DXY stalled last night:

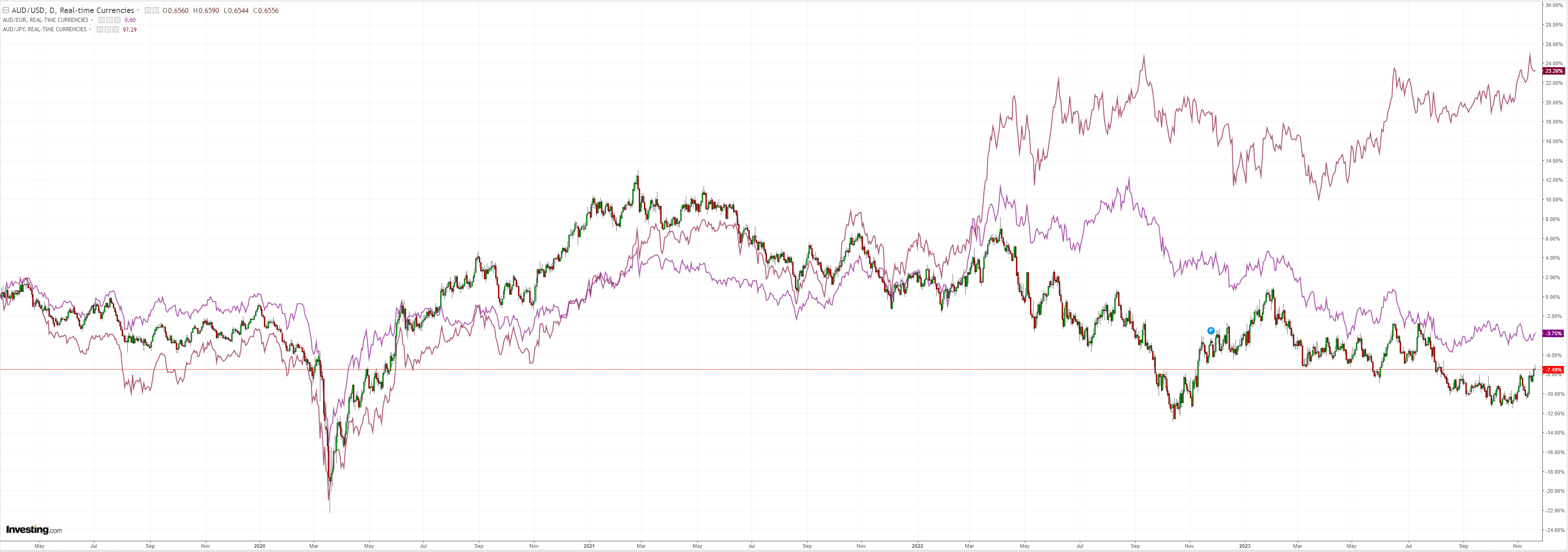

AUD did too:

That the Chinese peg has broken upwards is AUD bullish:

Gold firmed:

Metals were mixed:

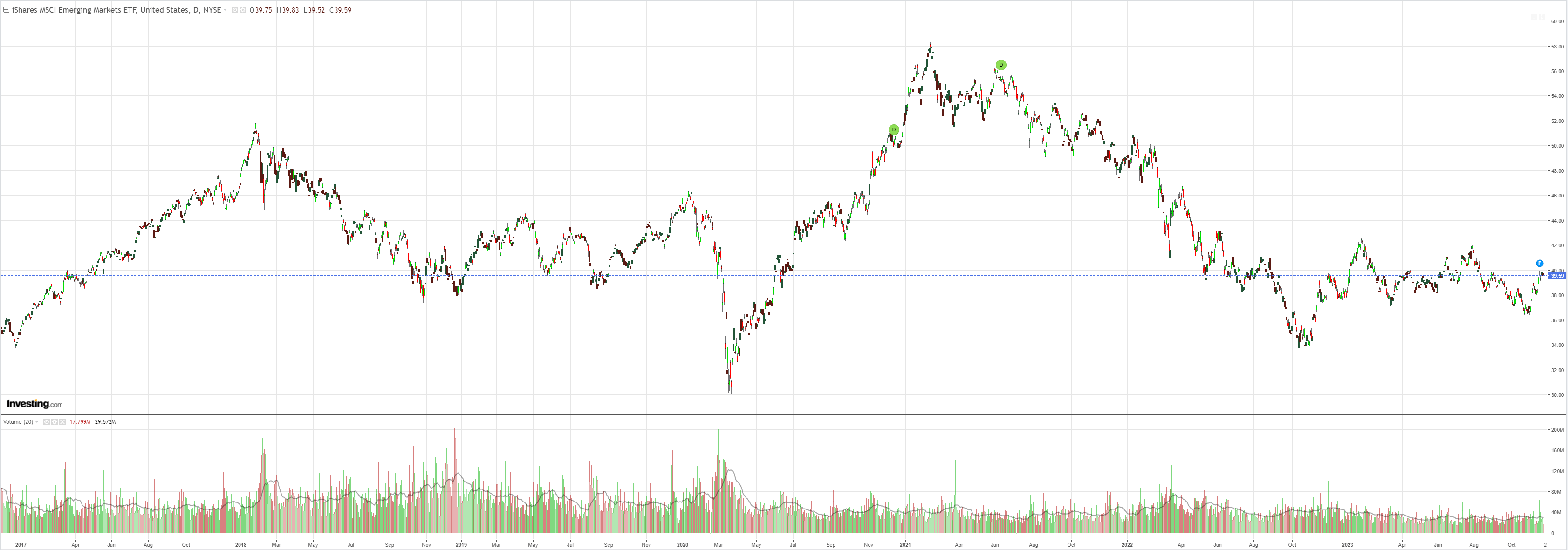

EM faded:

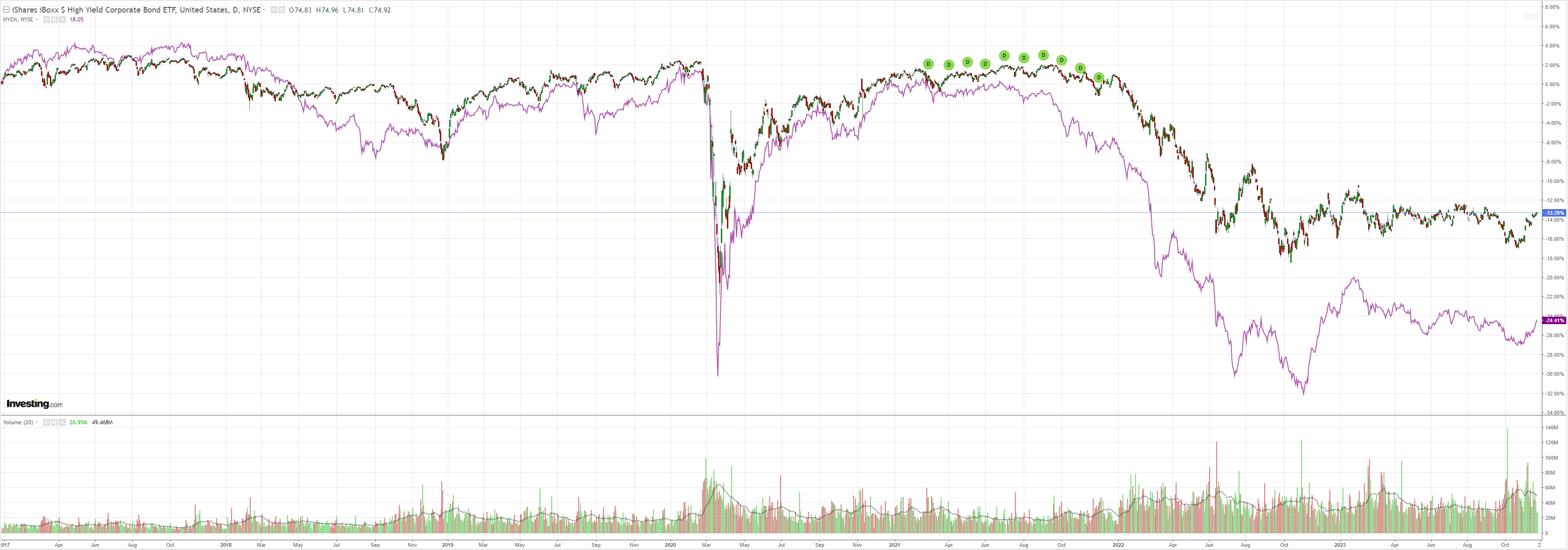

EM junk is offering bullish hope:

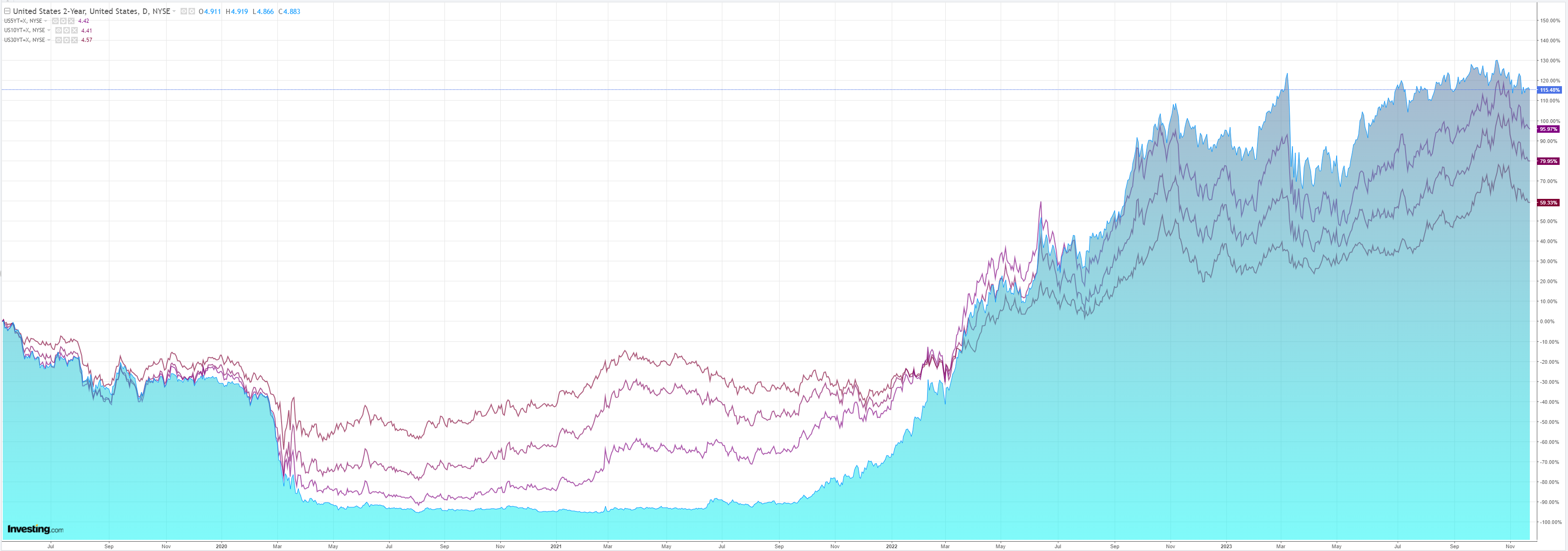

As yields come off:

Stocks stalled:

Societe General has more:

It’s as if someone announced that a soft landing is a done deal, sucking all the energy out of rates and equity markets, and dumping it on the FX market! I’m not complaining, because the FX market has been the poor relation when it comes to stuff happening of late, but I’m also not counting on this signalling the start of a major long-term rebound for FX vol. Still, with the SG Sentiment indicator settling at a high level (93on a0-100 scale today, down from a peak of 95 a week ago) we’re in a dollar-unfriendly environment and after a long period where it reigned supreme, any turn must come with at least temporary volatility.

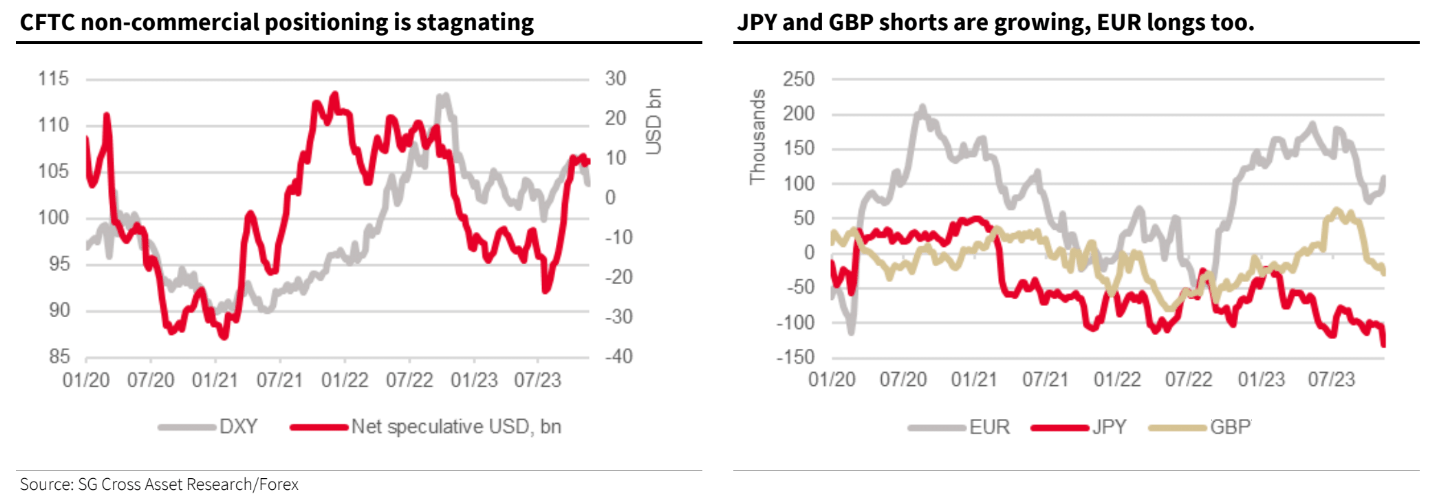

FX positioning data shows the Dollar falling despite net longs (as of lastweek) remaining stable. Digging down a bit further (in the right-hand chart), we see GBP and JPY shorts growing, while EUR/USD longs are also recovering. That’s a bit counter-intuitive, even if it matches what we saw in the week to November 14, with EUR doing better than GBP or JPY. What the positioning data does do however is highlight firstly that the speculative market remains just about net long USD overall and more importantly, very short JPY. This morning’s top G10 currencies are NZD, AUD and JPY, while the top EM currencies are TWD, CNH and KRW, which does hint at Monday morning reduction in short positions in AsianFX.

Speculators still long DXY is bullish for higher yet in this AUD move.