Street Calls of the Week

DXY was back with a vengeance last night:

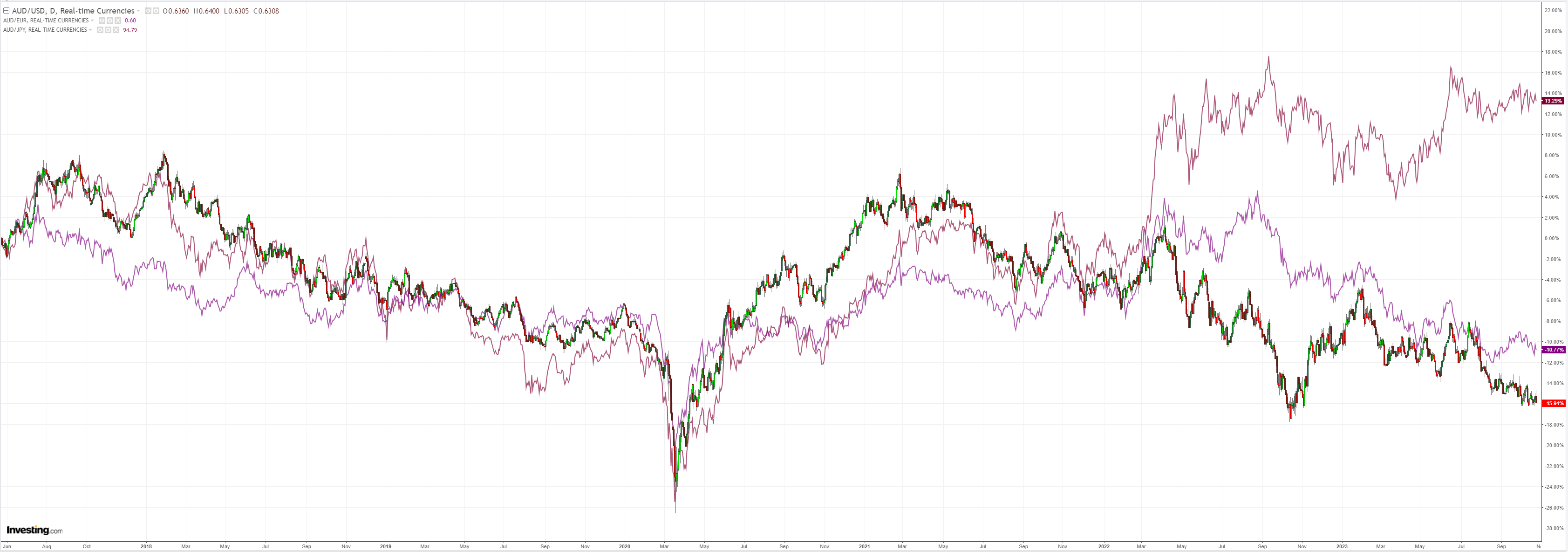

AUD is back to the lows and appears to be consolidating before breaking lower:

The re-pegged CNY is hilarious:

Oil and gold firmed:

Copper reversed down:

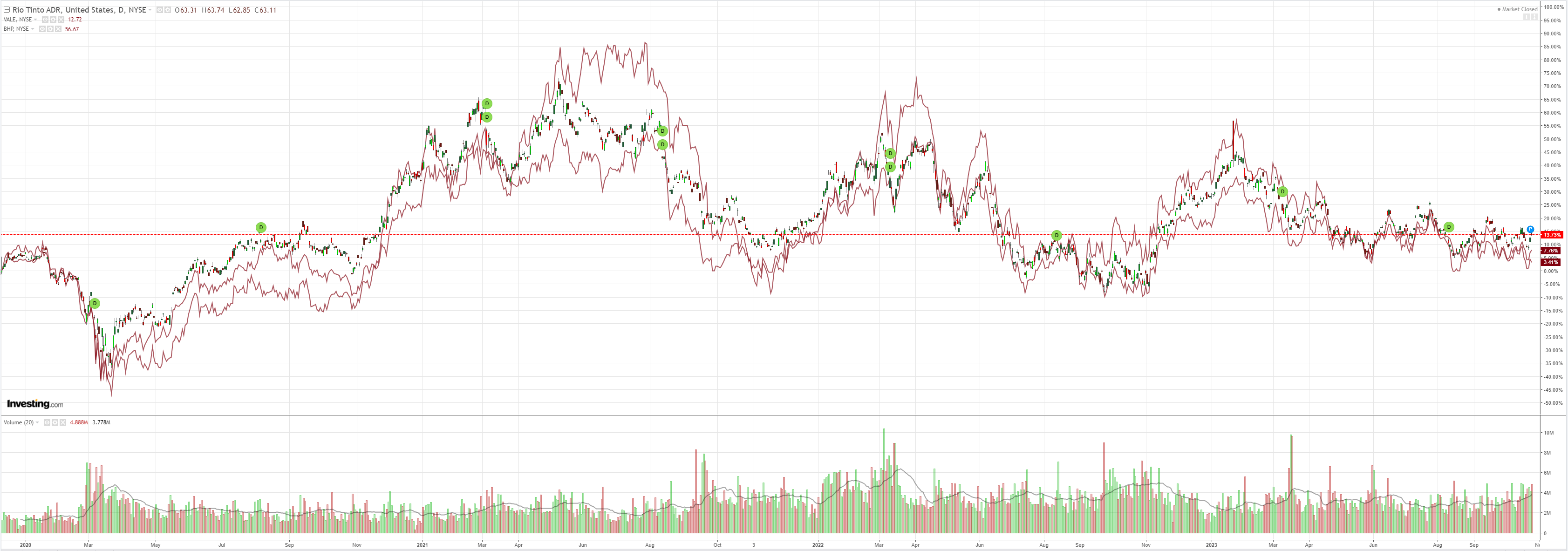

Miners did better:

EM is a goner:

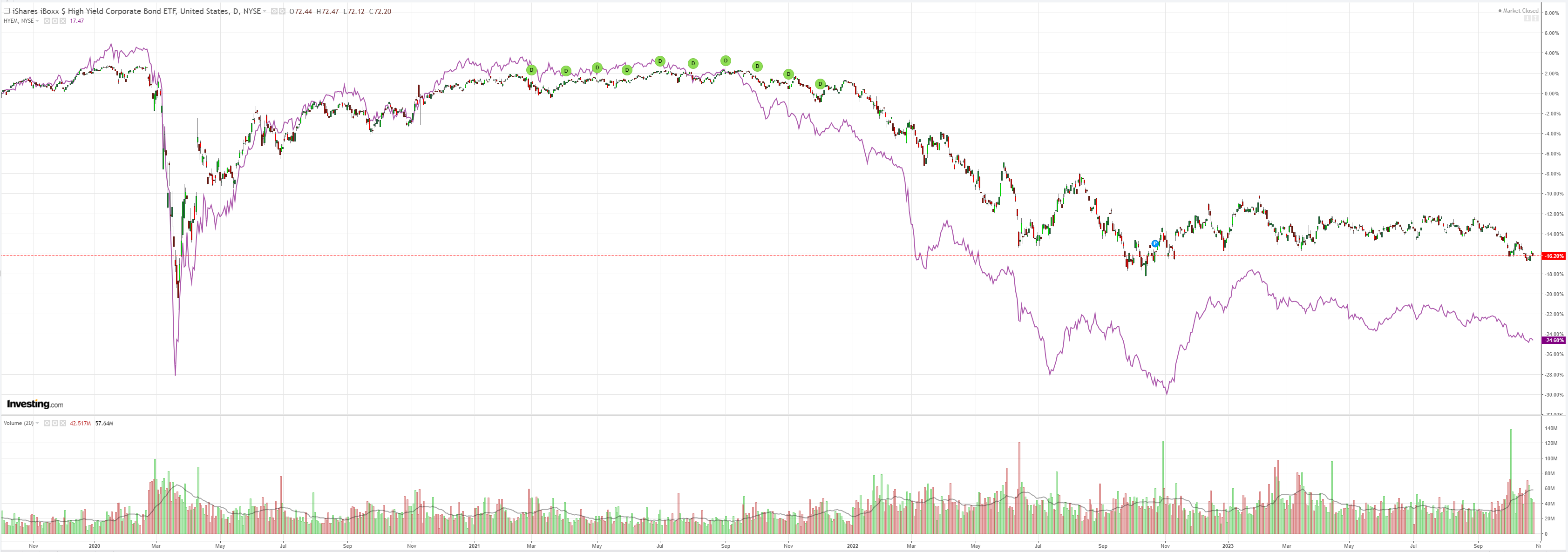

Junk us grinding lower:

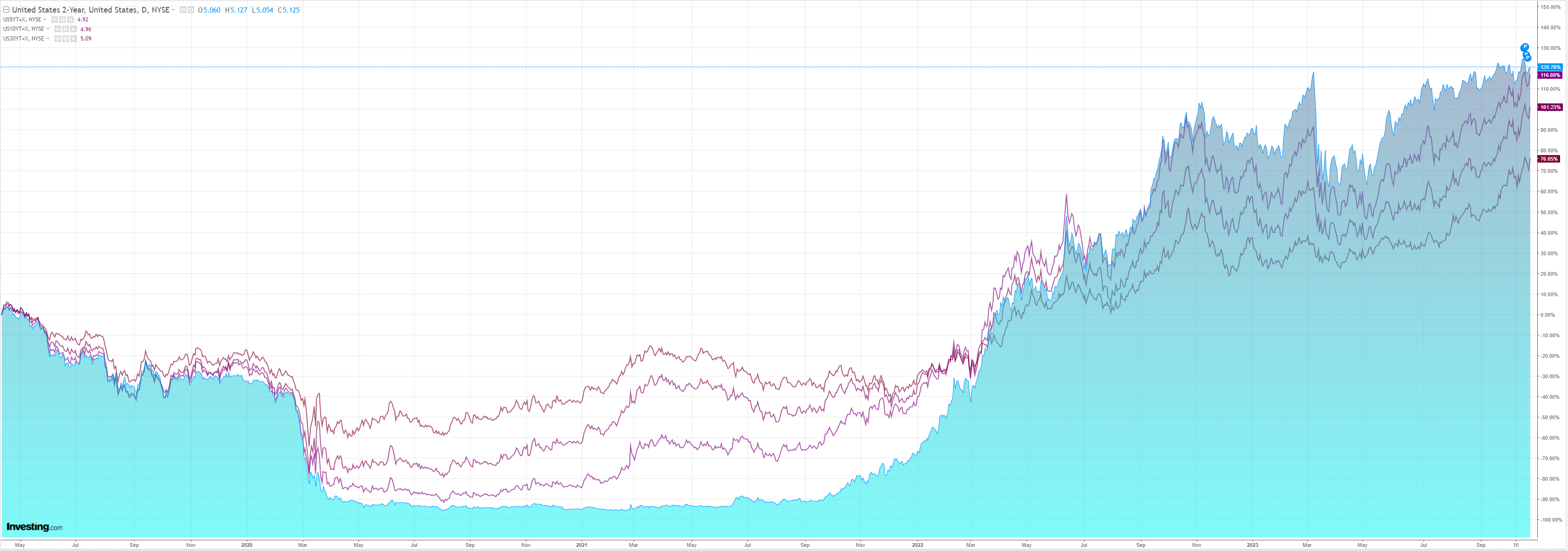

As yields poped again:

Which demolished stocks through critical support levels:

The US 10-year yield at 5% is holding as a destroyer of stocks. The risk-off mood is too strong for what are now likely further RBA rate hikes to lift the AUD.

However, the currency is still holding up pretty well amid the immense CFTC short.

My view is unchanged. A recession is coming in the US. It is already here in Europe. China is pretending it is OK by juking the stats, but it’s also vulnerable to deterioration in trade.

The Australian economy is equally weak, but Alboflation has delivered a stagflation pulse that the RBA must now deal with.

This will support the AUD at the margin, but as the global economy steadily falls apart, I can’t see the AUD bottoming until markets and then central banks panic.

With stocks joining the gloom, more downside is ahead for risk forex.