DXY was up overnight:

AUD was down but not as much JPY:

Which means CNY is next:

Oil is now a global wrecking ball:

Oil, DXY up and CNY down means the rest writes itself. Commodities, miners (LON:GLEN), EM (NYSE:EEM) down:

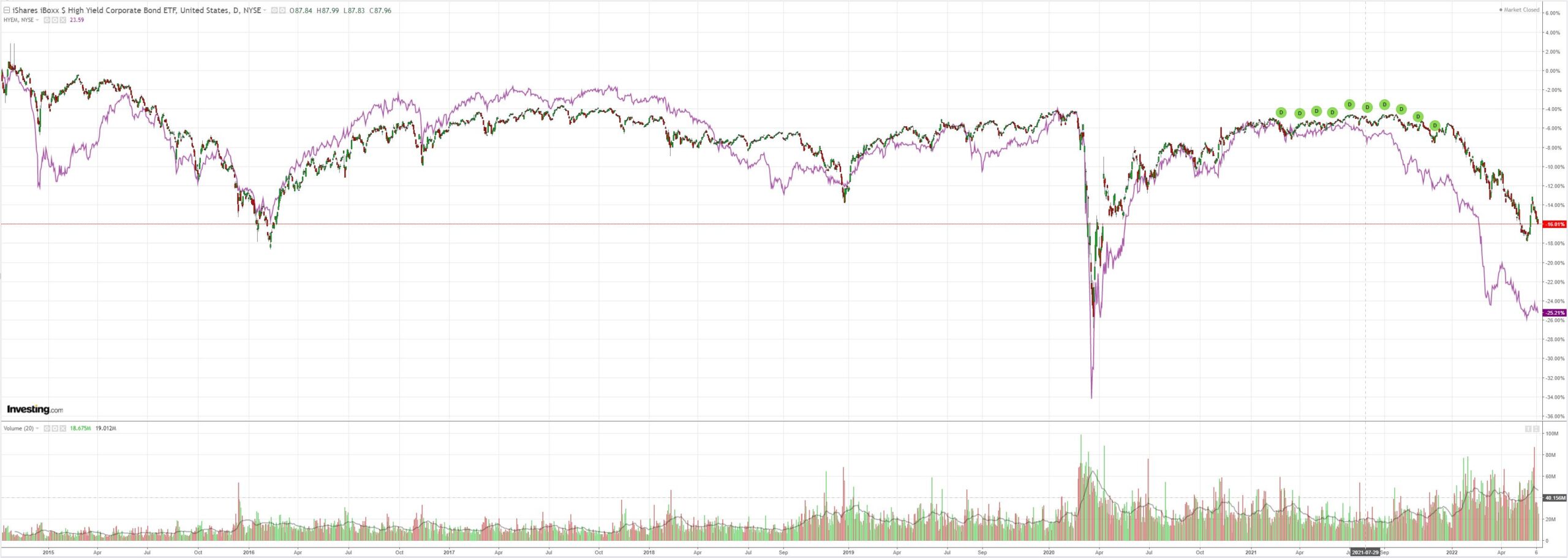

Junk (NYSE:HYG) is still howling “trouble ahead”:

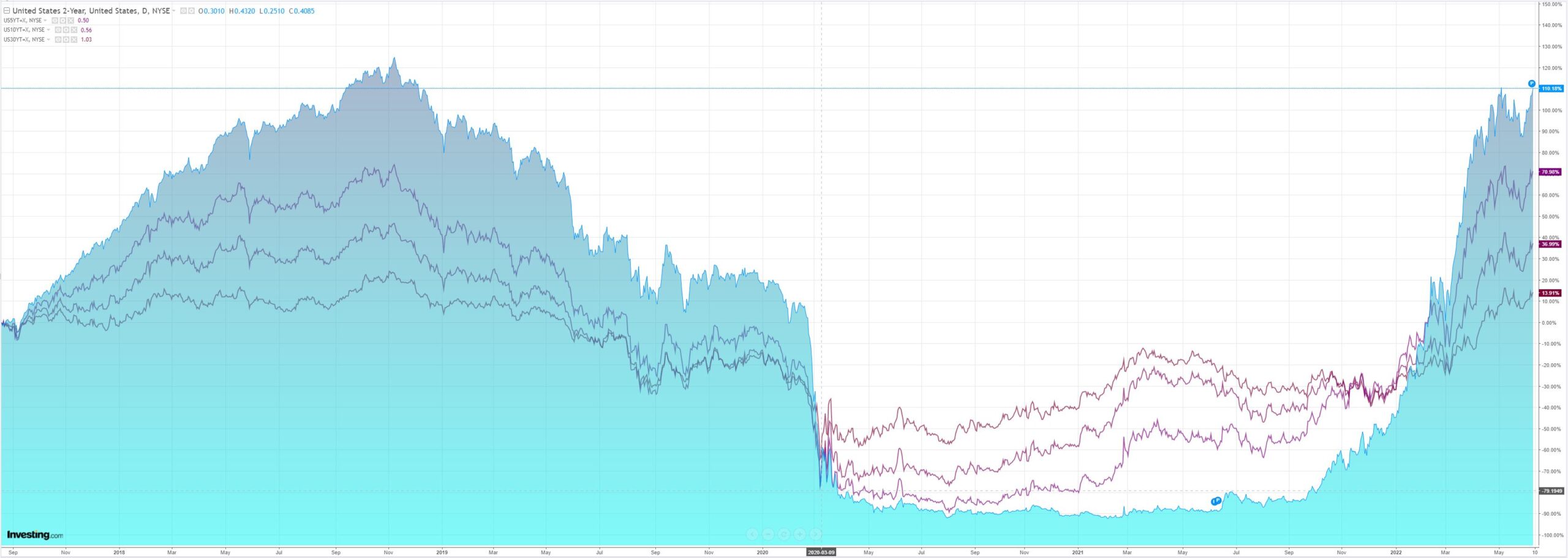

As oil pushes yields higher:

And stocks lower:

Westpac has the wrap:

Event Wrap

US wholesale inventories rose 2.2% in April (est. 2.1%), with notable strength in machineries.

Eurozone GDP for Q1 was finalised at 0.6%m/m and 5.4%y/y (est. 0.3% and 5.1%).

German industrial production in April rose 0.7% (est. 1.2%, prior -3.7%).

UAE Energy Minister Al-Mazrouei warned that the return of Chinese demand will likely push oil prices higher, while the CEO of global commodities trader Trafigura said oil prices could reach $150 a barrel with demand destruction likely by the end of the year.

Event Outlook

China: The trade surplus is expected to widen in May as some export operations begin the early stages of emerging from lockdowns (market f/c: US$57.7bn). Meanwhile, the support from authorities should see new loans expand and M2 money supply growth remain robust in May (market f/c: CNY1223.0bn and 10.3% respectively). Note the M2 and loan data are due 9-15 June.

Eur: The ECB is expected to announce the conclusion of asset purchases at their June policy meeting; the key focus will be on the Council’s updated forecasts and any guidance surrounding the path for policy rates over the second half of this year.

US: Initial jobless claims are set to remain at a low level (market f/c: 207k).

US inventories are up again. Even as oil cuts all hope of Fed pauses to shreds. It is only a matter of time before it goes one hike too far and the US consumer buckles under the combined energy, rates shock, then inventories destock into a major trade for Europe and China. This means DXY has another leg up and CNY another leg down.

We all know what that means. TSLombard:

Simultaneous USD strength and CNY weakness spells bad news for the world economy. A strong dollar acts a destabilising force via a number of channels that end up weighing on global trade, squeezing cross-border lending and amplifying balance sheet currency mismatch risks. All this as the Fed pushes through with QT, reducing global dollar liquidity and thereby rendering the refinancing of global dollar-denominated debt more difficult. What is more, a depreciating CNY puts more pressure on EM economies’ trade competitiveness and translates to diminishing support for industrial metal prices: it is no coincidence that the recent pullback has gone hand in hand with a weaker CNY.

No, is not a coincidence. AUD included.