DXY held its range:

AUD took off:

CNY peg is rock solid:

Oil was gazumped:

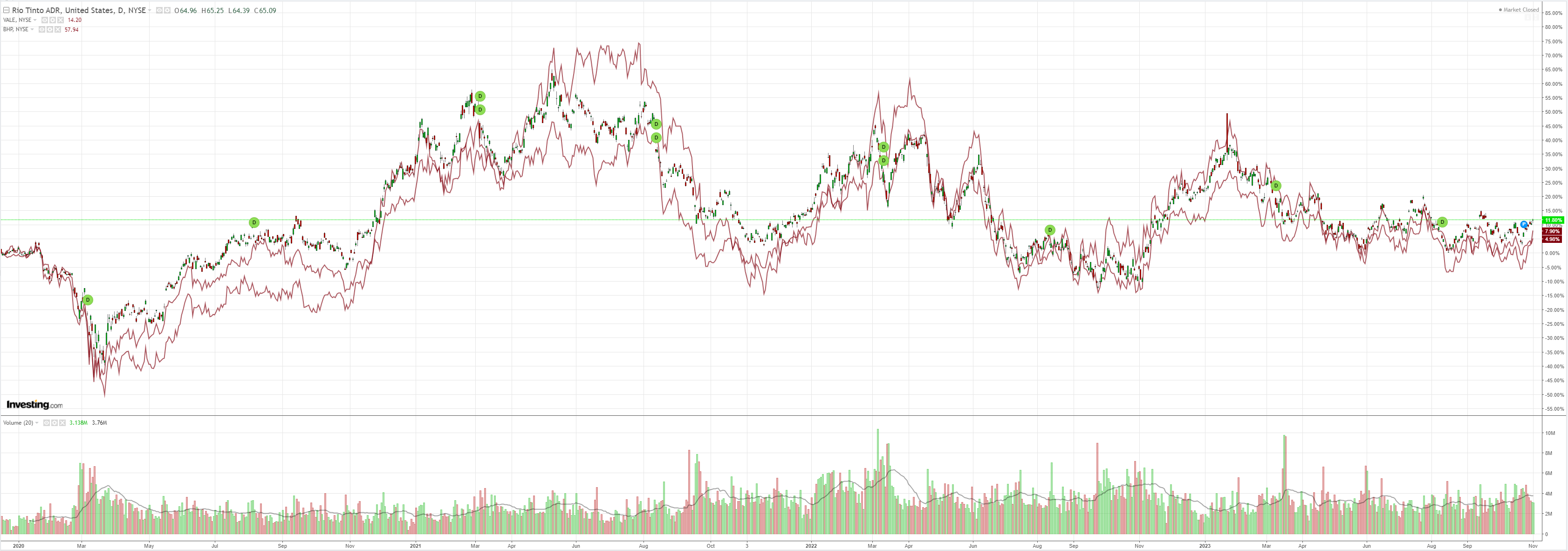

Dirt has improved only slightly:

Miners are rangebound:

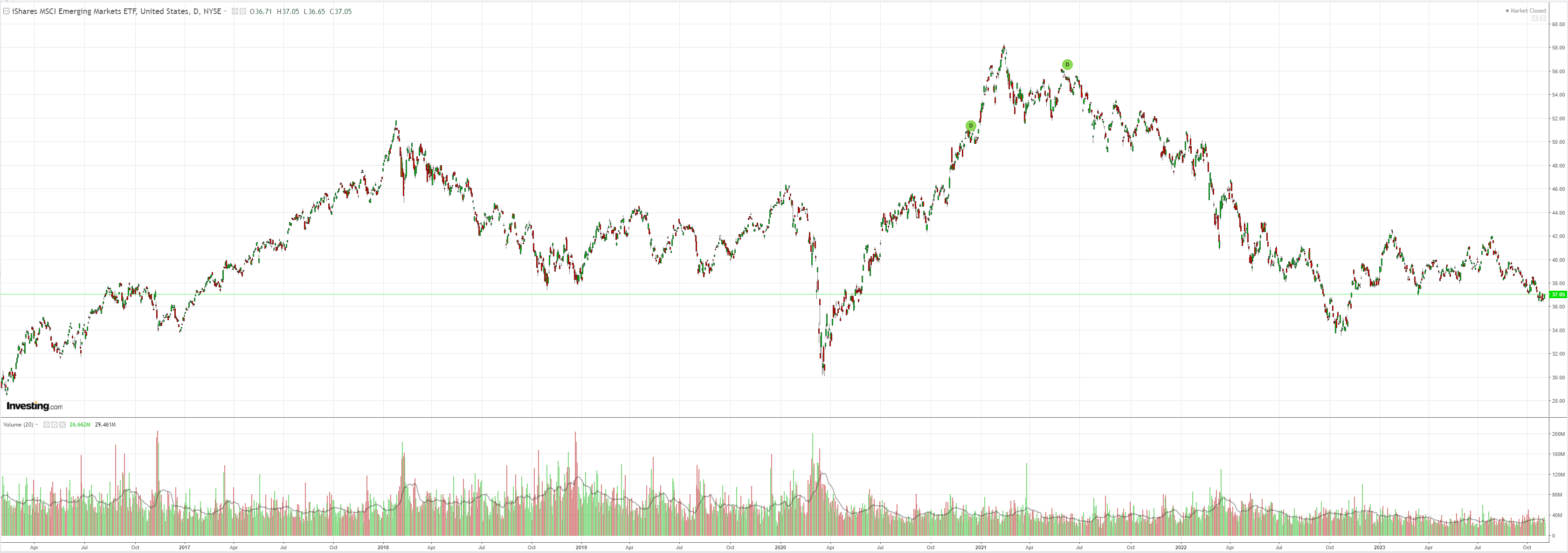

EM still sick:

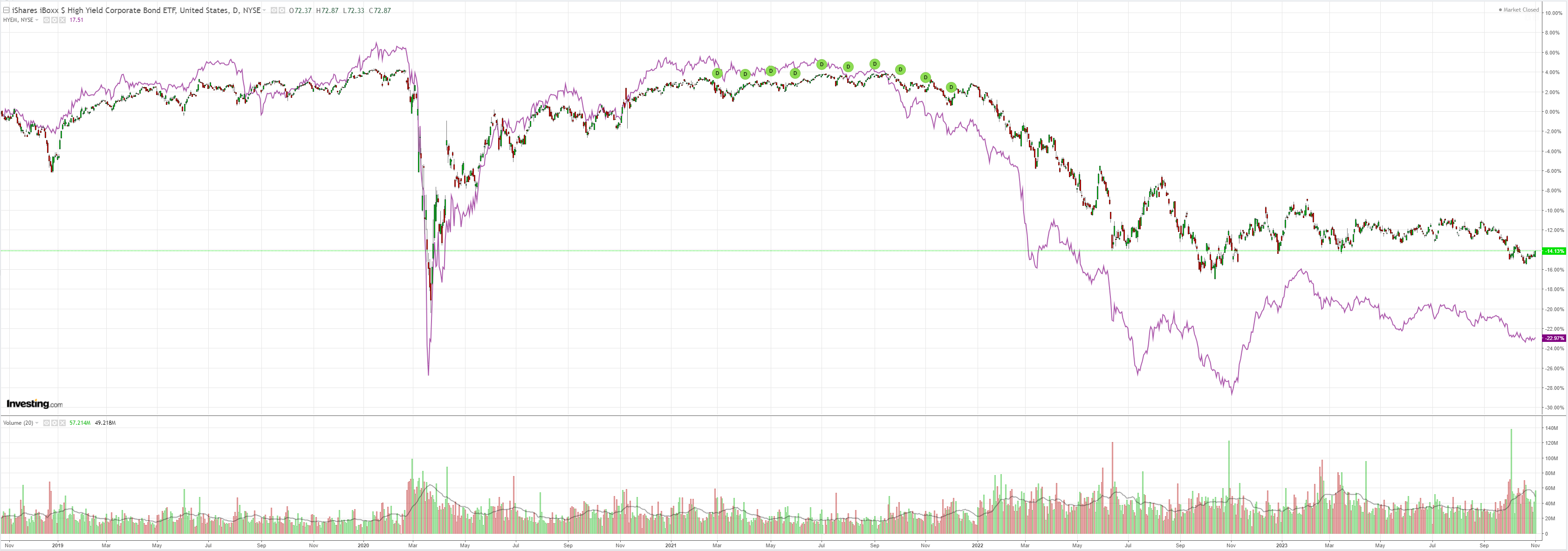

Junk firmed:

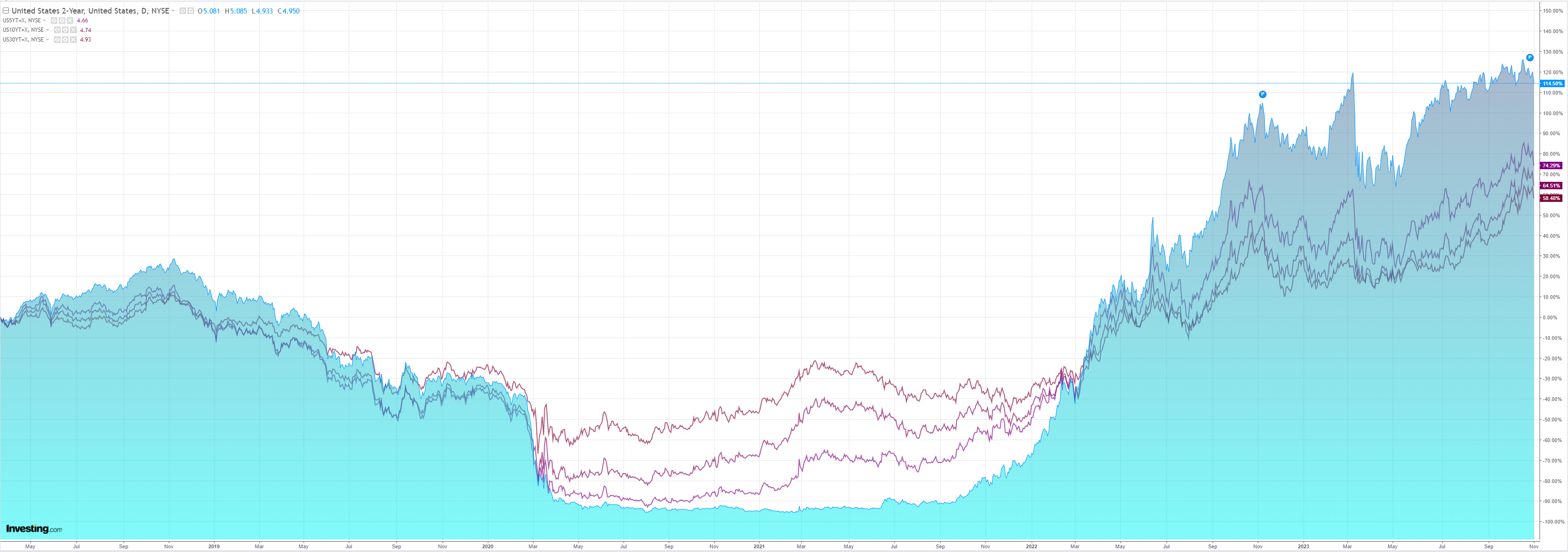

As yields plunged:

Liberating stocks:

It was a perfect night of bad data for falling yields and rising stocks.

ADP (NASDAQ:ADP) was soft:

Private sector employment increased by 113,000 jobs in October and annual pay was up 5.7 percent year-over-year, according to the October ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). The ADP National Employment Report is an independent measure and high-frequency view of the private-sector labor market based on actual, anonymized payroll data of more than 25 million U.S. employees.

ISM was weak:

Economic activity in the manufacturing sector contracted in October for the 12th consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 46.7 percent in October, 2.3 percentage points lower than the 49 percent recorded in September. The overall economy dropped back into contraction after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that. (A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory at 45.5 percent, 3.7 percentage points lower than the figure of 49.2 percent recorded in September.

The Fed was dovish enough as it held rates steady:

*POWELL: PROCESS OF GETTING INF. TO 2% HAS LONG WAY TO GO

*POWELL: FULL EFFECTS OF TIGHTENING YET TO BE FELT

*POWELL: NOT CONFIDENT WE’VE REACHED STANCE FOR 2% INFLATION

14:43 – Fed Chair Powell (Q&A) says Fed staff did not put a recession back into their forecast at this meeting

14:44 – Fed Chair Powell (Q&A) says financial conditions have clearly tightened; over time that will have an effect, we just do not know how quickly that will be

14:47 – Fed Chair Powell (Q&A) says Fed is not thinking about rate cuts right now at all, is not thinking or talking about rate cuts; are focused on if Fed is sufficiently restrictive; The question Fed is asking, is should we hike more

14:50 – Fed Chair Powell (Q&A) says they are very focused on getting confident that the Fed has achieved a sufficiently restrictive stance of policy

Hilariously, Powell has once again reversed the very FCI tightening he is citing as his reason for holding.

We appear set up for another bear market rally. I don’t think we’ll get overly far before yields reverse higher again, but there’s juice in the tank so long as they fall. CTAs are very short bonds.

If so, Powell may return shortly to declare higher for longer to snuff it out.

AUD will react accordingly.