Last night the Canadian central bank was the next cab off the rank in hiking interest rates, following the RBA on Tuesday, but the big one will be the European Central Bank (ECB) later tonight as the union currency battles with parity against the USD.

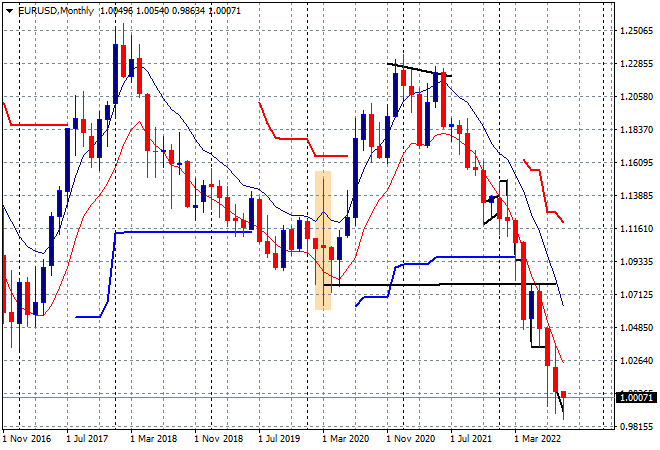

Euro has been in a terminal decline for nearly two years now, with the Ukrainian invasion and subsequent energy crisis exacerbating the divergence with the USD:

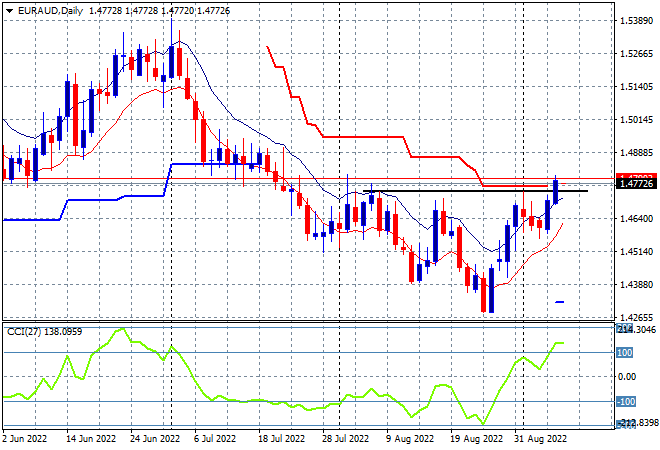

But not all is lost, as Euro continues to surge versus Australian dollar, with a technical breakout pattern from the recent lows fulfilled last night:

The ECB could surprise with a 75bps hike later tonight, “sacrificing” growth as it tries to reign in inflationary costs. From CNBC:

ECB Executive Board Member Isabel Schnabel’s speech in Jackson Hole set the tone for the upcoming policy meeting this week. With inflation in the euro zone projected to rise to at least 10% in the coming months and the risk of consumer prices rocketing higher, a “jumbo” rate hike of 75 basis points on Thursday is certainly a possibility.

The recent halt of gas deliveries to Europe via the Nord Stream 1 pipeline has not only pushed stocks lower and increased the risk of a recession in Europe, it’s also pushed Italian government 10-year yields to 4% — the highest level since mid-June before the ECB announced the creation of an anti-fragmentation tool. High yields for Italy — much higher than those in Germany — mean the government in Rome has to pay more to borrow, exacerbating concerns over its hefty debt pile.

Inflation in the euro zone hit 9.7% in August and with the continued pressure on energy prices it’s expected to reach double-digit levels in the coming months. At the same time the risk of a recession is looming large over the region’s economy as consumers feel the pain and scale back their consumption, and companies struggle with high energy prices.