It’s crazy time in markets. DXY is up and away as EUR snuffs it:

Australian dollar flamed out as puking shorts were hit with large risk off:

Commodities are the runaway train of doom. Oil has gone from -$27 to $129 in two years:

Nickel!

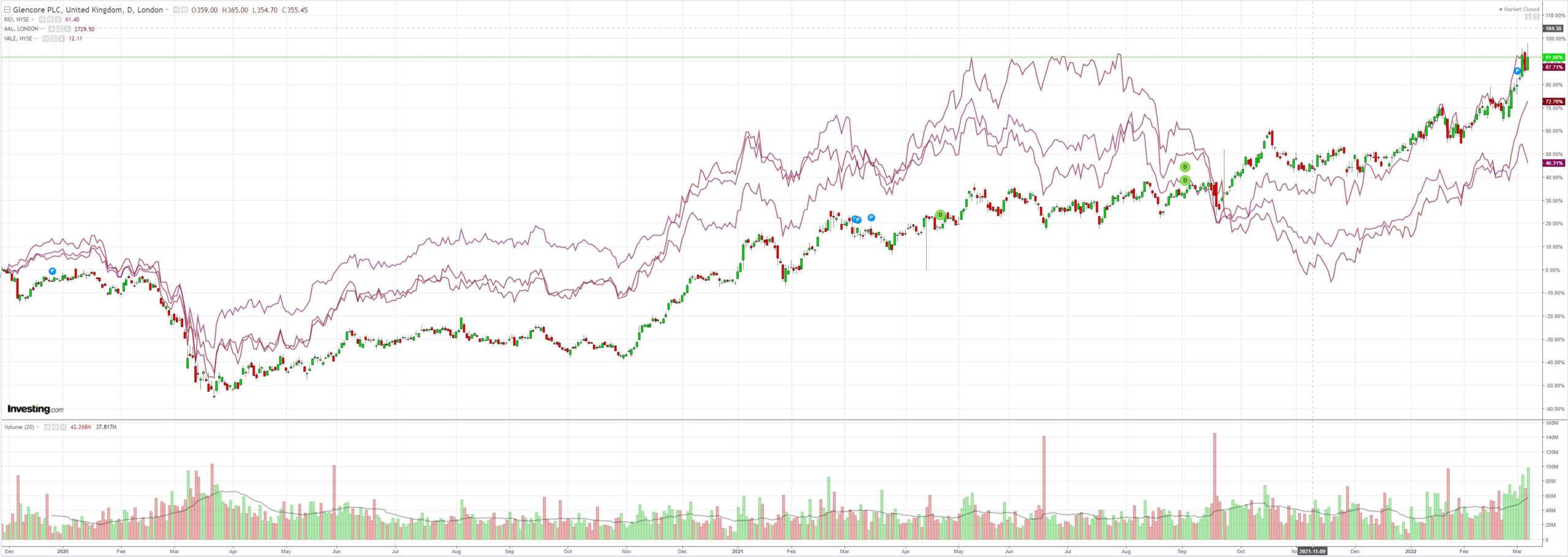

Big miners (LON:GLEN) were mixed. Aussie weak:

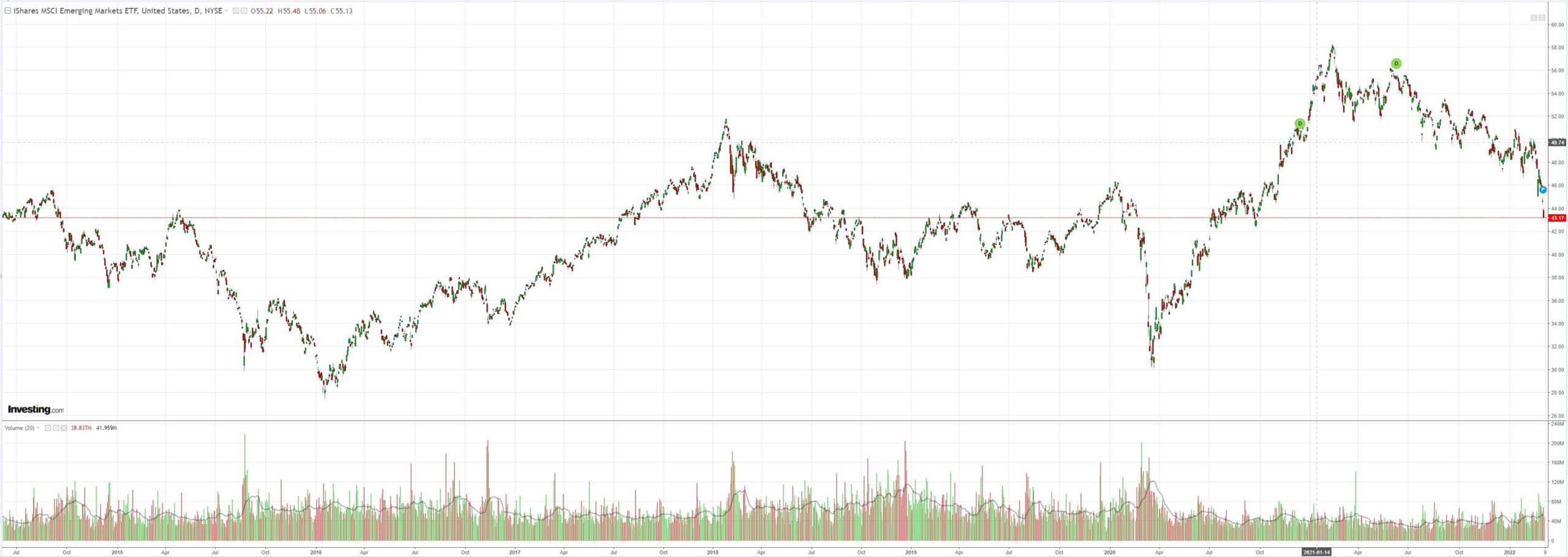

EM stocks (NYSE:EEM) are pointing to where it’s all going:

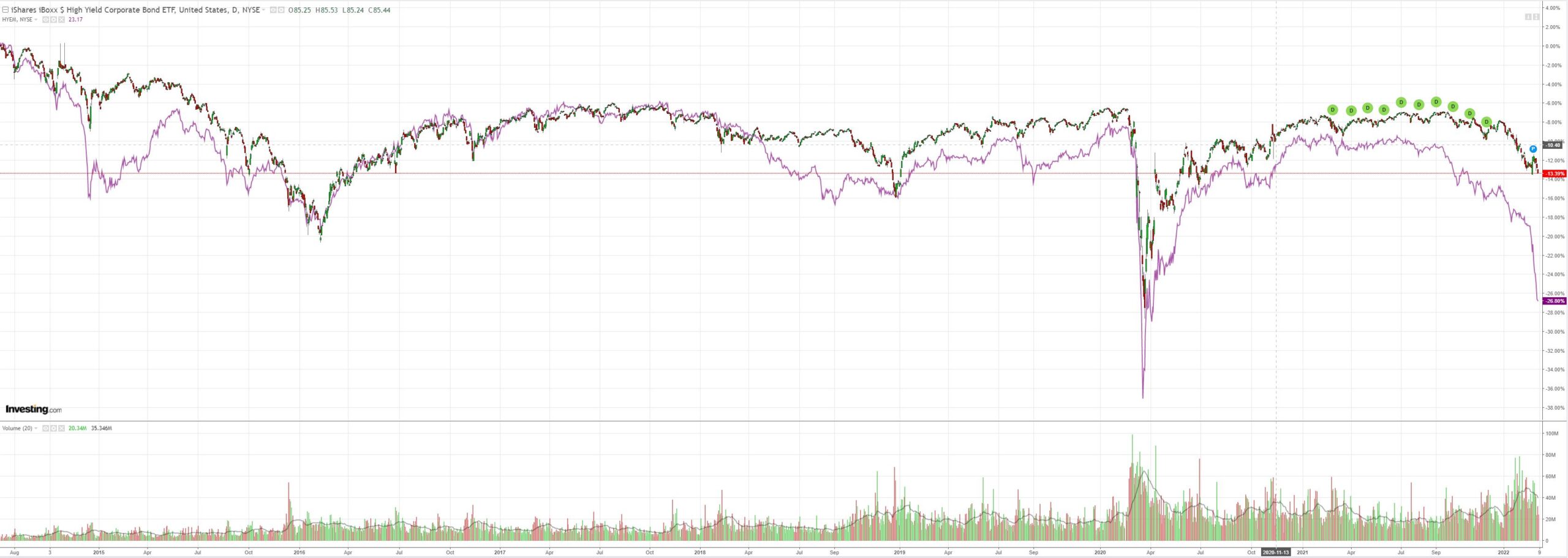

Led by junk (NYSE:HYG):

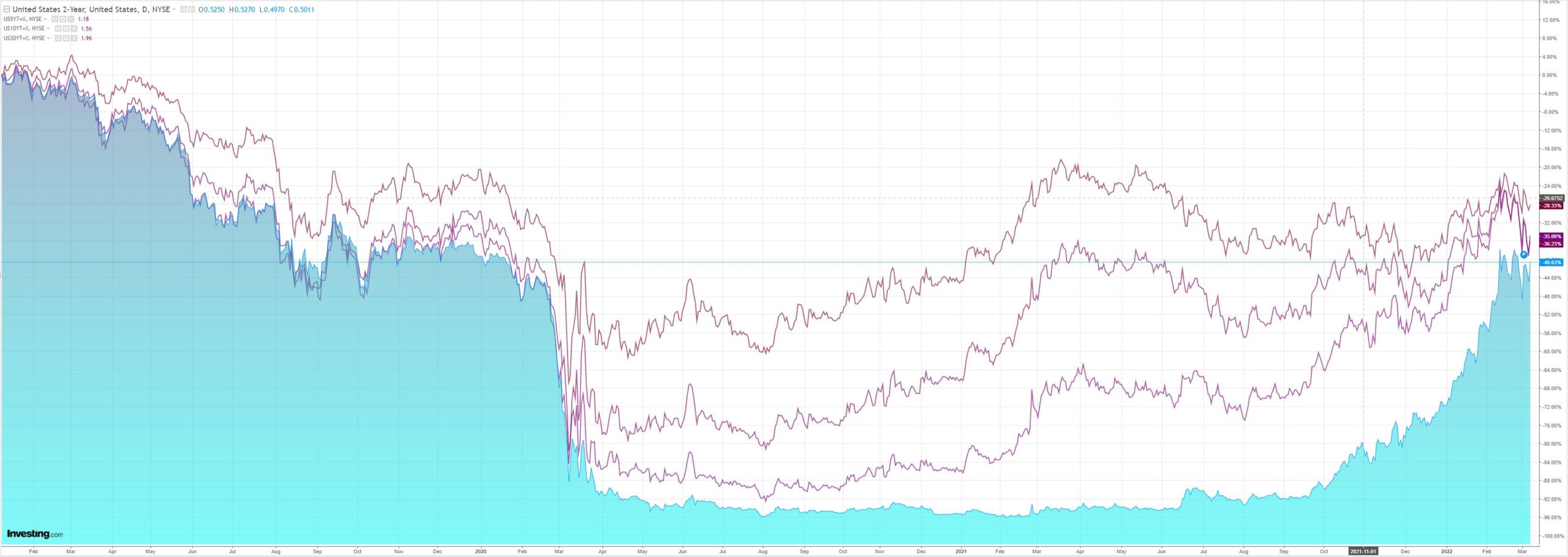

Yet Treasuries sold off and curve flattened with the Fed trapped:

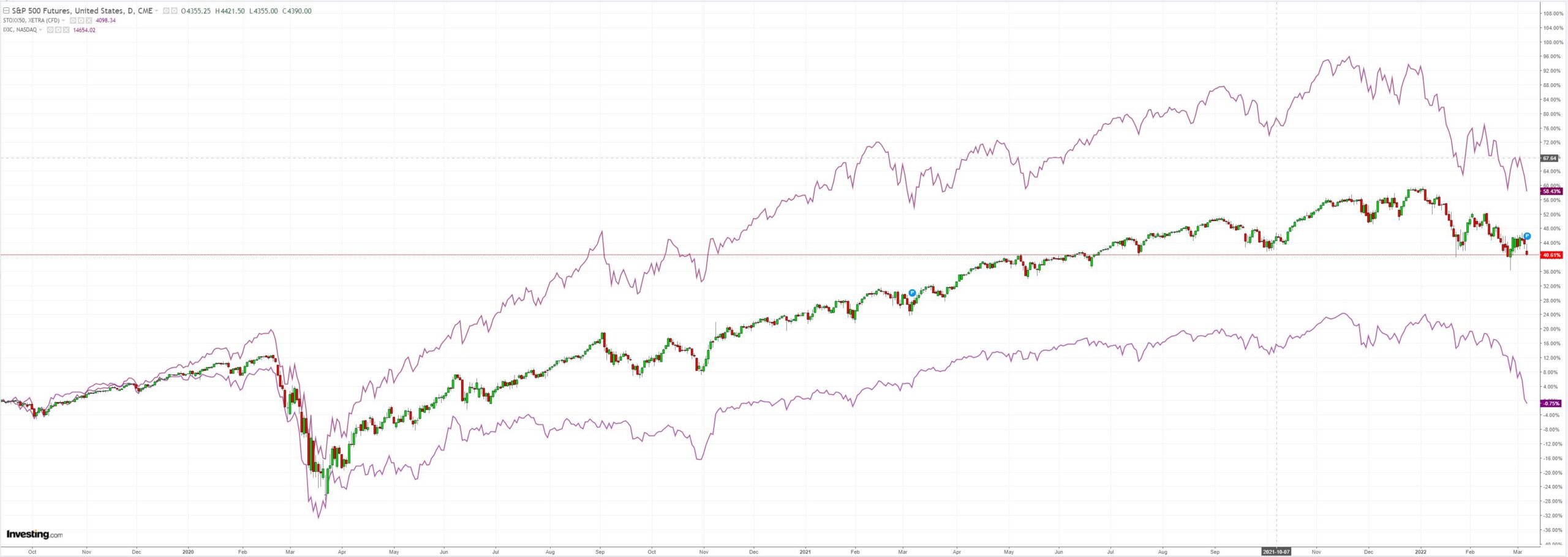

Stocks were hammered to new lows:

Westpac has the wrap:

Event Wrap

The US administration is considering a ban on Russian oil imports. The timing and scope of any move remain fluid. Lawmakers said in a bipartisan statement: “As Russia continues its unprovoked attack on the Ukrainian people, we have agreed on a legislative path forward to ban the import of energy products from Russia and to suspend normal trade relations with both Russia and Belarus.”

German factory orders beat expectations, with a rise of 1.8% m/m for January (est. +1.0%, December reading revised up to 3.0% from 2.8%). This, combined with survey data indicates that the German economy was on course to rebound from the covid-driven contraction in Q4. However, the war in Ukraine has derailed that.

Event Outlook

Aust: The February NAB business survey should reflect an improvement in confidence and conditions as omicron related disruptions fade.

NZ: Q4 building work is expected to rebound strongly from the lockdowns in Q3 (Westpac f/c: 8.0%).

Eurozone: The third estimate for Eurozone Q4 GDP will confirm the component detail outlined in February (market f/c: 0.3%). Meanwhile, German industrial production should continue to be affected by volatility from supply chain issues in January (market f/c: 0.5%).

US: Consumer credit is expected to post strong gains in January as pandemic savings continue to be worked down (market f/c: $24.5bn). Cost inflation is anticipated to hold small business optimism at weak levels in the NFIB’s February survey (market f/c: 97.4). Meanwhile, the trade deficit is set to remain wide in January on account of strong demand and inventory procurement (market f/c: -$87.3bn); the latter of which will be highlighted in the final estimate of January’s wholesale inventories (market f/c: 0.8%).

Here’s the problem with the usually very reliable AUD hedge, via Nomura:

Russia remains the primary near-term focus of markets, with the risk of negativity continuing from: 1) Recent US/allied sanctions feeding through to large foreign investment losses, deleveraging risk and economic damage to parts of Europe; 2) as Russia continues to advance into Ukraine, casualties will likely mount amid the destruction of key infrastructure (recent concerns over the Zaporizhzhia nuclear plant), that could lead to additional US/allied actions against Russia and; 3) growing concerns that this could become a prolonged conflict, given we have seen few signs of resolution from the Russia-Ukraine meetings and news that Russia is behind schedule in its drive to occupy Ukraine. We believe that, until there are more signs of some resolution, risks appear skewed towards continued risk negativity and EUR underperformance. That said, we see some clear divergences/likely outperformers against USD, such as AUD in G10 (we are long AUD/USD) with our view of solid commodity prices, macro data, a BoP surplus and improving China economic data all supportive.

This holds so long as the commodity craze does not destroy global growth or result in some kind of credit event. Neither precondition can hold for very long. Indeed, at the current rate of commodity bidding, the global economy will be roadkill by week’s end as $200 oil rocks DM consumers, food inflation starves EM consumers and all manner of inputs smash into producer margins. As well, Russian monetary sanctions are already destabilising bank funding markets.

The Fed is now caught in a nightmarish scenario in which it has to kill a supply-side shock with a demand-side tool to contain inflation as both the real and financial economies lurch towards crisis.

Ultimately, this does not end well for risk assets like the AUD.