Street Calls of the Week

DXY has stabilised:

AUD looks toppy:

Oil is puking the China rebound:

So is copper:

Big miners (NYSE:RIO) are glued to iron ore:

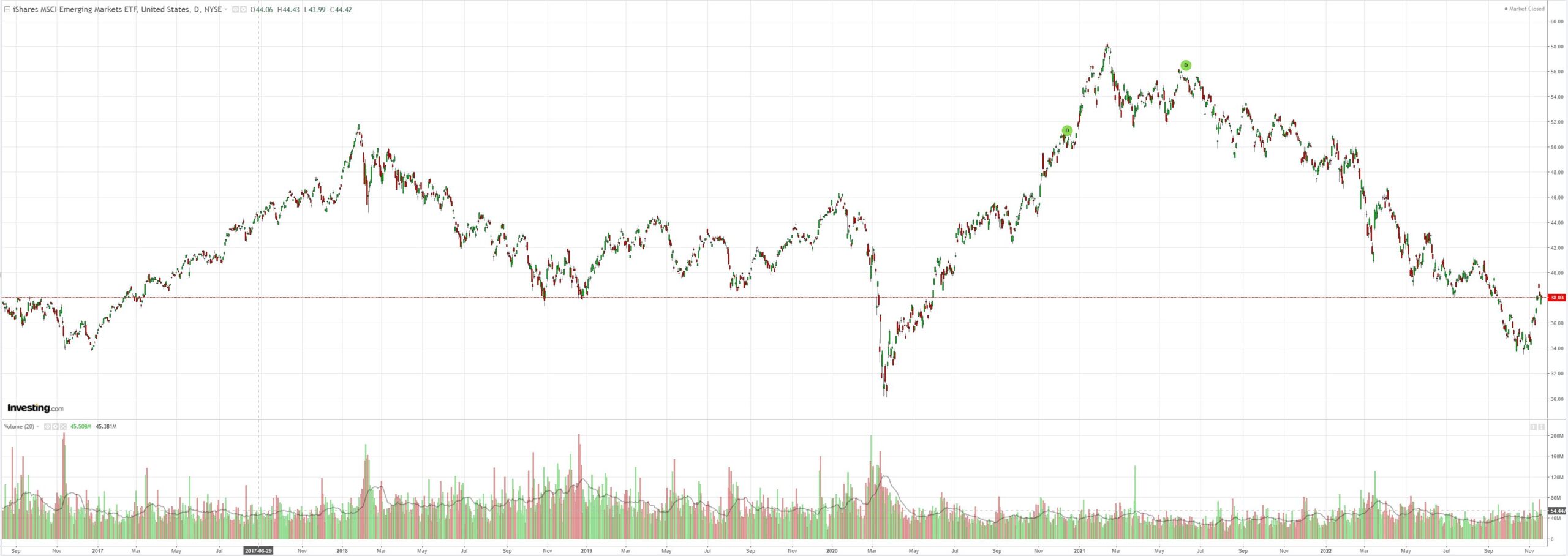

EM stocks (NYSE:EEM) are fading:

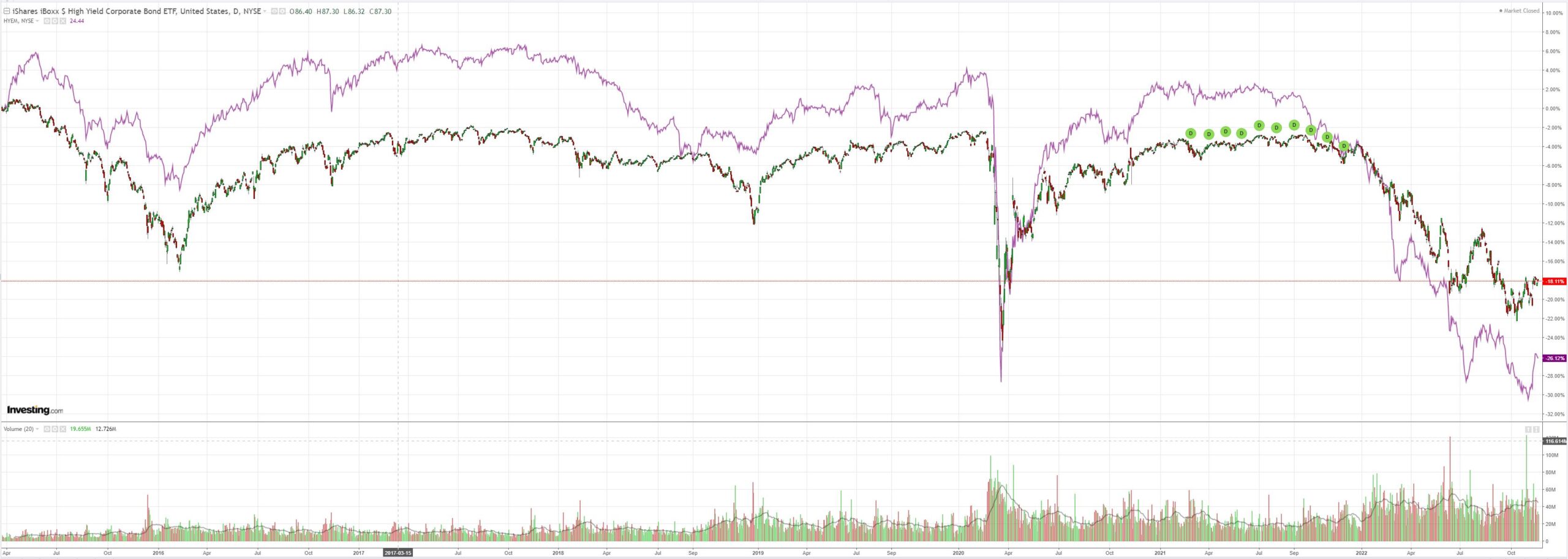

Junk (NYSE:HYG) too:

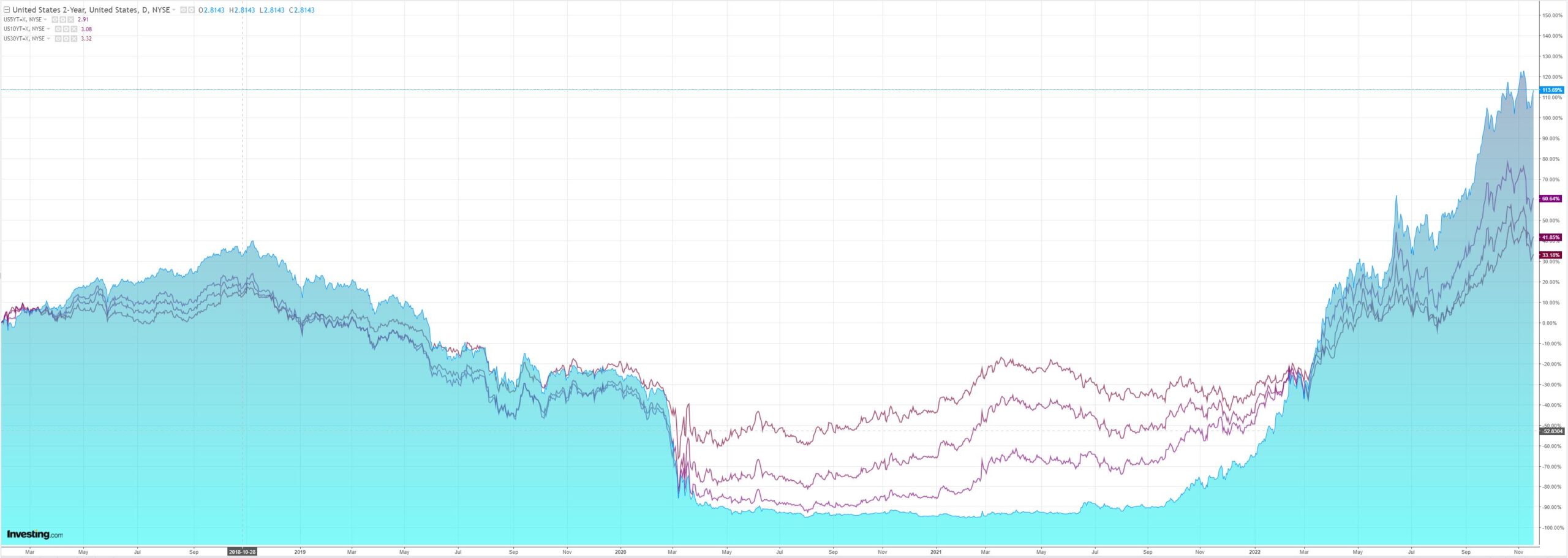

As the US curve sinks to its deepest inversion in nearly half a century:

Stocks held on:

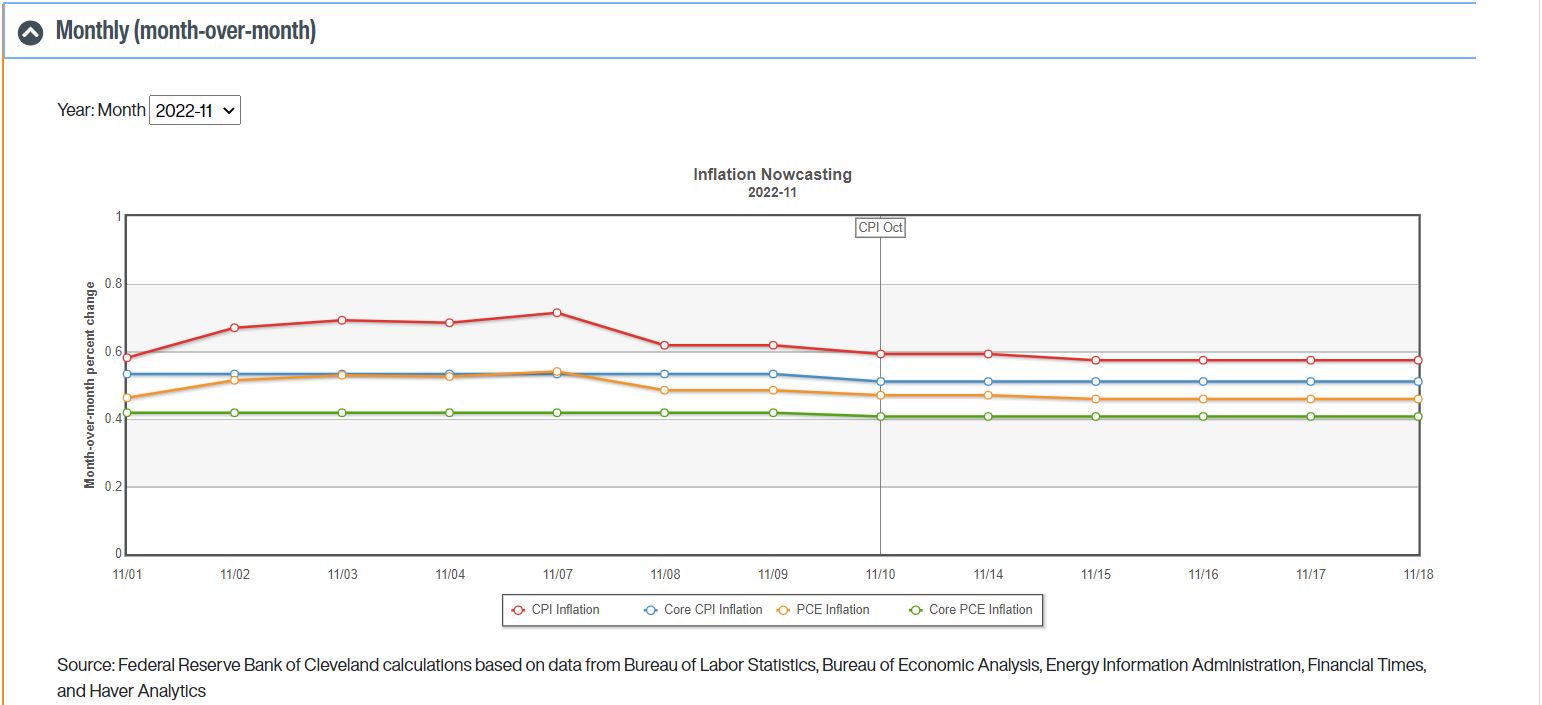

The latest Fed inflation nowcast is still glued to nearly 5% annualised:

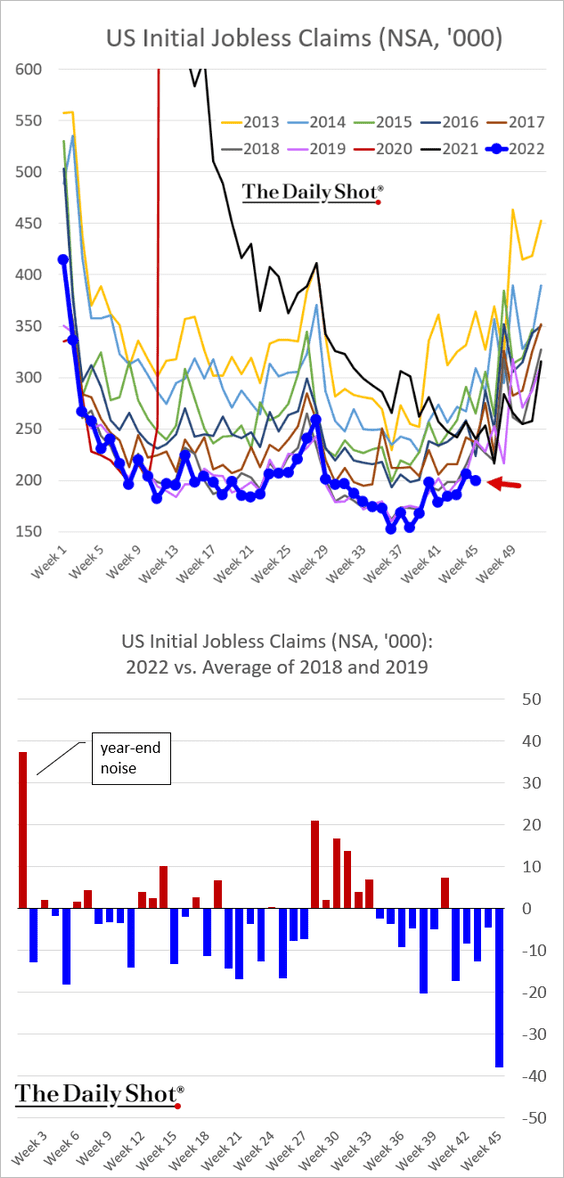

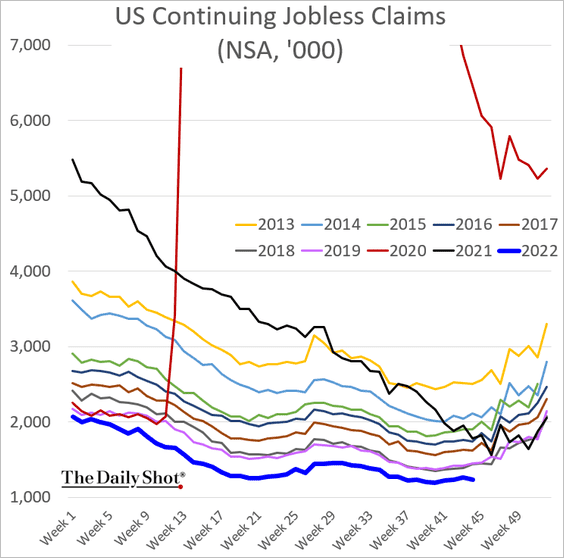

Despite Elon Musk’s best efforts, the US jobs market remains in rude shape:

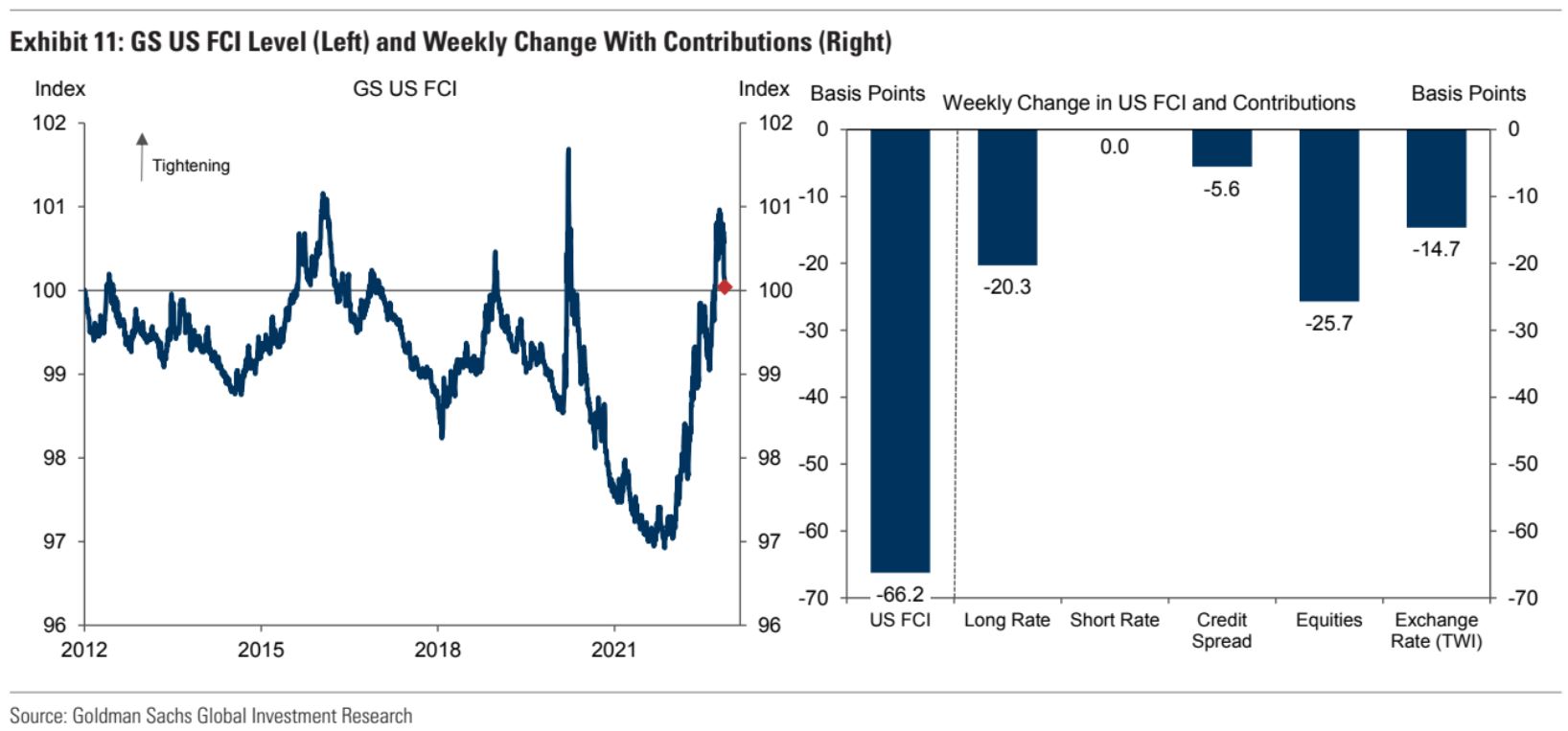

And now the robots have bid a material easing into US rates via equities and DXY, erasing the Fed’s last 75bps hike:

Fed rug pull for bear market rally and AUD approaching just as markets realise that China is going to get much worse before it gets better.