DXY was stable:

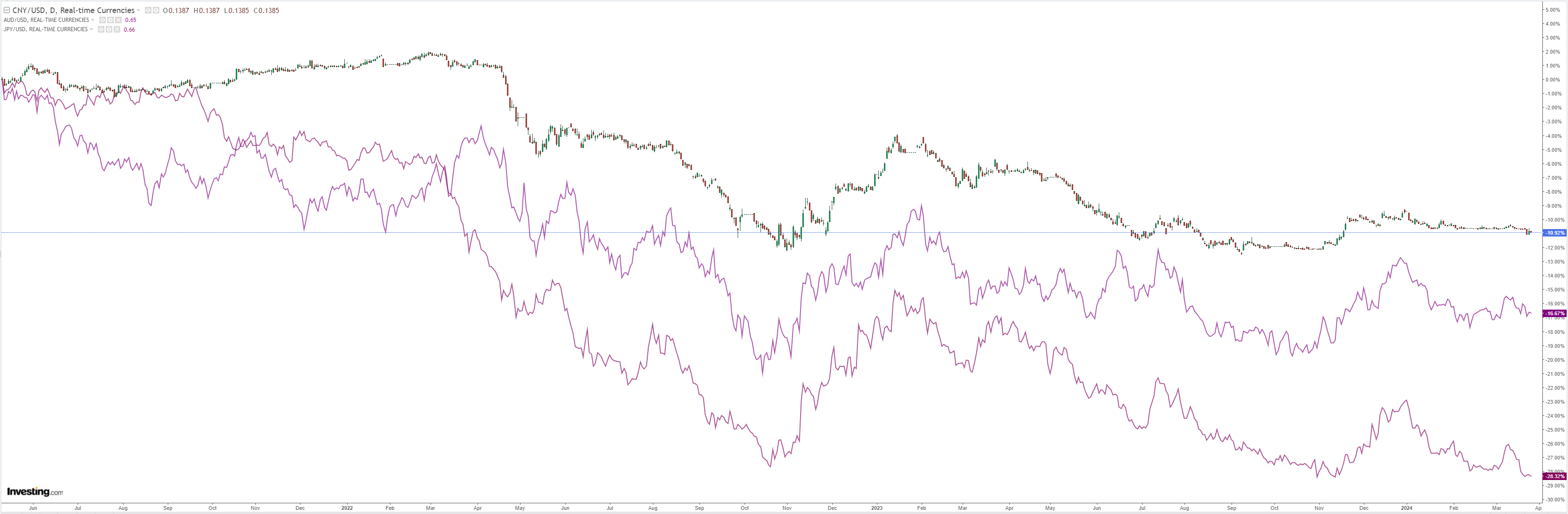

AUD fell:

North Asia is hanging on:

Oil and gold eased:

Metals meh:

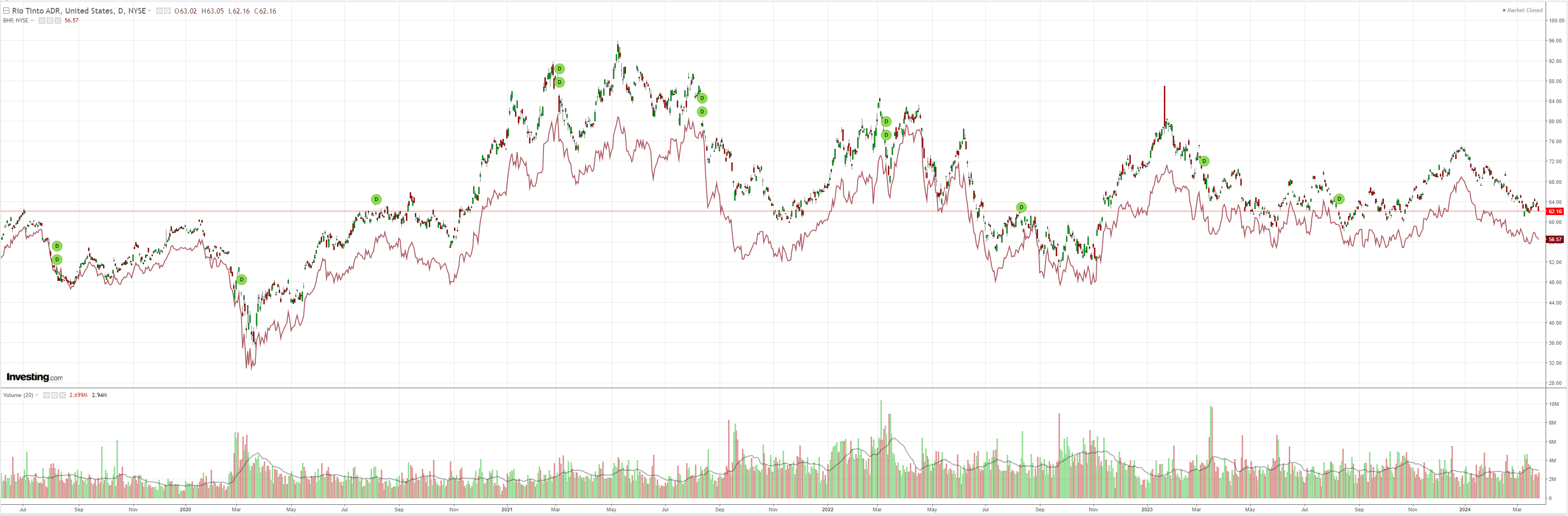

Big miner’s headed for big retest:

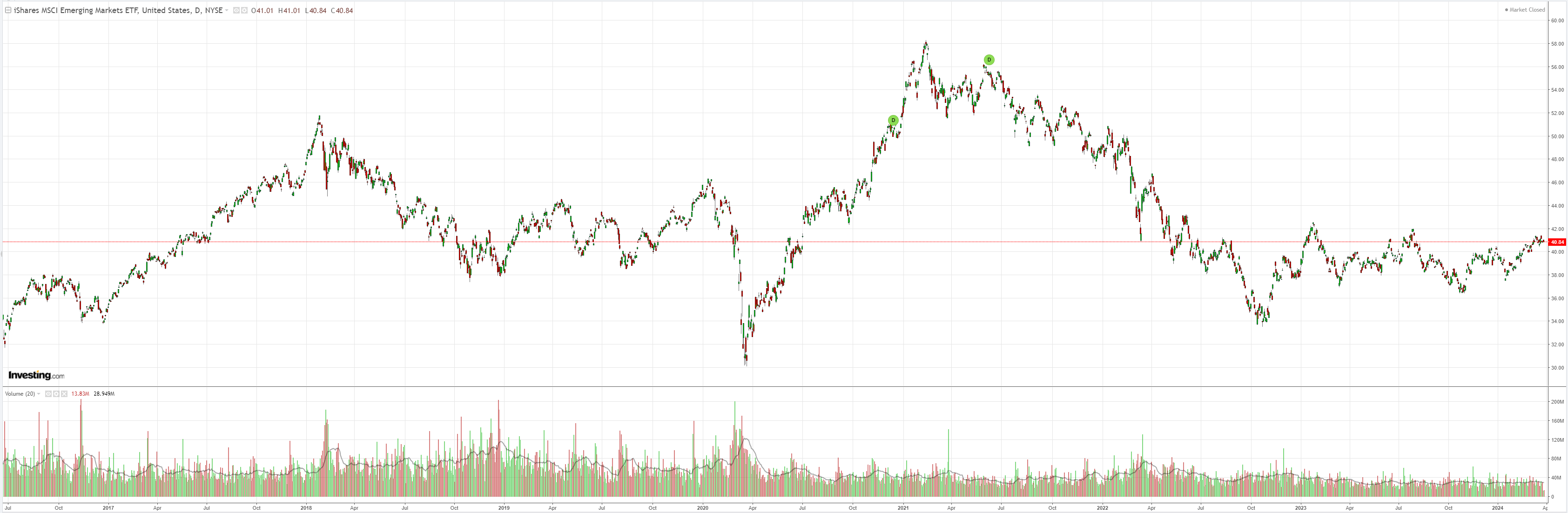

EM yawn:

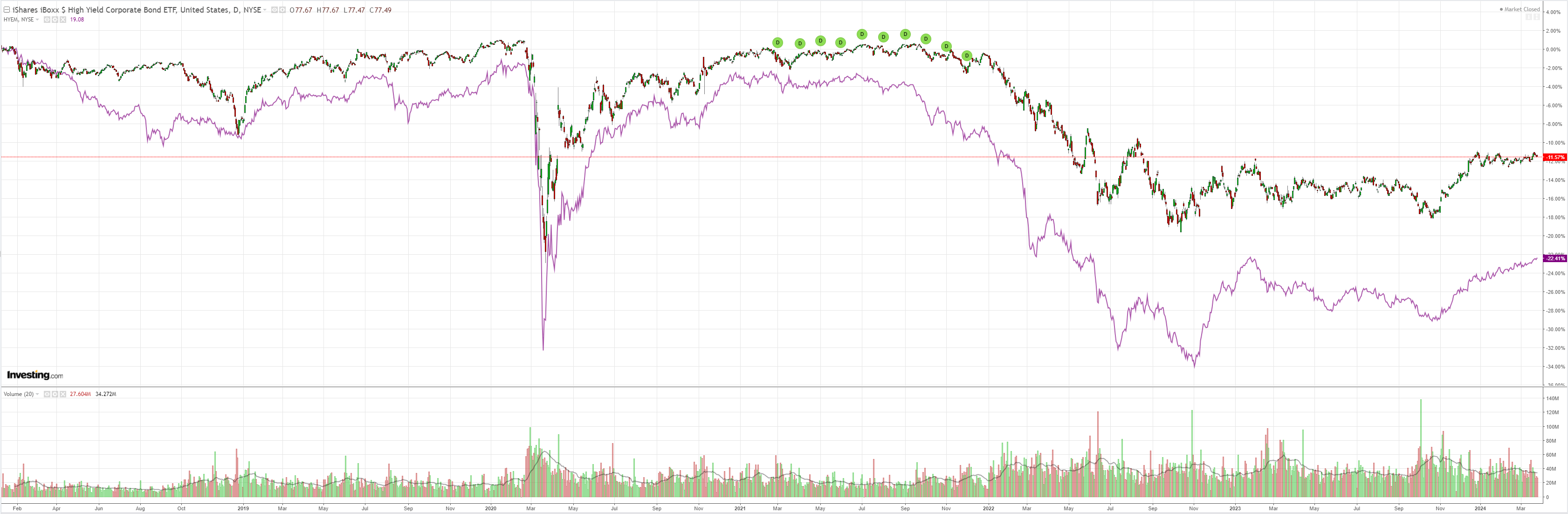

The junk bull gallops on:

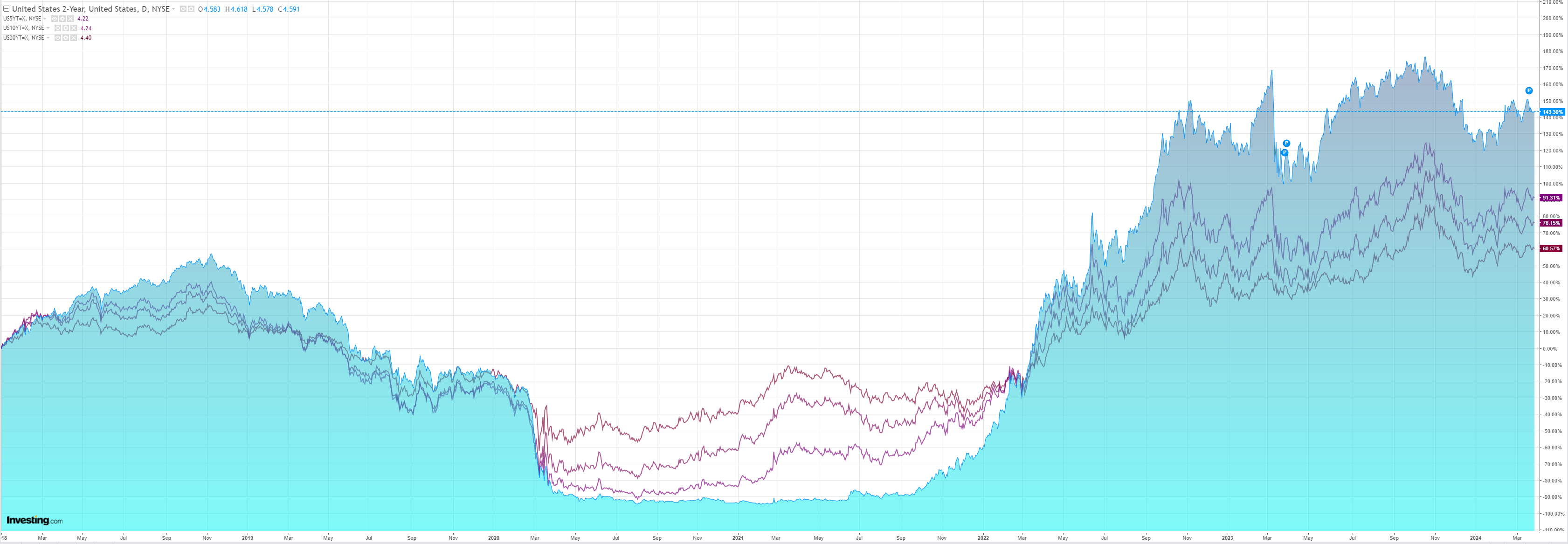

Yields eased:

Stocks too:

Credit Agricole (EPA:CAGR) says it’s all about Taylor Swift:

The PBoC beginning to stand in the way of further CNY weakness by fixing USD/CNY lower has led to a bit of a bounce in the AUD.

The AUD acts as a G10 proxy for investors to express their views on the CNH.

Investor attitudes towards China will remain a key driver of the AUD in the coming quarters and our China economist continues to expect little in the way of fiscal stimulus with policymakers tending to lean on monetary easing to try and boost growth.

Such a policy mix is not a positive for the AUD. Official China manufacturing PMI data later this weekis expected by our economist to show a modest bounce and reinforce cyclical data released last week showing the economy could be finding a bottom.

This would be some positive news for the AUD.

Taylor Swift’s Eras Tour reaching Australia in February will impact this week’s CPI and retail sales data. Australia’s monthly CPI reading, released Wednesday, will likely bounce as more services data enters the monthly survey and Swift’s tour leads to higher travel and accommodation costs.

Higher petrol prices will also offset a further retreat in food prices while home building costs as well as rising rents and insurance premiums will remain underlying supports for inflation.

While the quarterly inflation data are more important for the RBA outlook, the monthly inflation data should reinforce the strong labour market data from last week in suggesting rate cuts in Australia are a long way off.

Gosh:

- Yes, China is weighing, and the immense short makes pushing the AUD lower harder.

- That said, credit card data showed no impact from Taylor Swift, so if the market is expecting it, then the asymmetric risk for yields and the AUD is down today.

- ABS UE numberwang will catch up soon enough to a very loose labour market, and it will rain rate cuts in H2.

And, just in case you need to throw up your breakfast, here’s your morning Ipecac: