DXY was stable Friday night:

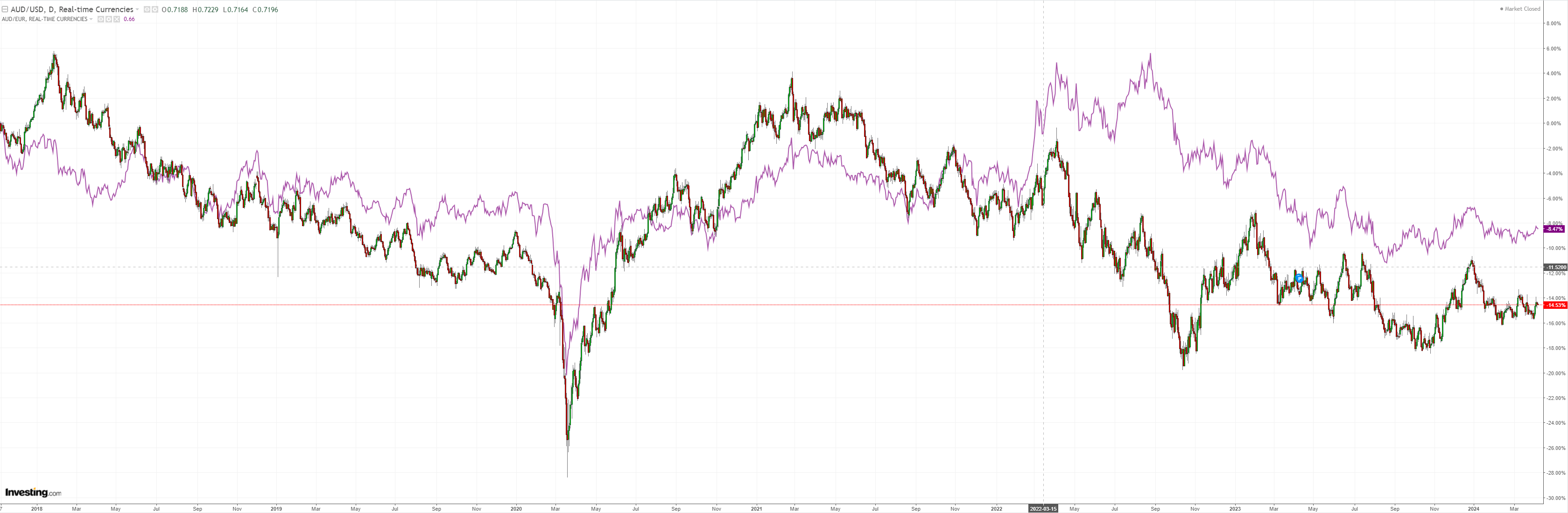

AUD the same:

No help from North Asia:

Gold and oil are wild:

Base metals are entering the same gravity well:

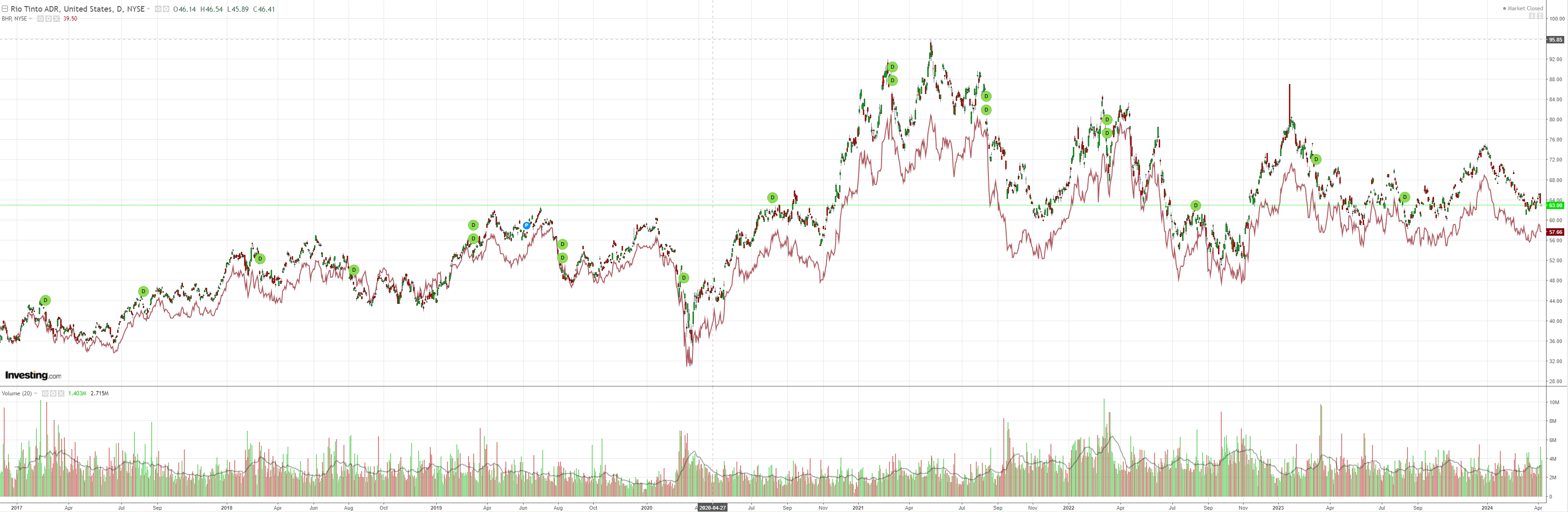

Miners went the other way:

EM still looks poised for breakout:

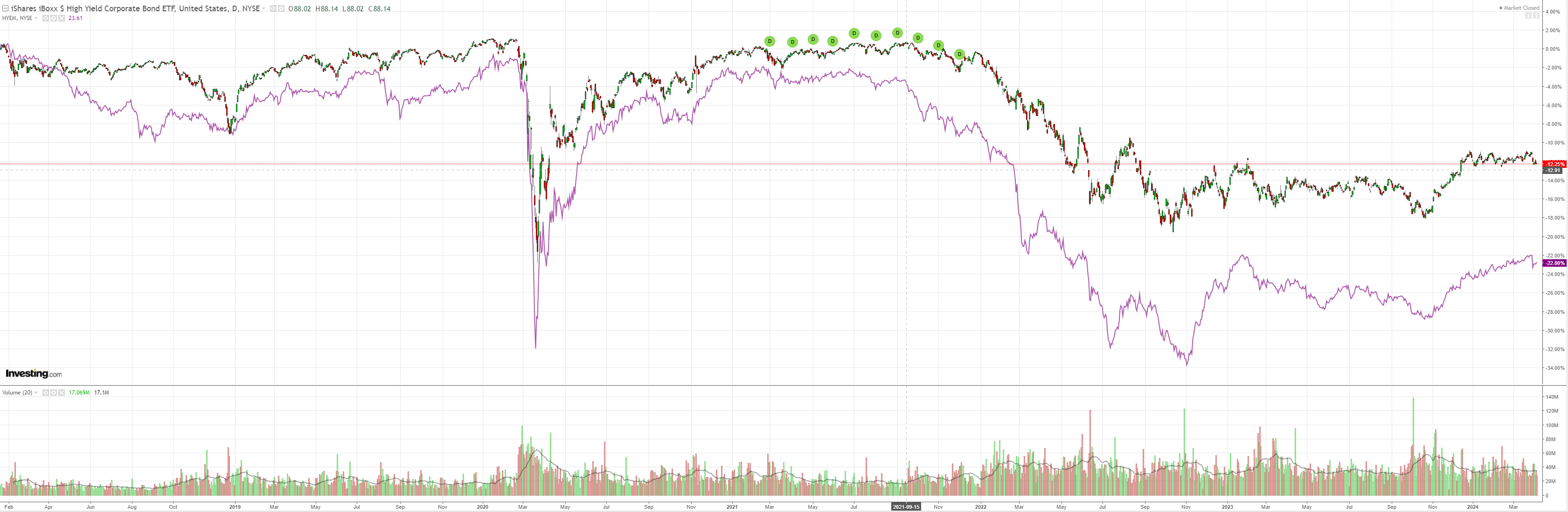

Junk firmed:

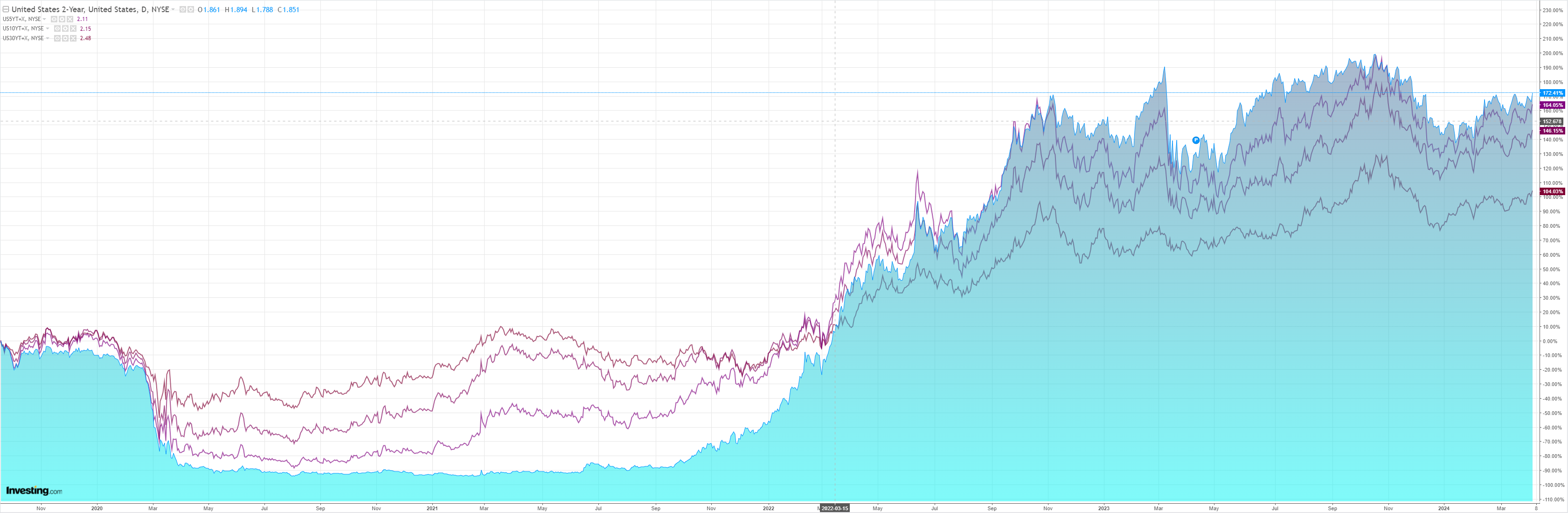

Yields are on the march:

Stocks rose anyway:

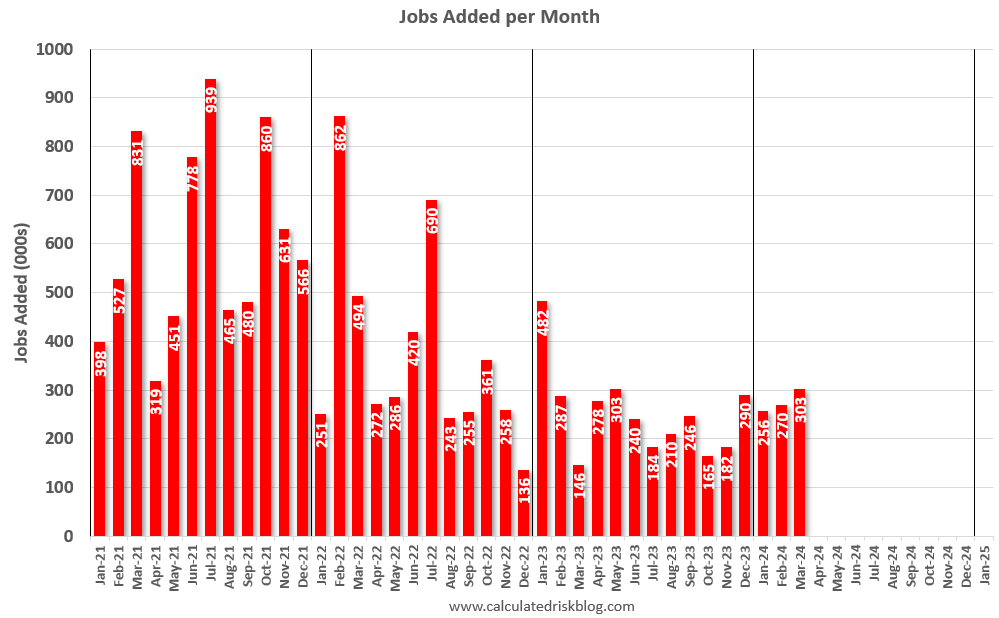

US jobs were once again strong:

Total nonfarm payroll employment rose by 303,000 in March, and the unemployment rate changed little at 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, government, and construction.

…The change in total nonfarm payroll employment for January was revised up by 27,000, from +229,000 to +256,000, and the change for February was revised down by 5,000, from +275,000 to +270,000. With these revisions, employment in January and February combined is 22,000 higher than previously reported.

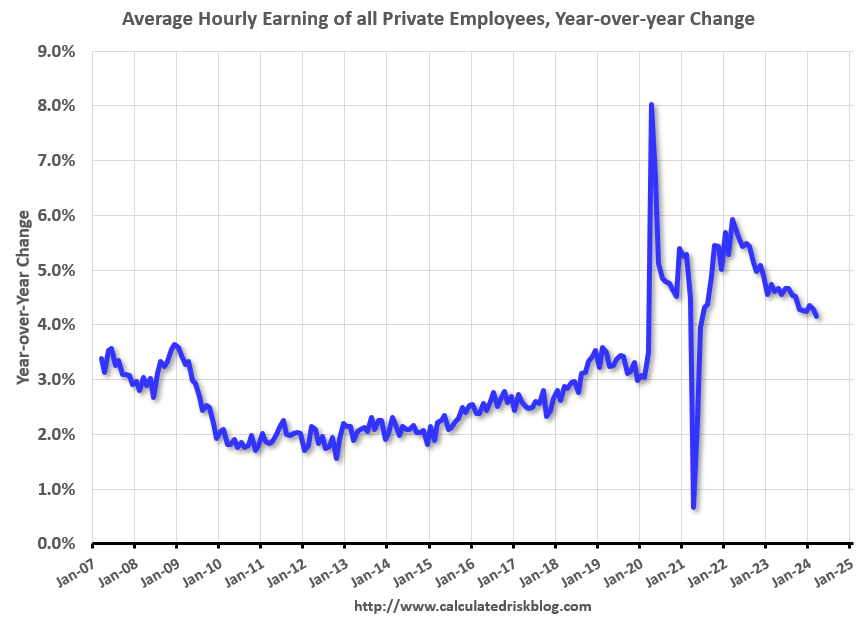

But wages were weak:

This combination has markets suddenly pricing the most unlikely scenario of the three macro cases that have been playing out for two years: no landing.

This would mean both strong profits and rate cuts, which commodities are mulling as overly reflationary, most especially via oil.

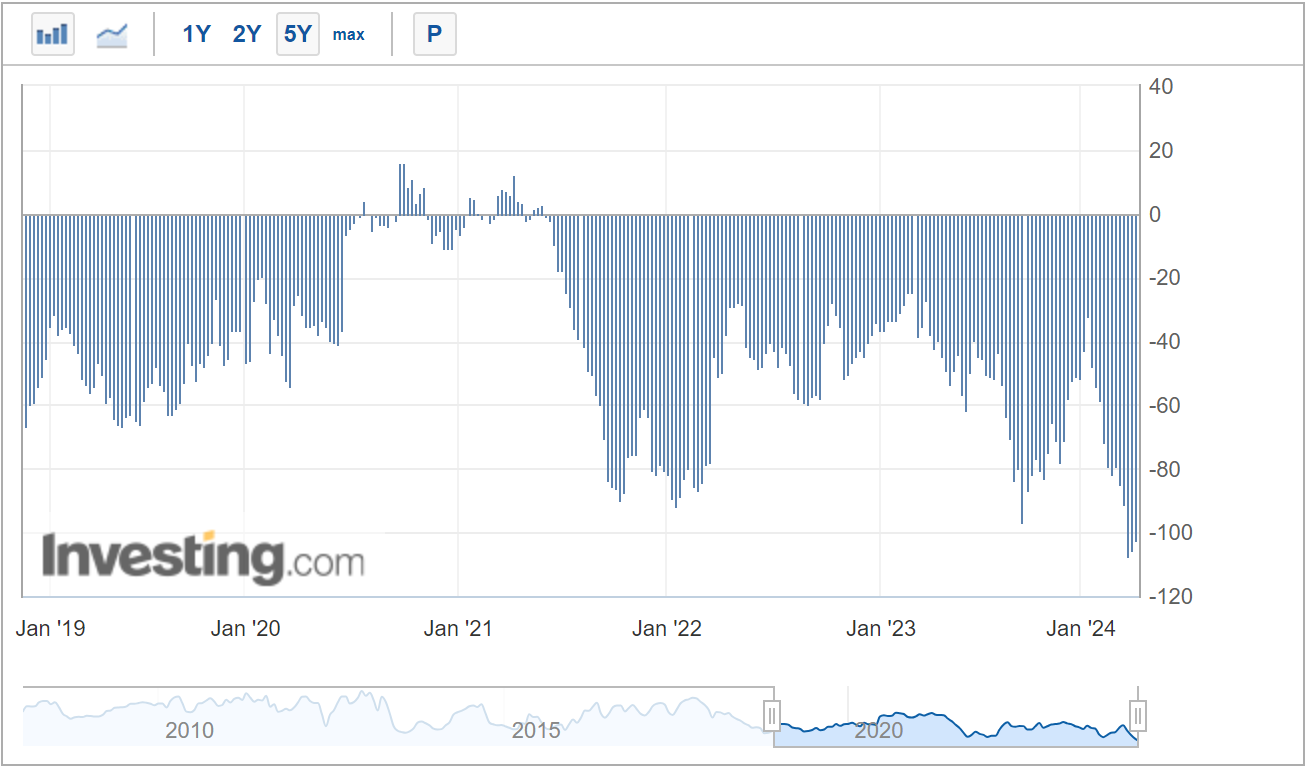

AUD could ride the golden wave of reflation for a while if it transpires, especially given the immense short:

However, the headwinds of US exceptionalism, local rate cuts, and relentless Chinese weakness remain, so I would still expect relative underperformance.