Behold the greenback rocket. DXY to the moon and EUR to the dirt:

Australian dollar was monkeyhammered:

Gold is toast. Maybe oil too:

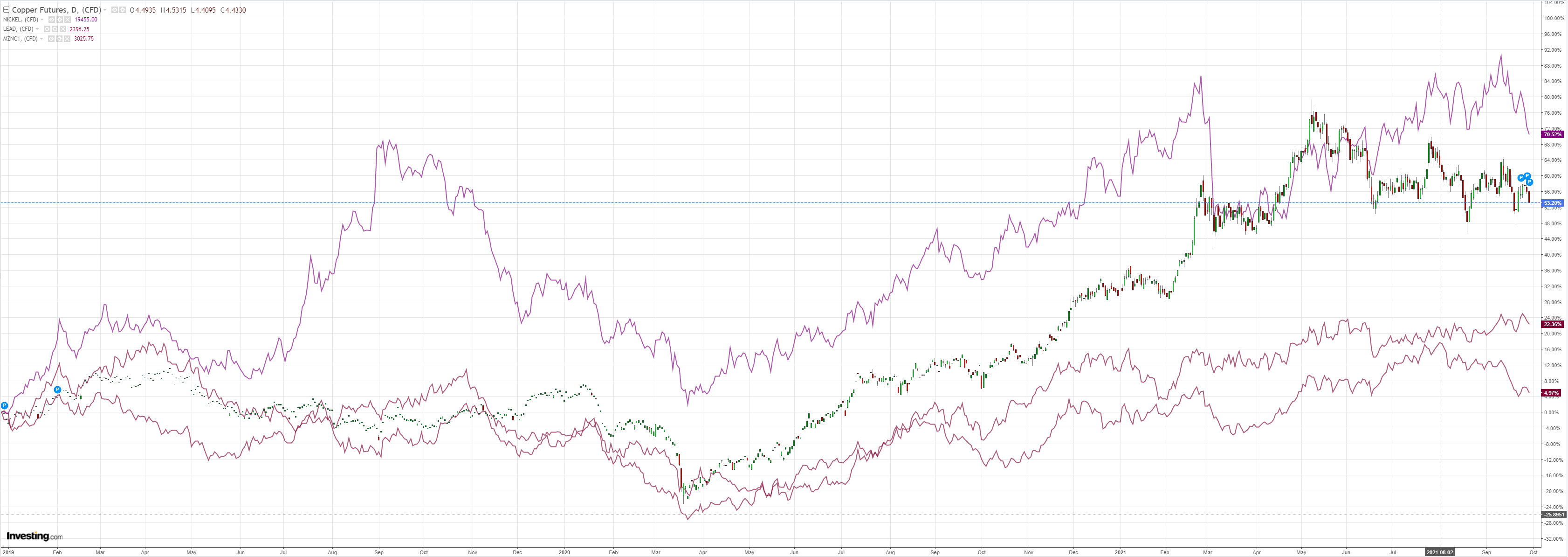

Base metals were hit. Copper is forming a bearish descending triangle. Meaningless unless it breaks:

Big miners held on grimly:

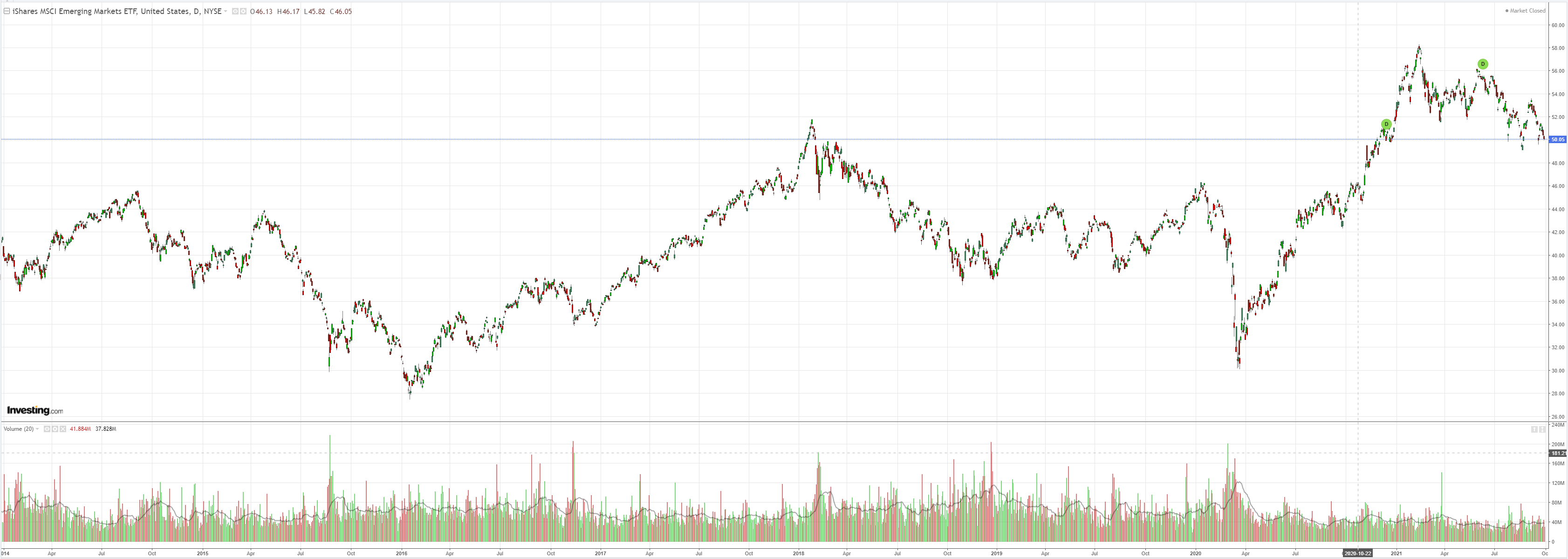

EM stocks do not flourish as DXY roars:

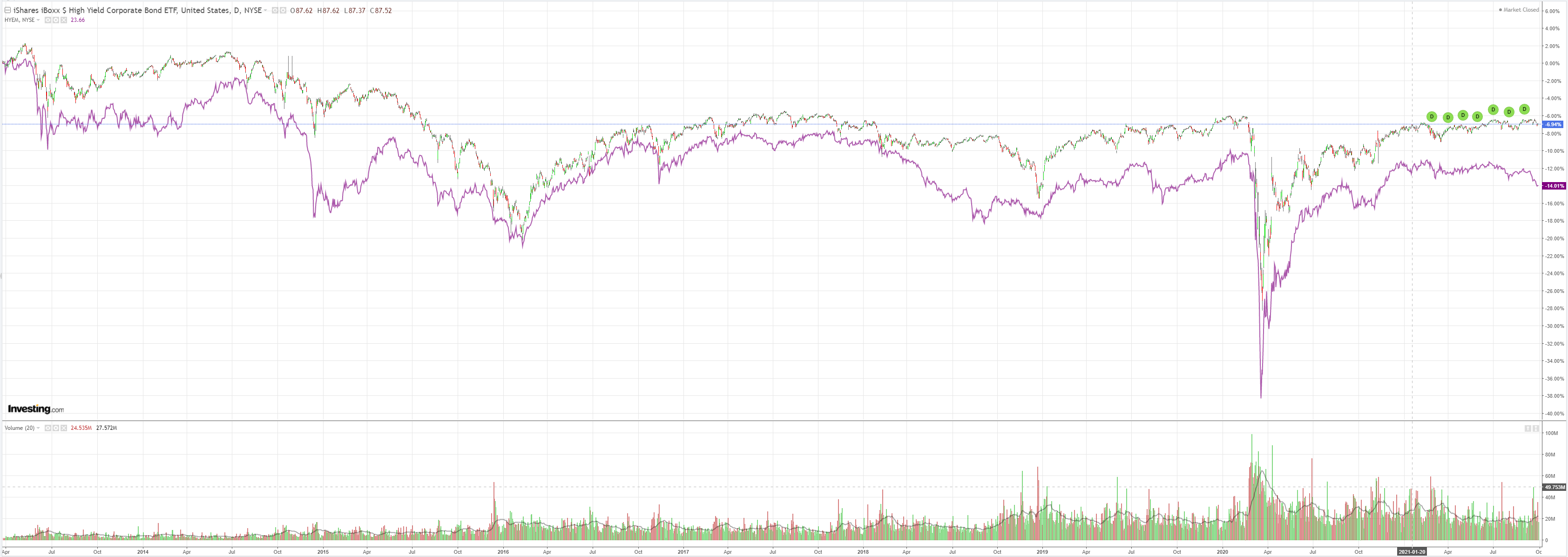

EM junk bounced a touch but still looks pointed down:

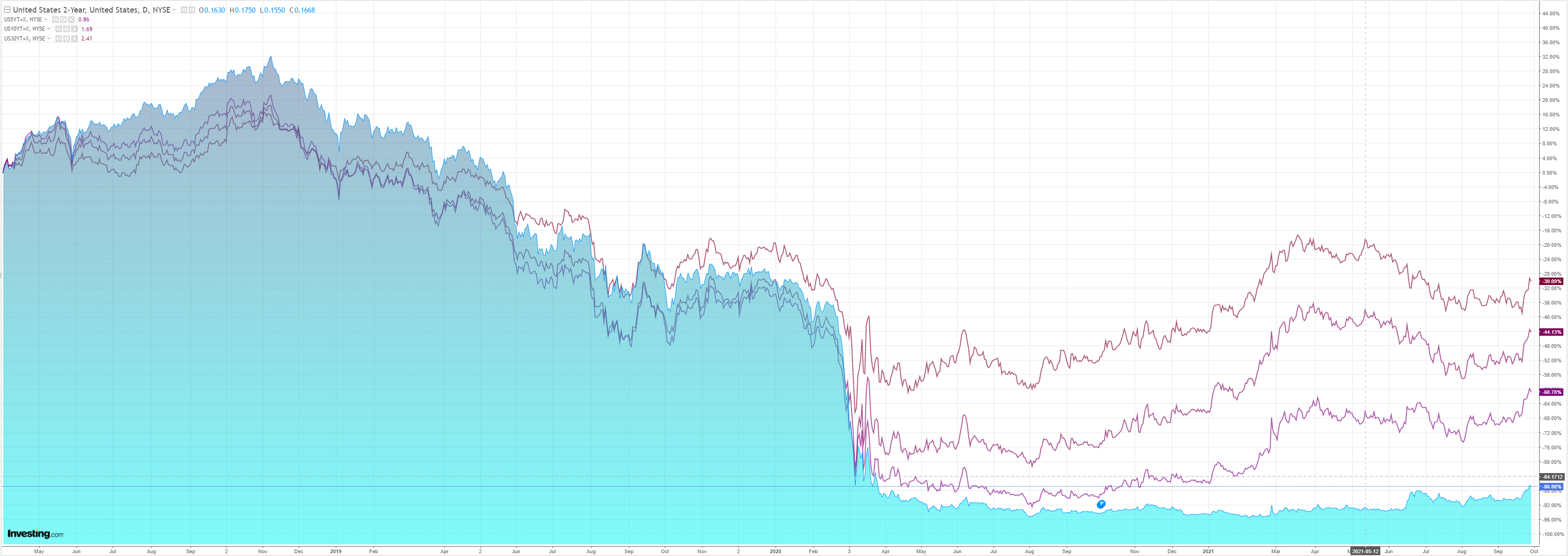

Yields came off:

And stocks:

Westpac has the wrap:

Event Wrap

US pending home sales in August surprised with a bumper +8.1%m/m rise (est. +1.3%m/m, prior -2.0%m/m). NAR Chief Economist Yun cited low borrowing costs, moderating price gains, and rising inventory as causing a resumption of buying activity, although concerns over high prices remain.

Fed Chair Powell spoke virtually at an ECB event, reiterating recent commentary. The economic outlook is “quite positive in the medium term”, but the near term outlook is uncertain given Delta and supply constraints. Higher inflation is mostly due to bottlenecks meeting strong demand, and the constraints are getting worse. So far the price spike has not affected inflation expectations, but the FOMC is ready to act if it does.

FOMC member Harker said it will soon be time to “boringly” start to taper asset purchases. There is no longer much need for QE since the problems facing the economy are not so much demand as supply. Downside risks and headwinds include supply chain issues and the virus upsurge. He did not expect rate hikes until late 2022 or early 2023.

Eurozone economic and business confidence were firm, at 117.8 (est. 117.0, prior 117.6) and 14.1 (est. 12.6, prior 13.8), respectively. Services confidence stuttered at 15.1 (est. 16.4, prior 16.8).

Event Outlook

Australia: Westpacis forecasting a 5.0% decline in dwelling approvals in August as the HomeBuilder unwind and lockdowns weigh on activity. Following strong gains in June and July, August private sector credit is expected to rise 0.5%. Finally, job vacancies for August will provide a timely update on labour demand.

New Zealand: Westpac is expecting a 20% fall in building consents in August as processing is likely to be affected by the lockdown. Further, the September ANZ business confidence release will provide the market with its first look at the impact of the latest lockdown on industries.

China: The NBS’ manufacturing and non-manufacturing PMIs for September are set for release as is the Caixin manufacturing survey. A bounce in the service sector is hoped for, but downside risks are clear.

Euro Area: The unemployment rate is expected to continue its downtrend in August given reopening tailwinds (market f/c: 7.5%).

US: Initial jobless claims for the week ending Sept 25should continue to show recovery in the labour market (market f/c: 330k). The September Chicago PMI will give a timely update on manufacturing in Chicago (market f/c: 65.0). Finally, the FOMC’s Bostic, Evans and Bullard will provide their respective views on the economy.

A roaring greenback is the last thing that the global reflation needs but that’s what the energy blowoff will deliver. US inflation is already far stronger than elsewhere and an energy shock will make it considerably worse in the short term. The Fed is going to taper directly into the US fiscal cliff and Chinese recession.

Everything else follows as a matter of course. EM assets will be bled dry by China on the trade side as CNY falls, and by the Fed on the capital side as DXY rises. Commodities will keep falling (including energy when the bubble pops in a few months). Eventually, the contagion will work its way from the periphery to the core DM asset markets.

We are now staring directly into the face of a post-COVID global shakeout within which the Australian dollar is a key whipping boy.