DXY eased overnight as the Fed delivered its 75bps knockout hike:

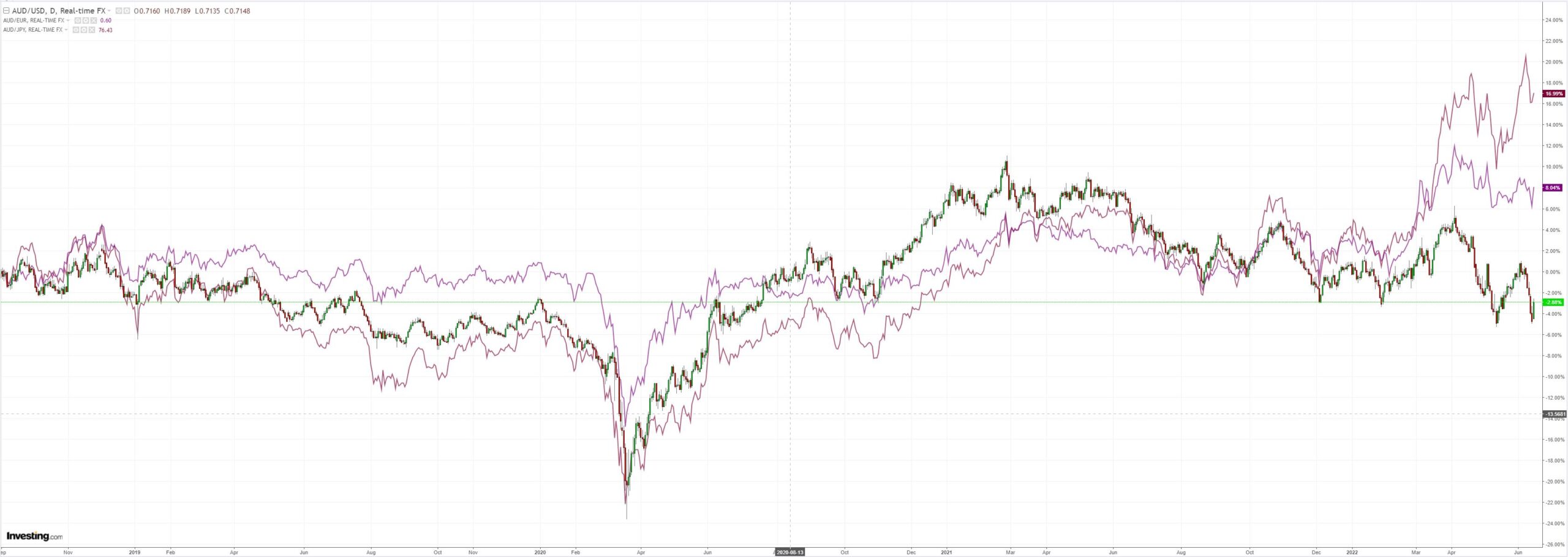

AUD did the usual buy the fact:

Encouragingly, oil did not:

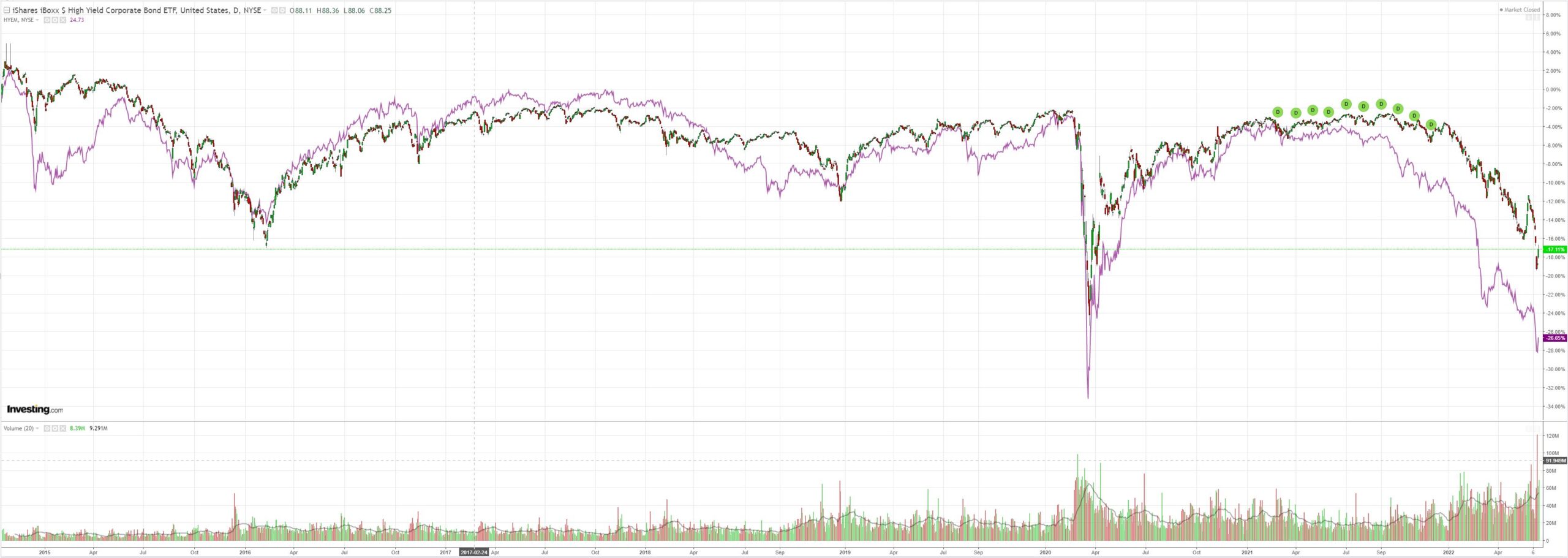

But everything else did: EMs (NYSE:EEM), miners (LON:GLEN), commodities, junk (NYSE:HYG):

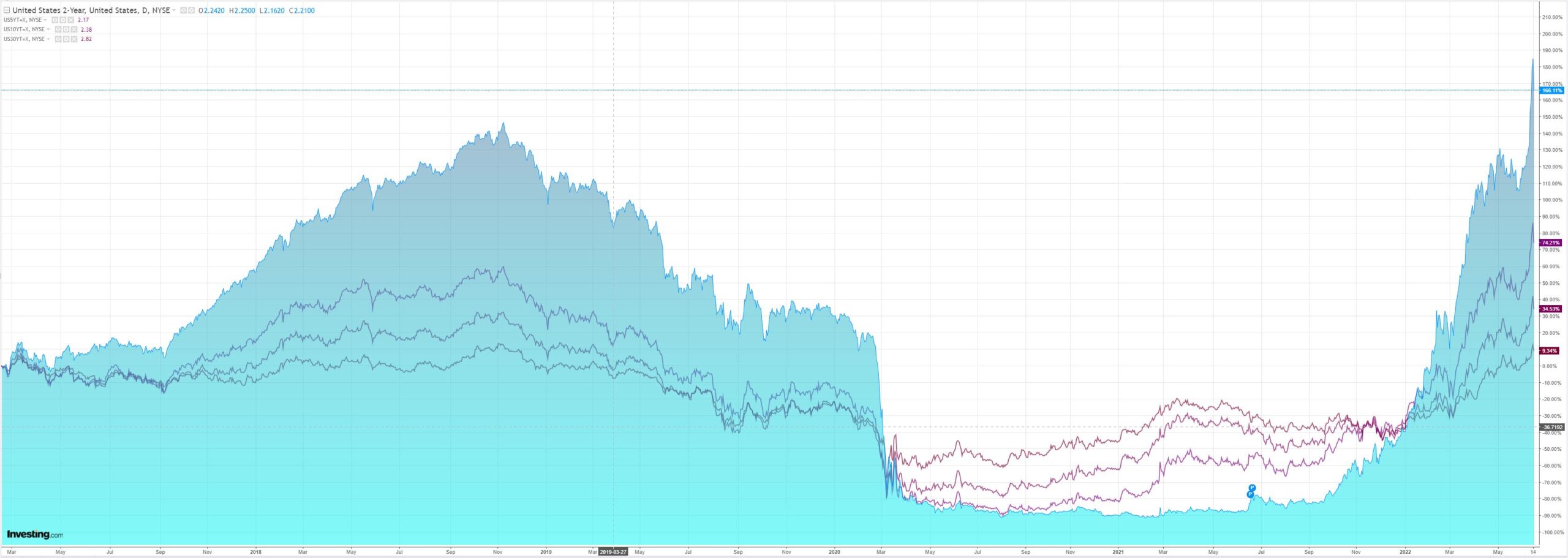

Treasuries were bid:

With stocks:

Westpac has the wrap:

Event Wrap

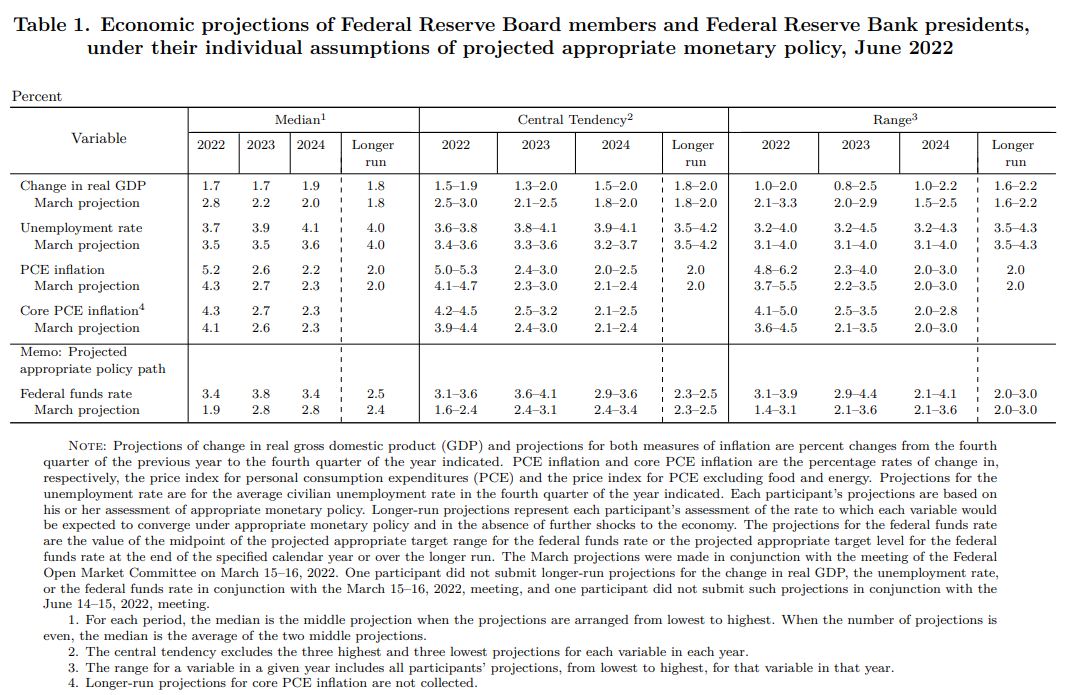

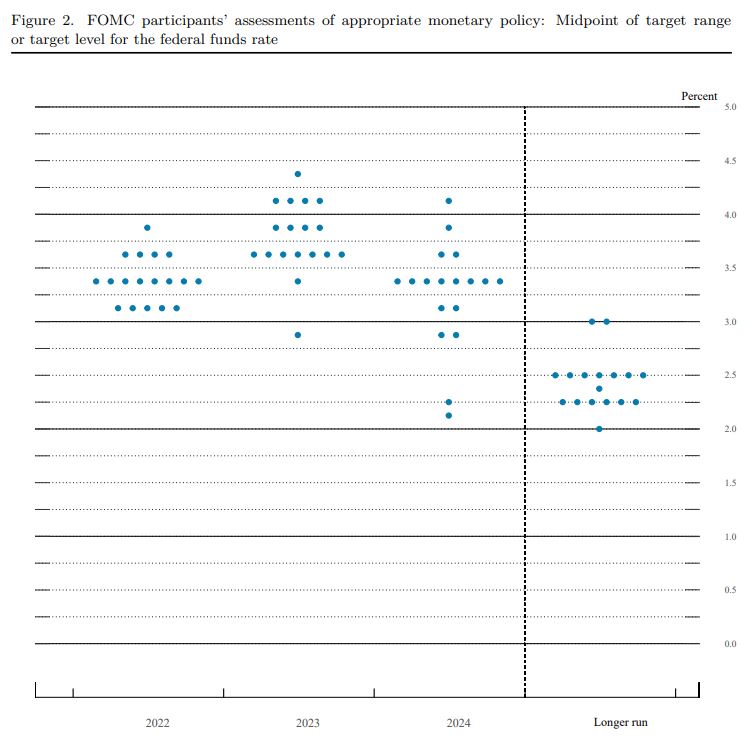

The Federal Reserve hiked the funds rate band by 75bp to 1.50%-1.75%, as was widely expected following last Friday’s inflation data surprise. It is the largest rate increase since 1994. The statement said that ongoing increases in the funds rate will be appropriate, without giving any indication of the size, although the accompanying dot plot rate projection jumped from 2.75% to 3.38% for end-2022, and from 2.75% to 3.75% by end-2023. The long-run rate is seen at 2.50% (from 2.38%). In his press conference, Chair Powell said the next moves are expected to be 50bp or 75bp, with the latter less common. He said the recent inflation data and inflation expectations survey warranted today’s large move. The vote was 10-1 (George dissented in favour of 50bp).

US retail sales in May disappointed at -0.3%m/m (est. +0.1%). Given prices rose, a large fall in volumes is implied. The NAHB homebuilder sentiment survey was close to expectations, at 67 (prior 69), reflecting softer demand after two strong years as mortgage rates rise and cost pressures persist. The Fed NY (Empire) manufacturing survey rebounded to -1.2 (est. +2.3, prior -11.6). While new orders and employment picked up, a headline reading below zero implies contraction.

ECB announced an out of schedule General Council meeting to discuss policy normalisation, the rapid shifts in yields, and the risk of greater fragmentation (i.e. inter-country yield spread widening).

Eurozone industrial production in April was near expectations at +0.4%m/m (est. +0.5%m/m), prior revised to -1.4%m/m from -1.8%m/m).

Event Outlook

Aust: Despite the robust demand for labour as evinced by job vacancies, weekly payrolls remain weak; Westpac therefore anticipates employment to lift by 5k in May (vs. consensus +25k) with a clear risk of a negative print. A very small decline in participation should see the unemployment rate round down to 3.8%. MI inflation expectations should continue to hold at an elevated level in June. The RBA’s June Quarter Bulletin will also be published.

NZ: Westpac expects GDP held flat in Q1 (market consensus +0.6%) due to omicron-related disruptions through the quarter.

UK: The Bank of England is expected to raise the bank rate by 25bps at their June meeting given the clear need to rein in inflation despite weak growth.

US: Strength in the labour market and limited supply should continue to support housing starts and building permits into the medium-term (market f/c: -1.8% and -2.5% respectively). The June Phily Fed index will reflect inflation and supply chain concerns; and initial jobless claims is expected to remain at a low level (market f/c: 218k).

The Fed sees a gentle slope down for inflation and growth as unemployment gradually rises:

As it expects to double the cash rate from here by 2023:

Expect, rather, more downside for asset prices, a recession and spike in unemployment, plus a huge deflationary wave in 2023.

If so, AUD has not bottomed.