DXY to the moon, ending global reflation:

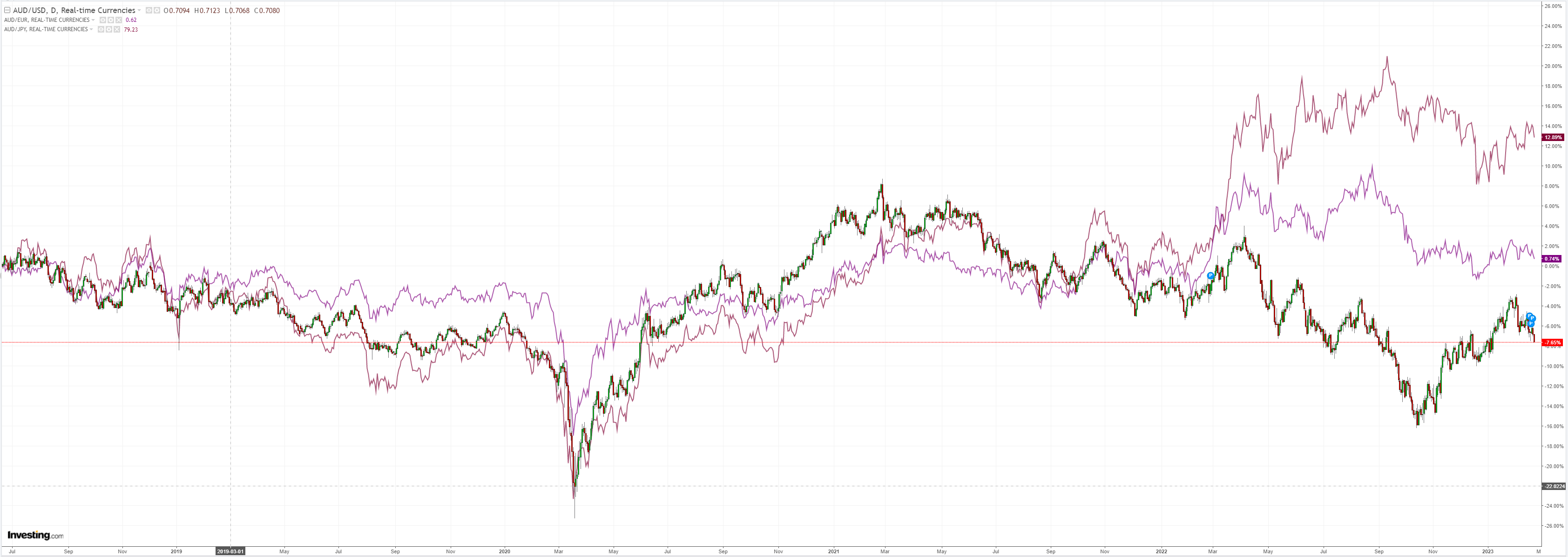

AUD trapdoor opens:

Oil is forming a bearish descending triangle. A break here would be an unambiguous global recession signal:

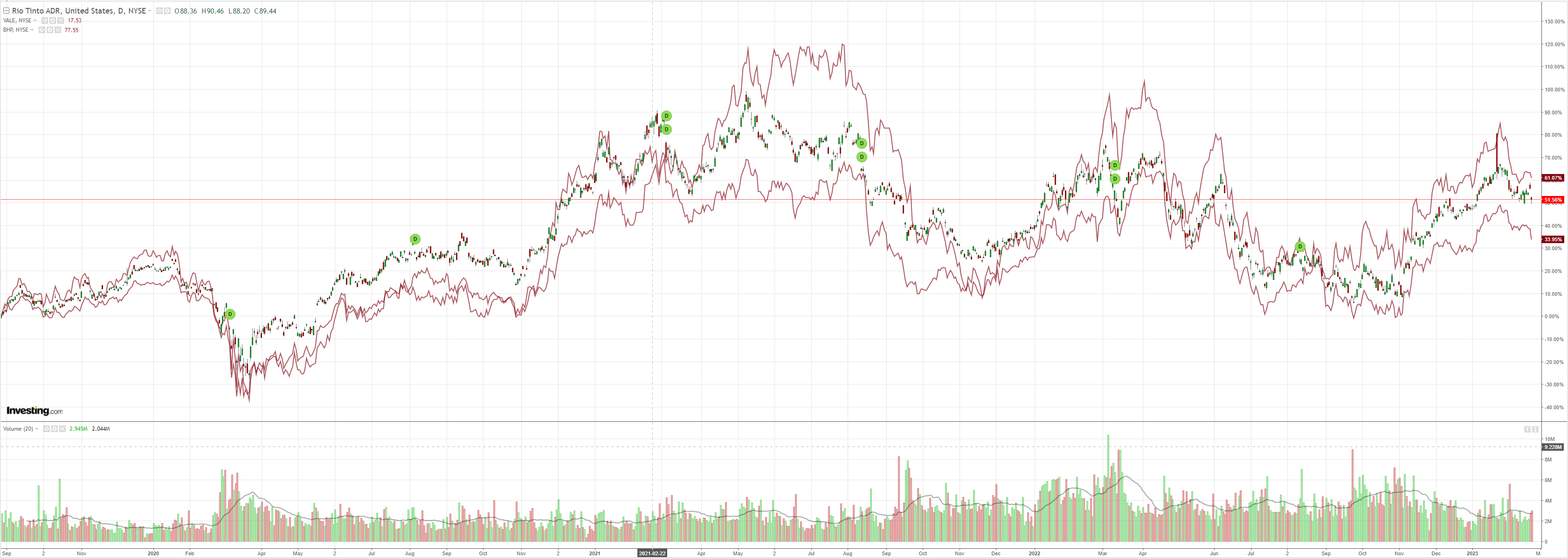

Dirt reversed:

Big miners (NYSE:RIO) ouch:

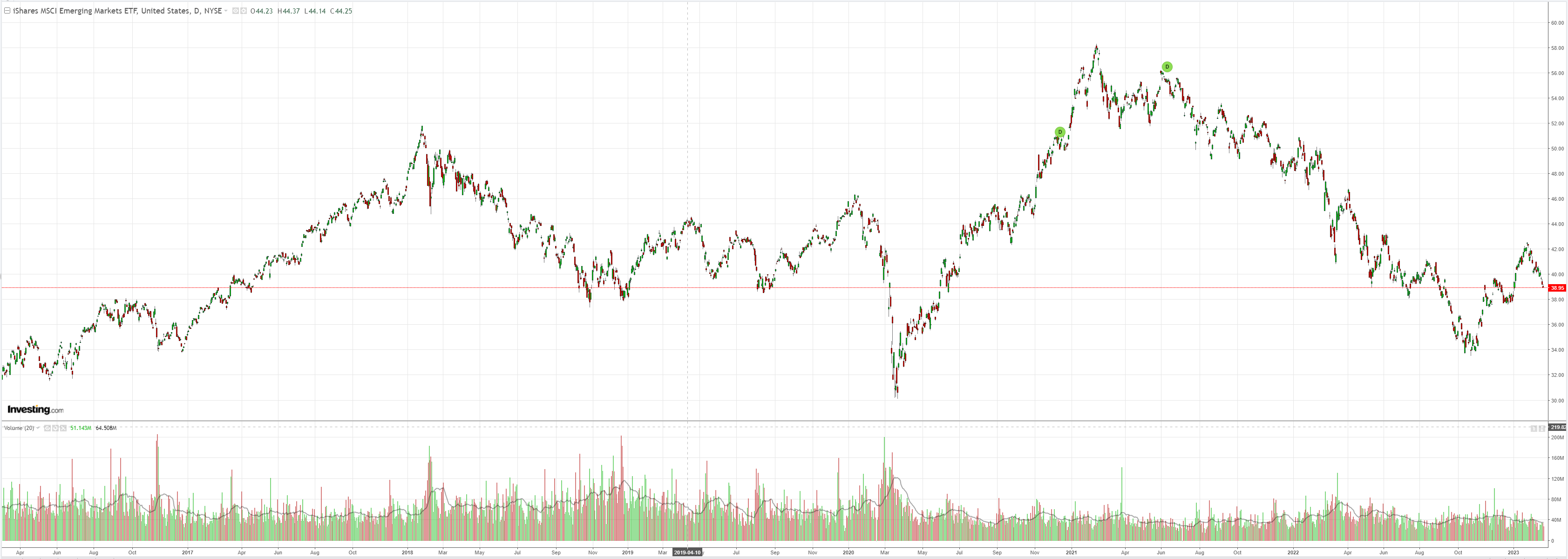

EM stocks (NYSE:EEM) likewise:

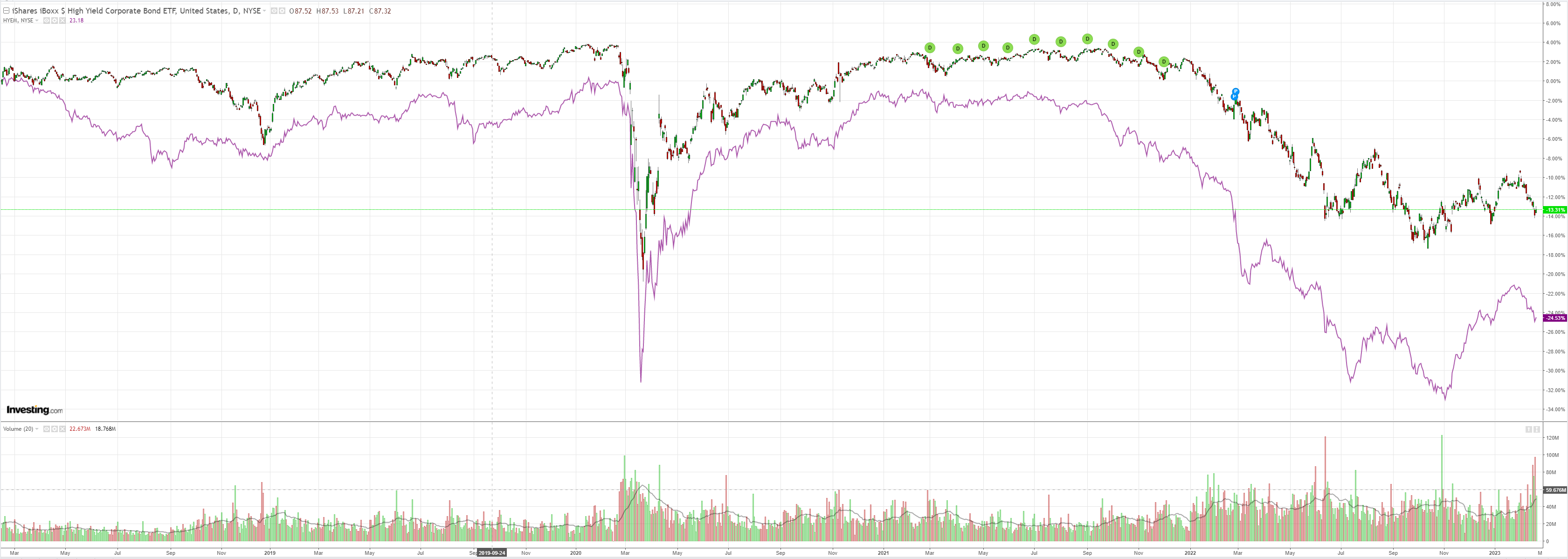

Junk (NYSE:HYG) did better:

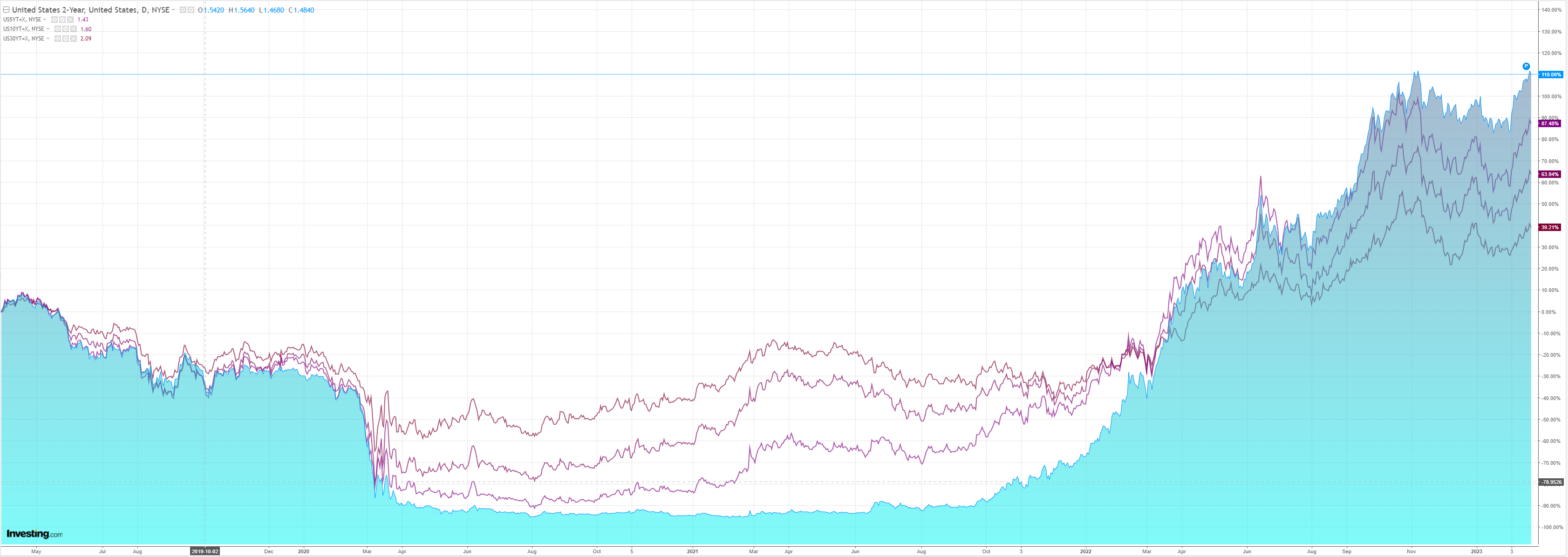

As yields eased:

Stocks not so much:

The Fed minutes continued its recent record of terrible communications, reversing Jay Powell’s endorsement of the bear market rally:

Participants observed that financial conditions remained much tighter than in early 2022. However, several participants observed that some measures of financial conditions had eased over the past few months. A few participants noted that increased confidence among market participants that inflation would fall quickly appeared to contribute to declines in market expectations of the federal funds rate path beyond the near term. Participants noted that it was important that overall financial conditions be consistent with the degree of policy restraint that the Committee is putting into place in order to bring inflation back to the 2 percent goal.

…In their consideration of appropriate monetary policy actions at this meeting, participants concurred that the Committee had made significant progress over the past year in moving toward a sufficiently restrictive stance of monetary policy. Even so, participants agreed that, while there were recent signs that the cumulative effect of the Committee’s tightening of the stance of monetary policy had begun to moderate inflationary pressures, inflation remained well above the Committee’s longer-run goal of 2 percent and the labor market remained very tight, contributing to continuing upward pressures on wages and prices. Against this backdrop, and in consideration of the lags with which monetary policy affects economic activity and inflation, almost all participants agreed that it was appropriate to raise the target range for the federal funds rate 25 basis points at this meeting.

Many of these participants observed that a further slowing in the pace of rate increases would better allow them to assess the economy’s progress toward the Committee’s goals of maximum employment and price stability as they determine the extent of future policy tightening that will be required to attain a stance that is sufficiently restrictive to achieve these goals. A few participants stated that they favored raising the target range for the federal funds rate 50 basis points at this meeting or that they could have supported raising the target by that amount. The participants favoring a 50-basis point increase noted that a larger increase would more quickly bring the target range close to the levels they believed would achieve a sufficiently restrictive stance, taking into account their views of the risks to achieving price stability in a timely way. All participants agreed that it was appropriate to continue the process of reducing the Federal Reserve’s securities holdings, as described in its previously announced Plans for Reducing the Size of the Federal Reserve’s Balance Sheet.

In discussing the policy outlook, with inflation still well above the Committee’s 2 percent goal and the labor market remaining very tight, all participants continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate to achieve the Committee’s objectives.

In short, some combination of higher yields, lower stocks, and a stronger DXY is needed to retighten the FCI:

All three are AUD negative.