Street Calls of the Week

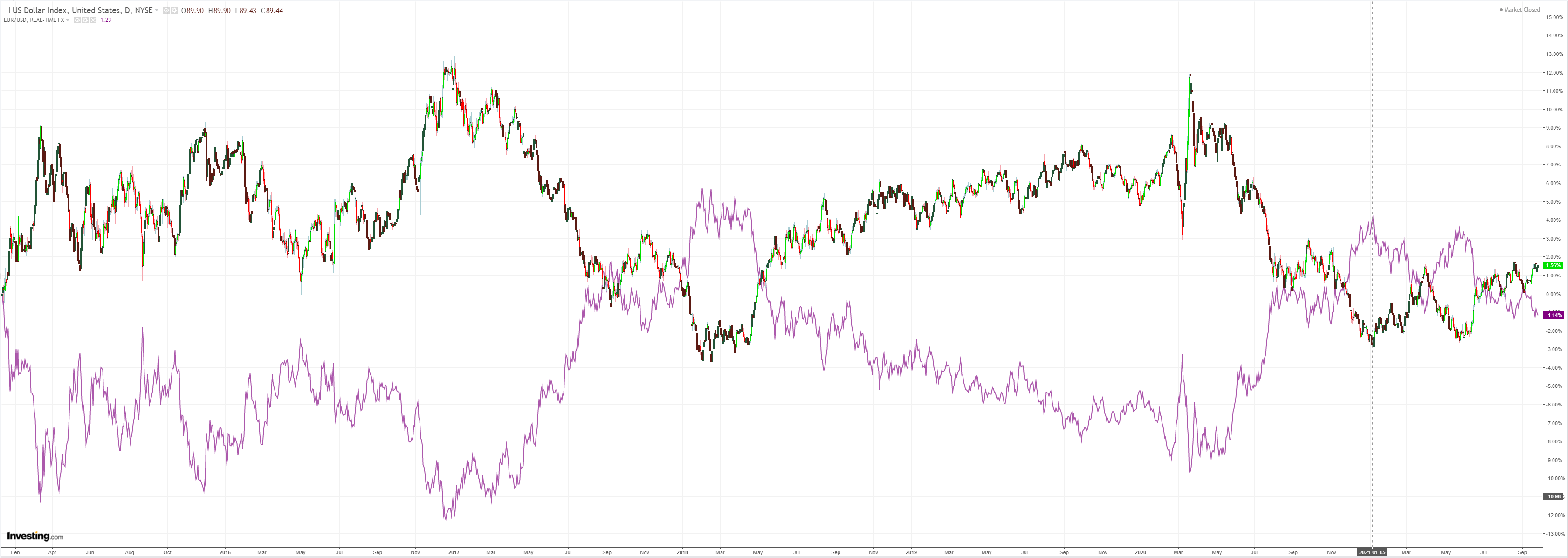

DXY was up overnight as EUR fell:

The Australian dollar was strong anyway:

The key was energy. Oil exploded:

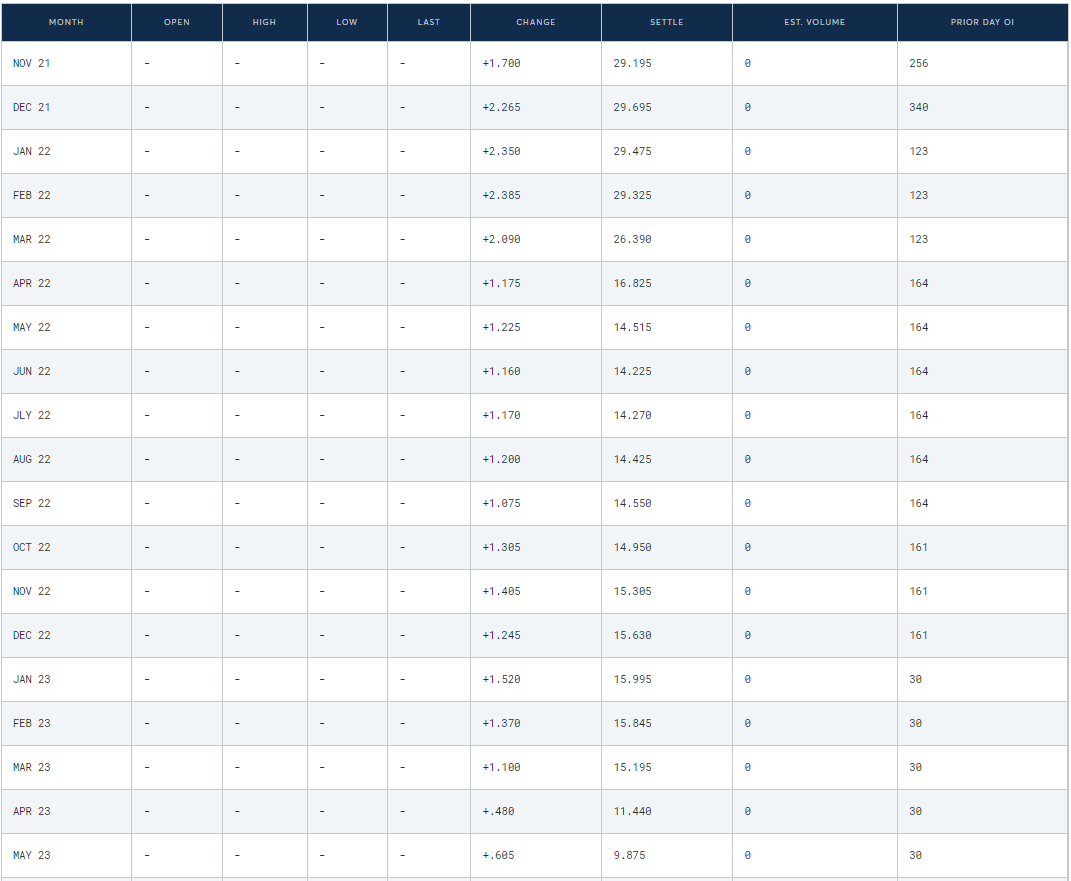

Thermal coal exploded:

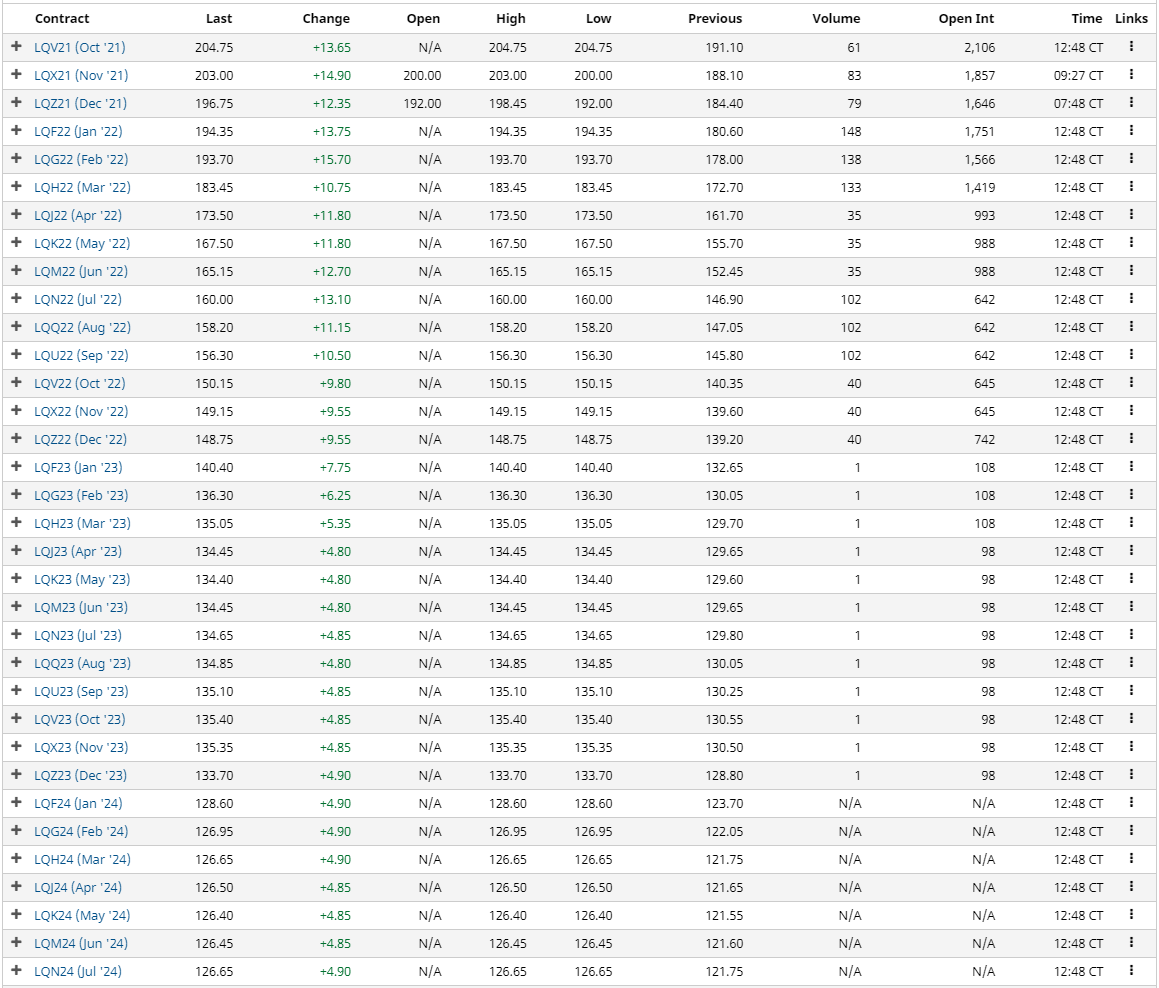

LNG exploded:

Coal adds to Australian income but oil and gas do not. They basically offset one another in the terms of trade.

Base metals were soft and why wouldn’t they be. This energy shock is going to hammer the global economy:

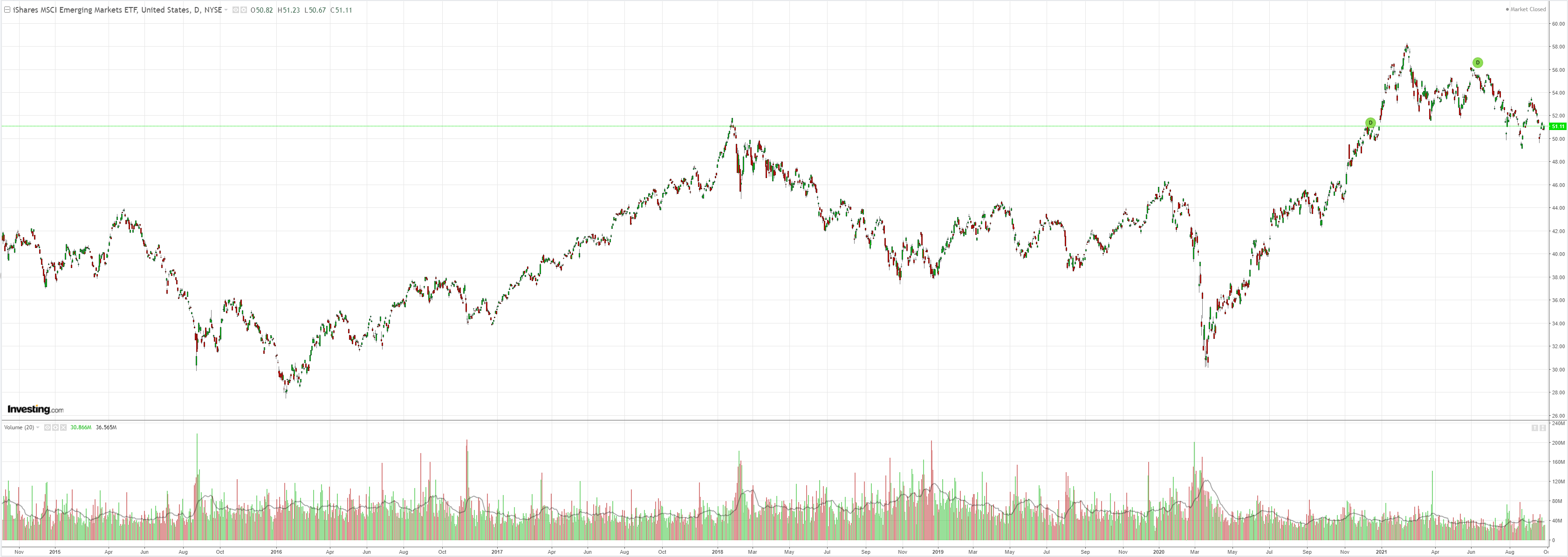

EM stocks still look precarious:

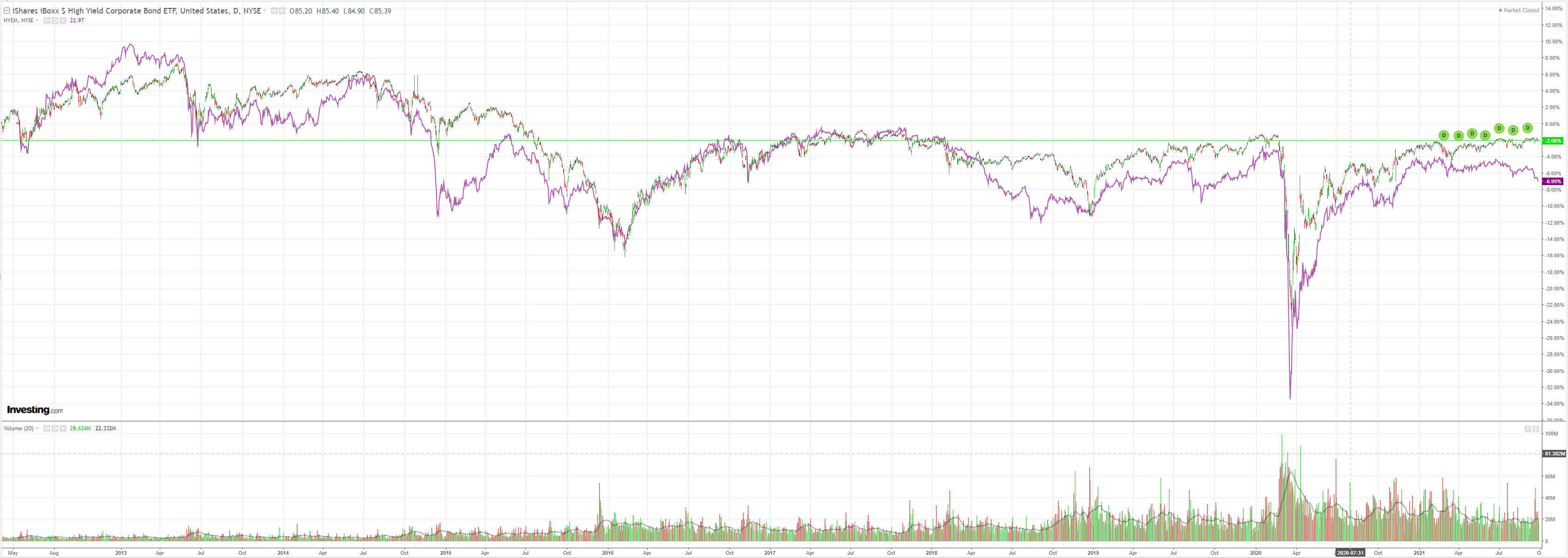

The EM junk siren is howling a warning:

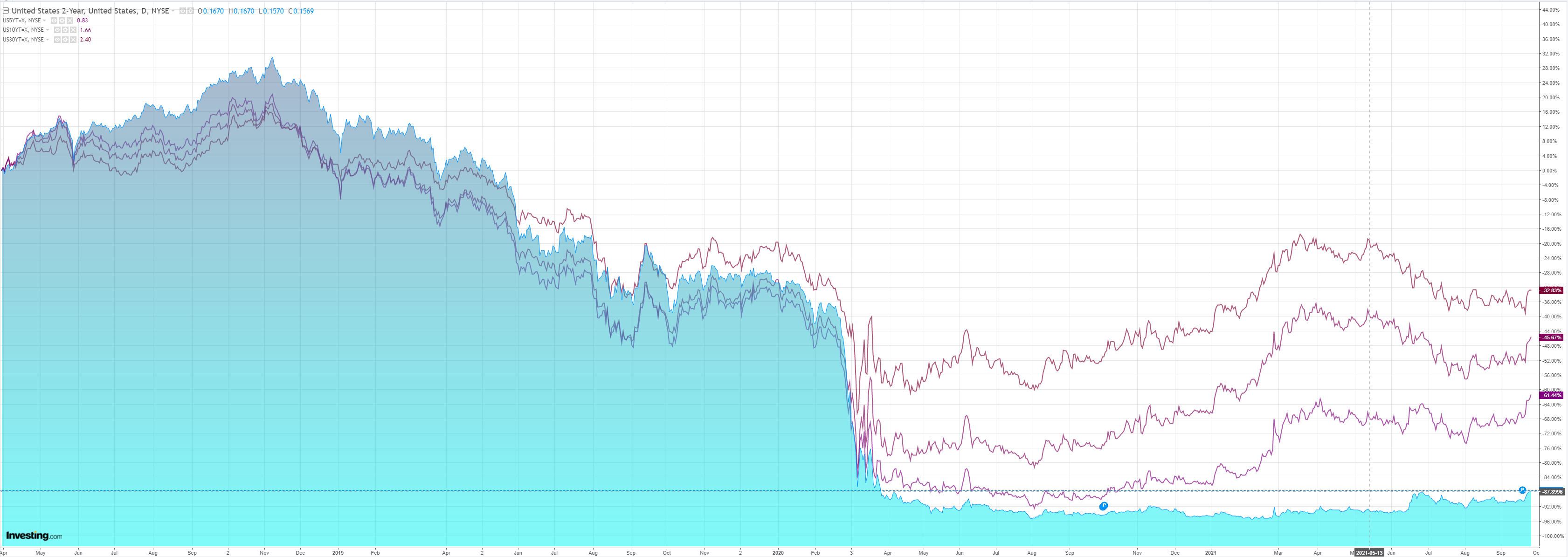

As Treasuries back up though the long end has slowed:

And stocks sold led by duration stocks:

Westpac has the wrap:

Event Wrap

US durable goods orders in August rose +1.8%m/m (est. +0.6%m/m, prior raised to +0.5%m/m from -0.1%m/m), with the ex-transport measure softer at +0.2%m/m (est. +0.5%m/m). Supply constraints featured once again. The Dallas Fed manufacturing survey, at 4.6, missed expectations at 11.0 (prior 9.0). Lower new orders and outlook were the main cooling components in a still robust report.

FOMC member Williams said good progress has been made on the inflation and job goals and hence reducing the pace of bond buying may “soon” be warranted. But the conditions to support rate hikes still lie well in the future, with long-term inflation expectations remaining relatively stable. Brainard said she expects the conditions on the labour market to be met soon, allowing bond purchases to be tapered, but added that there’s no signal from that for the timeline for rate hikes. Evans shifted to a more hawkish tone regarding tapering: “If the flow of employment improvements continues, it seems likely that those conditions will be met soon and tapering can commence”, but regarding rate hikes: “Future decisions regarding the path of short-term policy rates seem much less clear to me at the moment”, advocating a sustainable moderate overshoot in inflation.

Bank of England Governor Bailey repeated comments from the recent meeting minutes to clarify that unwinding stimulus should come from an increase in the Bank Rate that could occur even before the end of their APP (to cease at end 2021).

Event Outlook

Australia: Westpac anticipates a 1.5% decline (market at -2.5%) in August retail sales given restrictions intensified across the major states over the period. However, basic food spend, ~40% of retail consumption, likely outperformed over the month, partially offsetting declines in covid-affected categories. The Q3 AusChamber-Westpac survey will provide a timely update on Australia’s manufacturing sector; particularly significant for this edition will be the impact of current restrictions on hiring and investment.

New Zealand: The employment indicator for August should show limited impact from the latest Covid lockdown.

UK: September nationwide house prices may lose momentum on stretched affordability and the tax break expiry (market f/c: 0.6%).

US: Wholesale inventories are due for a rebuild, however supply constraints are a headwind (market f/c: 0.8%). The July S&P/CS home price index is expected to see a further acceleration in annual price growth to around 20.0%yr. Delta’s resurgence stands as a headwind for September consumer confidence index (market f/c: 115.0). Chair Powell and Secretary Yellen will appear before the Senate Banking Committee. The FOMC’s Bullard and Bostic will also speak.

We are now in a full-blown global energy panic. It is not overly beneficial for the Australian dollar given it is bullish at the margin for DXY, especially since the US already has the highest inflation rate and a tapering Fed that will get more hawkish.

If we roll on much longer here, and/or get a bad northern winter, the global economy is on the verge of a major energy crisis until demand destruction is enough to crash prices.

Given China is already shutting down which will take down European industry quickly, and the US is slowing, that will not take very long.

2008 might be the right comparison. Not 2015.