The forex market continued its recent counter-trend rally overnight as questions were raised over Biden stimulus plans. My charts are down today but AUD is sitting at 0.74 cents as DXY falls:

Sen. Joe Manchin urged Democrats Thursday to pause their effort to pass a $3.5 trillion social spending plan but suggested he’d be open to passing a pared-back version of it.

Nonetheless, the op-ed, published Thursday in the Wall Street Journal, could further complicate the path forward for Democratic leadership and progressives who are pushing to pass the legislation by the end of this month.

The West Virginia Democrat said that he would not support the $3.5 trillion package “or anywhere near that level of additional spending” without further clarity on the economic impact of inflation and the national debt on current government programs.

The Dems are refusing to pass the original $1.1tr package unless both are passed so the entire process is now held up.

The base case is still that this gets through but, for now, sentiment is turning against DXY.

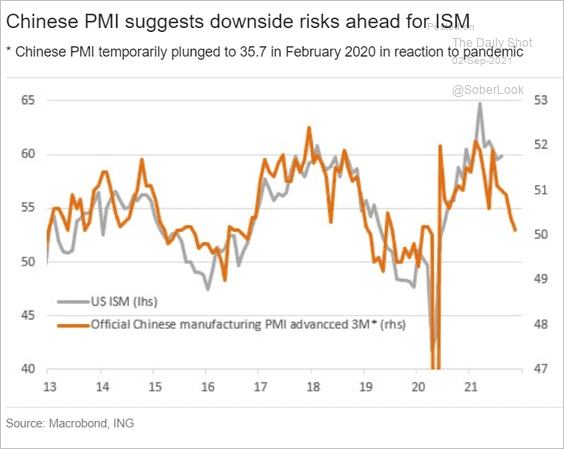

There is potentially more downside for it, too, as US growth rolls into the sharp Chinese slowdown:

Obviously, this will raise more questions about the US taper.

I am still bearish AUD over the stretch given the global slowdown is being led by China and I expect all hard commodity prices to crash in due course into a market-moving growth scare that equities are not priced for.