DXY was firm last night:

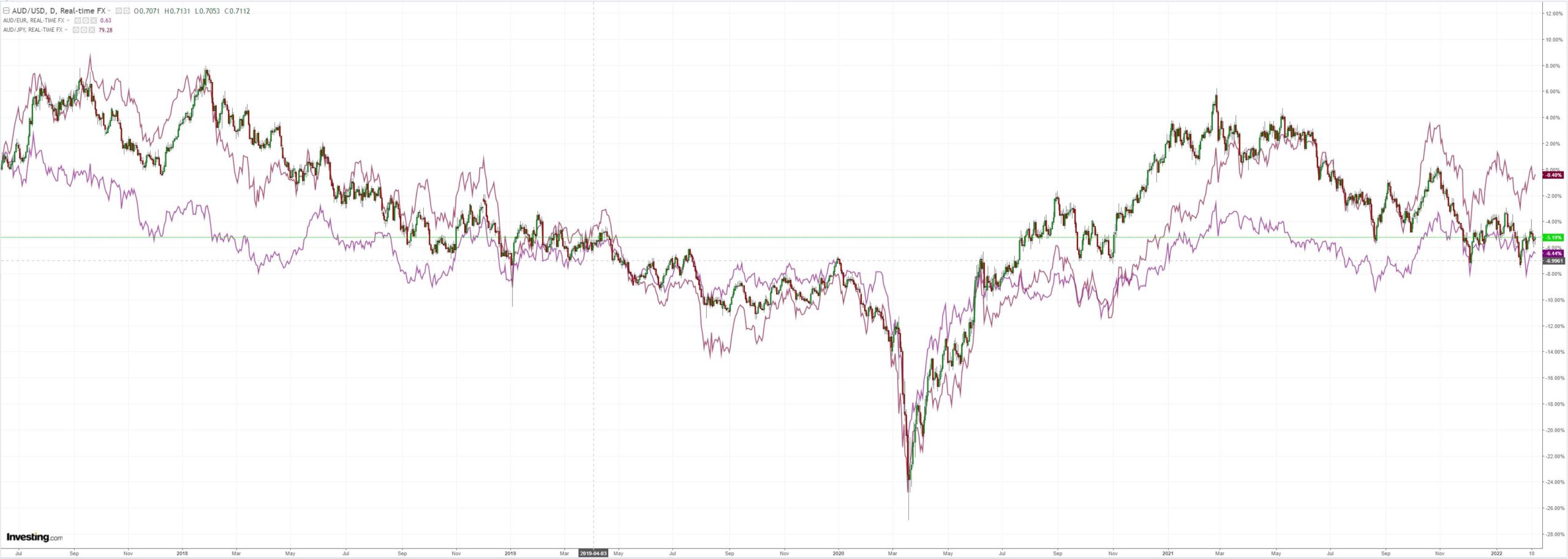

AUD was too:

Base metals were firm:

Big miners (LON:GLEN) were hit by iron ore. The entire segment ex-GLEN is now an iron ore play:

EM stocks (NYSE:EEM) were soft:

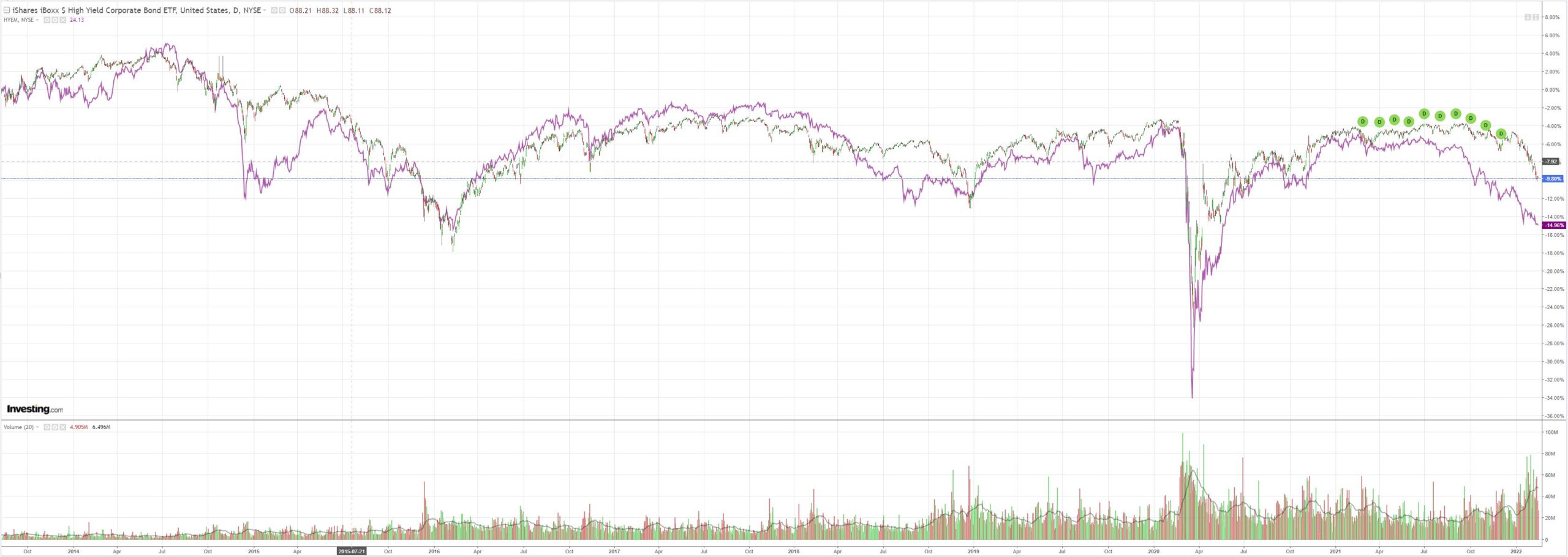

Critically, junk (NYSE:HYG) keeps falling:

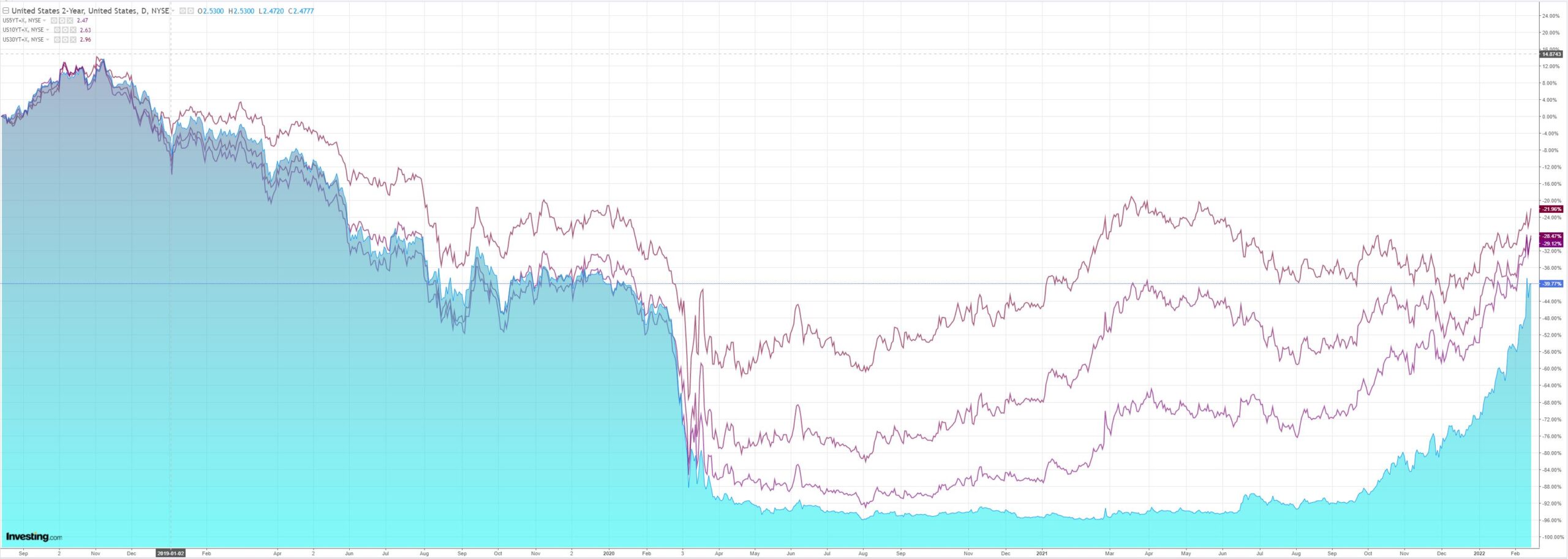

The curve steepened for once!

But stocks rallied on Russian relief:

Westpac has the wrap:

Event Wrap

US PPI inflation was stronger than expected in January, headline PPI up 1.0%m/m and 9.7%y/y (est. +0.5%m/m and 9.1%y/y, prior revised from +9.7%y/y to +9.8%y/y). The core measure rose +0.9%m/m and 6.9%y/y (est. +0.4%m/m and 6.3%y/y, prior revised to +7.0%y/y from 6.9%y/y). The Empire Fed manufacturing survey undershot expectations with a rise to 3.1 (est. 12.0). However, prices received were surprisingly strong (54.1 vs 37.1 expected, the highest in this series which began in 2001).

Eurozone Q4 GDP was unchanged from its initial reading of 4.6%y/y. ZEW expectations surveys slightly undershot, with German current conditions at -8.1 (est. -6.5, prior -10.2) and expectations at 54.3 (est. 55.0, prior 51.7), and Eurozone current conditions at +0.6 (-6.2 prior) and expectations at 48.6 (49.4 prior).

UK labour data was solid. Unemployment in December was steady at 4.1% (as expected) with employment falling 38k (est. -58k). Average weekly earnings rose 4.3%y/y (est. 3.8%y/y).

Event Outlook

Aust: The Westpac-MI Leading Index likely remained weak in January as the six-month annualised measure continued to cycle out of the delta shock.

China: Consumer inflation is expected to remain weak in January (market f/c: 1.0%yr) despite intense supply-side pressures as evinced by producer prices (market f/c: 9.5%yr).

Eur/UK: With the broad-based easing of supply pressures still absent, European industrial production is set to remain weak in December (market f/c: 0.3%). Meanwhile, CPI inflation in January is expected to remain near 30-year highs for the UK (market f/c: -0.2%mth; 5.4%yr).

US: January retail sales are anticipated to rebound from the fall in spending due to omicron (market f/c: 2.0%). Given ongoing supply issues, industrial production is set to remain volatile (market f/c: 0.5%) and import prices should continue to remain elevated (market f/c: 1.2%). Business inventories are expected to build further in December as firms push through supply issues (market f/c: 2.0%). Meanwhile, the FOMC’s January meeting minutes will be scrutinised for any details regarding the Committee’s views on inflation and the path for rates in 2022.

Russian games continue:

Vladimir Putin eased tensions in the Ukraine crisis on Tuesday, drawing down some Russian troops from border areas to enable “dialogue” with the west while still keeping the threat of invasion hanging over his neighbour.

Russia’s president said he was prepared to hold negotiations on intermediate nuclear missile forces and confidence-building measures with the west if the US and Nato agreed to discuss Moscow’s grievances with the transatlantic alliance — including its chief demand that it pledge never to admit Ukraine.

The comments, made after three hours of talks with German chancellor Olaf Scholz, were Putin’s strongest indication yet that Russia is ready to de-escalate despite western warnings of Moscow’s plans for a renewed invasion of Ukraine.

That was enough for the relief rally.

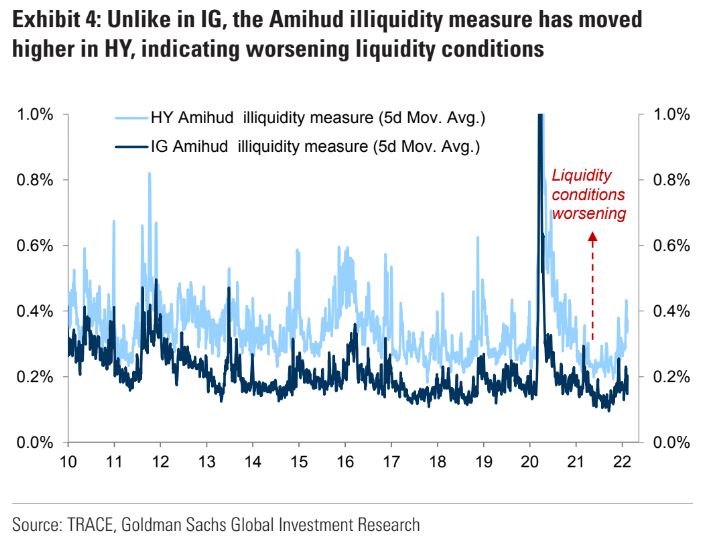

But be warned, so long as global junk debt runs lower, the rest of the market will follow, both stocks and the AUD. It always does. The liquidity risk is rising fast: