DXY was soft overnight:

AUD firmed:

Oil is a falling meteorite. $70 support here we come:

Dirt loves China:

But miners (NYSE:RIO) fell with iron ore:

EMs stocks (NYSE:EEM) too:

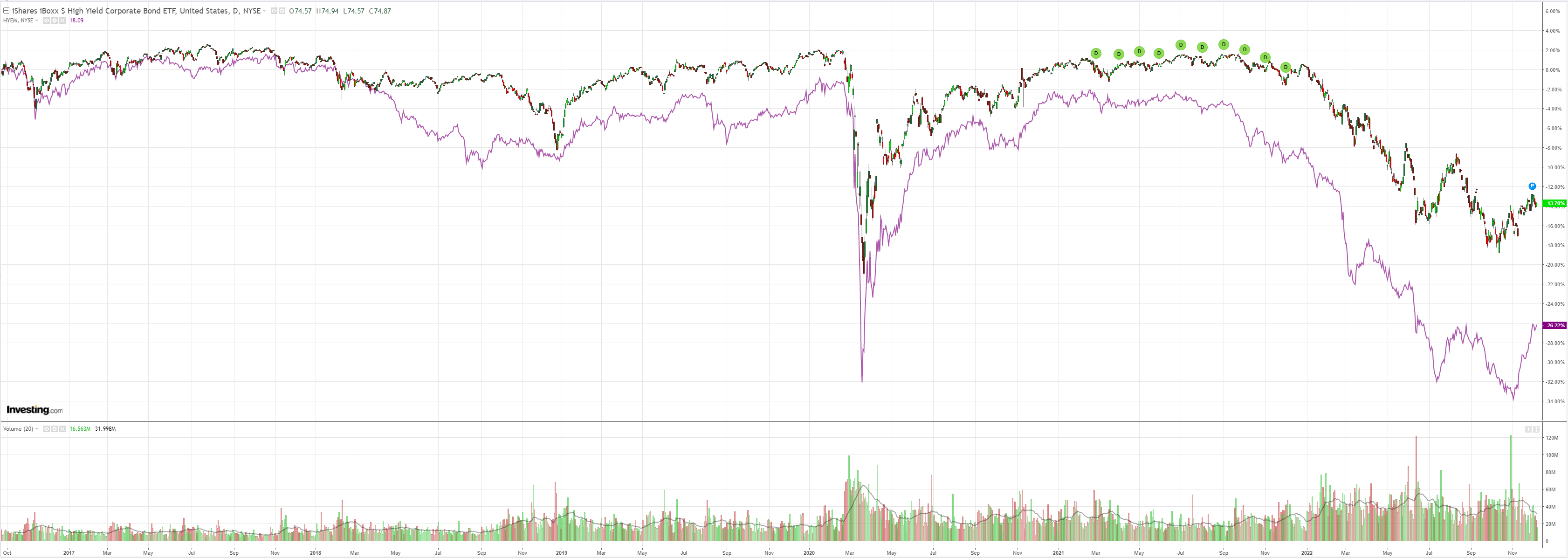

But EM junk (NYSE:HYG) is still warm:

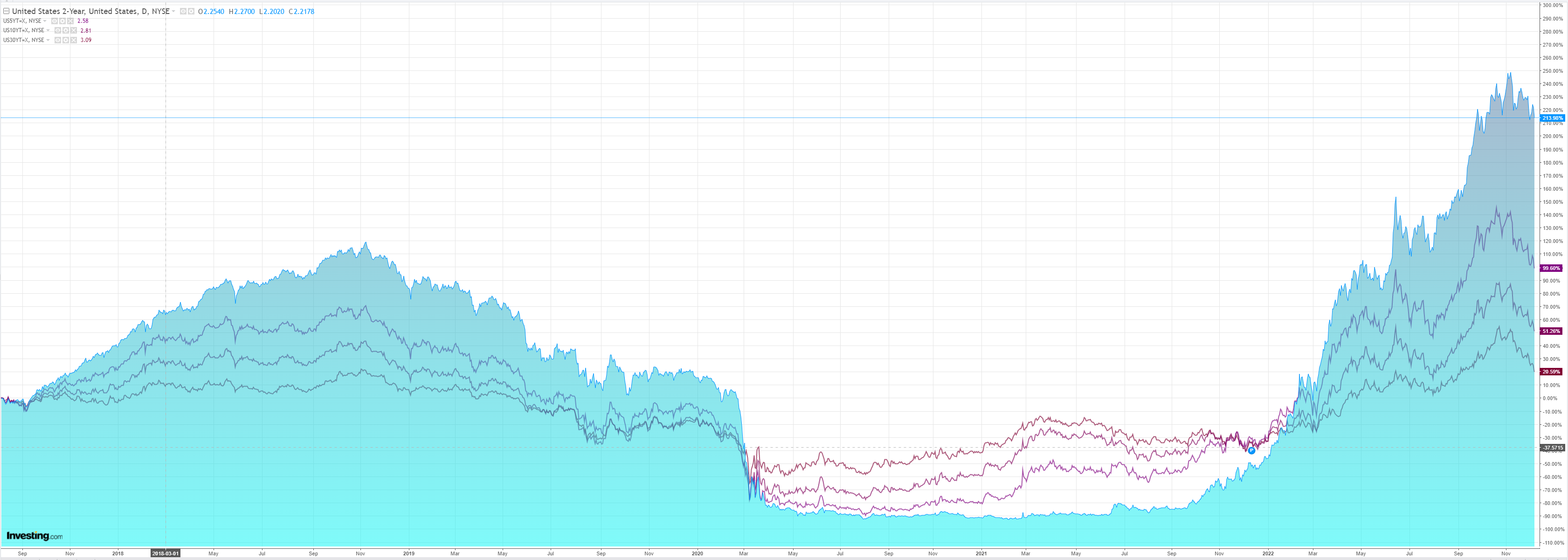

As US yields sink with oil:

As do stocks:

This week has seen a major phase shift in market dynamics. Oil is beginning to price US and global recession. This is triggering a sizable bond bid and falling yields as inflation expectations fall, and we approach the next US CPI which is likely to be soft again at the headline level.

Until this week, this would have also triggered a stock bid. But we are now toying with a recessionary regime and stocks are falling on worries over earnings on top line weakness (recession), as well as falling inflation (crushed margins).

In short, good news is bad news and bad news is bad news.

This is not a market regime in which the AUD will do well but DXY may do even worse, at least until it gets unruly, which is my expectation.

Hang on to your hats. We have begun to price global recession 2023.