Street Calls of the Week

DXY sagged on soft retail sales:

AUD rose on more hawkish RBA rhetoric:

No help from North Asia:

Oil is a CTA mania machine:

Saving base metals:

Miners less so:

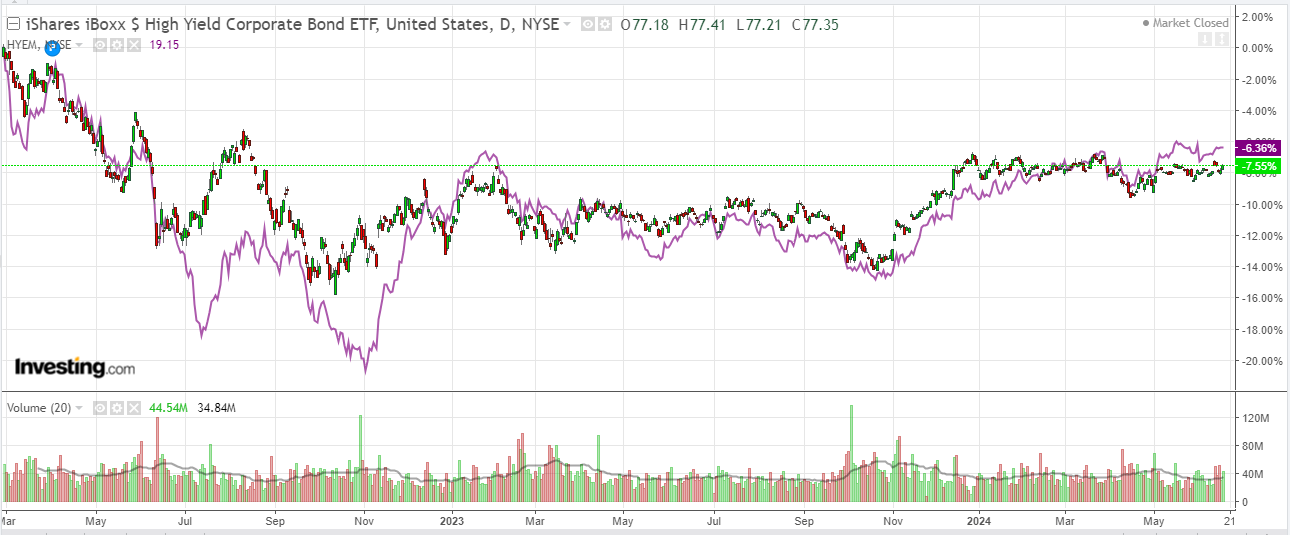

Junk has stalled. This bodes poorly for any broadening of the stock rally:

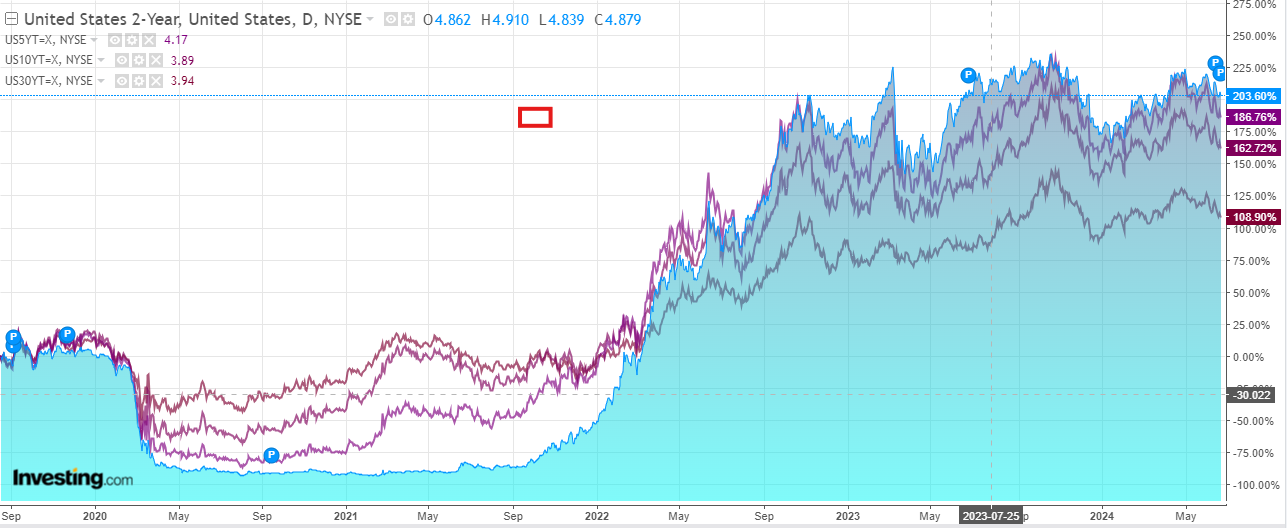

Despite falling yields:

Stocks had a day off:

With European risk on the backburner for a day, the RBA’s stiffer rhetoric (not a tightening bias) played itself out in forex.

10 year Australian yields have almost flipped positive versus the US overnight, the first time since February:

However, I wonder how far this trade can get with local inflation still set to fall, Europe in crisis, China stuffed and the AI favouring the US.