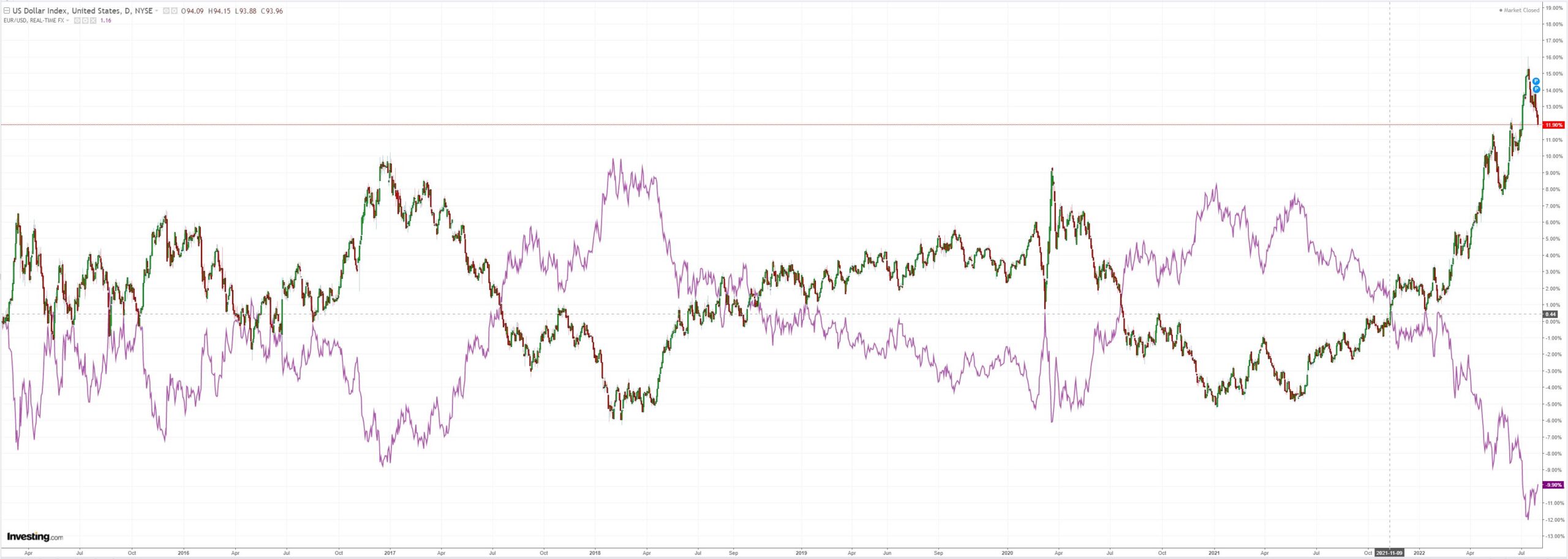

DXY is still falling as EUR bounces:

The AUD materially underperformed the DXY sag:

Oil dumped:

Dirt too:

And miners (LON:GLEN):

Plus all EM (NYSE:EEM):

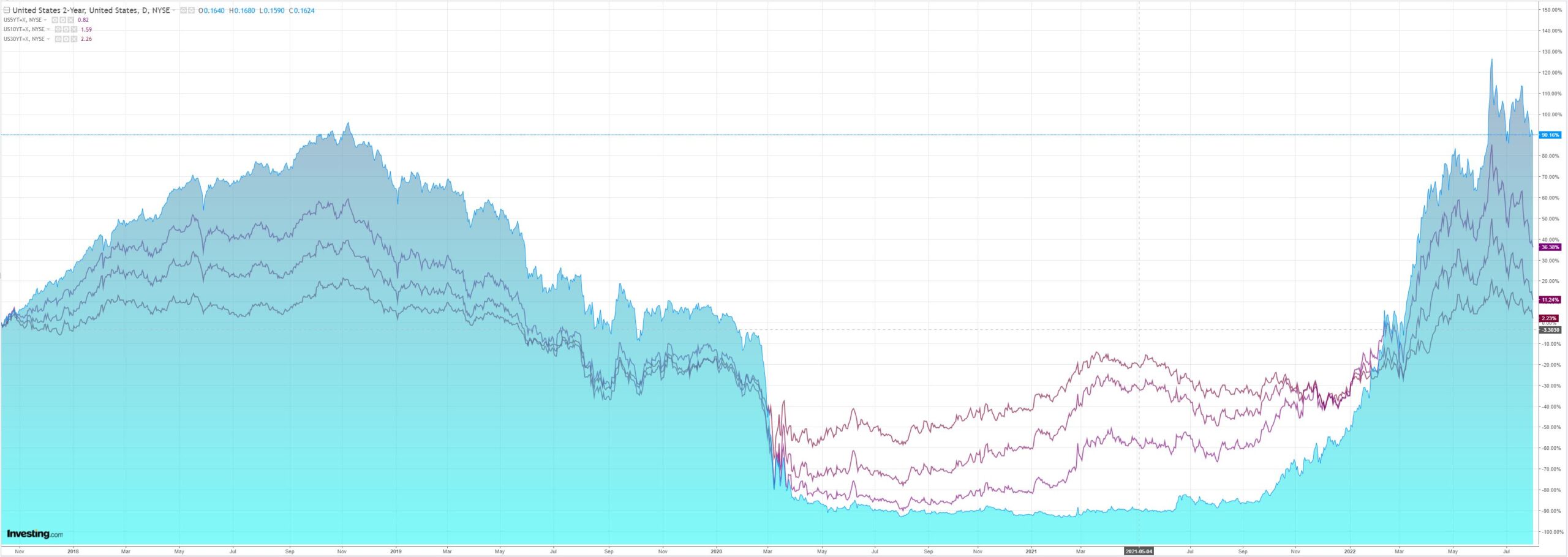

Yields fell:

But stocks did too:

Westpac has the wrap:

Event Wrap

US ISM manufacturing survey at 52.8 was above estimates of 52.0 (prior 53.0). The details showed a sharp pullback in both prices paid and new orders, and some slippage in employment, while inventories reached their highest level since 1984.

Eurozone manufacturing PMI was finalised higher at 49.8 (from a flash reading of 49.6), despite softer Spanish and Italian outturns. German retail sales in June fell 1.6%m/m (and -9.8%y/y – largest fall since 1980), against estimates of +0.3%m/m, as inflation, cost of living and growth concerns sapped consumer activity. Eurozone unemployment in June was in line with expectations at 6.6%.

Event Outlook

Aust: The RBA is expected to deliver a third consecutive 50bp rate hike at their August policy meeting, to 1.85%, lifting the cash rate quickly back to “neutral” territory with more still to come. With rates rising rapidly and building costs surging, dwelling approvals should see renewed weakness in June (Westpac f/c: -5.0%). The downturn in housing finance is expected to show through more clearly in June (Westpac f/c: -5.0%); affordability constraints are set to impact owner-occupiers more strongly than investor financing for the month (Westpac f/c: -5.5% and -4.5% respectively).

UK: Nationwide house price growth should begin to show some slowing in July as rate hikes begin to take effect (market f/c: 0.2%).

US: JOLTS job openings will continue to indicate an extraordinary demand for labour in June (market f/c: 11000k). Meanwhile, the FOMC’s Evans and Mester are due to speak at different events and the New York Fed will release its Q2 household debt and credit report.

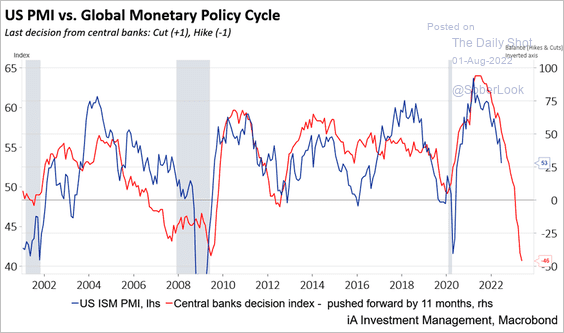

Here’s the future of the ISM:

I am not a believer in the AUD rally.