DXY got spanked last night:

AUD popped but dropped:

North Asia took off:

Oil and gold up:

Base metals sold on deflation:

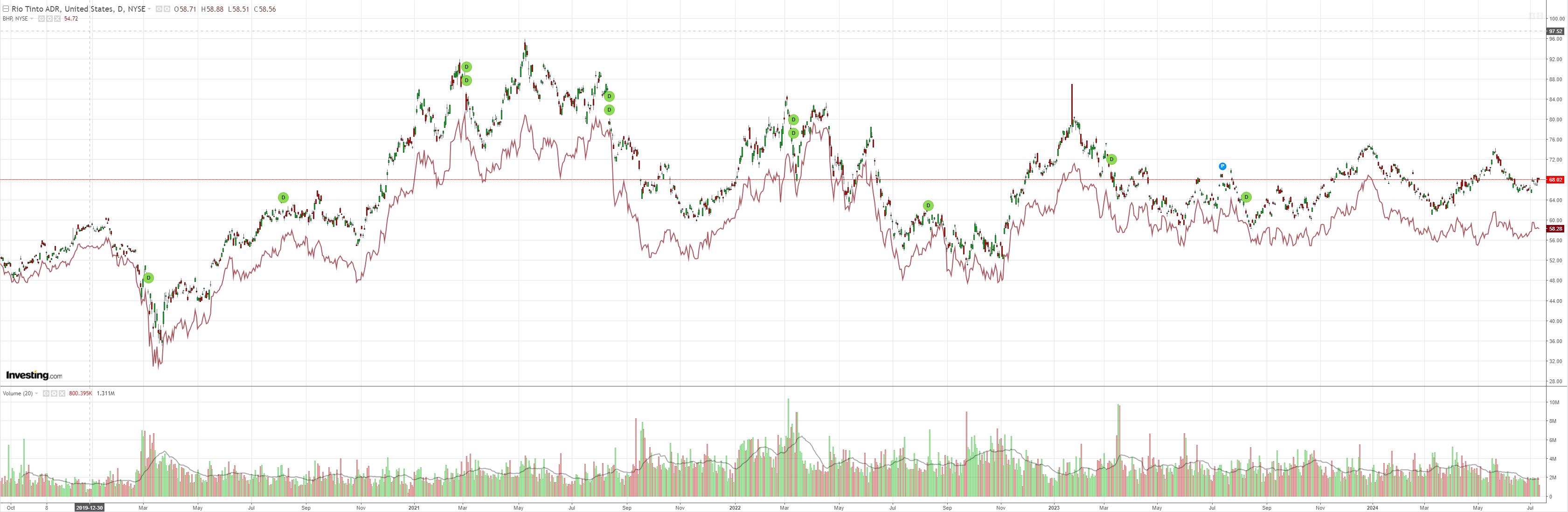

Miners meh:

EM rocket:

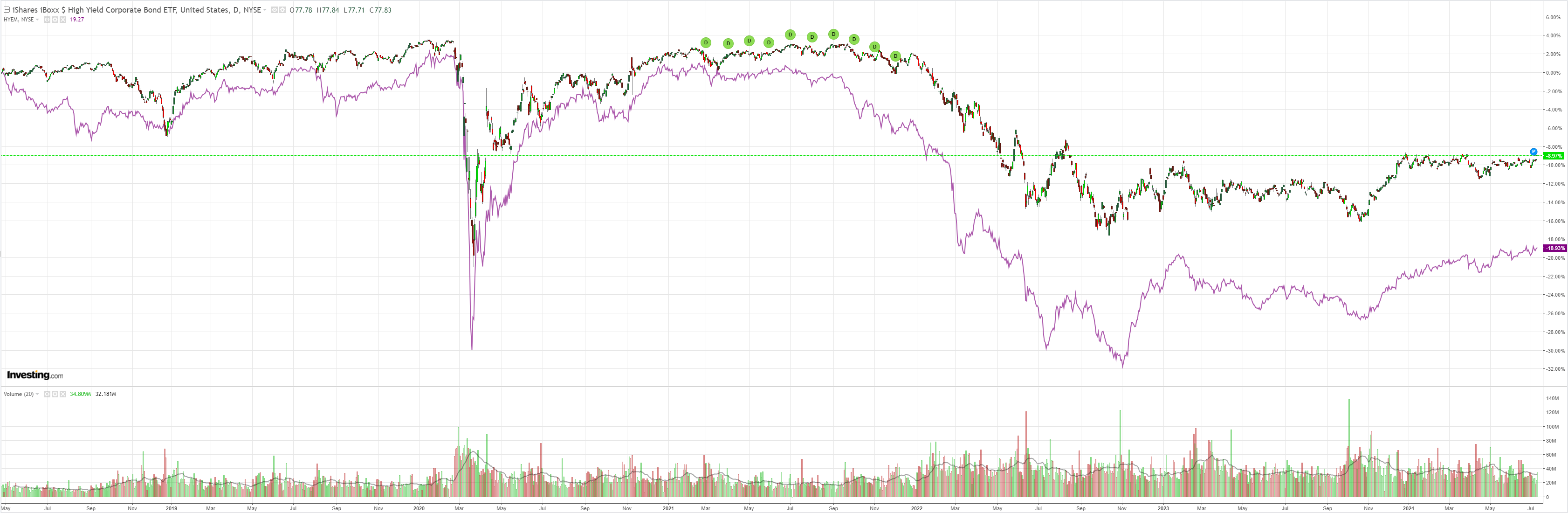

Junk a bit:

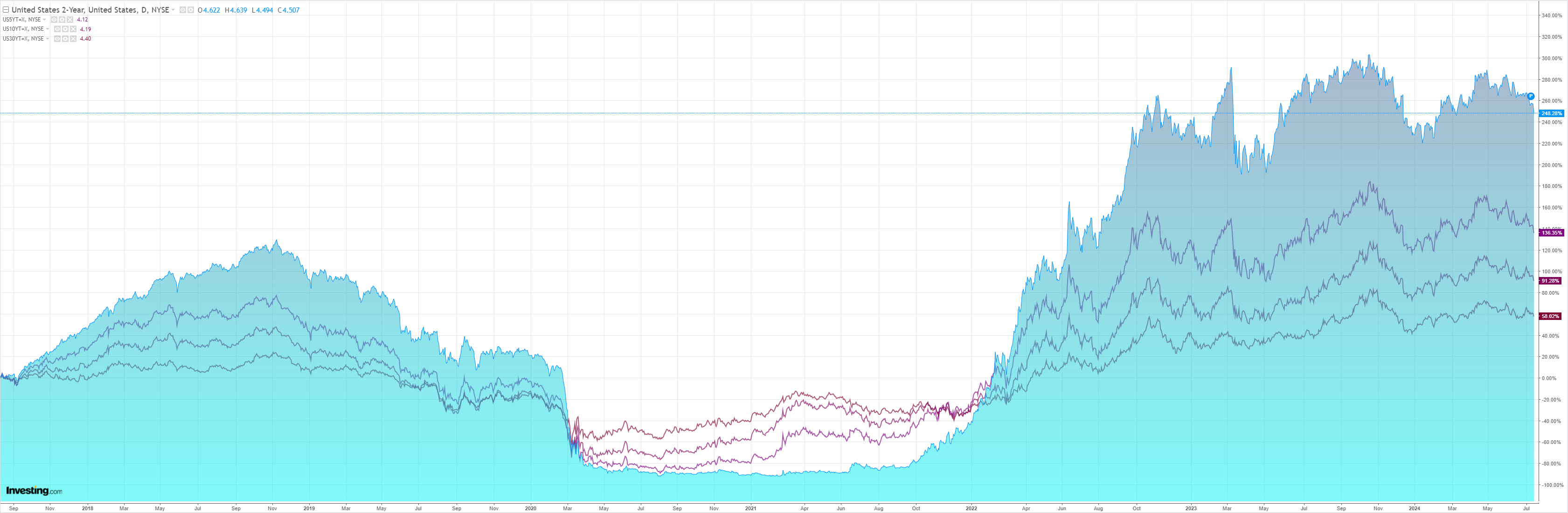

With US yields finally break the uptrend?

Stocks sold the first cut:

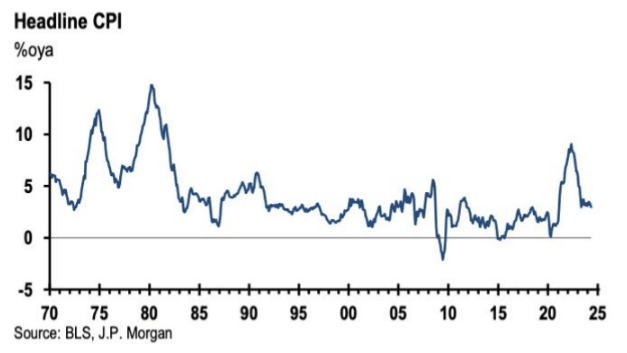

JPM wraps the US CPI:

Sticky inflation is coming unglued

The Jue CPI report was very benign. The headline figure fell 0.06% (expected up 0.1%) and the core figure was up only 0.06%.

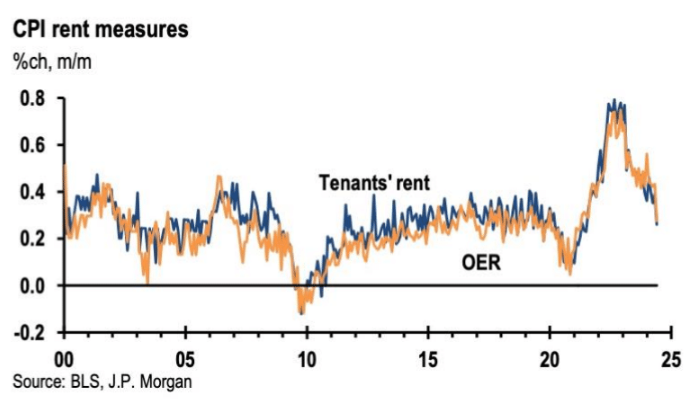

Within the core component, the long-awaited slowing of both tenant’s’ and owners’ equivalent rental inflation took place last month as the monthly increases skidded to low-side 0.3% increases after running 0.4% increases much of the prior six months.

Core services ex-rents slipped 0.05%, the second consecutive decline.

Core goods prices slipped 0.1%.

Today’s report is, to use Powell’s words, “good news” and we now think this paves the way for the first cut in September followed by quarterly cuts after that.

I think we cut faster. Inflation is cooked and a growth scare is next.

AUD up for now but high-beta means any growth issues prevent it from running away.