DXY fell last night despite heavy risk off:

AUD rose:

Oil is proving to be an immovable object:

Not so metals. Copper is at breakdown point:

Miners (LON:GLEN) were hit:

EM stocks (NYSE:EEM) too:

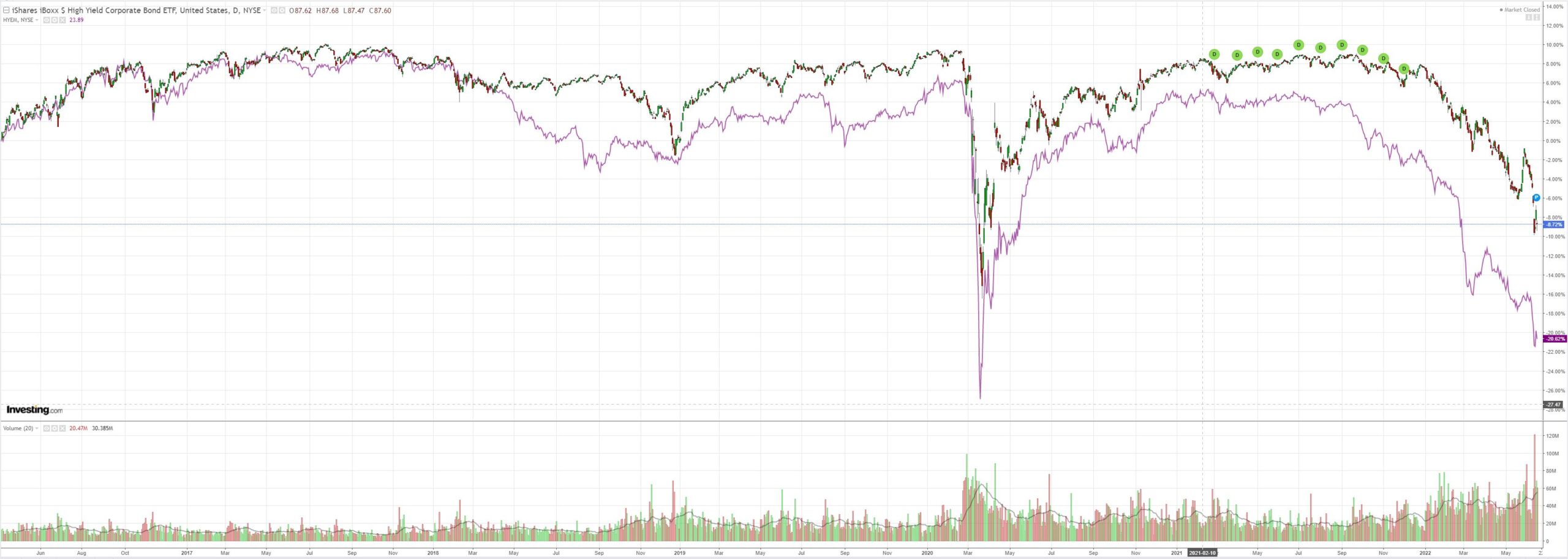

Junk (NYSE:HYG) whoa!

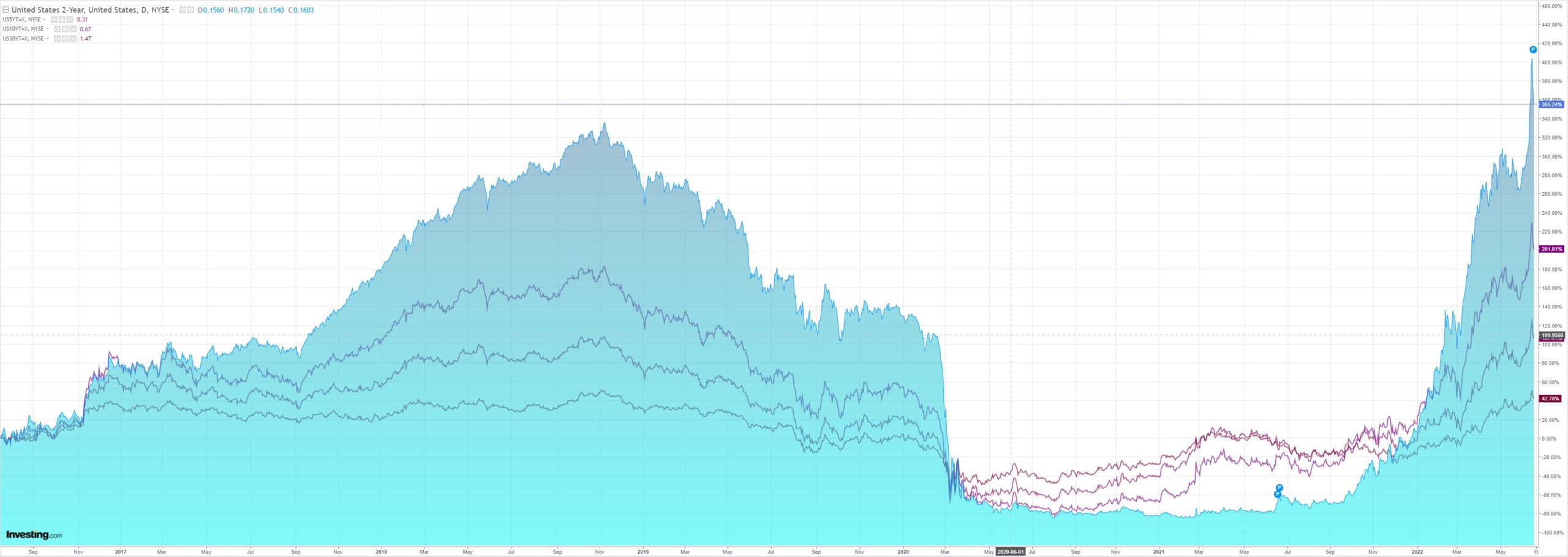

Treasuries were bid, signaling a shift from inflation worries to growth panic:

Especially since stocks fell as well:

Westpac has the wrap:

Event Wrap

The Bank of England hiked by 25bp to 1.25% (highest level for 13 years). Dissenters in the vote of 6-3 all voted for a 50bp hike. The minutes stressed the tightness of UK labour market, persistence of some activity indicators, and a desire to tighten even as slack in the economy appears. The MPC said that it will “if necessary act forcefully in response” to persistent inflationary pressures.

The Swiss National Bank surprised with a 50bp hike to -0.25% (consensus was for unchanged) and a strong indication of further policy moves to coming months in order to counter inflationary pressures.

US housing starts and permits in May declined more than anticipated, but from upwardly revised levels. Starts fell 14.4%m/m to an annualised +1.549mn (est. 1.693m, prior 1.810m from initial 1.724m) and permits fell 7.0%m/m to annualised 1.695m (est. 1.778m, prior 1.823m from initially 1.819m).

The Philadelphia Fed survey fell to -3.3 (est. +5.0) from +2.6 in May with mixed components: higher employment and faster deliveries suggesting an easing of recent constraints, but orders cooling.

Event Outlook

NZ: The firming of economic conditions should lend some support to the manufacturing PMI in May.

Eur: The final estimate of Europe’s May CPI will confirm price pressures are intensifying and broadening (market f/c: 0.8%mth, 8.1%yr).

US: Industrial production will likely remain volatile as firms navigate supply issues (market f/c: 0.4%). Meanwhile, the leading index is expected point to a slowing of economic momentum in May (market f/c: -0.4%). FOMC Chair Powell will provide opening remarks at the Inaugural Conference on the International Roles of the US Dollar.

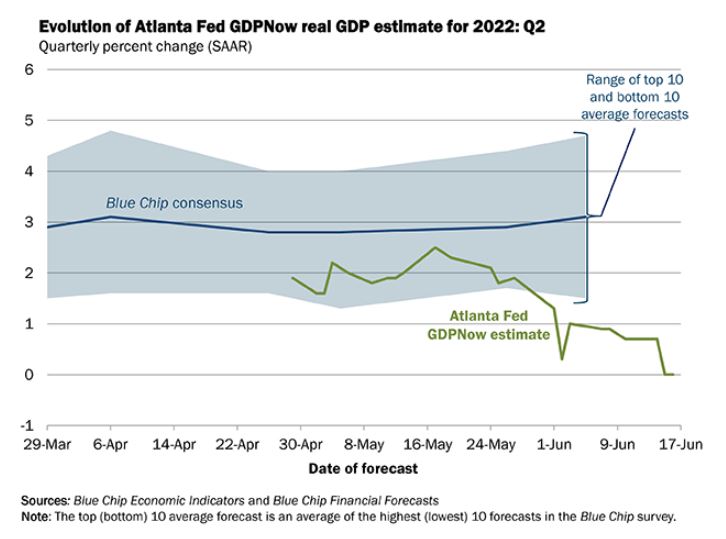

It increasingly looks possible that the US is already in recession. Atlanta Fed’s GDPNow is zero for Q2 following the negative Q1 print:

If so, we’re already passing through the stagflationary shock posed by Ukraine and coming out the other side to a gigantic deflationary accident as the global economy lands hard:

- US consumer buckles;

- trade spillovers hammer a COVID and property smashed China;

- EMs are clubbed on all fronts;

- Europe follows it all down.

All of this must be severe enough to crash oil and the wider commodities complex so we are nowhere near it yet.

Albo’s energy crisis is widening AUD/USD spreads, which is supporting the currency a little.

But I still find it hard to believe that AUD won’t be smashed as the above transpires.