DXY launched last night:

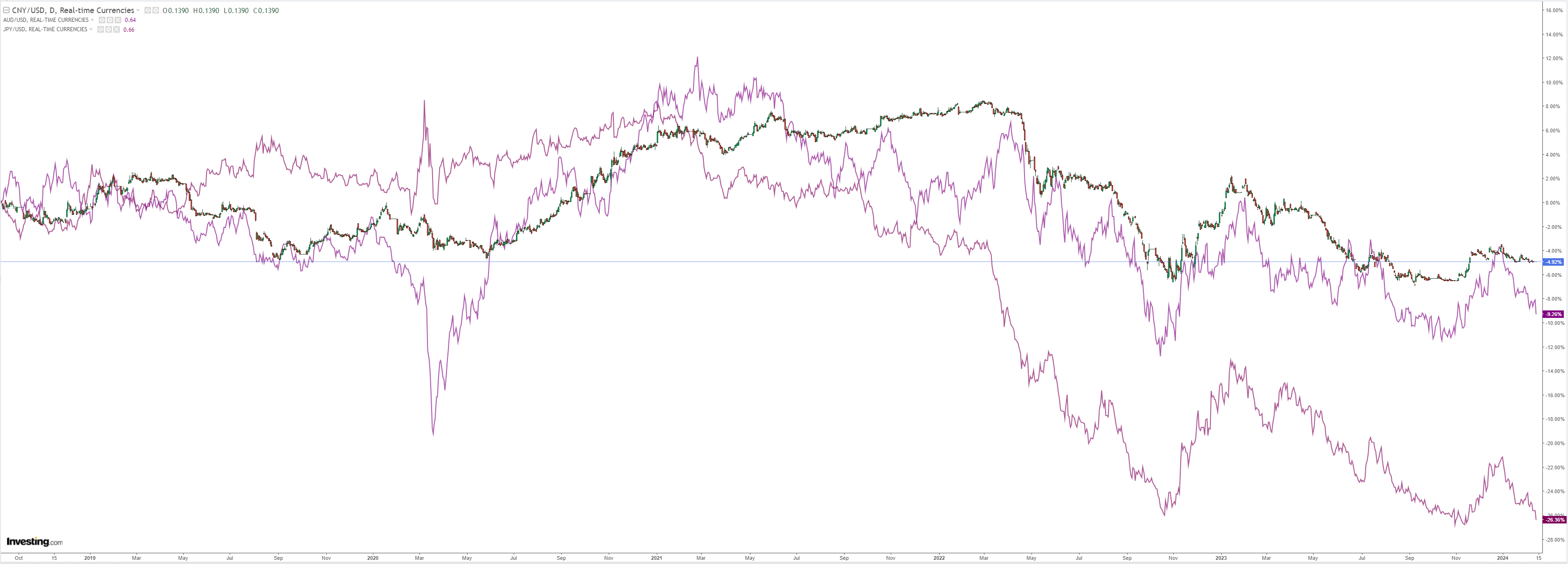

AUD copped the blast:

North Asia too:

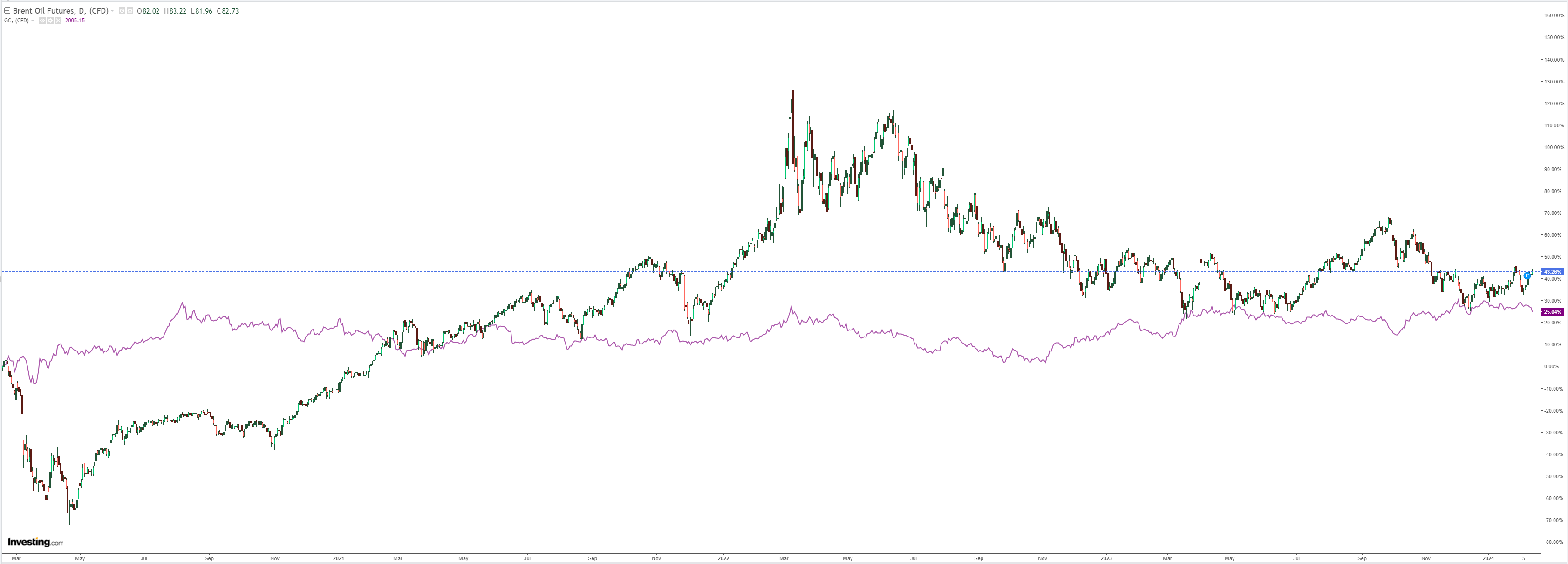

Oil held on, gold gave way:

Dirt is in free fall:

Miners were whacked:

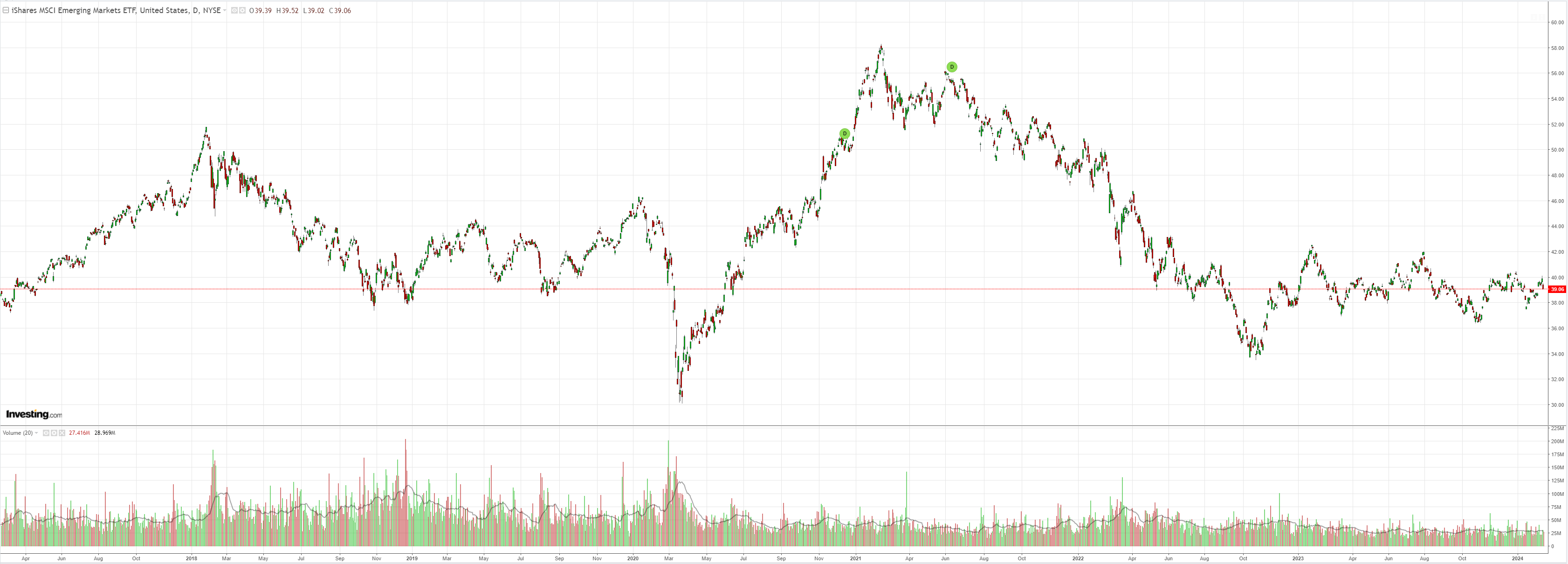

EM too:

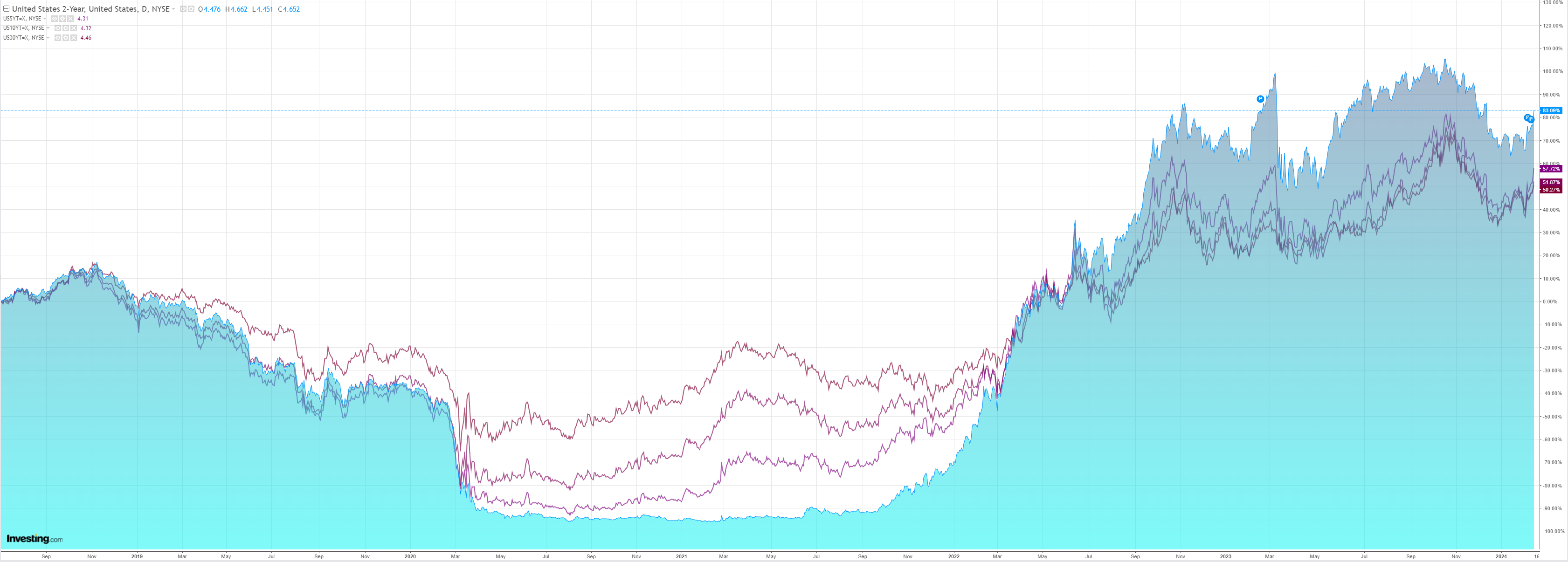

Treasuries were flogged:

And stocks thumped:

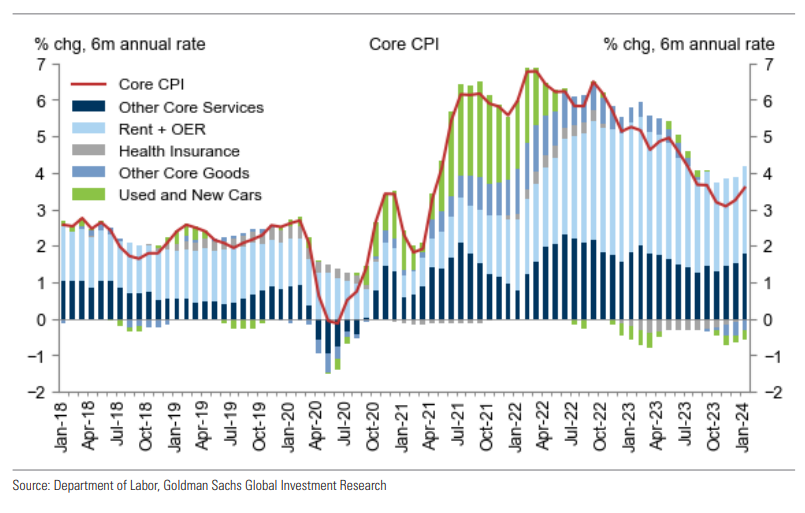

Goldman with the culprit:

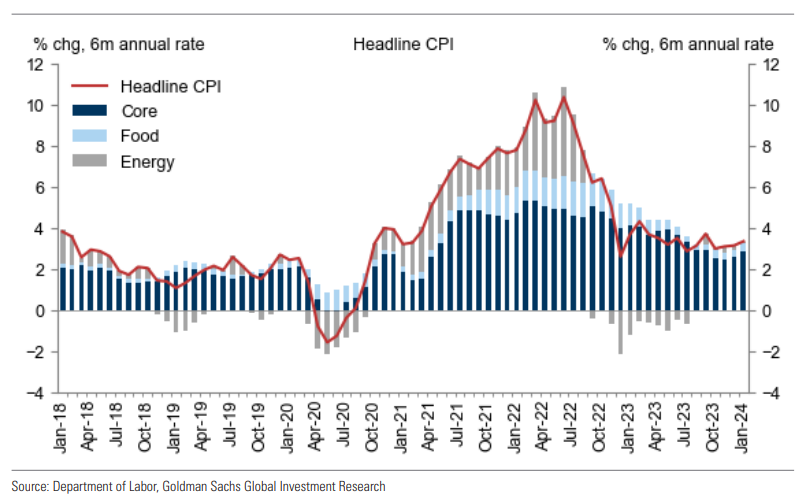

January core CPI rose 0.39%, 9bp above consensus expectations and compared to +0.28% in December. The year-on-year rate was unchanged at 3.9% compared to consensus of 3.7%.

The strength largely reflected start-of-year price increases for labor-reliant categories such as medical services, car insurance and repair, and daycare, and we assume inflation in these categories returns to the previous trend on net in February and March.

However, the large and persistent owners’ equivalent rent category (OER) was also surprisingly strong, perhaps driven by the rebounding housing market.

Used car prices fell sharply, and we continue to expect further declines in February and later this year. We tentatively expect core PCE prices rose 0.34% in January (mom sa). We will update our estimate after this week’s import price and PPI data.

Private rent measures are much weaker, so OER should roll over in due course.

Remember that it is PCE that matters to the Fed, so we may still escape with pop in prices.

My hope is we get a decent sell-off for a re-entry point. I am not convinced that this is anything other than a blip that impacts the timing but the eventuality of Fed easing.

AUD down while it lasts!