DXY was down last night but it has a bullish ascending triangle pattern:

AUD blasted off again:

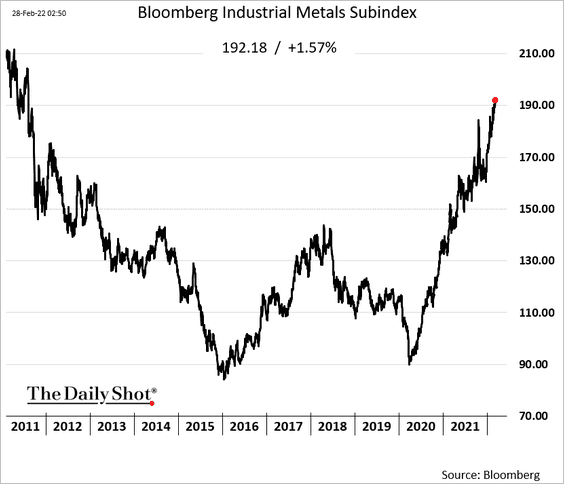

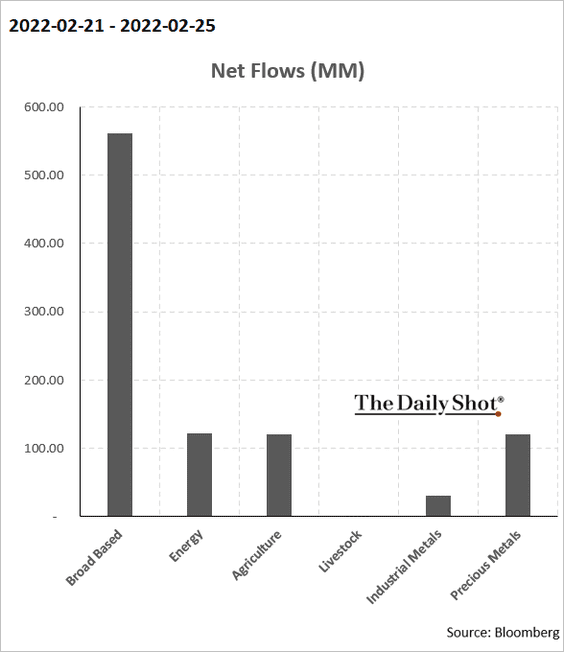

Base metals keep on keeping on:

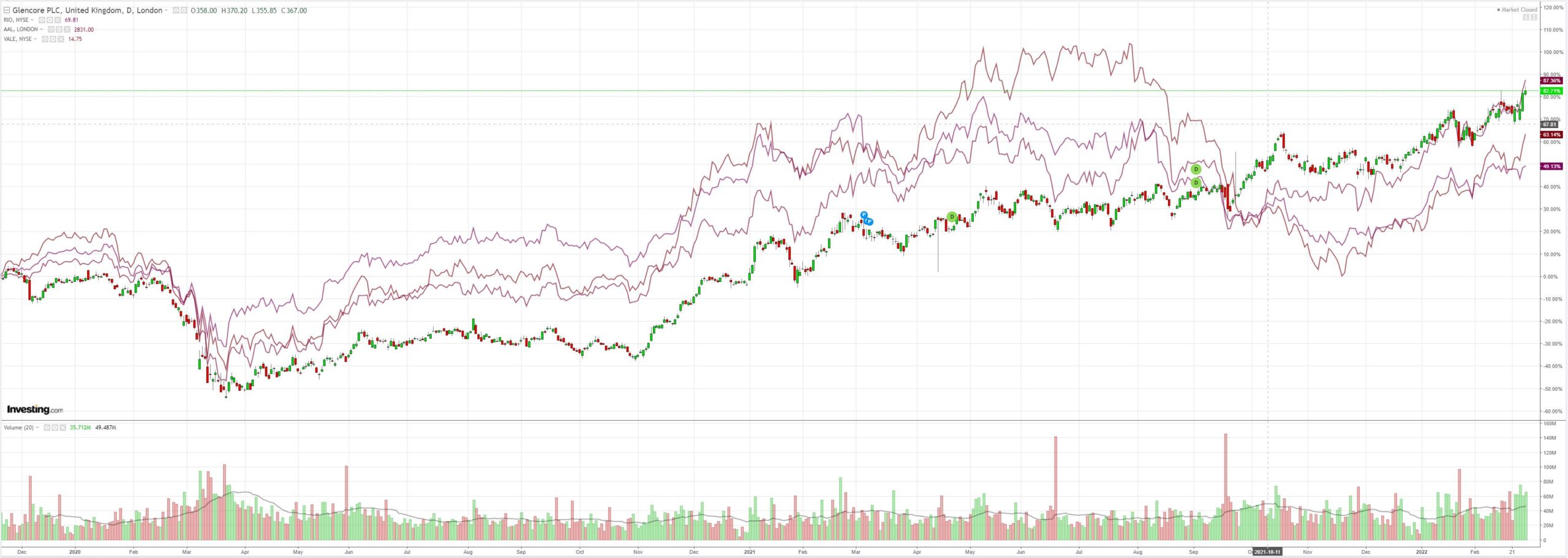

There’s nothing big miners (LON:GLEN) love more than a looming global recession. Say what?

EM stocks (NYSE:EEM) copped it:

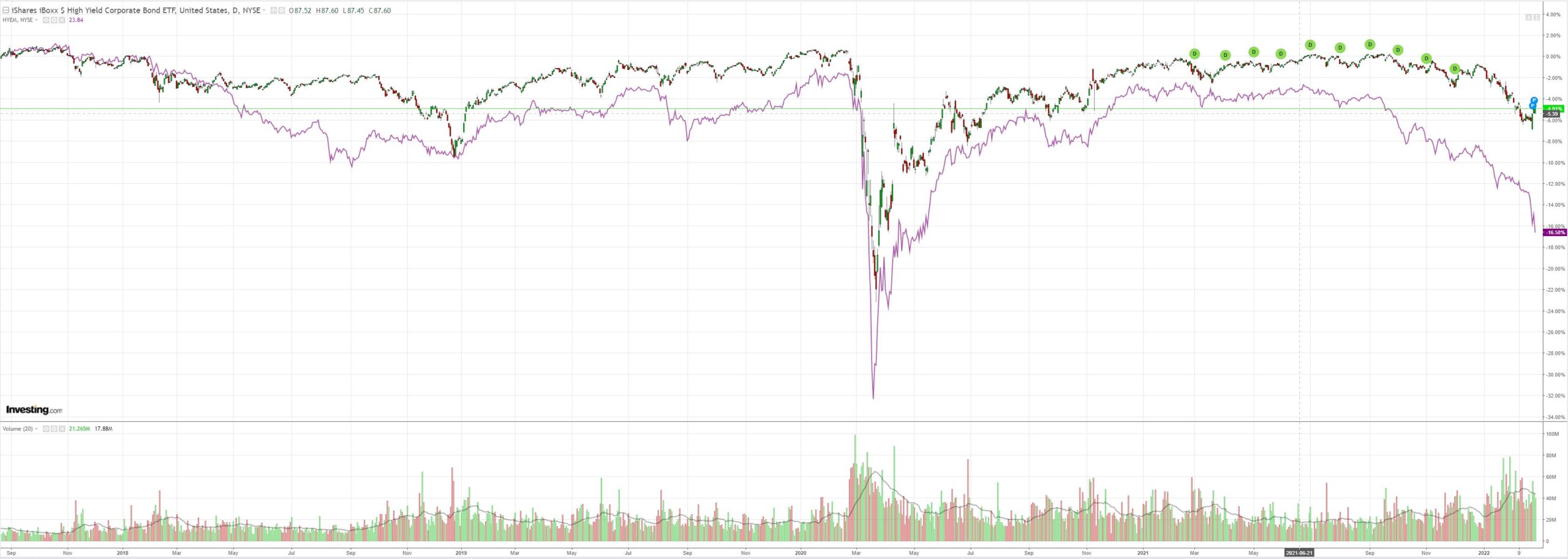

As EM junk (NYSE:HYG) enters free-fall. US did better:

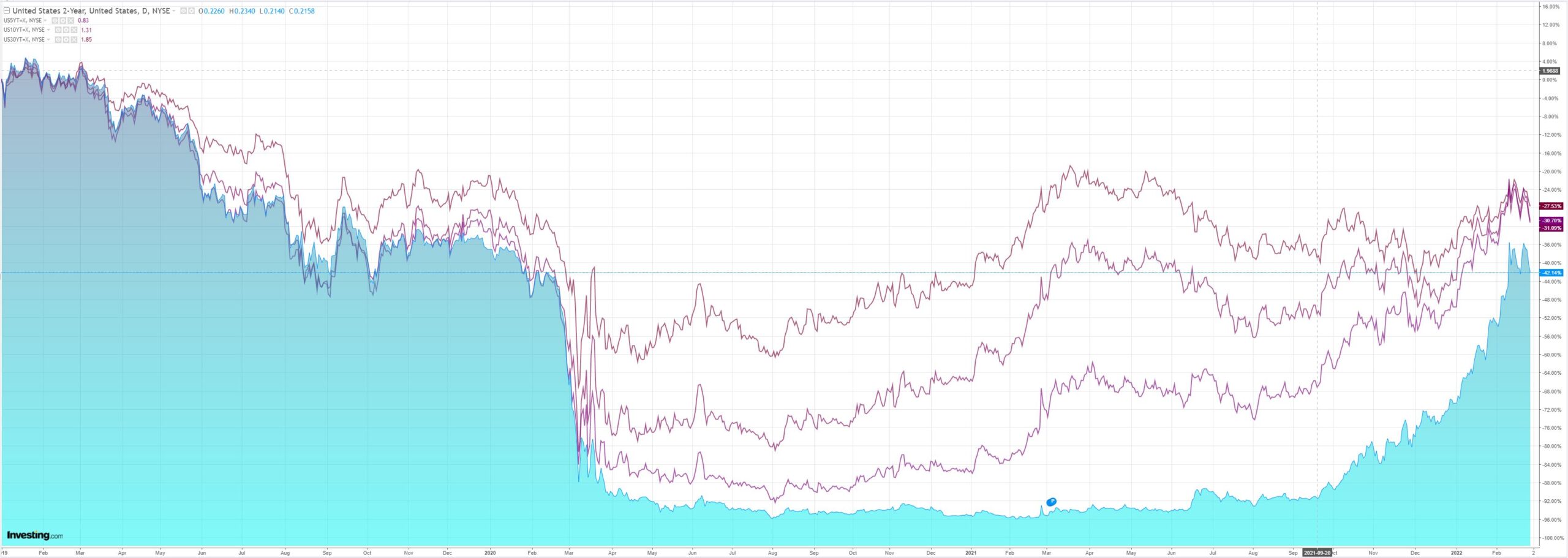

As Treasuries were bid:

But stocks fell anyway. Growth is stronger now as yields fall:

Westpac has the wrap:

Event Wrap

US trade deficit in January widened to, another record, -USD107.6bn (est. -USD99.5bn, prior -USD100.5bn), as imports rose +1.7%m/m and exports fell 1.8%m/m. Wholesale inventories rose +0.8%m/m (est. +1.0%m/m). Chicago PMI fell to 56.3 (est. 62.3, prior 65.2) – the lowest level since August 2020. Dallas Fed manufacturing survey rose to 14.0 (est. 3.5, prior 2.0). Although business activity, new orders and outlook picked up; employment, hours worked, and wages fell.

EU harmonised CPI rose to 7.5%y/y (est. 7.0%y/y, prior 6.2%y/y), core CPI to 3.0%y/y (prior 2.4%y/y).

Event Outlook

Aust: A softer gain in CoreLogic’s home value index is anticipated for February given the signs of slowing in Sydney and Melbourne (Westpac f/c: 0.3%). Meanwhile, the surge in turnover value points to robust gains in total housing approvals in January (Westpac f/c: 5.0%); investor loans are expected to outperform owner occupier loans slightly (Westpac f/c: 4.5% and 5.5% respectively). The current account surplus is set to narrow in Q4 with weaker export earnings reducing the trade surplus (Westpac f/c: $13.5bn); Westpac therefore expects net exports to subtract 1.0 percentage points from GDP growth in Q4. Public demand should be supported by the ongoing delta responsein Q4 (Westpac f/c: 1.6%). The RBA will keep rates on hold at their March meeting; focus will be centred on any shift in rhetoric concerning the timing of the tightening cycle, which Westpac expects to begin in August 2022.

Japan: The final estimate for February’s Nikkei manufacturing PMI is due.

China: February’s manufacturing and non-manufacturing PMIs should continue to signal the underlying strength of the economy given COVID-19 concerns and start-of-year seasonality (market f/c: 49.8 mfg; 50.7 non-mfg; 49.1 Caixin mfg)

Eur/UK: Softer net mortgage lending in January should indicate cooling demand for housing in the UK (market f/c: £4.1bn). The final estimate for the Euro Area and UK Markit manufacturing PMIs are due.

US: Construction spending continues to be supported by strength in home building (market f/c: -0.1%). Meanwhile, the ISM and Markit manufacturing PMIs should reflect the strength of the sector despite omicron disruptions (market f/c: 58.0 and 57.5 respectively). The FOMC’s Bostic will discuss business uncertainty and Mester will make opening comments at an inflation conference.

My favourite AUD leading indicator, EM junk debt, continues to point deep south but the AUD is still playing at being a safe haven:

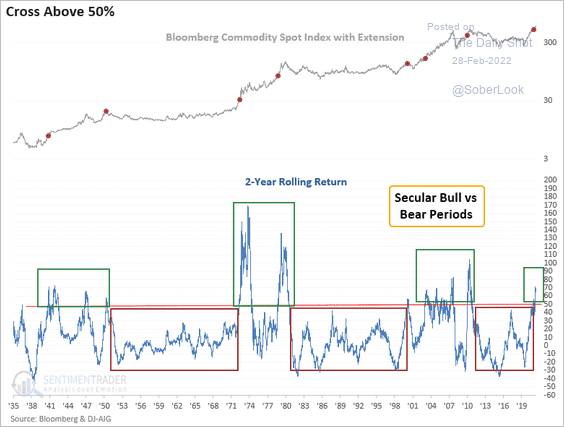

Thanks to Wall Street’s commodities bubble, now re-enforced by Russian supply worries:

I remain of the view that it is mostly artificial thanks to COVID and hoarding, and it will come apart as global growth slows materially ahead. This will now be made all the worse by the bubble itself via demand destruction.

But until then the always treasonous Wall Street can have its way and the AUD will fight any downdraft.