DXY was stable last night and EUR eased:

The AUD recovered some poise:

Oil is still crazy:

The commodities crazy bid lives:

Big miners took off. Everybody but (LON:GLEN) is little more than an iron ore proxy:

EM stocks (NYSE:EEM) marked time:

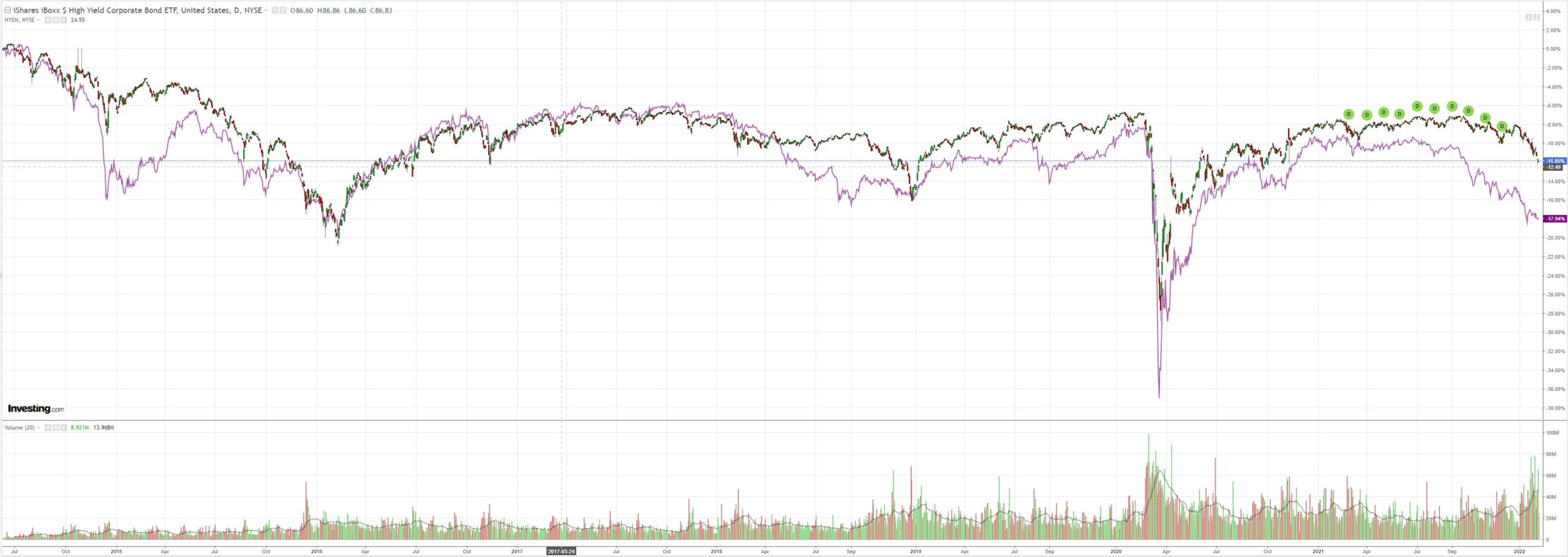

Sinking junk (NYSE:HYG) too:

As yields eased:

Stocks were roughly flat:

The stress we have seen growing in peripheral FX for the past quarter, then into junk debt, and now stocks, has begun to agitate European peripheral spreads. The ECB is in a similar position to the RBA. It has economic slack to cover before it needs to tighten, but markets are possessed with only one idea at the moment, that it will need to.

Potentially, this could provide some relief for global reflation and risk assets if the EUR was to strengthen and take pressure off a rising DXY.

But, the ECB is still well behind the Fed so I do think so. BofA agrees:

Eurozone inflation is also persistent. January CPI surprised strongly to the upside, both headline and core. Our economists and the consensus were looking for core inflation to drop below 2%, as early evidence that headline inflation would also drop below the target by year-end. Although core inflation did drop, to 2.3% from 2.6%, it remains above the target, while headline inflation increased instead of falling. Even if eventually Eurozone inflation does fall below the target, it is now clear to us that it will take longer than we had expected.

Persistent inflation will force the ECB to start policy normalization this year, in our view. Our economists now expect the ECB to end QE in July, and hike in September and in December, bringing the depo rate to 0% by the end of the year, for the first time since 2014. Expecting inflation to drop below the target next year, they don’t think the ECB will manage to bring rates above zero. However, everything depends on getting inflation right and uncertainty is high.

On balance, we still expect the risks to be to the downside for EURUSD this year and to the upside next year. We have been forecasting EURUSD at 1.10 this year, 1.15 next year and 1.20 (lower end of long-term equilibrium range) in 2024. Although getting the timing right of such a path will be difficult, we stick with it for now.

Inflation in the US remains much higher than the Eurozone. Core inflation in the US is 5.5% vs. 2.3% in the Eurozone. Such a huge difference is consistent with a weak EURUSD.

Fed and ECB monetary policies will still diverge, particularly compared with market pricing. Following the hawkish ECB meeting this week, the market is now already pricing the ECB to start hiking this year, bring rates to zero by year-end, and then 2 more hikes next year. However, we don’t believe the market is pricing enough for the Fed yet. Our economists expect the Fed to hike 7 times this year (market is pricing 5) and 4 times next year (market is pricing 1.5),

Crossing the zero–rate threshold in the Eurozone could still have non-linear EUR implications. EURUSD dropped from 1.38 to 1.07 when the ECB introduced negative rates and started QE in 2014-15. But we would not expect EURUSD to go back to such levels. Back then, Greece was in a crisis and, although the Fed had started QE tapering, it was keeping rates at zero. Unlike the Fed, the ECB is not starting QT any time soon. And we doubt the ECB will be able to go much above zero rates, if at all. However, we could still see a jump in EURUSD, as non-negative rates start attracting funds in Europe that for various reasons have been avoiding negative rates.

A lot also depends on the Fed. Recent Fed speakers have downplayed aggressive rate hikes, which means to us that the Fed is comfortable with current market pricing and may even like to stay somewhat behind it. However, this makes the inflation data even more important. If we are right that US inflation will continue surprising to the upside, the Fed will likely do more than current pricing.

I have no idea how many times the Fed will hike this year but if it is seven then I’ll eat my hat. That said, I think the outlook is roughly right. DXY up for now and EUR later but not until after markets crash and force the Fed backward.

AUD will follow EUR.