DXY faded:

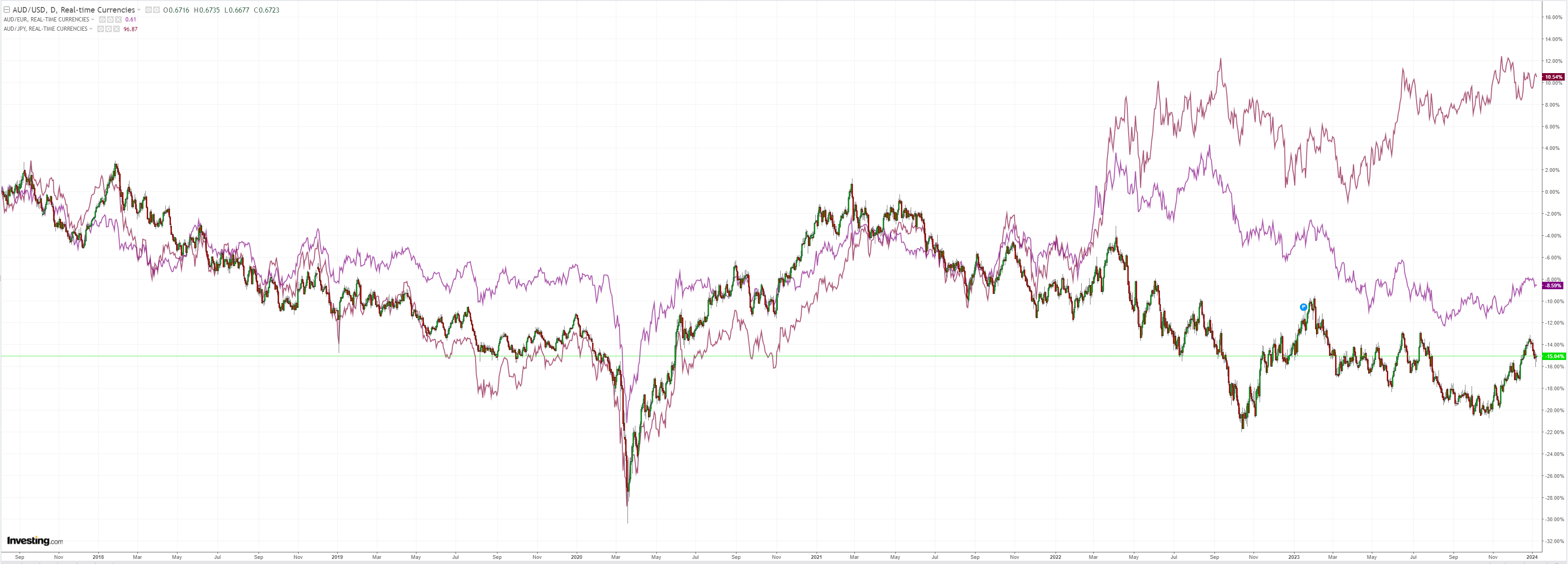

AUD bounced:

CNY will cap the rally:

Oil was smashed:

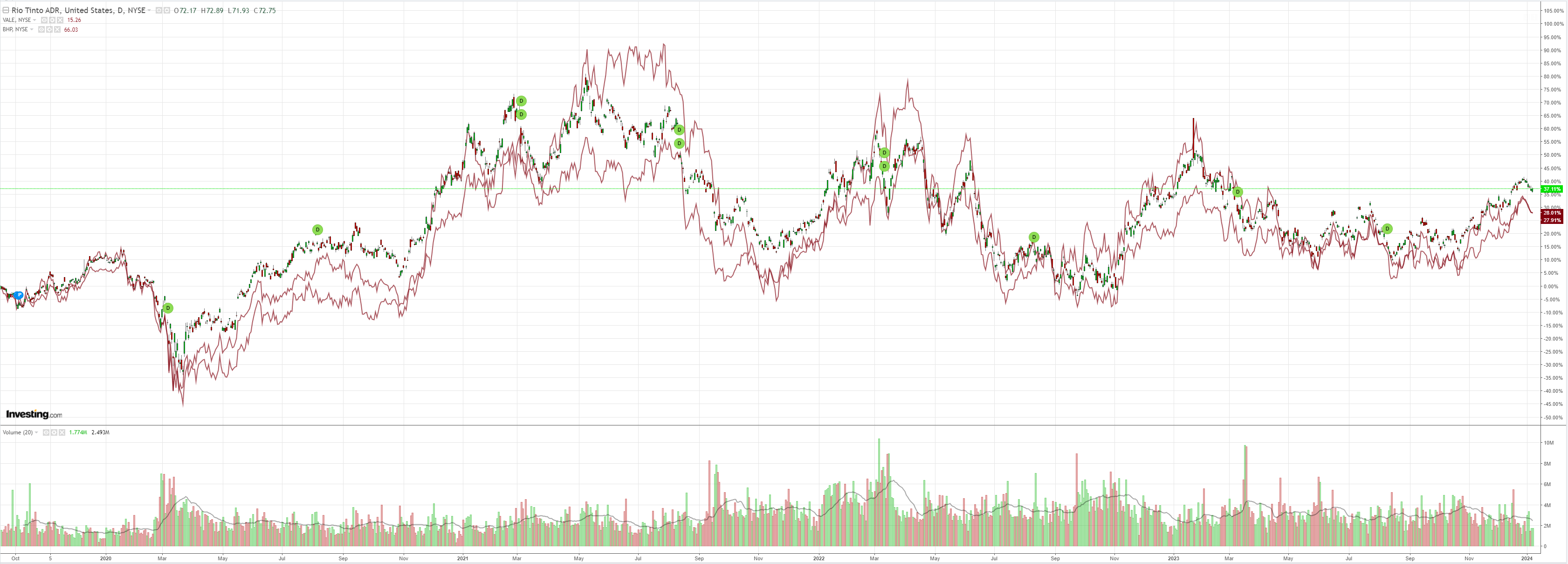

Dirt too:

Miners couldn’t rally:

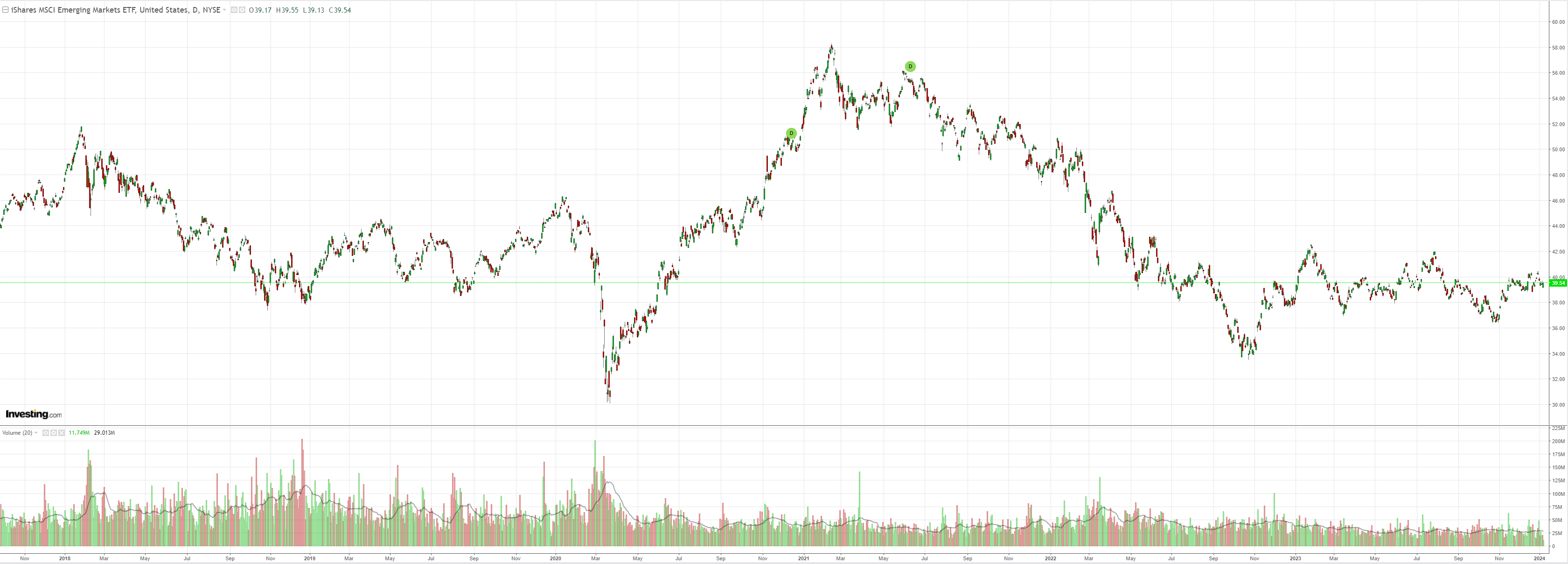

EM is dead:

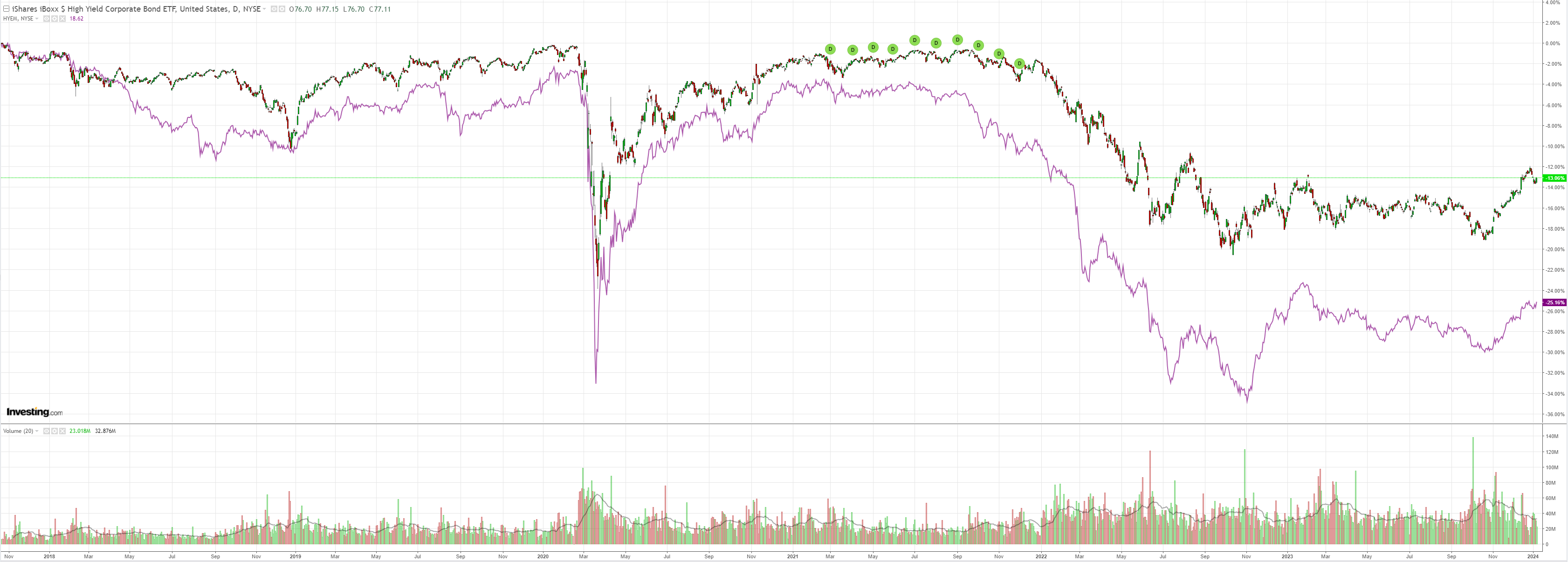

Junk party:

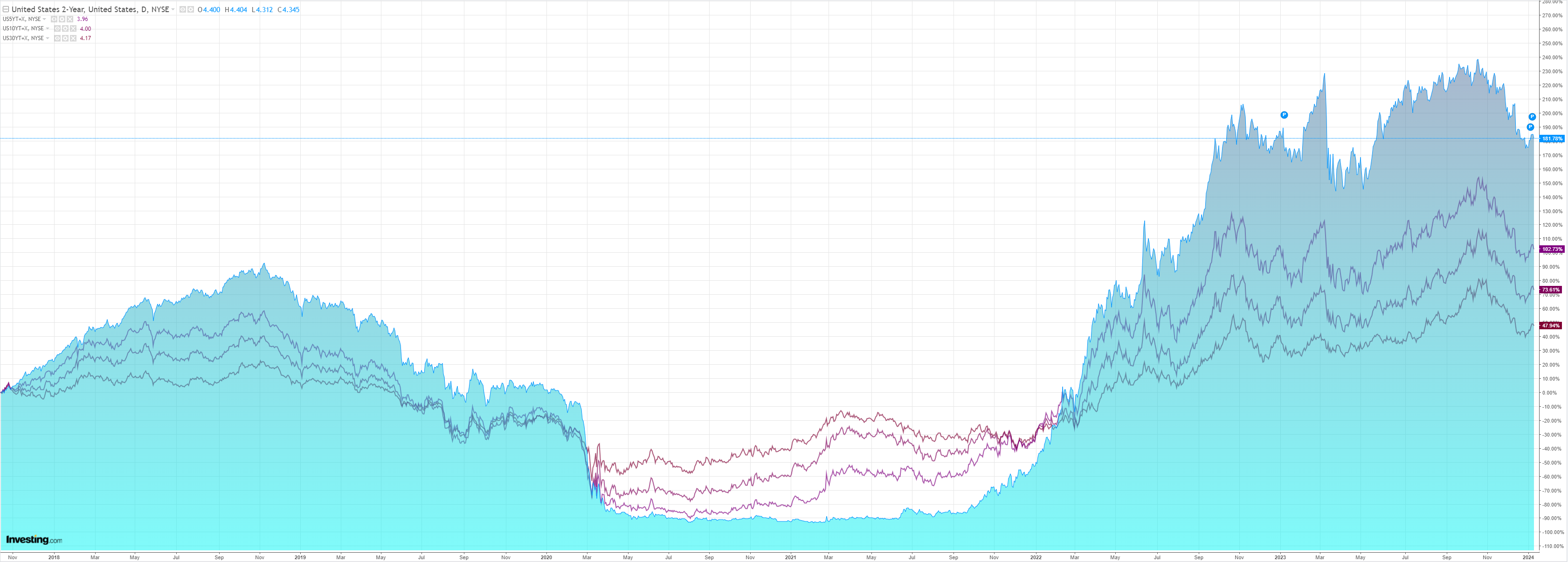

As yields fell:

And stocks took off:

From the outset, this rally has been all about energy. An Israel-inspired spike in oil and yields ended quickly and oil has cratered ever since.

There is too much of it:

Top oil exporter Saudi Arabia on Sunday cut the February price of its flagship Arab Light crude to Asian customers to the lowest level in 27 months, a company statement showed, amid competition from rival suppliers and concerns about supply overhang.

Oil needs to pressure the highest-cost marginal producer in US shale. We are still $10 from that, and an overshoot would be par for the course given galloping shaler efficiencies.

While oil falls, it cures all inflation evils and yields can rally, driving stocks higher.

DXY is an oil currency these days. It rises and falls with black gold.

Conversely, poorly structured Aussie gas exports make them counter-cyclical for the currency versus oil.

While oil falls, AUD can rise.