DXY and EUR have been in a state of confused paralysis for 20 months. The market simply has no idea what is happening:

AUD roared back with risk:

North Asia went into hard reverse:

Oil survives again:

Copper lol:

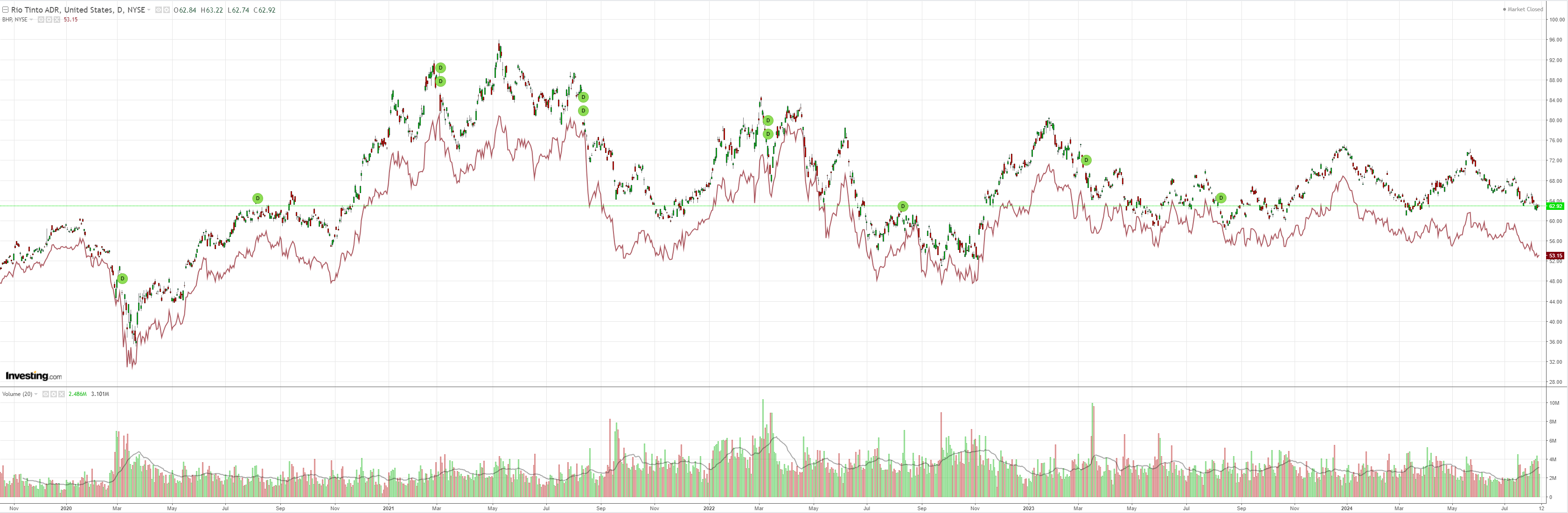

Miners are trending lower towards an iron ore cliff:

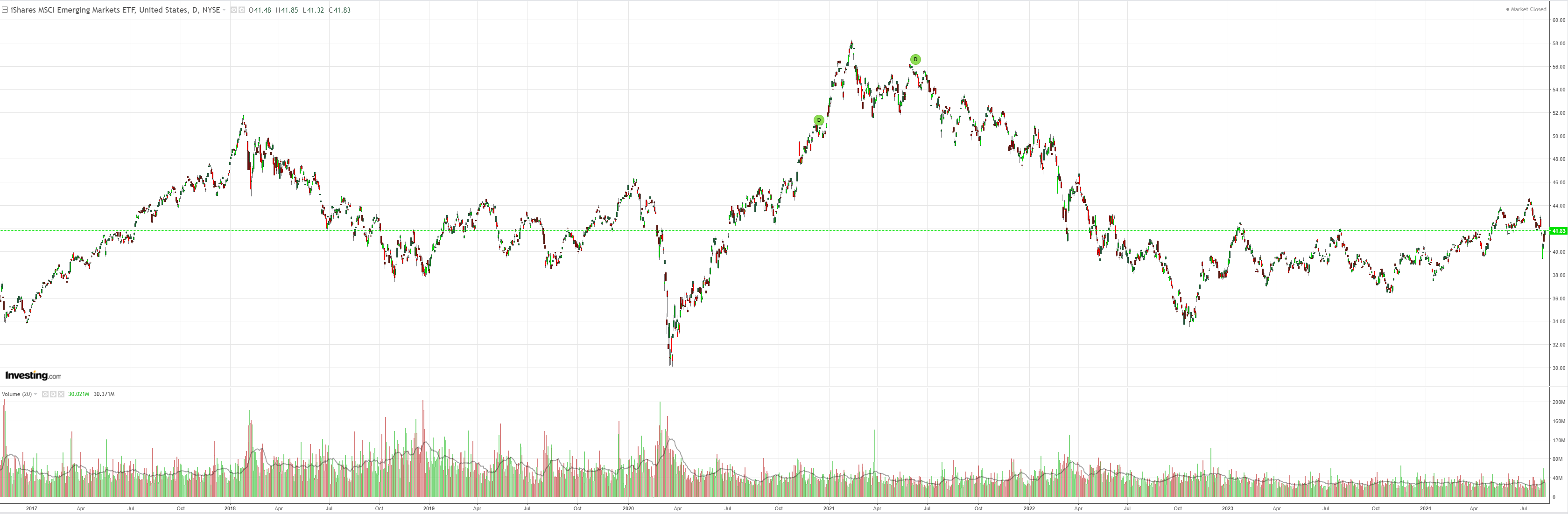

EM is very confused:

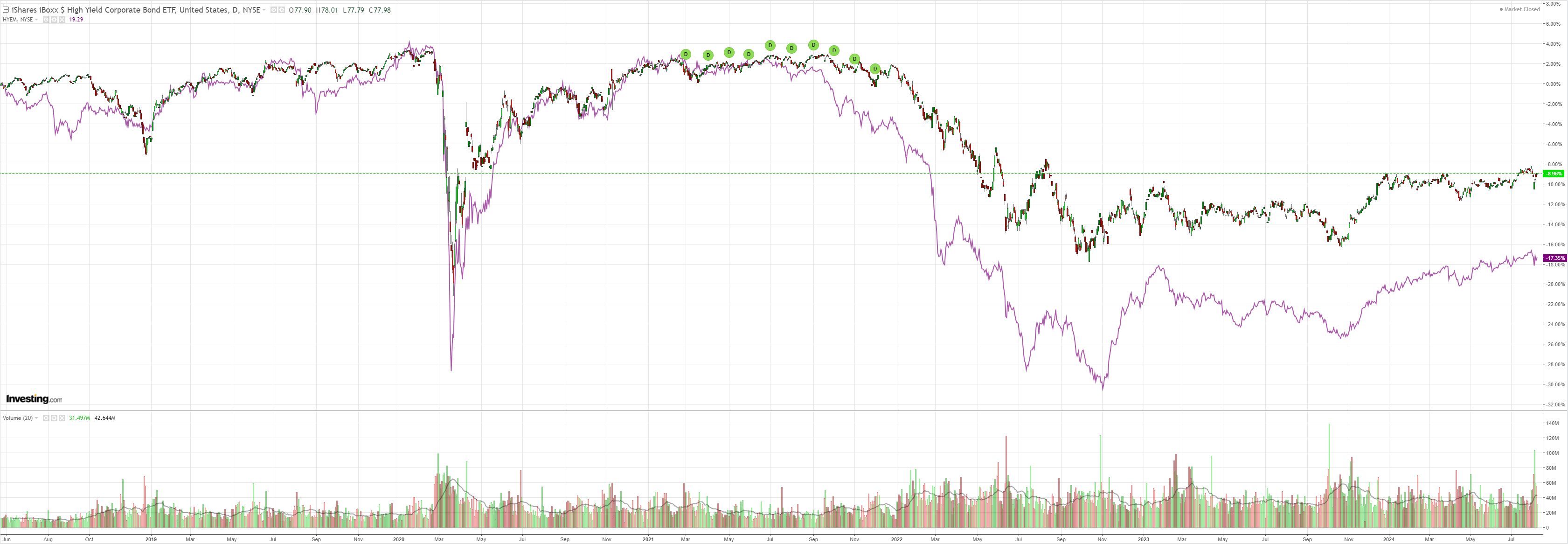

Junk spreads look frozen in fear:

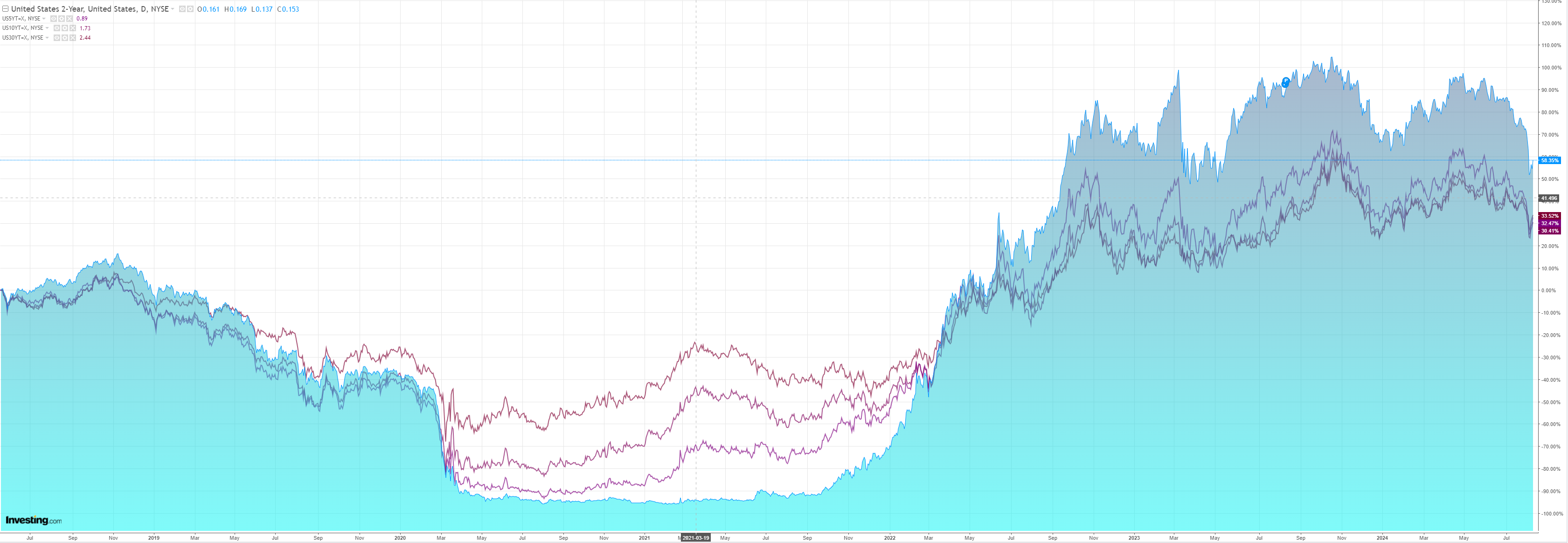

Yields gave back some rally:

As stocks took off for no reason. But the S&P has not closed that nasty island top:

We are caught in a systemics paroxism in which vol strategies blew us off, then blew us up, and are now flopping around like half-dead fish.

Good luck figuring out where we go next when minor improvements in wildly volatile jobless claims trigger hysterical gains.

What we can say is that the conditions that triggered the correction: concentration and overvaluation running aground on slowing growth and an extreme US election—have not changed.

I still think soft landing is the play if Harris wins.

If Trump were to win, that would change to a hard landing as the US dollar soared and China crashed.

Markets cannot price such binary outcomes when they are so far above their fair value.

What they can do is oscillate madly on every data point.

With the AUD to follow.