.25-2.5%. We will therefore be paying close attention to any comments from Chair Powell at the press conference that suggest the FOMC intends to hike in50bp increments beyond June.

There are two additional issues that are top of mind for some investors ahead of the May meeting. First, St. Louis Fed President Bullard recently raised the possibility of a future 75bp hike, but we view such an acceleration in tightening as unlikely, especially because several FOMC participants have since stressed they do not see a 75bp hike as appropriate. Second, the March FOMC meeting minutes opened the door to selling mortgage backed securities (MBS) during the balance sheet reduction process, but our best guess is that the FOMC will not do so since FOMC participants have a strong preference for using the policy rate as the primary tool for adjusting monetary policy and MBS holdings as a share ofthe Fed’s balance sheet will most likely never rise to an uncomfortable level.

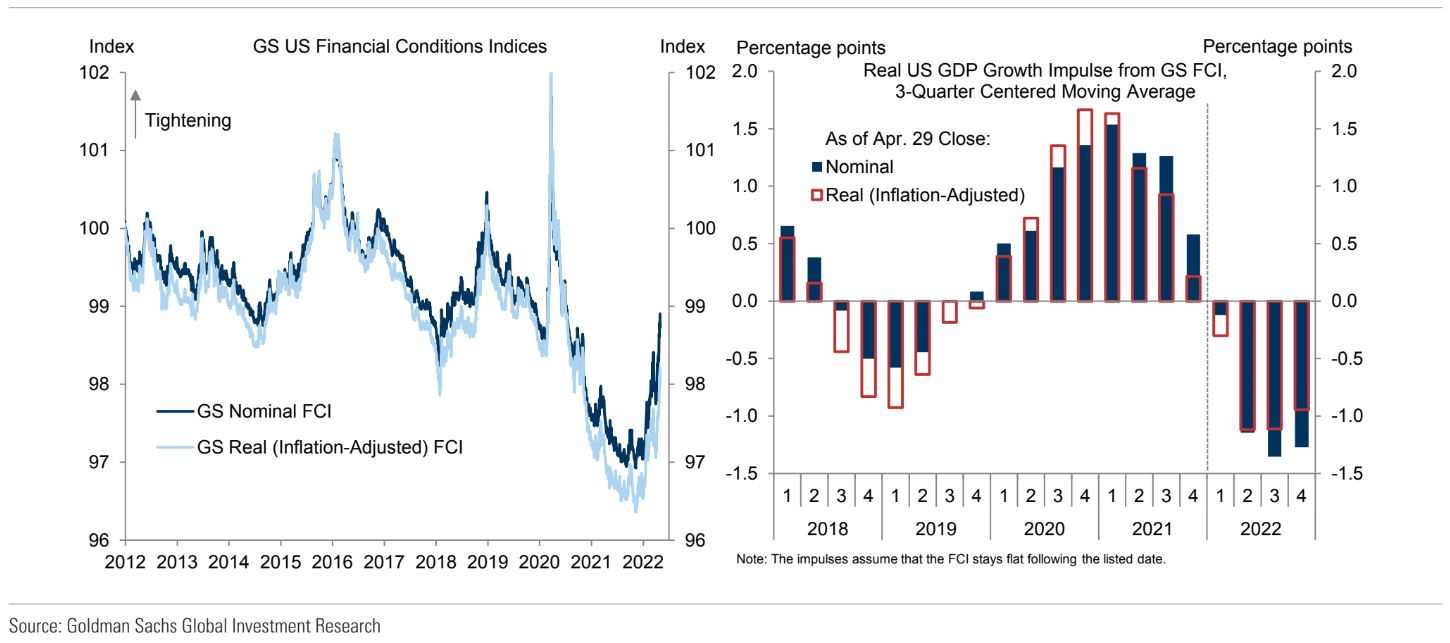

Everything I have seen from the Fed for months has been uber-hawkish. I can’t see why it would stop now. In its own terms, it has urgent work to do:

The danger is that the market will do all of the tightening in one almighty purge as equities, bonds and commodities all crash at once a’la 2020.

AUD is no place to hide.