Street Calls of the Week

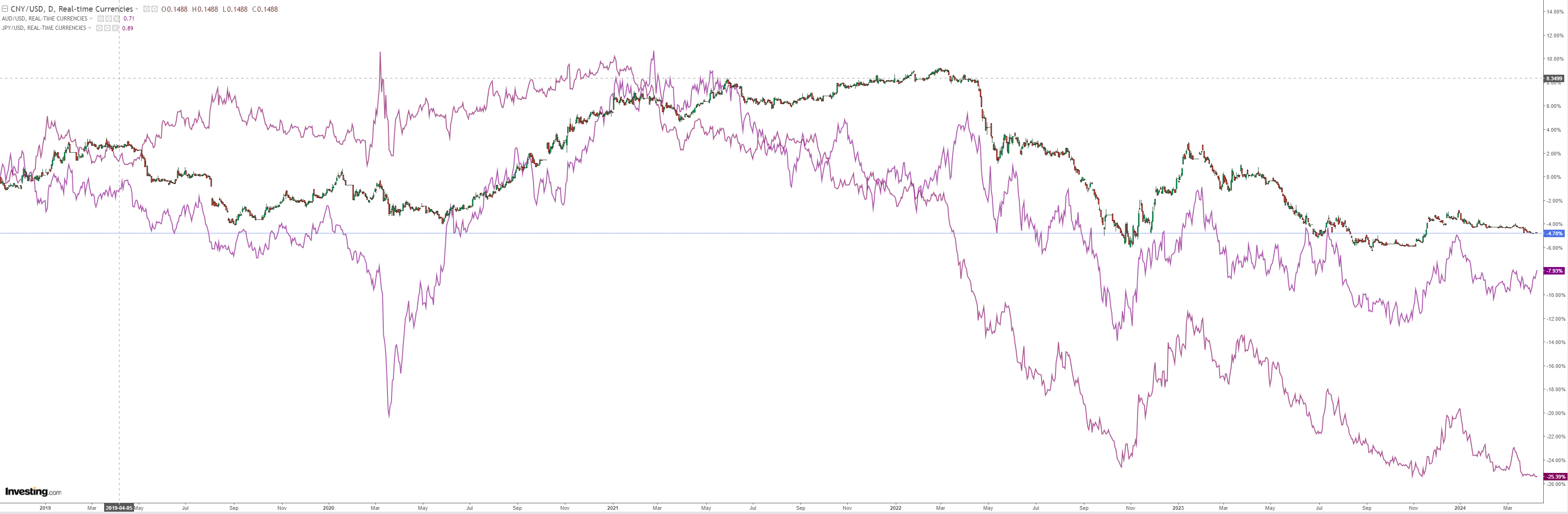

DXY eased last night:

AUD got squeezy against both majors:

Zero aid from North Asia:

But some from oil and gold:

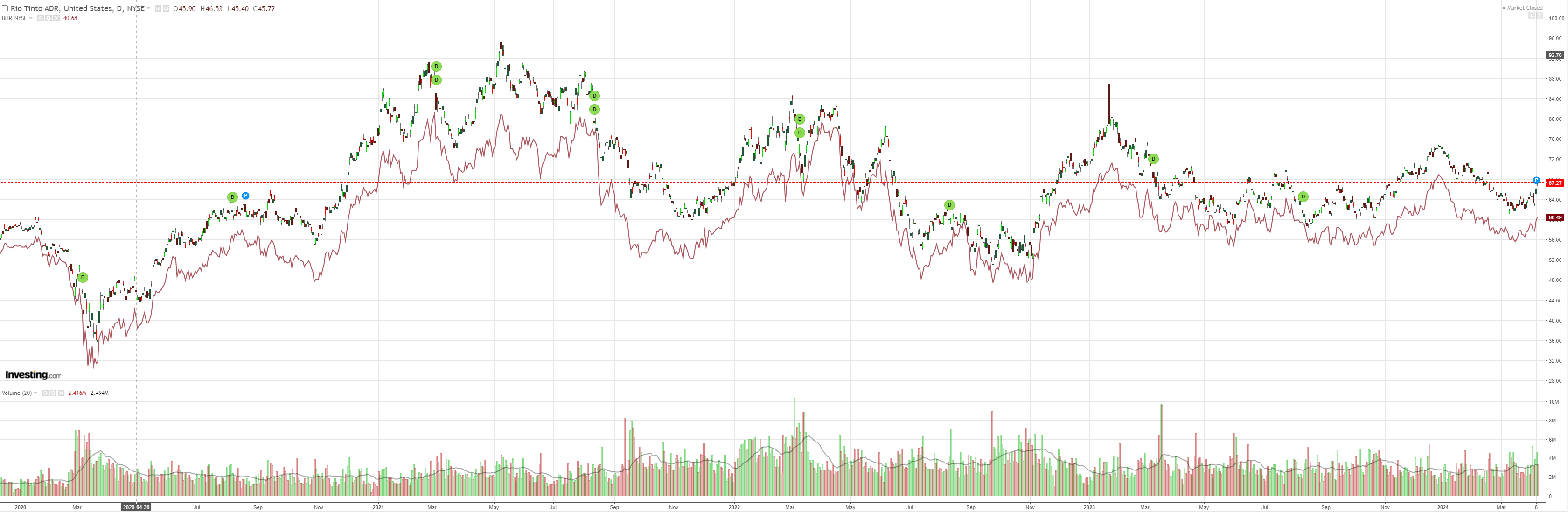

Goldman’s fancy copper squeeze is going nicely. Beware.

Big miners are back!

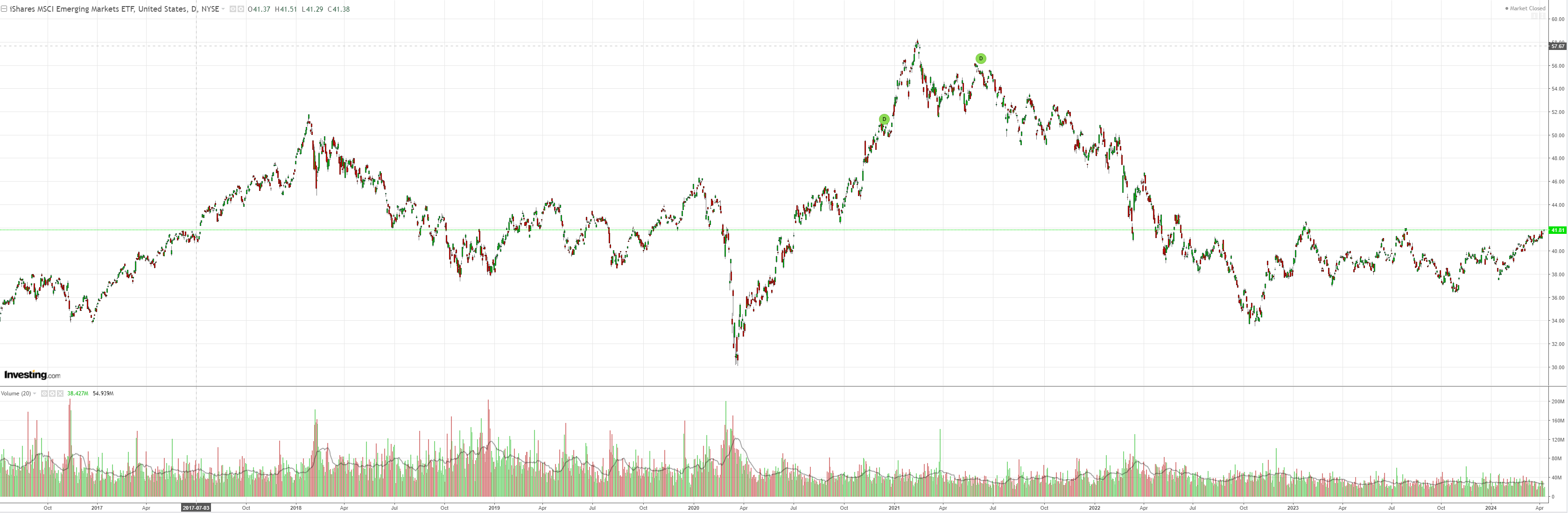

EM stocks look poised:

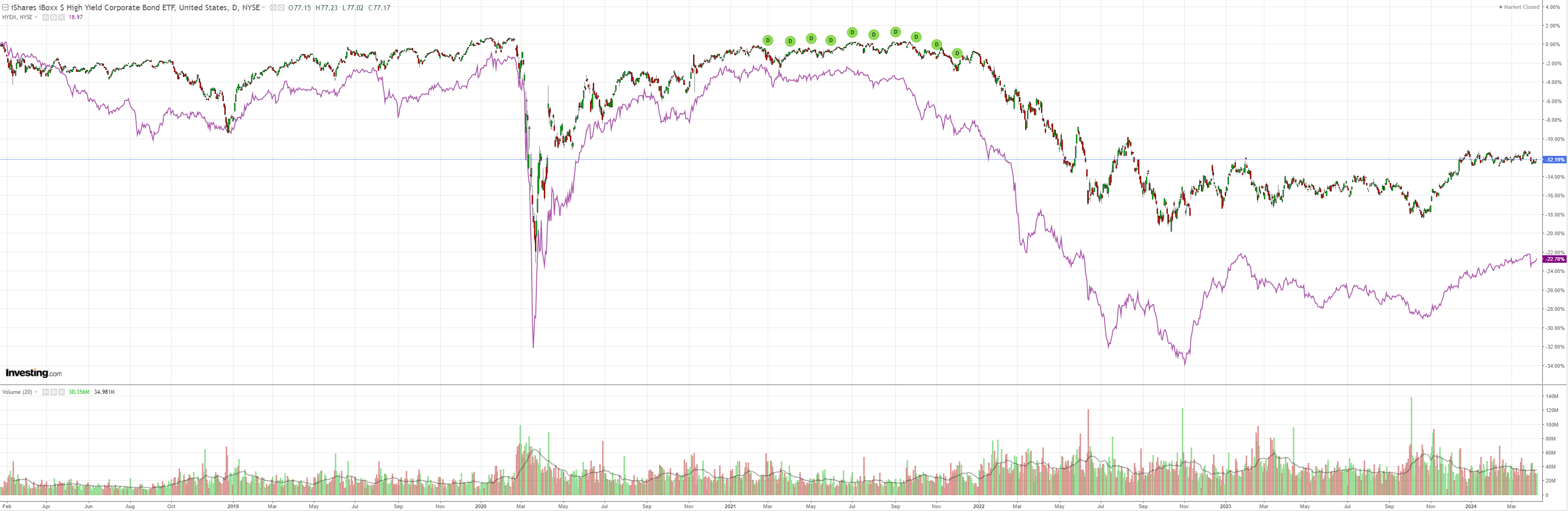

Junk BTFD:

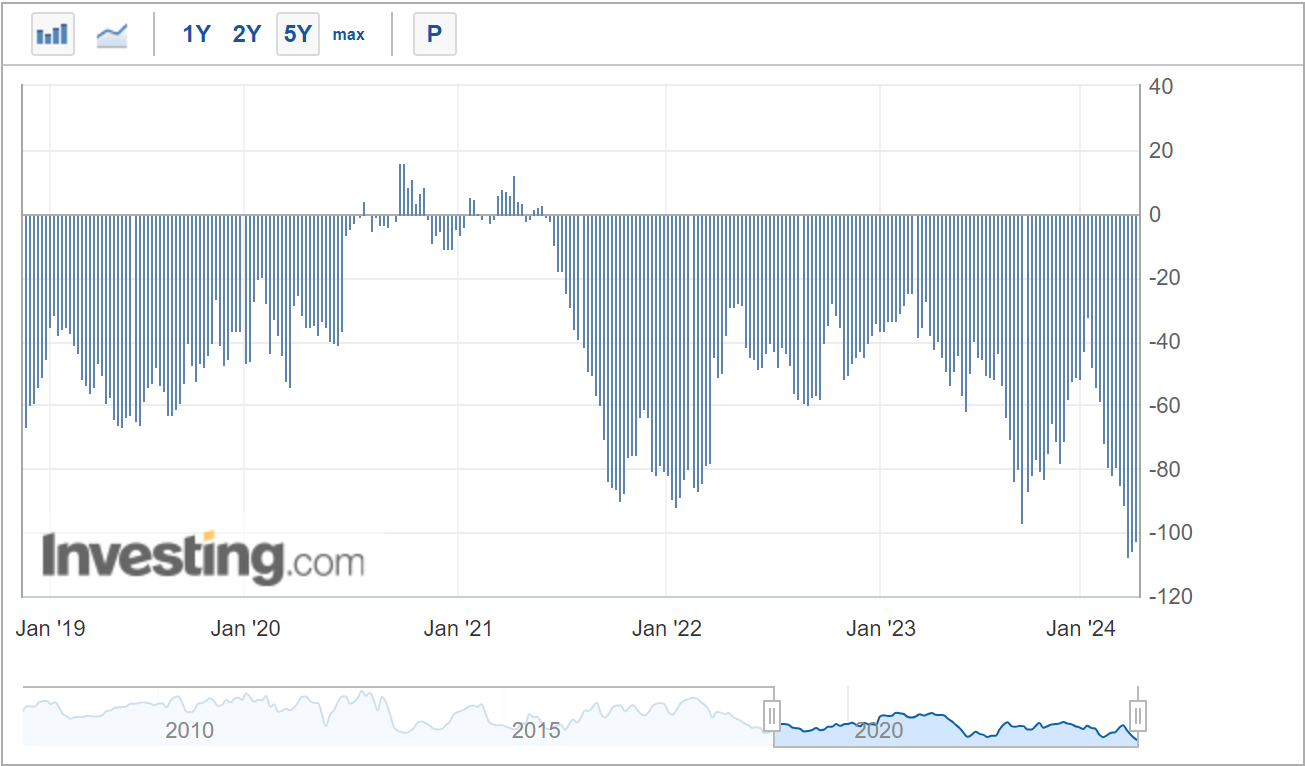

As yields peeled back with oil:

Stocks await US CPI:

Everything awaits US CPI! Tomorrow.

From BofA:

After two firm reports to start the year, core CPI inflation should cool off in March. We expect core CPI inflation to round down to 0.2% m/m (0.24% unrounded) owing to a slight decline in core goods prices and less price pressure from core services. Meanwhile, headline CPI should round up to 0.3% m/m (0.25% unrounded). If our forecast proves correct, it should provide some confidence to the Fed.

From Goldman:

We expect a 0.27% increase in March core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.70% (vs. 3.7% consensus). We expect a 0.29% increase in March headline CPI (vs. 0.3% consensus), which corresponds to a year-over-year rate of 3.37% (vs. 3.4% consensus).

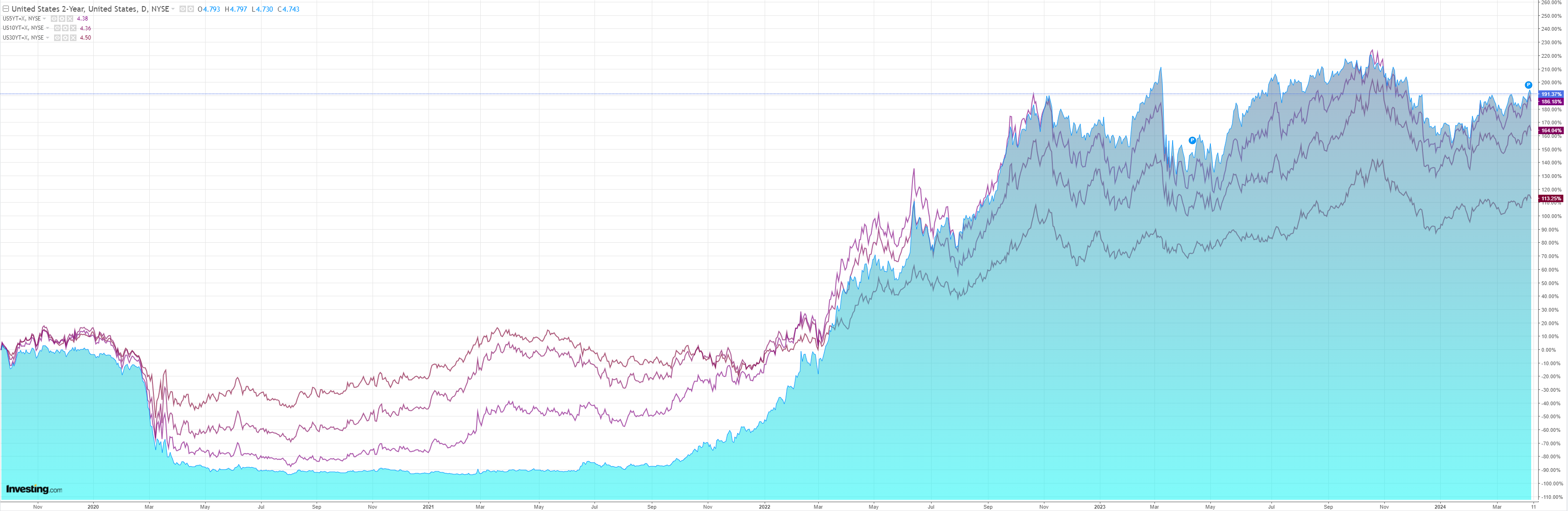

Either of these would do for some more AUD squeeze. The CFTC shorts are sitting ducks:

If the squeeze does trigger, then how far we get will hang on the headwinds of China and oil.

Oil will have a bigger say in the US PPI then CPI, which is part of the Fed’s preferred PCE inflation measure.