The DXY correction continues:

Which is powering the AUD dead cat bounce:

Oil looks sick again:

Metals are trying on futile China hopes:

Miners (LON:GLEN) too:

EM stocks (NYSE:EEM) were soft:

Junk (NYSE:HYG) is still bouncing:

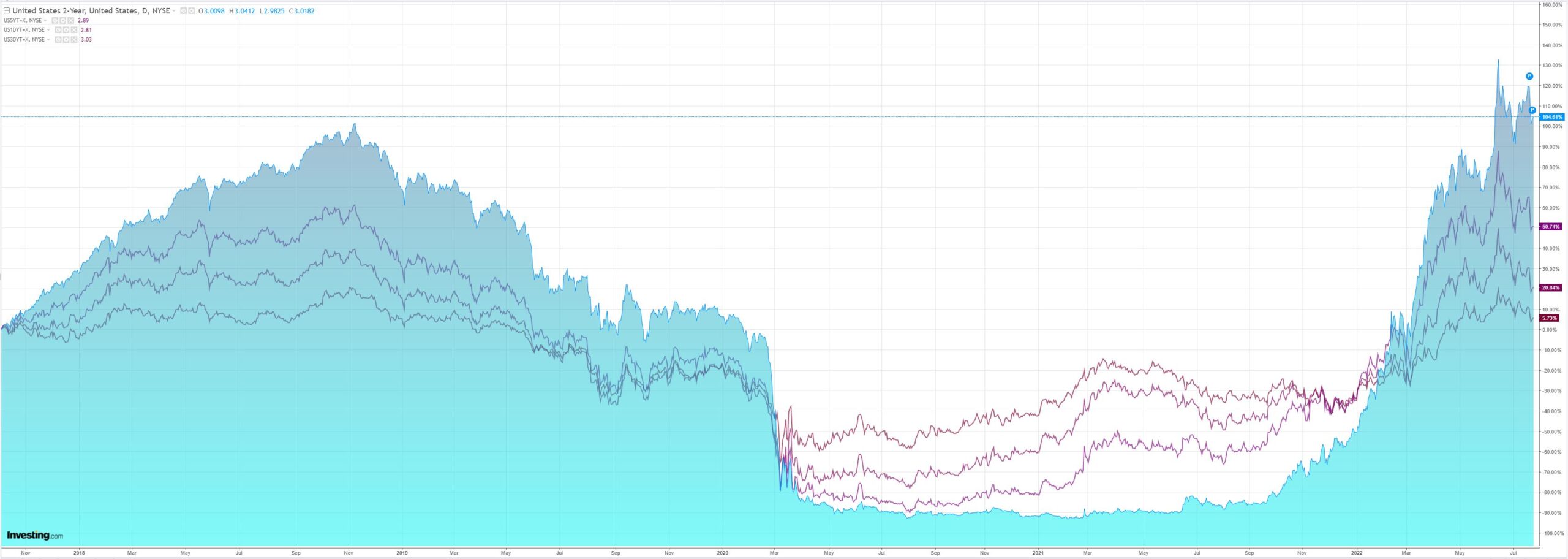

Yields lifted:

And stocks fell:

Westpac has the wrap:

Event Wrap

The Chicago Fed national activity index for June disappointed at -0.19 (est. 0.00, prior -0.19), much of the weakness in the production related components. The Dallas Fed manufacturing survey for July also disappointed at -22.6 (est. -18.5), prior -17.7) – lowest since May 2020, although pricing components did recede.

Germany’s IFO business survey disappointed at 88.6 (est. 90.1,prior 92.2). The expectations component fell sharply, from 85.5 to 80.3. The threat of a cut in energy supply and downward revisions to the global growth outlook are weighing on confidence, and recession risks appear to be rising.

The ECB’s Visco (Italy) said that it will follow a data dependent approach to policy normalisation, but stressed that “moving step by step” doesn’t mean “being very slow”. Kazaks (Latvia) rejected the notion “that this was the only front-loading”, adding that “the rate increase in September also needs to be quite significant”.

Event Outlook

US: New home sales are expected to decline in June given ongoing construction headwinds and affordability concerns (market f/c: -5.0%). Consequently, the gradual slowing in price momentum should be evident in May’s FHFA and S&P/CS home price indices (market f/c: 1.5% for both). Inflation concerns are still weighing heavily on consumer confidence (market f/c: 96.9) and the July Richmond Fed index will continue to show a deteriorating outlook for manufacturing (market f/c: -22).

EUR has no reason to bounce. The ECB is tightening into an energy-induced recession it cannot affect. To wit:

Russian gas giant Gazprom (MCX:GAZP) said Monday it was cutting daily gas deliveries via the Nord Stream 1 pipeline to 33 million cubic metres starting Wednesday.

That would correspond to 20% of the pipeline’s capacity. The current flow of gas into Germany is only at 40%.

The company said it was halting the operation of another turbine due to the “technical condition of the engine”.

SocGen sums it up:

Open your eyes, look up to the skies and see: Europe’s caught in a Russian landslide: The ECB’s monetary policy matters less, than President Putin’s gas export strategy. Nordstream1 came back online yesterday, but markets aren’t comforted. Not when even the European Commission President acknowledges that “Russia is using energy as a weapon; It is a likely scenario that there is a full cut-off of Russian gas and that would hit the while European Union”.

So, the euro’s pre-ECB euro bounce after failing to break convincingly below parity with the dollar, wasn’t given further impetus by a 50bp rate hike and isn’t supported by the market now pricing a 1% discount rate by Christmas.

Sure, some of the issue is a lack of confidence in the new TPI (Transmission Prevention Instrument) that is intended to fight fragmentation,i.e.,prevent peripheral yields from rising too far. But while the details of the tool are flaky, the market still know that when the crunch comes, the ECB will find a way to support the bond market.

The big issue is that the most optimistic outcome for the rest of this year is while President Putin keeps the gas flowing, he continues to use uncertainty about how much will flow as a bargaining tool and as a means of sowing uncertainty and discord among Europe’s political elite. That still leaves the Euro, to all intents and purposes, unbuyable for the time being (probably for the rest of this year given that the leverage gas supplies afford the Russian President is at its greatest in the winter).

Yep. If the EUR turns it will drag AUD lower though, first, we have to negotiate the CPI!